Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or type values,

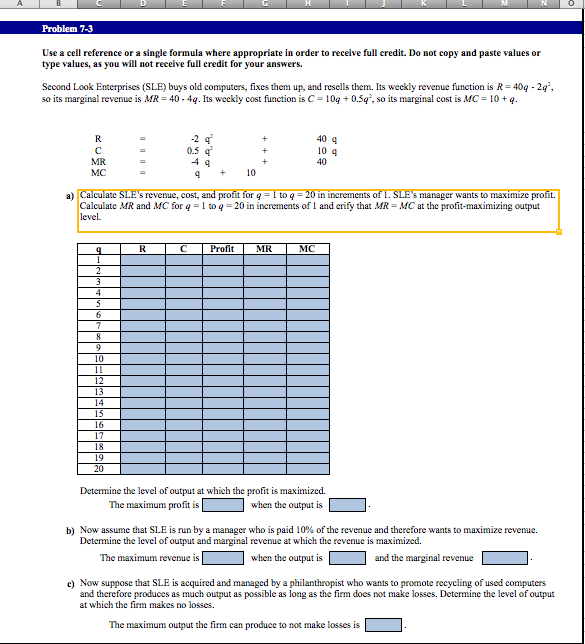

Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or type values, as you will not recelve full credit for your answers. Second Look Enterprises (SLE) buys old computers, fixes them up, and resells them. Its weekly revenue function is R=40q2q2, so its marginal revenue is MR=404q. Its weekly cost function is C=10q+0.5q2, so its marginal cost is MC=10+q. RCMRMC====2q20.5q24qq+10++4040q10q a) Calculate SLE's reverue, cost, and profit for q=1 to q=20 in increments of 1 . SLE's manager wants to maximize profit. Calculate MR and MC for q=1 to q=20 in increments of l and erify that MR=MC at the profit-maximizing output level. Determine the level of output at which the profit is maximized. The maximum profit is when the output is b) Now assume that SLE is run by a manager who is paid 10% of the revenue and therefore wants to maximize revenue. Determine the level of output and marginal revenue at which the revenue is maximized. The maximum revenue is when the output is and the marginal revenue c) Now suppose that SLE is acquired and managed by a philanthropist who wants to promote recycling of used computers and therefore produces as much output as possible as long as the firm does not make losses. Determine the level of output at which the firm makes no losses. The maximum output the firm can produce to not make losses is

Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or type values, as you will not recelve full credit for your answers. Second Look Enterprises (SLE) buys old computers, fixes them up, and resells them. Its weekly revenue function is R=40q2q2, so its marginal revenue is MR=404q. Its weekly cost function is C=10q+0.5q2, so its marginal cost is MC=10+q. RCMRMC====2q20.5q24qq+10++4040q10q a) Calculate SLE's reverue, cost, and profit for q=1 to q=20 in increments of 1 . SLE's manager wants to maximize profit. Calculate MR and MC for q=1 to q=20 in increments of l and erify that MR=MC at the profit-maximizing output level. Determine the level of output at which the profit is maximized. The maximum profit is when the output is b) Now assume that SLE is run by a manager who is paid 10% of the revenue and therefore wants to maximize revenue. Determine the level of output and marginal revenue at which the revenue is maximized. The maximum revenue is when the output is and the marginal revenue c) Now suppose that SLE is acquired and managed by a philanthropist who wants to promote recycling of used computers and therefore produces as much output as possible as long as the firm does not make losses. Determine the level of output at which the firm makes no losses. The maximum output the firm can produce to not make losses is Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started