US TAX LAW

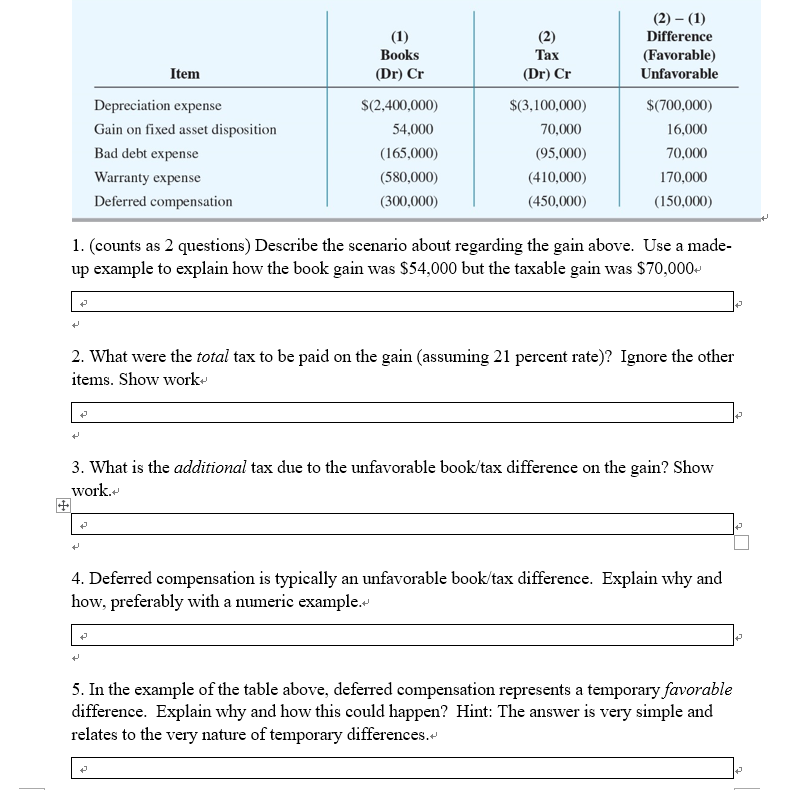

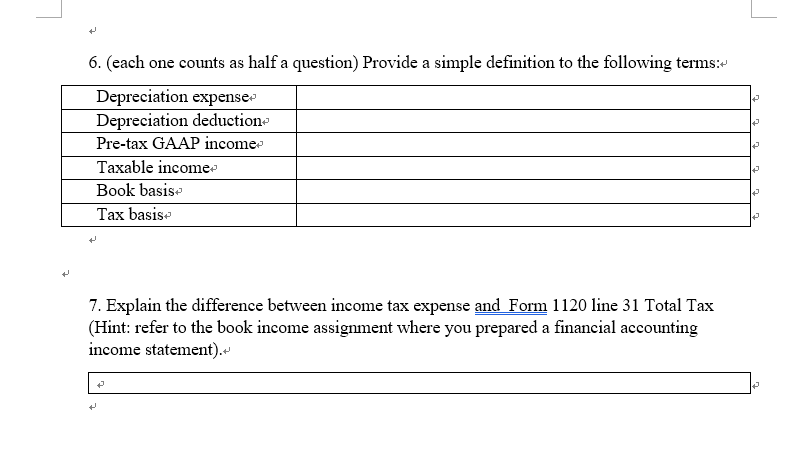

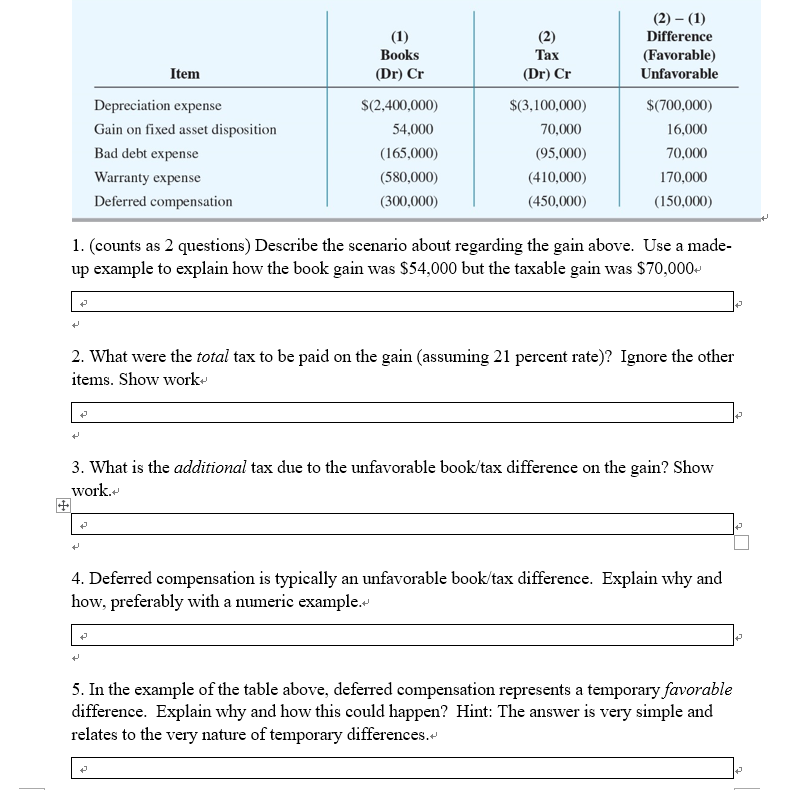

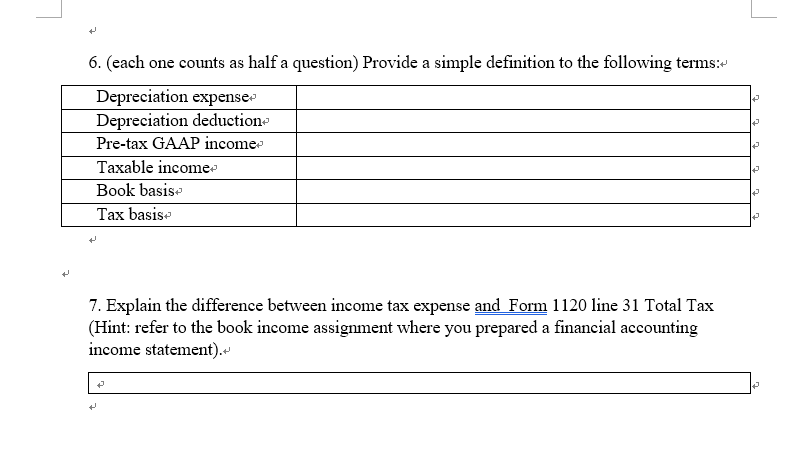

Tax (Dr) Cr Item Depreciation expense Gain on fixed asset disposition Bad debt expense Warranty expense Deferred compensation (1) Books (Dr) Cr $(2,400,000) 54,000 (165,000) (580,000) (300,000) $(3,100,000) 70,000 (95,000) (410,000) (450,000) (2) -(1) Difference (Favorable) Unfavorable $(700,000) 16,000 70,000 170,000 (150,000) 1. (counts as 2 questions) Describe the scenario about regarding the gain above. Use a made- up example to explain how the book gain was $54,000 but the taxable gain was $70,000- 2. What were the total tax to be paid on the gain (assuming 21 percent rate)? Ignore the other items. Show work t 3. What is the additional tax due to the unfavorable book/tax difference on the gain? Show work. t 4. Deferred compensation is typically an unfavorable book/tax difference. Explain why and how, preferably with a numeric example. t t 5. In the example of the table above, deferred compensation represents a temporary favorable difference. Explain why and how this could happen? Hint: The answer is very simple and relates to the very nature of temporary differences.' t + 6. (each one counts as half a question) Provide a simple definition to the following terms:- Depreciation expenser Depreciation deduction Pre-tax GAAP income- Taxable income- Book basis- Tax basise + 2 le + 7. Explain the difference between income tax expense and Form 1120 line 31 Total Tax (Hint: refer to the book income assignment where you prepared a financial accounting income statement). Tax (Dr) Cr Item Depreciation expense Gain on fixed asset disposition Bad debt expense Warranty expense Deferred compensation (1) Books (Dr) Cr $(2,400,000) 54,000 (165,000) (580,000) (300,000) $(3,100,000) 70,000 (95,000) (410,000) (450,000) (2) -(1) Difference (Favorable) Unfavorable $(700,000) 16,000 70,000 170,000 (150,000) 1. (counts as 2 questions) Describe the scenario about regarding the gain above. Use a made- up example to explain how the book gain was $54,000 but the taxable gain was $70,000- 2. What were the total tax to be paid on the gain (assuming 21 percent rate)? Ignore the other items. Show work t 3. What is the additional tax due to the unfavorable book/tax difference on the gain? Show work. t 4. Deferred compensation is typically an unfavorable book/tax difference. Explain why and how, preferably with a numeric example. t t 5. In the example of the table above, deferred compensation represents a temporary favorable difference. Explain why and how this could happen? Hint: The answer is very simple and relates to the very nature of temporary differences.' t + 6. (each one counts as half a question) Provide a simple definition to the following terms:- Depreciation expenser Depreciation deduction Pre-tax GAAP income- Taxable income- Book basis- Tax basise + 2 le + 7. Explain the difference between income tax expense and Form 1120 line 31 Total Tax (Hint: refer to the book income assignment where you prepared a financial accounting income statement)