Answered step by step

Verified Expert Solution

Question

1 Approved Answer

US: year 1. year 2. year 3. % change. % change. %change in IQ in IQ. in IQ 0.00. 0.00. 0.00 year 4 % change

US: year 1. year 2. year 3. % change. % change. %change

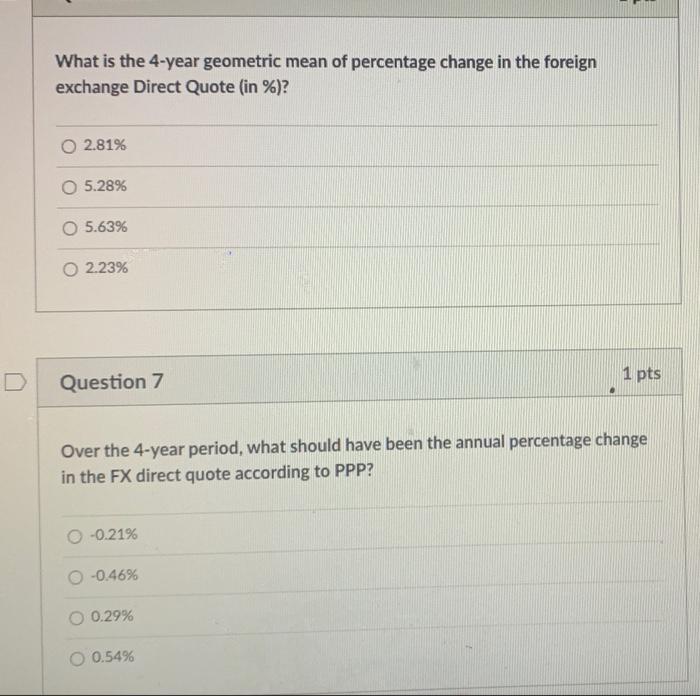

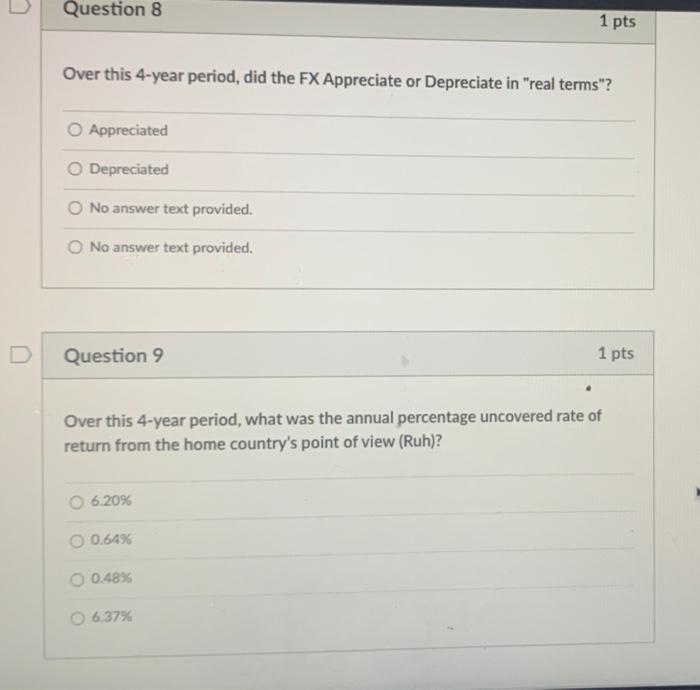

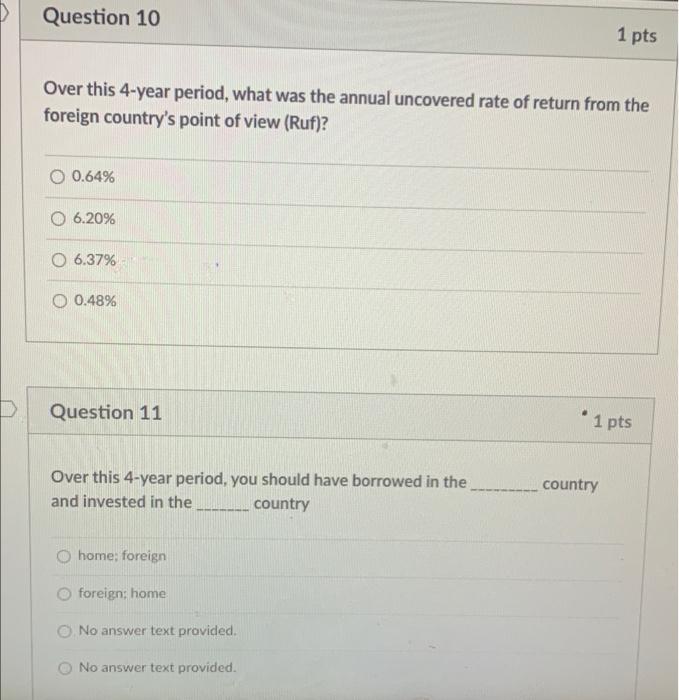

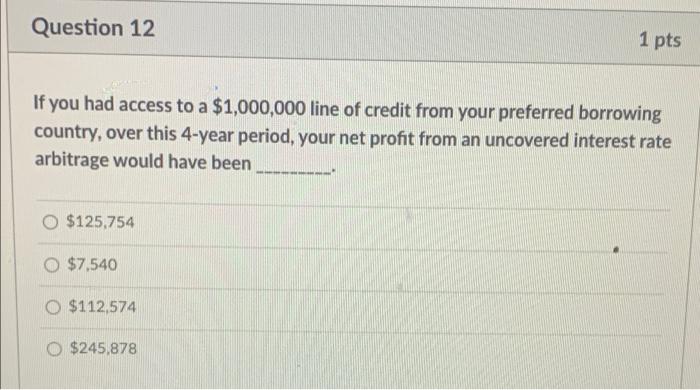

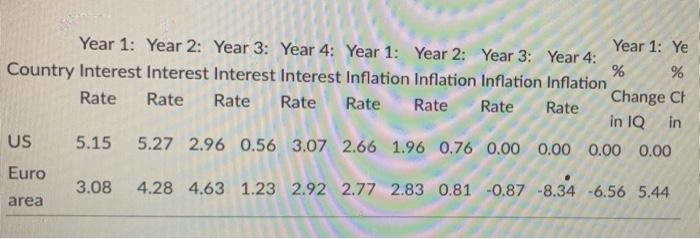

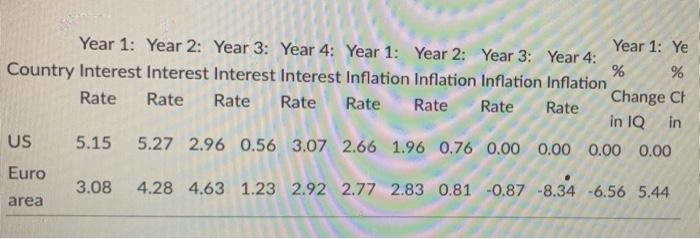

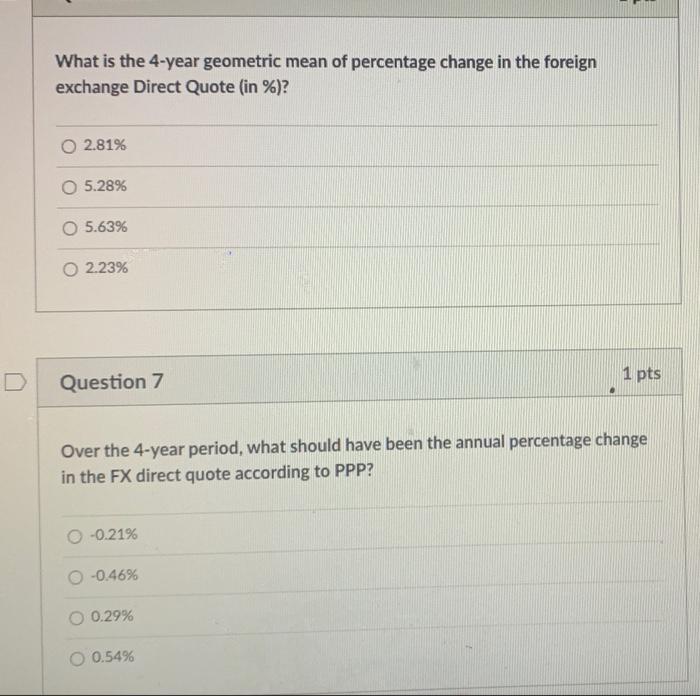

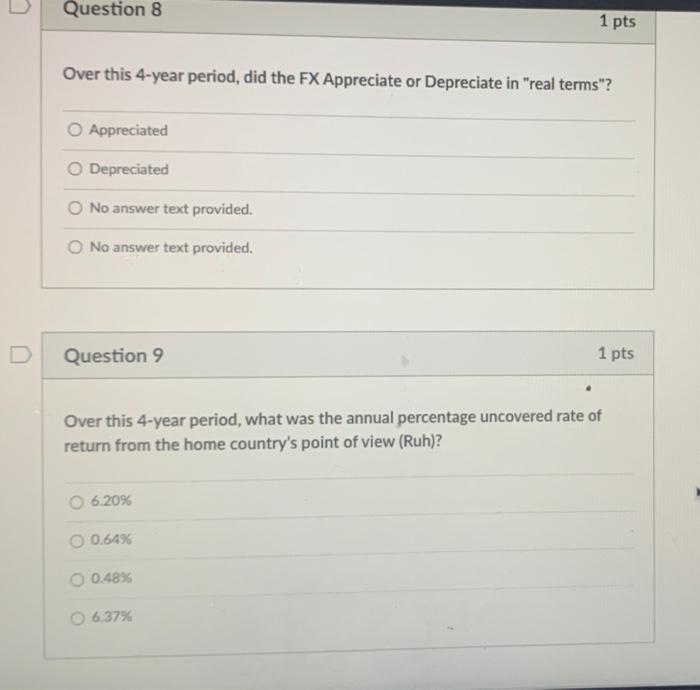

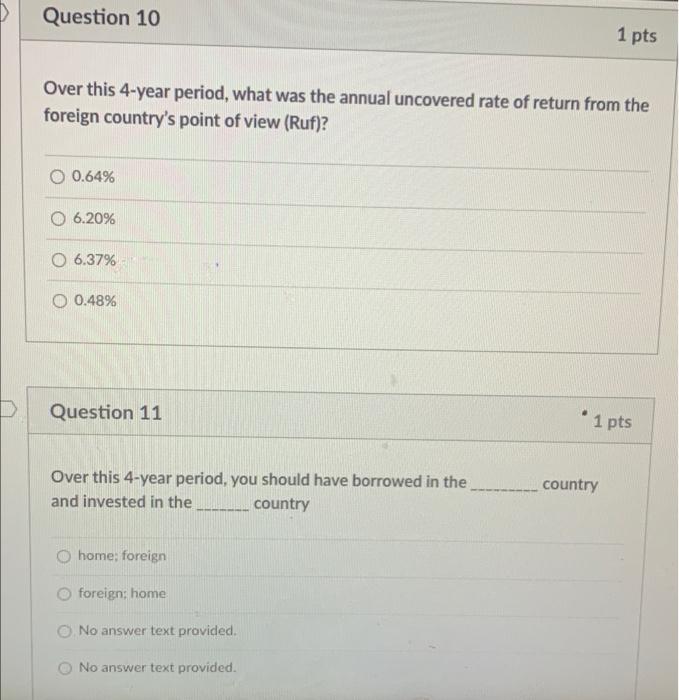

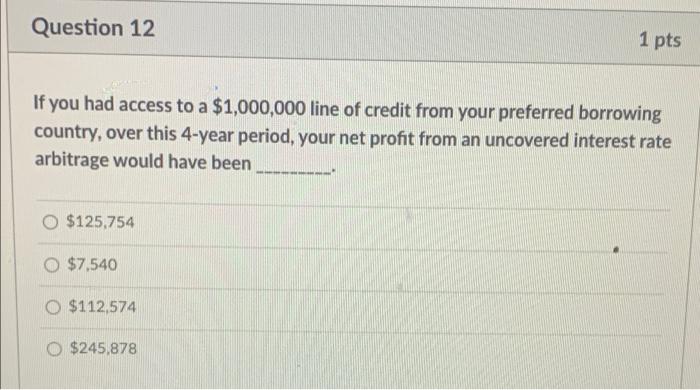

Year 1: Year 2: Year 3: Year 4: Year 1: Year 2: Year 3: Year 4: Year 1: Ye % Country Interest Interest Interest Interest Inflation Inflation Inflation Inflation % Rate Rate Rate Change CH Rate Rate Rate Rate Rate in IQ in US 5.15 5.27 2.96 0.56 3.07 2.66 1.96 0.76 0.00 0.00 0.00 0.00 Euro 3.08 4.28 4.63 1.23 2.92 2.77 2.83 0.81 -0.87 -8.34 -6.56 5.44 area What is the 4-year geometric mean of percentage change in the foreign exchange Direct Quote (in %)? 2.81% O 5.28% O 5.63% O 2.23% D Question 7 1 pts Over the 4-year period, what should have been the annual percentage change in the FX direct quote according to PPP? -0.21% 0 -0.46% O 0.29% 0.54% Question 8 1 pts Over this 4-year period, did the FX Appreciate or Depreciate in "real terms"? O Appreciated Depreciated No answer text provided. No answer text provided. D Question 9 1 pts Over this 4-year period, what was the annual percentage uncovered rate of return from the home country's point of view (Ruh)? 6.20% 0.64% O 0.48% 6.37% Question 10 1 pts Over this 4-year period, what was the annual uncovered rate of return from the foreign country's point of view (Ruf)? 0.64% O 6.20% O 6.37% O 0.48% D Question 11 ' 1 pts Over this 4-year period, you should have borrowed in the and invested in the country country home; foreign foreign; home No answer text provided. No answer text provided. Question 12 1 pts If you had access to a $1,000,000 line of credit from your preferred borrowing country, over this 4-year period, your net profit from an uncovered interest rate arbitrage would have been $125,754 O $7,540 O $112,574 O $245,878 Year 1: Year 2: Year 3: Year 4: Year 1: Year 2: Year 3: Year 4: Year 1: Ye % Country Interest Interest Interest Interest Inflation Inflation Inflation Inflation % Rate Rate Rate Change CH Rate Rate Rate Rate Rate in IQ in US 5.15 5.27 2.96 0.56 3.07 2.66 1.96 0.76 0.00 0.00 0.00 0.00 Euro 3.08 4.28 4.63 1.23 2.92 2.77 2.83 0.81 -0.87 -8.34 -6.56 5.44 area What is the 4-year geometric mean of percentage change in the foreign exchange Direct Quote (in %)? 2.81% O 5.28% O 5.63% O 2.23% D Question 7 1 pts Over the 4-year period, what should have been the annual percentage change in the FX direct quote according to PPP? -0.21% 0 -0.46% O 0.29% 0.54% Question 8 1 pts Over this 4-year period, did the FX Appreciate or Depreciate in "real terms"? O Appreciated Depreciated No answer text provided. No answer text provided. D Question 9 1 pts Over this 4-year period, what was the annual percentage uncovered rate of return from the home country's point of view (Ruh)? 6.20% 0.64% O 0.48% 6.37% Question 10 1 pts Over this 4-year period, what was the annual uncovered rate of return from the foreign country's point of view (Ruf)? 0.64% O 6.20% O 6.37% O 0.48% D Question 11 ' 1 pts Over this 4-year period, you should have borrowed in the and invested in the country country home; foreign foreign; home No answer text provided. No answer text provided. Question 12 1 pts If you had access to a $1,000,000 line of credit from your preferred borrowing country, over this 4-year period, your net profit from an uncovered interest rate arbitrage would have been $125,754 O $7,540 O $112,574 O $245,878 in IQ in IQ. in IQ

0.00. 0.00. 0.00

year 4

% change

in IQ

0.00

Euro: year 1. year 2. year 3. year 4

-8.37. -8.34 -6.56. 5.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started