Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U.S.A Rules 3. Josette, age 18 , is claimed as a dependent by her parents. For 2022, she has the following income: $6,400 wages from

U.S.A Rules

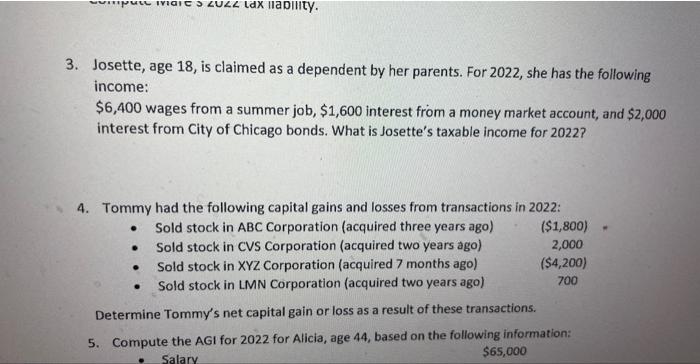

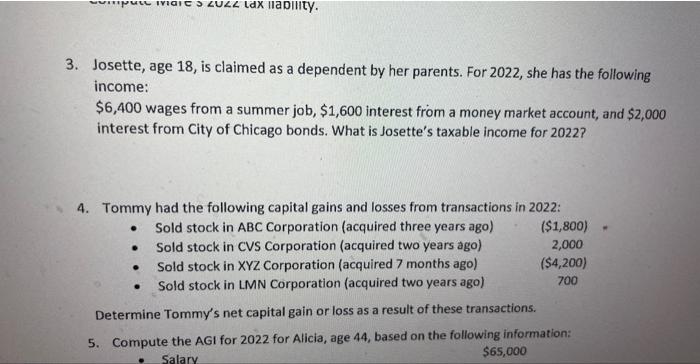

3. Josette, age 18 , is claimed as a dependent by her parents. For 2022, she has the following income: $6,400 wages from a summer job, $1,600 interest from a money market account, and $2,000 interest from City of Chicago bonds. What is Josette's taxable income for 2022? 4. Tommy had the following capital gains and losses from transactions in 2022: -SoldstockinABCCorporation(acquiredthreeyearsago)-SoldstockinCVSCorporation(acquiredtwoyearsago)-SoldstockinXYZCorporation(acquired7monthsago)-SoldstockinIMNCorporation(acquiredtwoyearsago)($1,800)2,000($4,200)700 Determine Tommy's net capital gain or loss as a result of these transactions. 5. Compute the AGI for 2022 for Alicia, age 44 , based on the following information: $65,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started