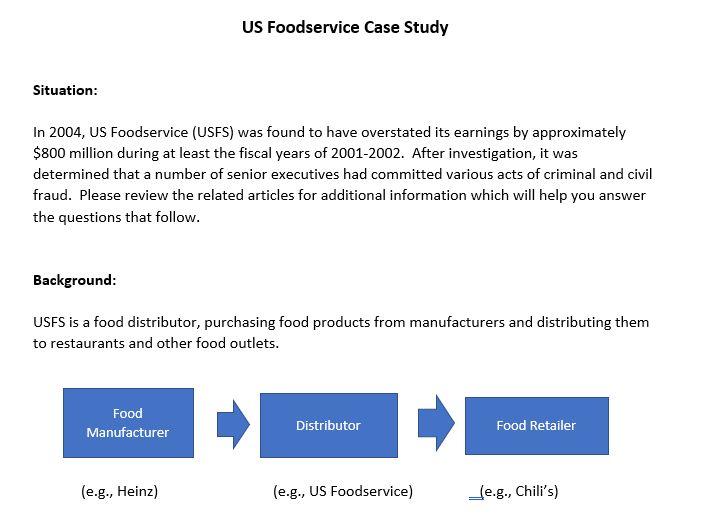

US Foodservice Case Study Situation: In 2004, US Foodservice (USFS) was found to have overstated its earnings by approximately $800 million during at least the fiscal years of 2001-2002. After investigation, it was determined that a number of senior executives had committed various acts of criminal and civil fraud. Please review the related articles for additional information which will help you answer the questions that follow. Background: USFS is a food distributor, purchasing food products from manufacturers and distributing them to restaurants and other food outlets. Food Manufacturer Distributor Food Retailer (e.g., Heinz) (e.g., US Foodservice) _e.g., Chili's) USFS generated profit two ways: 1. Purchases products and resells them at a higher price (e.g., buy at $1.00, sell at $1.50, generating a $0.50 profit); and 2. Receives fees from the manufacturers called "promotional allowances" or "rebates" in exchange for promotional and other services provided. For example, Heinz may pay USFS $5 million for USFS to promote or feature Heinz' products to restaurants. USFS therefore would record revenue when they perform such services (note that technically, certain rebates are treated as reductions of expenses, but for simplicity we are assuming they are treated as revenues for this case). While not always the case, we will assume the rebates involve cash payments from the manufacturer to USES, sometimes in advance, sometimes after the services are performed. This was the area in which the fraud occurred. Question 4: How did these individuals think they could get away with this given the magnitude of the fraud? Do you think they intentionally tried to defraud the company of $800 million? What do you think might have happened? Were these just evil people? US Foodservice Case Study Situation: In 2004, US Foodservice (USFS) was found to have overstated its earnings by approximately $800 million during at least the fiscal years of 2001-2002. After investigation, it was determined that a number of senior executives had committed various acts of criminal and civil fraud. Please review the related articles for additional information which will help you answer the questions that follow. Background: USFS is a food distributor, purchasing food products from manufacturers and distributing them to restaurants and other food outlets. Food Manufacturer Distributor Food Retailer (e.g., Heinz) (e.g., US Foodservice) _e.g., Chili's) USFS generated profit two ways: 1. Purchases products and resells them at a higher price (e.g., buy at $1.00, sell at $1.50, generating a $0.50 profit); and 2. Receives fees from the manufacturers called "promotional allowances" or "rebates" in exchange for promotional and other services provided. For example, Heinz may pay USFS $5 million for USFS to promote or feature Heinz' products to restaurants. USFS therefore would record revenue when they perform such services (note that technically, certain rebates are treated as reductions of expenses, but for simplicity we are assuming they are treated as revenues for this case). While not always the case, we will assume the rebates involve cash payments from the manufacturer to USES, sometimes in advance, sometimes after the services are performed. This was the area in which the fraud occurred. Question 4: How did these individuals think they could get away with this given the magnitude of the fraud? Do you think they intentionally tried to defraud the company of $800 million? What do you think might have happened? Were these just evil people