Question

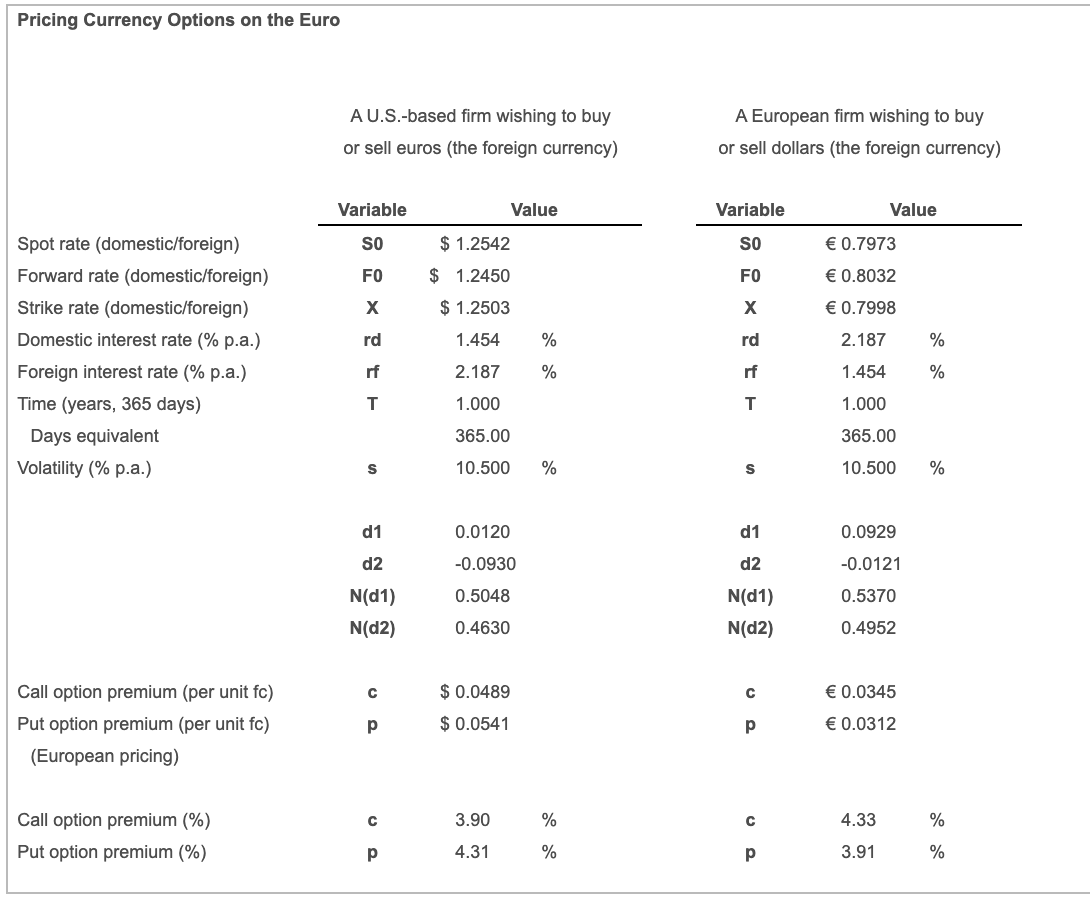

U.S. Dollar/Euro.The table, indicates that a 1-year call option on euros at a strike rate of $ 1.2503 divided by euro$1.2503/ will cost the buyer

U.S. Dollar/Euro.The table, indicates that a 1-year call option on euros at a strike rate of $ 1.2503 divided by euro$1.2503/

will cost the buyer $ 0.0489 divided by euro$0.0489/, or 3.903.90%. But that assumed a volatility of 10.500%

when the spot rate was $ 1.2542 divided by euro$1.2542/.

What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $ 1.2485 divided by euro$1.2485/?

The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.24851.2485/euro would be $nothing/euro. (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started