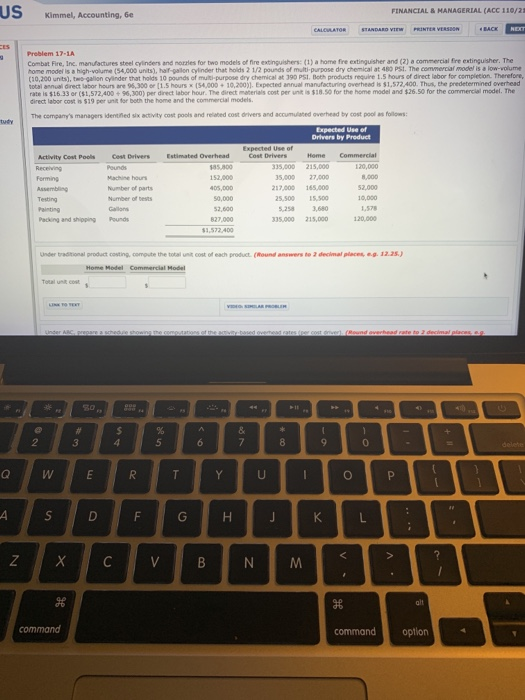

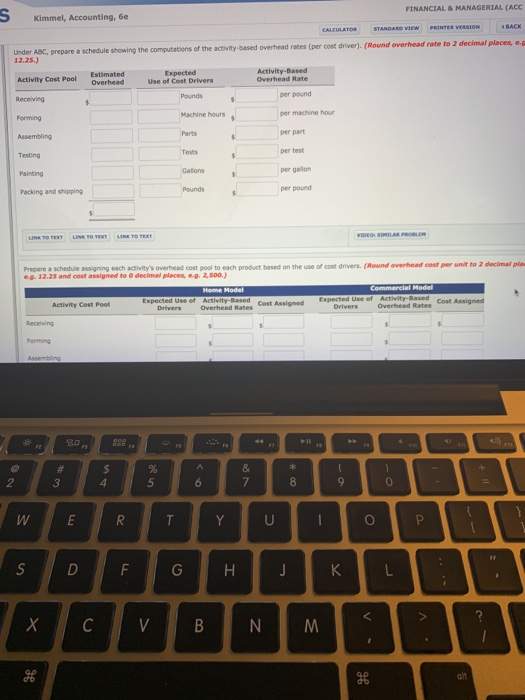

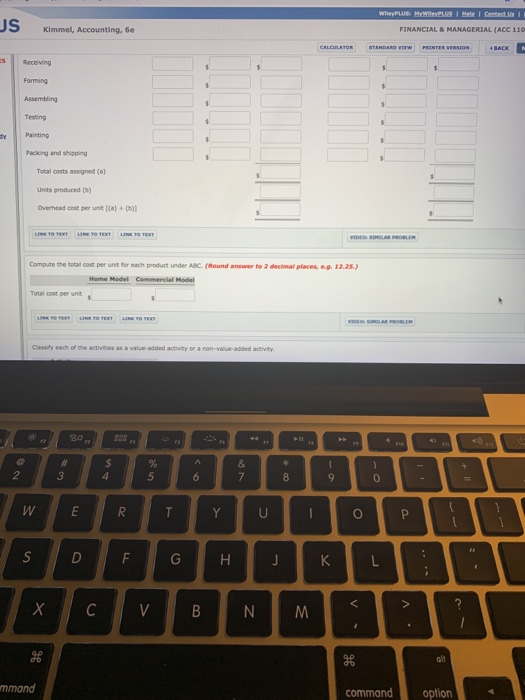

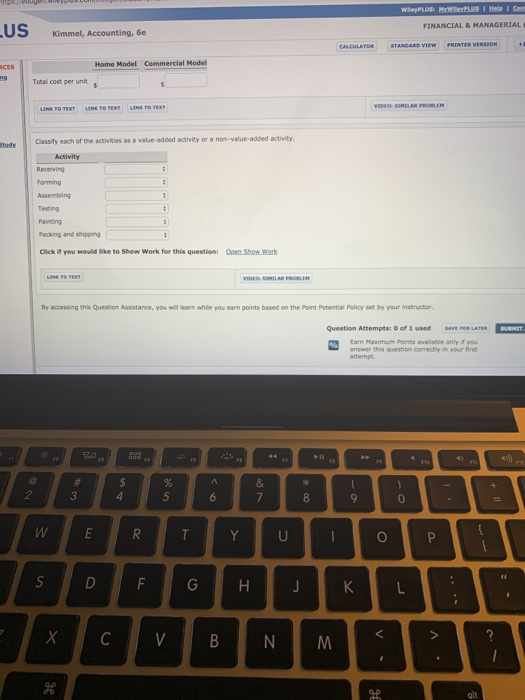

US FINANCIAL & MANAGERIAL (ACC 110/1 Kimmel, Accounting, 6e Problem 17-1A Combat Fire, Inc. manufactures steel cylinders and norrles for two models of fire extinguishers: (1) a home fre extinguisher and (2) a commercial fre extinguisher. The home model S'hi h volume 54,000 uts har1on order that holds 2 1/2 po ds of multi-purpose dry chemical at 480 Pst. The enme or moe sal run (30,200 units),to-galion cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore total annual direct labor hours are 96,300 or 11.5 hours x (54,000+ 10,200)1. Expected annual manufactuning overheed is $1,572,400. Thus, the predetermined overhead rate is $16 33 or ($1,572,400 96,300) per direct labor hour. The direct materials cost per un'$18.50 for the home model and S265 for the commerw model. The direct labor cost is $19 per unit for beth the home a and the commercial models The company's managers identuiied six ativity cost pools and reliated cost drivers and accumuiated overhead by cost pool as follows Expected Use of Drivers by Product Activity Cost Pools Cest Drivers Estimated Overhead Cost DriversHome Commercial 35,000215,000 5,000 27,000 17,000 165,000 00 15,500 ,2583,680 35000 215,000 Machine hous Number of parts 52,000 1,578 Packing and shipping Pounds Under traditional product costing, compute the total unit cost off each product (Round answers to 2 decimal places.g 1225.) Model Commercial Model Total unt 2 command command option FINANCIAL & MANAGERIAL (ACC SKimmel, Accounting, 6e showing the computations of the activity-based overhead rates (per cost driver). (Round overhead rate to 2 decimal places, e.s 12.25.) Estimated Overhead Expected Use of Cost Drivers Activity Cost Pool per pound per machine hour per part Machine hourss Testing per gailon Pounds per pound Packing and shipping Prepare a schedule assigning each activity's overhead cost pol to each product based on the use of cost drivers.(Round overhead cost per unit to 2 decimal pla e.g. 12.25 and cost assigned te O decimal places, e-g. 2,500) Expectod use of Onertieyd Rates Cost Assigned of Use of Activity-Based cost Assigned Activity Cost Poel Overhead Rates Cost Assigned 3 S Kimmel, Accounting, 6e FINANCIAL &MANAGERIAL (ACC 110 S Receving Testing Painting Packing and shipping Total costs assigned (a) Units produced t) Overhead cost per unit (a) + (n) Compute the total cost per unit for each product under ABC (Round answer to 2 decimal places,e.g.12.25) Home Model Commercial Model Total cost per unts olt ommand option US FINANCIAL&MANAGERIAL Kimmel, Accounting, 6e STANDARD vIEW Home Model Commercial Model Total cost per unt Classify each of the activities as a value-added activity or a non-value-added activity Packing and shipping Click if you would like to Show Work for this question! Open Show Work by accessing this question Assistance, you walearn whie you earn ports based on the Pont Potential Policy set by your structor Question Attempts: 0of 1 used satro"LATE Ean Maximum Points available only if you answer this question correctly in your first 0 5