Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USA Tax Laws 4. Assume that Lawn Corporation has $10 million of Ordinary income from its operations, $45,000 of interest received from its investments on

USA Tax Laws

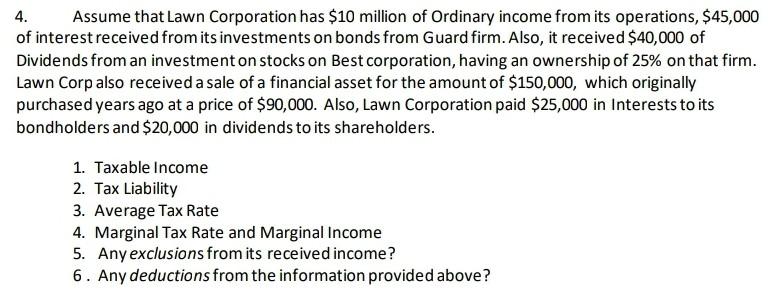

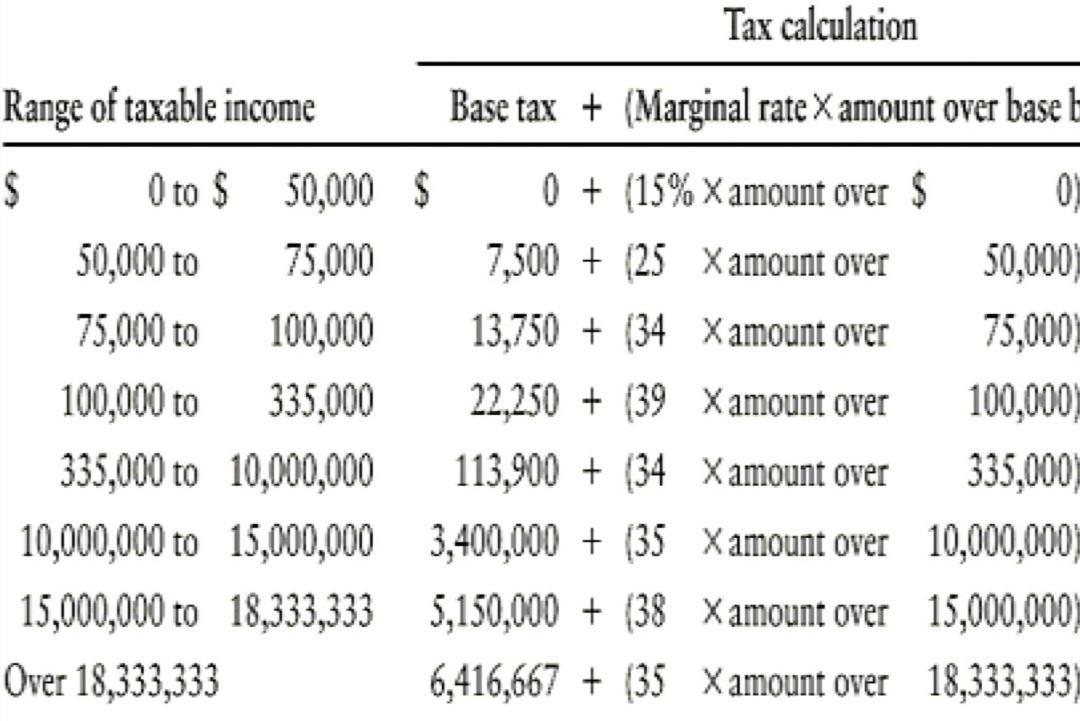

4. Assume that Lawn Corporation has $10 million of Ordinary income from its operations, $45,000 of interest received from its investments on bonds from Guard firm. Also, it received $40,000 of Dividends from an investment on stocks on Best corporation, having an ownership of 25% on that firm. Lawn Corp also received a sale of a financial asset for the amount of $150,000, which originally purchased years ago at a price of $90,000. Also, Lawn Corporation paid $25,000 in Interests to its bondholders and $20,000 in dividends to its shareholders. 1. Taxable income 2. Tax Liability 3. Average Tax Rate 4. Marginal Tax Rate and Marginal Income 5. Any exclusions from its received income? 6. Any deductions from the information provided above? Tax calculation Range of taxable income Base tax + (Marginal rate X amount over base $ 0 to $ 50,000 $ 0 + (15% X amount over $ 09 50,000 to 75,000 7,500 + (25 X amount over 50,000 75,000 to 100,000 13,750 + (34 X amount over 75,000 100,000 to 335,000 22,250 + (39 X amount over 100,000) 335,000 to 10,000,000 113,900 + 34 X amount over 335,000 10,000,000 to 15,000,000 3,400,000 + 35 X amount over 10,000,000) 15,000,000 to 18,333,333 5,150,000 + (38 X amount over 15,000,000) Over 18,333,333 6,416,667 + (35 X amount over 18,333,333)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started