Use 2018 as the current tax year.

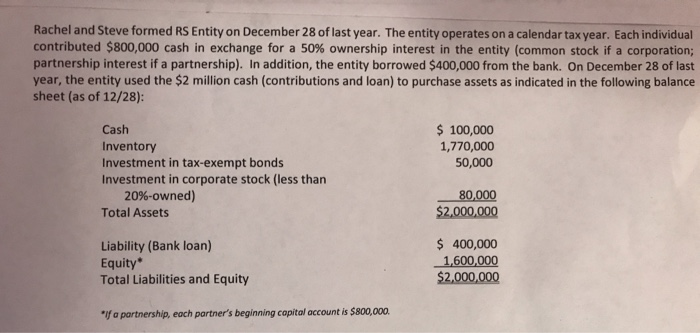

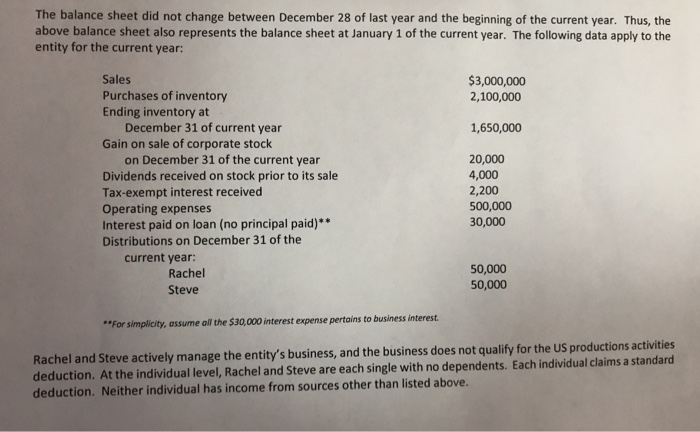

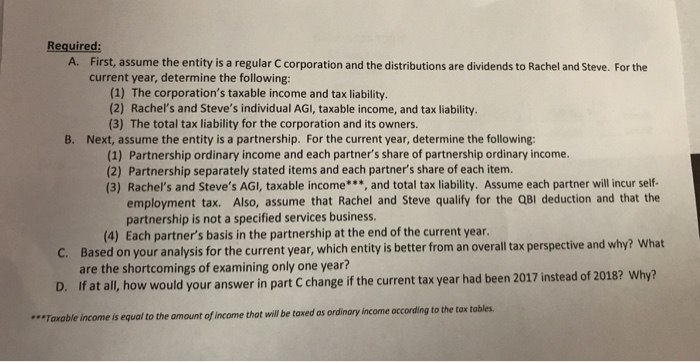

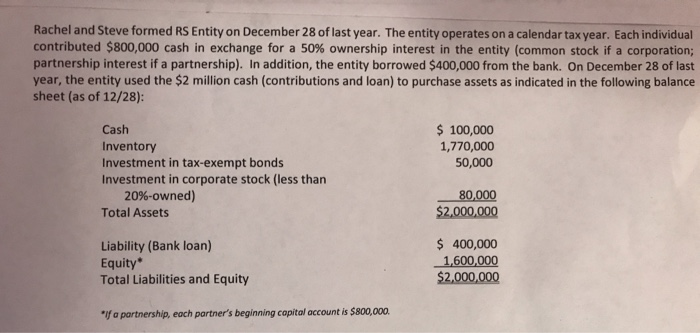

Rachel and Steve formed RS Entity on December 28 of last year. The entity operates on a calendar tax year. Each individual contributed $800,000 cash in exchange for a 50 % ownership interest in the entity (common stock if a corporation; partnership interest if a partnership). In addition, the entity borrowed $400,000 from the bank. On December 28 of last year, the entity used the $2 million cash (contributions and loan) to purchase assets as indicated in the following balance sheet (as of 12/28): Cash $100,000 1,770,000 Inventory Investment in tax-exempt bonds 50,000 Investment in corporate stock (less than 20%-owned) 80,000 $2,000,000 Total Assets 400,000 1,600,000 $2,000,000 Liability (Bank loan) Equity* Total Liabilities and Equity f a partnership, each partner's beginning capital account is $800,000. The balance sheet did not change between December 28 of last year and the beginning of the current year. Thus, the above balance sheet also represents the balance sheet at January 1 of the current year. The following data apply to the entity for the current year: Sales $3,000,000 2,100,000 Purchases of inventory Ending inventory at December 31 of current year 1,650,000 Gain on sale of corporate stock on December 31 of the current year 20,000 4,000 2,200 500,000 30,000 Dividends received on stock prior to its sale Tax-exempt interest received Operating expenses Interest paid on loan (no principal paid)** Distributions on December 31 of the current year: 50,000 50,000 Rachel Steve For simplicity, assume all the $30,000 interest expense pertains to business interest Rachel and Steve actively manage the entity's business, and the business does not qualify for the US productions activities deduction. At the individual level, Rachel and Steve are each single with no dependents. Each individual claims a standard deduction. Neither individual has income from sources other than listed above. Required: A. First, assume the entity is a regular C corporation and the distributions are dividends to Rachel and Steve. For the current year, determine the following: (1) The corporation's taxable income and tax liability. (2) Rachel's and Steve's individual AGI, taxable income, and tax liability. (3) The total tax liability for the corporation and its owners. B. Next, assume the entity is a partnership. For the current year, determine the following: (1) Partnership ordinary income and each partner's share of partnership ordinary income. (2) Partnership separately stated items and each partner's share of each item. (3) Rachel's and Steve's AGI, taxable income, and total tax liability. Assume each partner will incur self- employment tax. Also, assume that Rachel and Steve qualify for the QBI deduction and that the partnership is not a specified services business. (4) Each partner's basis in the partnership at the end of the current year. C. Based on your analysis for the current year, which entity is better from an overall tax perspective and why? What are the shortcomings of examining only one year? D. If at all, how would your answer in part C change if the current tax year had been 2017 instead of 2018? Why? **Taxable income is equal to the amount of income that will be taxed as ordinary income occording to the tax tables Rachel and Steve formed RS Entity on December 28 of last year. The entity operates on a calendar tax year. Each individual contributed $800,000 cash in exchange for a 50 % ownership interest in the entity (common stock if a corporation; partnership interest if a partnership). In addition, the entity borrowed $400,000 from the bank. On December 28 of last year, the entity used the $2 million cash (contributions and loan) to purchase assets as indicated in the following balance sheet (as of 12/28): Cash $100,000 1,770,000 Inventory Investment in tax-exempt bonds 50,000 Investment in corporate stock (less than 20%-owned) 80,000 $2,000,000 Total Assets 400,000 1,600,000 $2,000,000 Liability (Bank loan) Equity* Total Liabilities and Equity f a partnership, each partner's beginning capital account is $800,000. The balance sheet did not change between December 28 of last year and the beginning of the current year. Thus, the above balance sheet also represents the balance sheet at January 1 of the current year. The following data apply to the entity for the current year: Sales $3,000,000 2,100,000 Purchases of inventory Ending inventory at December 31 of current year 1,650,000 Gain on sale of corporate stock on December 31 of the current year 20,000 4,000 2,200 500,000 30,000 Dividends received on stock prior to its sale Tax-exempt interest received Operating expenses Interest paid on loan (no principal paid)** Distributions on December 31 of the current year: 50,000 50,000 Rachel Steve For simplicity, assume all the $30,000 interest expense pertains to business interest Rachel and Steve actively manage the entity's business, and the business does not qualify for the US productions activities deduction. At the individual level, Rachel and Steve are each single with no dependents. Each individual claims a standard deduction. Neither individual has income from sources other than listed above. Required: A. First, assume the entity is a regular C corporation and the distributions are dividends to Rachel and Steve. For the current year, determine the following: (1) The corporation's taxable income and tax liability. (2) Rachel's and Steve's individual AGI, taxable income, and tax liability. (3) The total tax liability for the corporation and its owners. B. Next, assume the entity is a partnership. For the current year, determine the following: (1) Partnership ordinary income and each partner's share of partnership ordinary income. (2) Partnership separately stated items and each partner's share of each item. (3) Rachel's and Steve's AGI, taxable income, and total tax liability. Assume each partner will incur self- employment tax. Also, assume that Rachel and Steve qualify for the QBI deduction and that the partnership is not a specified services business. (4) Each partner's basis in the partnership at the end of the current year. C. Based on your analysis for the current year, which entity is better from an overall tax perspective and why? What are the shortcomings of examining only one year? D. If at all, how would your answer in part C change if the current tax year had been 2017 instead of 2018? Why? **Taxable income is equal to the amount of income that will be taxed as ordinary income occording to the tax tables