Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U.S. Tax rate is 21% This is all the information given. Sombrero Corporation, a U.S. corporation, operates through a branch in Espania. Management projects that

U.S. Tax rate is 21%

U.S. Tax rate is 21%

This is all the information given.

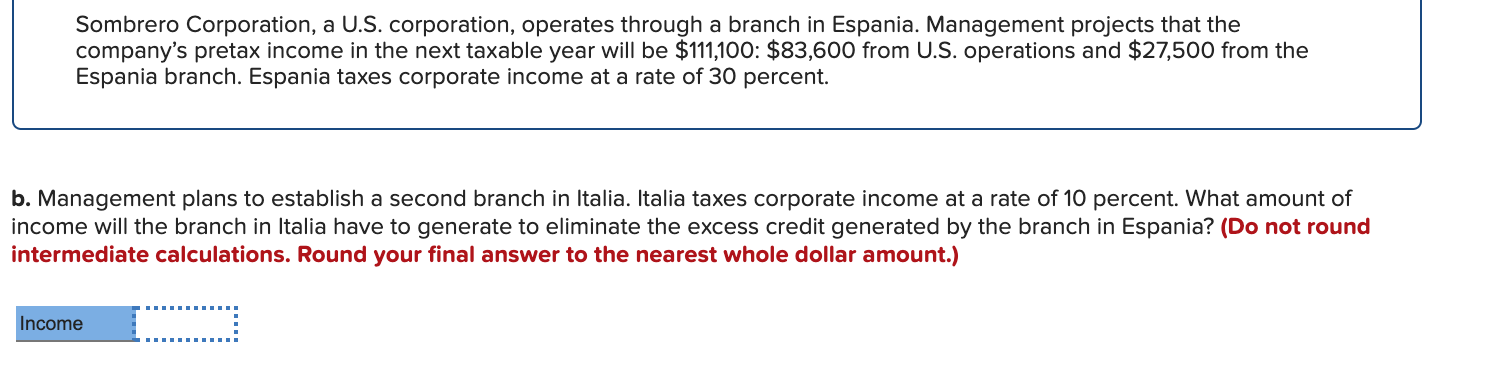

Sombrero Corporation, a U.S. corporation, operates through a branch in Espania. Management projects that the company's pretax income in the next taxable year will be $111,100: $83,600 from U.S. operations and $27,500 from the Espania branch. Espania taxes corporate income at a rate of 30 percent. b. Management plans to establish a second branch in Italia. Italia taxes corporate income at a rate of 10 percent. What amount of income will the branch in Italia have to generate to eliminate the excess credit generated by the branch in Espania? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started