Answered step by step

Verified Expert Solution

Question

1 Approved Answer

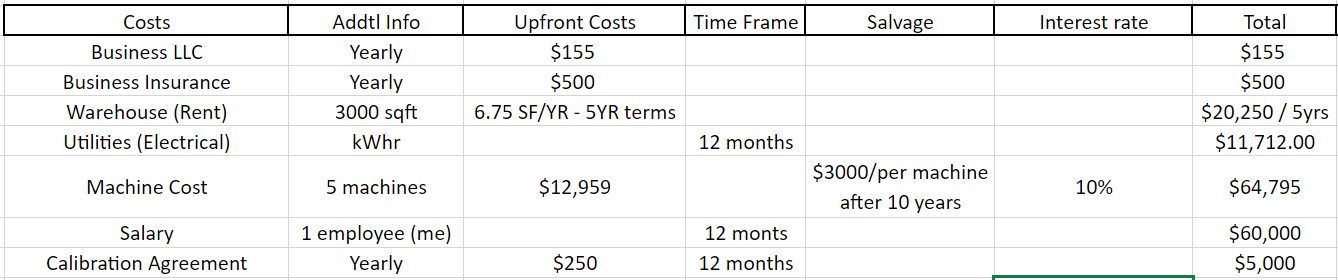

Use a 10-year planning horizon, and whatever interest rate(s) you determine to be appropriate. Assume that all assets will be sold off at the end

- Use a 10-year planning horizon, and whatever interest rate(s) you determine to be appropriate. Assume that all assets will be sold off at the end of the ten years. The effects of depreciation should be included where appropriate.

Costs Business LLC Business Insurance Warehouse (Rent) Addtl Info Upfront Costs Time Frame Salvage Interest rate Total Yearly $155 $155 Yearly $500 $500 Utilities (Electrical) 3000 sqft kWhr 6.75 SF/YR-5YR terms $20,250/5yrs 12 months $11,712.00 Machine Cost 5 machines $12,959 $3000/per machine. after 10 years 10% $64,795 Salary Calibration Agreement 1 employee (me) Yearly 12 monts $60,000 $250 12 months $5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To create a 10year financial plan we need to consider the upfront costs salvage values and ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started