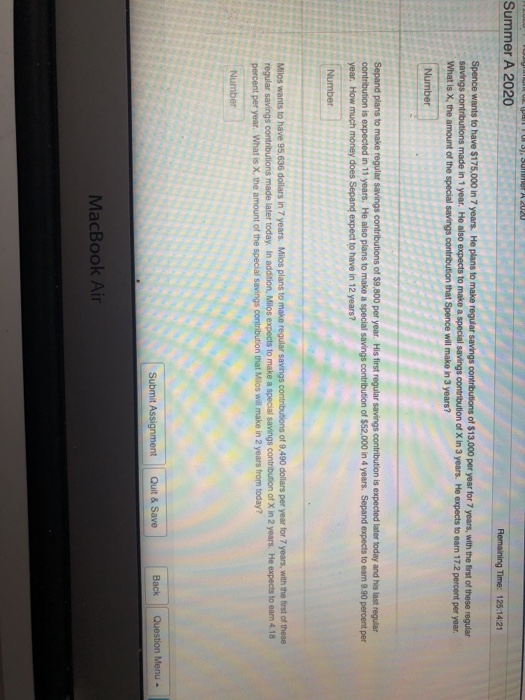

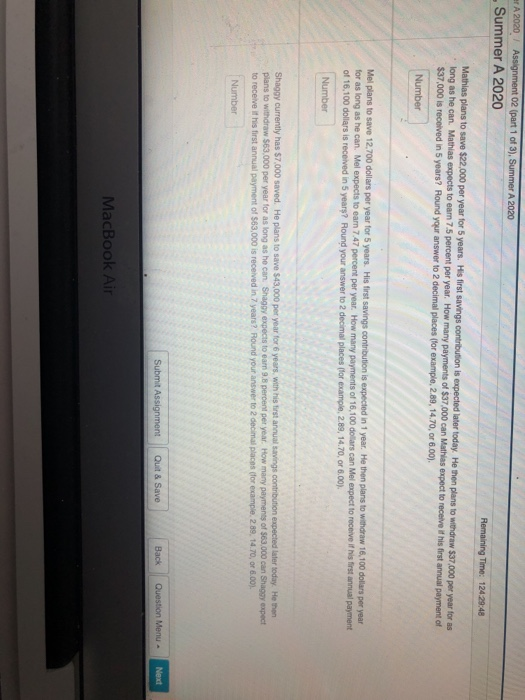

US. SUMA 2020 Summer A 2020 Remaining Time: 125:14:21 Spence wants to have $175,000 in 7 years. He plans to make regular savings contributions of $13,000 per year for 7 years, with the first of those regular savings contributions made in 1 year. He also expects to make a special savings contribution of Xin 3 years. He expects to earn 17.2 percent per year. What is the amount of the special savings contribution that Spence will make in 3 years? Number Sepand plans to make regular savings contributions of $9,800 per year. His first regular savings contribution is expected later today and his last regular contribution is expected in 11 years. He also plans to make a special savings contribution of $52,000 in 4 years. Sepand expects to earn 9.90 percent per year. How much money does Sepand expect to have in 12 years? Number Milos wants to have 95,636 dollars in 7 years. Milos plans to make regular savings contributions of 9,490 dollars per year for 7 years, with the first of these regular savings contributions made later today. In addition, Milos expects to make a special savings contribution of Xin 2 years. He expects to earn 4.18 percent per year. What is X, the amount of the special savings contribution that los will make in 2 years from today? Number Submit Assignment Quit & Save Back Question Menu MacBook Air er A 2020 Assignment 02 (part 1 of 3), Summer A 2020 Summer A 2020 Remaining Time: 124.29:48 Mathias plans to save $22,000 per year for 5 years. His first savings contribution is expected later today. He then plans to withdraw $37.000 per year for as long as he can. Mathias expects to earn 7.5 percent per year. How many payments of $37,000 can Mathias expect to receive it his first annual payment of $37.000 is received in 5 years? Round your answer to 2 decimal places for example, 2.89, 14.70, or 6.00). Number Mel plans to save 12.700 dollars per year for 5 years. His first savings contribution is expected in 1 year. He then plans to withdraw 16,100 dollars per year for as long as he can. Mel expects to earn 7.47 percent per year. How many payments of 16,100 dollars can Mel expect to receive if his first annual payment of 16,100 dollars is received in 5 years? Round your answer to 2 decimal places (for example, 2.89, 14.70, or 6.00). Number Shaggy currently has $7,000 saved. He plans to save $43,000 per year for 6 years with his first annual savings contribution expected later today. He then plans to withdraw 563.000 per year for as long as he can Shaggy expects to earn 9.8 percent per year. How many payments of $63,000 can Shaggy expect to receive it his first annual payment of $63,000 is received in 7 years? Round your answer to 2 decimal places (for example289, 14.70, or 6.00). Number Submit Assignment Quit & Save Back Question Menu - Next MacBook Air US. SUMA 2020 Summer A 2020 Remaining Time: 125:14:21 Spence wants to have $175,000 in 7 years. He plans to make regular savings contributions of $13,000 per year for 7 years, with the first of those regular savings contributions made in 1 year. He also expects to make a special savings contribution of Xin 3 years. He expects to earn 17.2 percent per year. What is the amount of the special savings contribution that Spence will make in 3 years? Number Sepand plans to make regular savings contributions of $9,800 per year. His first regular savings contribution is expected later today and his last regular contribution is expected in 11 years. He also plans to make a special savings contribution of $52,000 in 4 years. Sepand expects to earn 9.90 percent per year. How much money does Sepand expect to have in 12 years? Number Milos wants to have 95,636 dollars in 7 years. Milos plans to make regular savings contributions of 9,490 dollars per year for 7 years, with the first of these regular savings contributions made later today. In addition, Milos expects to make a special savings contribution of Xin 2 years. He expects to earn 4.18 percent per year. What is X, the amount of the special savings contribution that los will make in 2 years from today? Number Submit Assignment Quit & Save Back Question Menu MacBook Air er A 2020 Assignment 02 (part 1 of 3), Summer A 2020 Summer A 2020 Remaining Time: 124.29:48 Mathias plans to save $22,000 per year for 5 years. His first savings contribution is expected later today. He then plans to withdraw $37.000 per year for as long as he can. Mathias expects to earn 7.5 percent per year. How many payments of $37,000 can Mathias expect to receive it his first annual payment of $37.000 is received in 5 years? Round your answer to 2 decimal places for example, 2.89, 14.70, or 6.00). Number Mel plans to save 12.700 dollars per year for 5 years. His first savings contribution is expected in 1 year. He then plans to withdraw 16,100 dollars per year for as long as he can. Mel expects to earn 7.47 percent per year. How many payments of 16,100 dollars can Mel expect to receive if his first annual payment of 16,100 dollars is received in 5 years? Round your answer to 2 decimal places (for example, 2.89, 14.70, or 6.00). Number Shaggy currently has $7,000 saved. He plans to save $43,000 per year for 6 years with his first annual savings contribution expected later today. He then plans to withdraw 563.000 per year for as long as he can Shaggy expects to earn 9.8 percent per year. How many payments of $63,000 can Shaggy expect to receive it his first annual payment of $63,000 is received in 7 years? Round your answer to 2 decimal places (for example289, 14.70, or 6.00). Number Submit Assignment Quit & Save Back Question Menu - Next MacBook Air