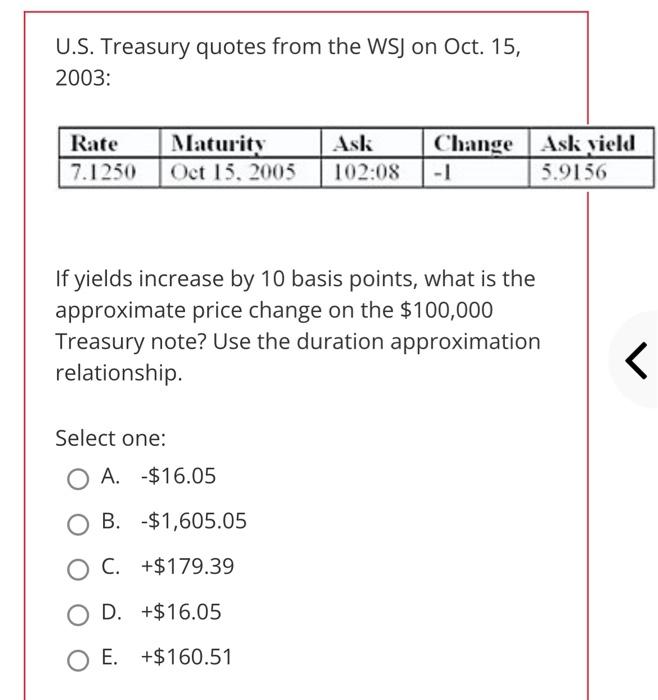

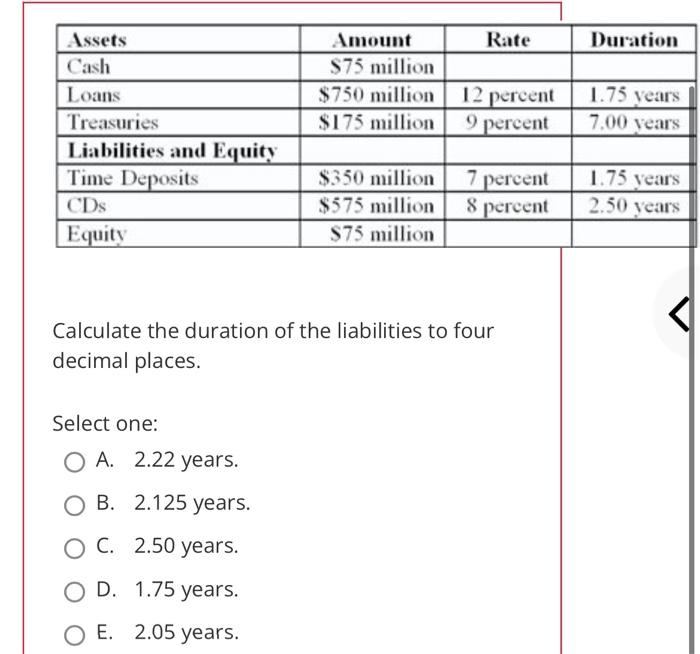

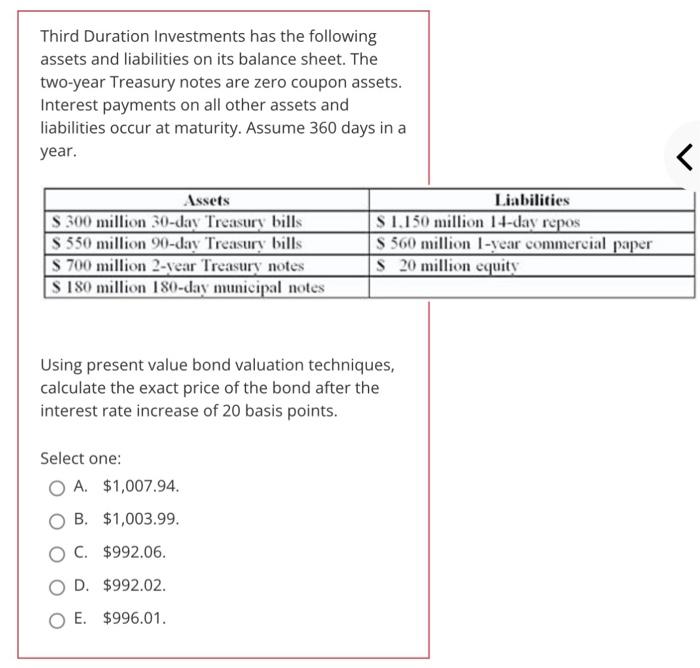

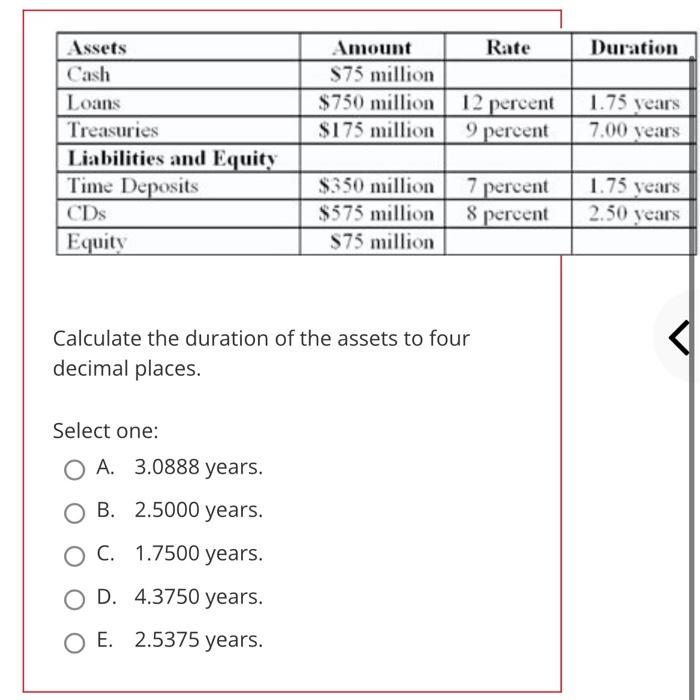

U.S. Treasury quotes from the WSJ on Oct. 15, 2003: If yields increase by 10 basis points, what is the approximate price change on the $100,000 Treasury note? Use the duration approximation relationship. Select one: A. $16.05 B. $1,605.05 C. +$179.39 D. +$16.05 E. +$160.51 Calculate the duration of the liabilities to four decimal places. Select one: A. 2.22 years. B. 2.125 years. C. 2.50 years. D. 1.75 years. E. 2.05 years. Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year. Using present value bond valuation techniques, calculate the exact price of the bond after the interest rate increase of 20 basis points. Select one: A. $1,007.94. B. $1,003.99. C. $992.06. D. $992.02. E. $996.01. Calculate the duration of the assets to four decimal places. Select one: A. 3.0888 years. B. 2.5000 years. C. 1.7500 years. D. 4.3750 years. E. 2.5375 years. U.S. Treasury quotes from the WSJ on Oct. 15, 2003: If yields increase by 10 basis points, what is the approximate price change on the $100,000 Treasury note? Use the duration approximation relationship. Select one: A. $16.05 B. $1,605.05 C. +$179.39 D. +$16.05 E. +$160.51 Calculate the duration of the liabilities to four decimal places. Select one: A. 2.22 years. B. 2.125 years. C. 2.50 years. D. 1.75 years. E. 2.05 years. Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year. Using present value bond valuation techniques, calculate the exact price of the bond after the interest rate increase of 20 basis points. Select one: A. $1,007.94. B. $1,003.99. C. $992.06. D. $992.02. E. $996.01. Calculate the duration of the assets to four decimal places. Select one: A. 3.0888 years. B. 2.5000 years. C. 1.7500 years. D. 4.3750 years. E. 2.5375 years