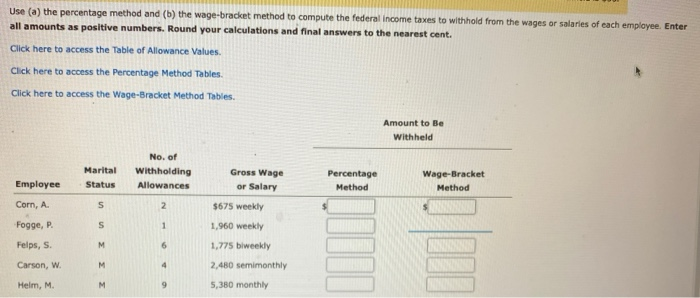

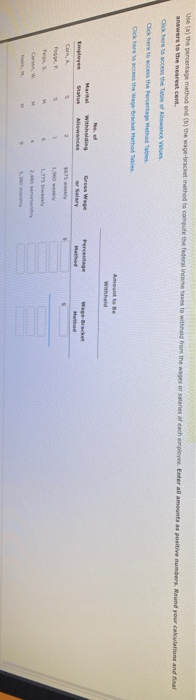

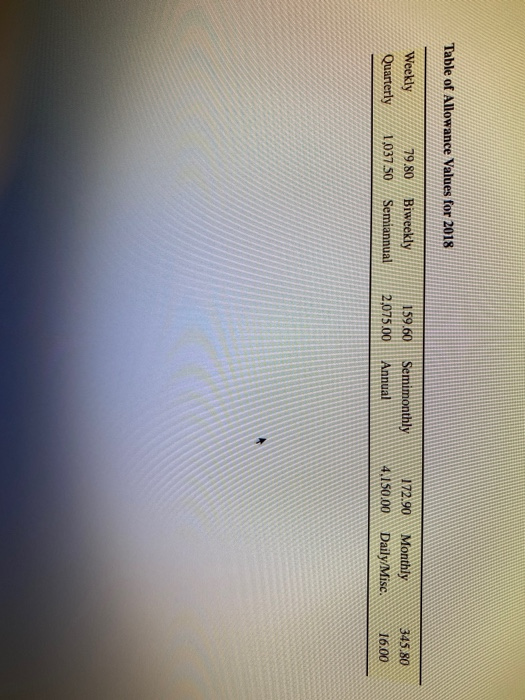

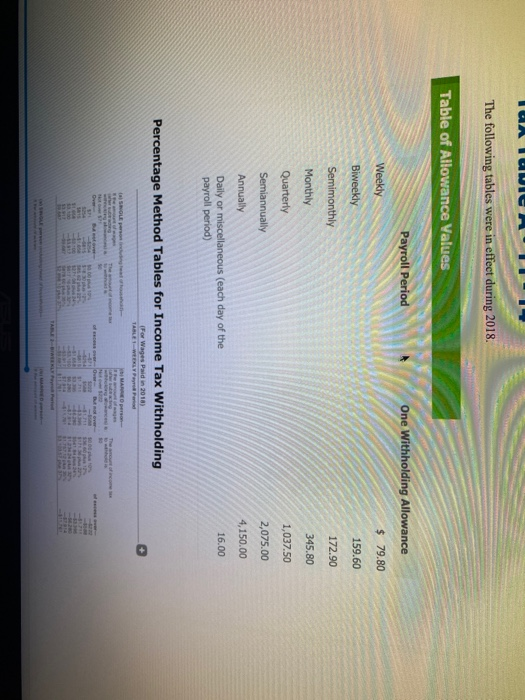

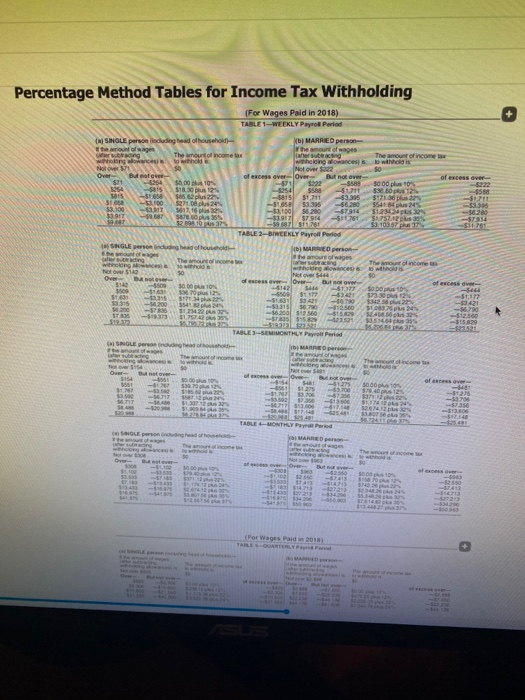

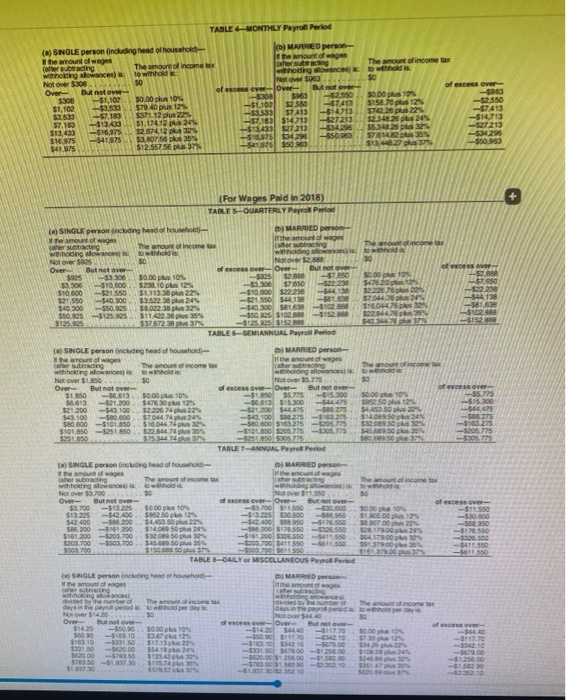

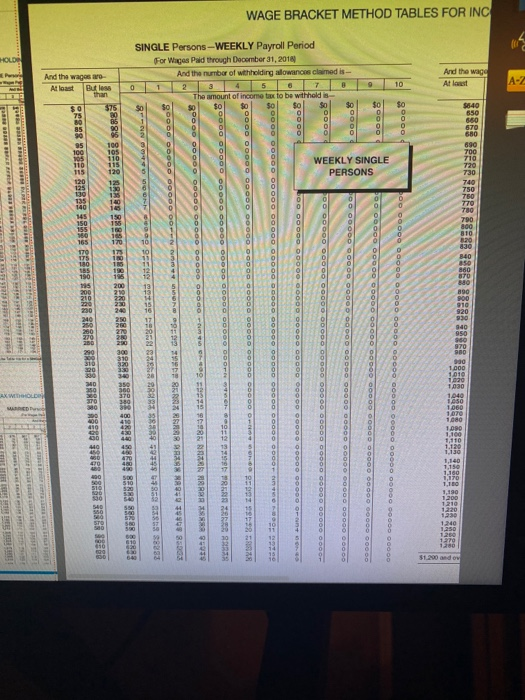

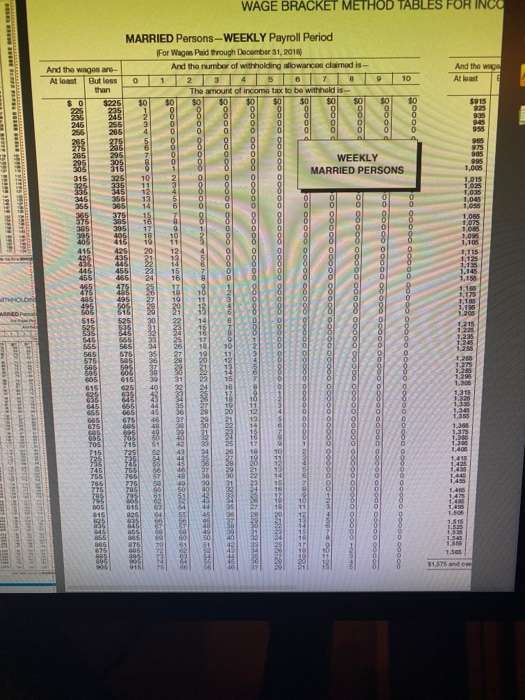

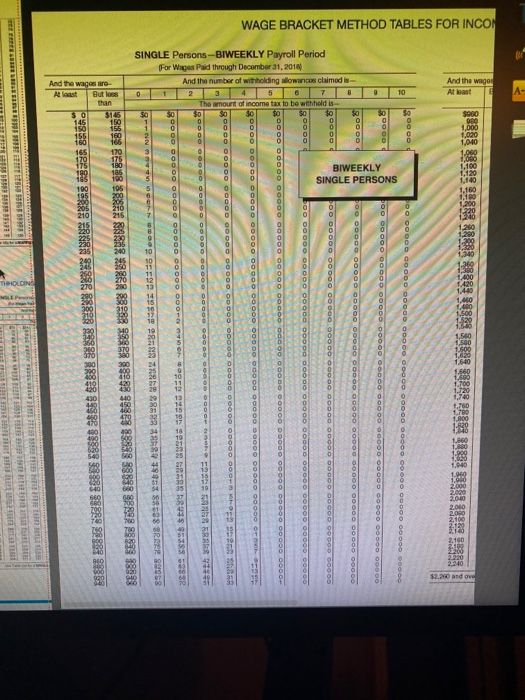

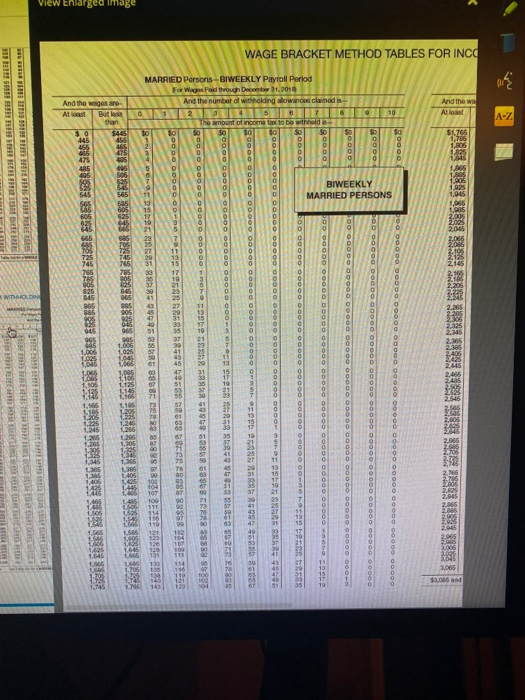

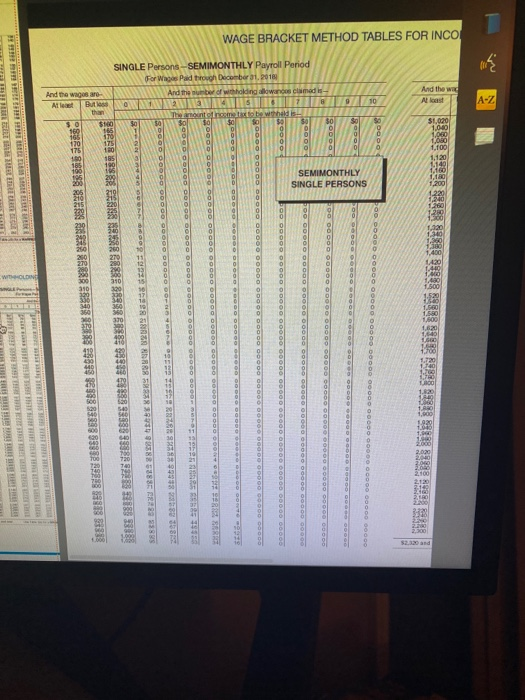

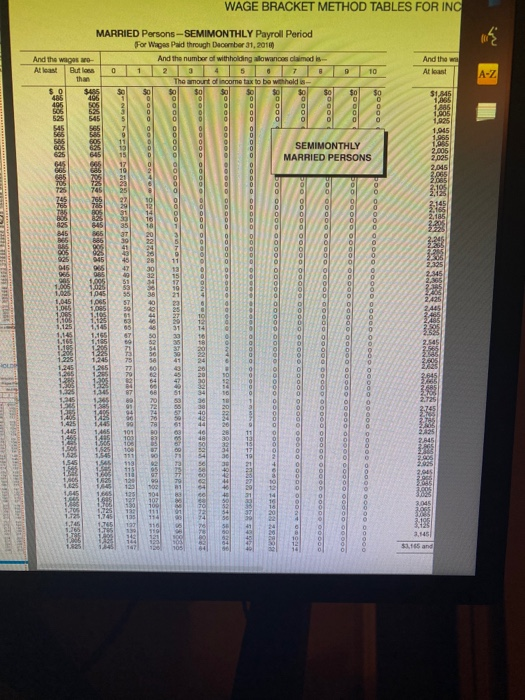

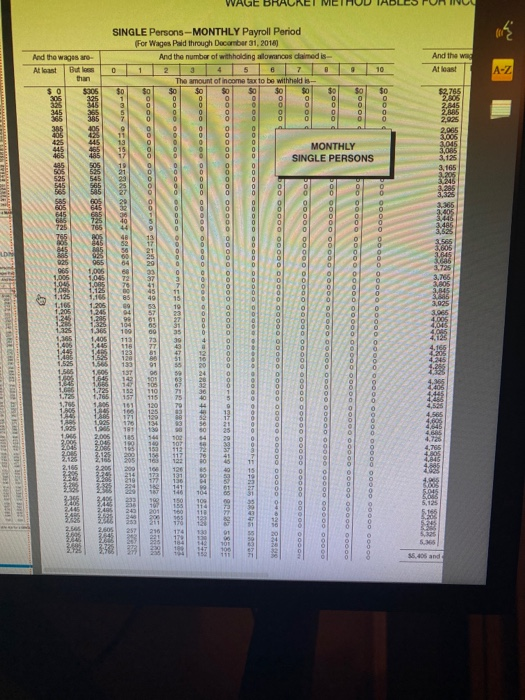

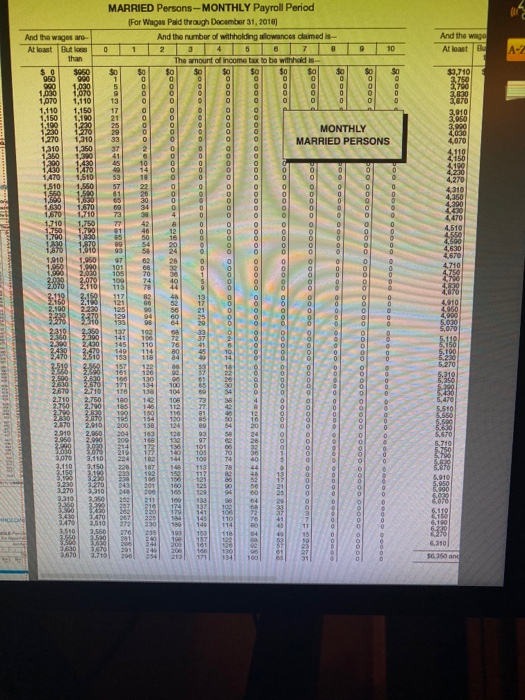

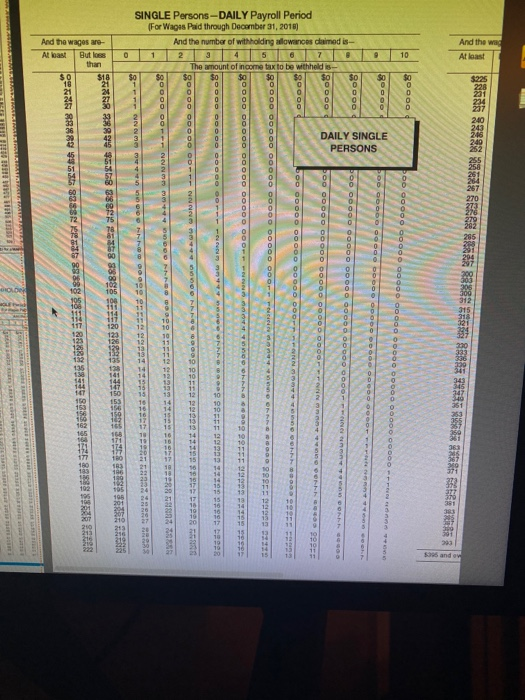

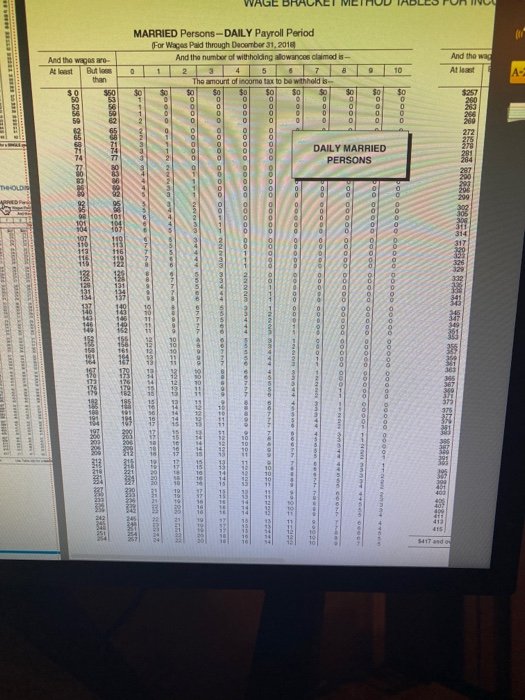

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Amount to Be Withheld No. of Marital withholding Gross Wage Percentage Wage-Bracket Employee Status or Salary Allowances Method Method Corn, A. 2. $675 weekly Fogge, P. 1,960 weekly Felps, S. M. 1,775 biweekly Carson, W. 2,480 semimonthly M. 5,380 monthly Helm, M. Use (a) the percentage method and (b) the wage-bracket method to compute the federal income tases te withhold from the wages or salaries af each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Click here ta access the Tahe of Aliowance Values Cick here to access the Percentage Hethod Tables Click here to access the Wage-Bracket Hethod Tables Amount to Be withheld No. of Withholding Allewances Gress Wage or Salary Marital Percentage Wage-Bracket Employee Status Method Method Con, A 75 weekly Togge, Feion,S 1775 biwekly Carsen, W 2.480 sennenthy 5.30moy Table of Allowance Values for 2018 Weekly 79.80 Biweekly 159.60 Semimonthly 172.90 Monthly 345 80 Quarterly 1,037.50 Semiannual 2,075.00 Annual 4.150.00 Daily/Misc. 16.00 The following tables were in effect during 2018. Table of Allowance Values Payroll Period One Withholding Allowance Weekly $ 79.80 Biweekly 159.60 Semimonthly 172.90 Monthly 345.80 Quarterly 1,037.50 Semiannually 2,075.00 Annually 4,150.00 Daily or miscellaneous (each day of the payroll period) 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1-WEEKLY Payro Period (a SOLE person nugtead ohoho- MAREO person Faages The anount f income The amount of income wit Not er $7 Over SPI of eecess over Over- But not eve fescess over TABLE 2-BIWERKLY Py Pertd IMARRIED esen Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1-WEEKLY Payrol Period SINGLE person induding head ofhousehold- The amount of wage erubrang wihholong alowances Not over $71 Over ST1 (b) MARRIED person rhe amount of wages liaher suteactng wihhoing aloances) Not over S2 The amount of income la lo wihhold The amount of income ta wthold is But not over 4254 of excess over-Over But not over of excess over- 4222 4588 -51711 -53.395 -56.200 -57.914 511761 $0.00 p 10 S18.30 p12 $8s 62 plus22 $271.00 pl2 361716 ps 32% sa 00 plus 10 $36.60 ps125 $171.36 plus 2s $54184 pus 2NS $123424 30% S1757.12s 305 $3. 103 67h37% -471 -5254 -5815 $222 $588 S1.711 $3.395 $6.280 -5588 -$1.711 63.395 46.200 $1.658 -83/00 -3317 S858 $1.658 $3.100 $3.917 9.447 -$7914 -$3.917 $7 914 $2.898.10 s 37% 87 sit.761 TABLE 2-BWEEKLY Payroll Period (SNGLE person ndluding head of hoihold he t of wages Hafter utacing withoong alo Not over $142 Over $142 ss09 ST43 19.315 200 STA35 S19.373 (b) MARRED person Lahe anourt ofwages liahersobeacing ihholding atownces Nor over $44 The amount olincore wihold The amount ofincome wthhcid s B netover -4509 of excess ove Jover -4142 -5509 -51.631 But so over of escess dver- $444 $1.17 $3.421 is se.790 -6.200 $12 560 so be ps 10 $73.0 pus 2N $342.56 plus 22% S1083.26ps24% SEAA.50cs 32% $3.514.64 s 3 13420phs 2% $171 13541.82ph24% $1.23422 3 $1.75742 % $5.795.22. S -43421 -50.790 -512.560 415429 -S1322 -3421 -4.790 -312300 5429 -523.321 .200 -S19.373 TABLE3-5EMIMONTHLY Payroll Period SNGLE peson ndungheaoho The anout ofeaes laher subeactg bi MARRED person The amount tnome wages Fonersuba The a t dtocoe t Ne ver S Neroer Sn Over $154 But net ove Texcess over- Over Bot ove 1.275 -45.00 of excess avier- -481 -1275 -3.706 5461 s0.00p10 379.46phust25 37112phsN S374.120k 24% 1glus 12% $1.767 -4717 4.717 $1.307.12 k 32 1,900.4s3 A275.643 -313.406 S20 -12000s5.481 TABLE MONTHLY Pay Period -da5401 NOLE person nuding head ofhousek- Teou deages terdcting whong ance Not or Sce Over laMARRED person The amountinome to whhd wages The amount ofncome t thhods st over- -11.100 -43.533 Texpess over Ove 10.00 But t ever 2550 of excess oer- -8063 -12.500 s000 ph 1 $2.500 S742.0 2 pks 2 $134 asi4.213 22% 12342 24% S7A148 2 1382ps 3% -514.713 $41 -534.20 -di0.063 (For Wages Paid in 2018) TAILES-OUARTERLY P a Pa NOEpon. ingeat h MARRED Ncome t AS TABLE MONTHLY PayrolI Period le MARRIED person- e the amount of wages her subracting holding owance o wthhold is Not over $963 JOver- S963 $2.580 $7 A13 (a) SINGLE person (including head ol household- Ihe amount of wages (after subtracting weholding akowancen) Not over $308 Ove $308 $1, 100 $3.530 $7. 183 $13.433 S1e.975 S41.975 The amount of income tax The amount ol income ox to wihhold is 50 of excess over -5963 -$2.550 STA13 -$14.713 -27213 -$34296 -%250.963 But not eve 2.550 ATA13 excess ever- S0.00 pus 10 $158.70 pus 12 S7422 pus 22% $2.34 pus 24s $5342 ps 2s 578142 3% But not over- 308 50.00 plun 10 $79.40 pus 12% $371.12 plus 225 $1.174.12 pus 24% $2.674.12 s 32% $3.80750 plus 35% $12.557 56 plus 37% -$1.102 533 27213 834298 -850.063 37.163 $14.713 $13.433 27 213 $13.433 S16,975 al975 16.975 $34.296 (For Wages Paid in 2018) TABLE SOUARTERLY Payoll Period DI MARRIED perse linthe amountd wages (ater subtracting weholding allo Notover $26e But not ove 7.850 (a) SINGE pers (nckding headof household- he amount of wages aher suotracting wthhong alowances is Not over $92s Over The The amount of income tax owthhold is Tercess over- of escess over-Over -$025 -33.306 $10.600 $2225 21.550 $44.3 S40.300 sa But net over $3.306 S10.600 RL550 SC.00 p 10 $47620 $2.20 57.044 $16.04476 ps 32 $2284476pk 35% $280 $7.650 $0.00 plus 10% $238.10 plus 12 $1.113.38 plus 22% $3.522 38 plus 24% S8.022 38 plus 32 $11.422 36 plus 35% $37 672 38 plus 37 $3.306 $10.600 $2150 $40.300 550.925 $125.925 -444130 L838 24% 550.925 41255 TABLE 6-SEMIANNUAL Payroll Period MARRIED person Ithe anourt of wages (ater subtracting hoiding allo Notover $5.775 (a) SINGLE person (inckuding head of household he amount of wages after suttracing wihholding alowances) is Not over $1.8so Over $1.850 $6.013 $21.200 $43 100 s80.000 -sio1.0 si01,850 -S2S1.850 $251.850 The tofincome tak The amount of income ta owehold in of excess ove-Over- $5.775 of excessover -85.775 5.300 4.475 s88.275 S103.275 5206.775 But not over -56.613 But net ever- 15.300 644 475 s88.275 4A so00 41850 -56.613 S15.300 -$21.200 $4,475 -S43, 100 s275- 5 -S80.600 S163.275-205.775 -S10180 S205.775-305.775 -5251850 30s 775 S0.00 pus 10% -21.200 47630ps 12 $2226 74 pus 22% S7044.74 pus 24% S16.044.7 plus 32% $22844.74 plus 35% $7534474 pus 3% -543,100 80.600 775 TABLE 7ANNUAL Payro Period MARRIED person nthe amout wages (a) SINGLE person including head of householdi- he amount of wages ater subrading whholding alownces is lowihold is Not over $3.700 Over- $3.700 $13.225 $42.400 S86.200 -S161.200 SIG1 200 -s203.700 S203.700S503,700 $s03.700 The amount of ncome tax The aount of income t withholding allowances is ehols Not over $11,500 so of excess over-Over- But not over -S13.225 But not over- -4.00 of excess over- -$11.550 -500.600 -S88.950 176.550 -4320.550 -2411.550 $011.550 -53.700 S11550 -$13.225 30B00- 50 -$2.400 S950-176 5.s700 h 2 S00.200 $176.550-326550 1200 $306.550 -41150 S17900 pn 3 s200.700 $411550-561L500 -$s03.700 ser1550 S0.00 ps 10% -42.400. S95250 ps 12 S6.200 $4453.50 plus 22 $140e9 50 plus 24% $32.0 s0 phus % s0.00 p 10 S1.905.00 pus 12% S217900ps 24% nd os sass TABLE 8-DAILY or MSCELLANEOUS Payo Peried S9137900 ps 30 $1613900 pus 37% DI MARRED perso () SINGLE person (incudng head of hounehold- The amount of wages wr ttacting withhodng aloances dvided by the umber of days in the payrl period Hehold per day is Not over $1420 Over- $14.20 S50.90 $163.10 $331 50 S620 00 S783 50-1.907.30 $1.07 30 me amount of wages fcater wthholding wtow lovided by bher Days in the payrok peroda o wenod per day s Notover $4440 bacino The amount ofincome The amount ot income ta of escess over-lover -214.20 But not over- -150.90 -$163.10 -5331.50 -M20 00 -$78350 But not ove 4117.20 1342 10 of excess over- $44 40 0s0 $117.70 -$163.10 $34210 s0.00 plus 10 $347 plus 12 $17.13 ps 22 S54.18 p 2S $12342p 32s $175.74 p 3% $579.57 3% s.00 p 1% $7.30 p 12% $34.2 p 22% $108.3 -244.40 -$117.70 -1342 10 -4679.00 -4125.00 41582.90 -42252.10 so $478.00 254.00 0.00s1.256.00 -1520 -$783.501.582 0-230210 -41.207.30.352 10 $35147 gs 30% $420 s37% WAGE BRACKET METHOD TABLES FOR INC SINGLE Persons-WEEKLY Payroll Period HOLD For Wgas Paid through December 31, 201 Ard the wage And the numbar of withholding allowancen claimed is- Pers And the wages aro- 9 10 012 34 567 The amount of income tax to be withhold in- At last But less than At loast WEEKLY SINGLE PERSONS $1.200 and ov bo0 00 000 0000000000000000000 o 0o000 0000o 00000 00000 00000 0000g pO00000000000 0000000000 00D00 0000o 00000 00000 0000000000 00000 00 0000000000 0000000000.00000 00000000000o00o 00000 00000 000o- b0000 00000000000 00000000000 000000 000000 000000000 OrNne den WAGE BRACKET METHOD TABLES FOR INCO MARRIED Persons-WEEKLY Payroll Period For Wagen Paid through December 31, 2016 And the number of withholding allowancos claimed is- And the wage And the wagos are- O1 2 3 4 5 7 B9 10 At least At loast But less than The amount of incomo tax to be withhold is- WEEKLY MARRIED PERSONS 1,505 $1,575 and ow go000 000000000000 000000 000000000 0000 000000 0000000000 0000o 00000 000000O000000 000000 000000000 0000 000000000000000 0000O 00000 00 00000 0000o 00000 O0000 00000 000000000000000000000000014040 10000 000000000000 0000000000000000 0000 00000000000000-234501 00- 00000 00000 00000 000000 00000 000000 000010v h-00123iO Ogr WAGE BRACKET METHOD TABLES FOR INCON SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through Decomber a1, 201 And the number of withholding allowancos claimod is- And the wager At least And the wages are- 10 a 4 5 6 7 012 At legst But los The amount than nt of income tax to be withheld is- $0 BIWEEKLY SINGLE PERSONS TieOLOIN $2.200 and ove L22el edeleleiel elelelelel 0o 000000000 o00000 00000 o0000 00000 00000 00000 00000 00000 00000 boo 00000 0000 o 00000 000000000000000 00000 00000 0o000 0000o 00000 boo 00000 0000 000000 0c0000 0o000 00000 00000 o000o o0000 00000 00000 190000 pOo 000000000o 00000 0000000000 00000 00000 00000 00000 00000 00000 boo oo 000 00 000 00 000 000 00 000 00 0000 0 00000o00000 00000000000 o0000 00000 00000 00000 00000 000000 00000 o00000 000000 000 0O00 000 000000 000000 0000 lgo000 00000 00000 00000 00000 00000 000000 0000 0000000000 000 00000000100 oro 1ULLLL R0000 00000 00000 00000 00000 00000 000000 00000000000000 00019579 R r h View Enlarged Image WAGE BRACKET METHOD TABLES FOR INCO MARRIED Persons- BIWEEKLY Payroll Perlod bentr 1.201 Fa Wagns Pd though D And the number of withnolding alowancos claimod is And the wa And the wages are But le than At loast At lont A-Z t ol income tax to be wthneld a REAL BIWEEKLY MARRIED PERSONS eR iedeiedel elrieiriel eleieleied edelelelel edeinni cieleirel eleieleir eirieleiei addin Ne poo 0000 00000 0000000000b0000 00000.0000000000 0000000000 00000 PO0 0000000000 000000o000 00000 0000o 00000 0000000000 00000 00000 100000 000000000000 o 00000 000000000000000000 000 000 000000 0 000-n b0000000 000 00000000000 0080000 0000000000000000 00 000-00n 11LLL 00000 000000000000 000000 00000 00000 00000 00120791n0e50e ere l00000 00000 000000000000 000000000 00000 00000 0000o -0000E 2 2 SEDRE SR: WAGE BRACKET METHOD TABLES FOR INCO SINGLE Persons-SEMIMONTHLY Payroll Period For Wages Paid trovgh Decomber a1. P018 And the number of withholding aowancos clamad is MEWAKAWNE WWhonont of nsme taxto be wthhalk And the wa And the wagon are /O/ Al kast SEMIMONTHLY SINGLE PERSONS rid ninininini doininin niininin 20000 1900000 F00 0000 000000 00000 000000000o 00000 00000 0000O 00000 00000 00000 bO0000o 00 000000000 O 00000 00000 00000 00000 0000000000 00000 00000 pOo000000000 000000 00000 00000 00000 00000 00000 00000 O0000 00000 Ro000 00000 00000 0 0000 00 000 OD0 000000 0 00000 00000 00000 000 000000o 00000 00000 33888 939AF 381 RERE R 83 8318 ES R 10700000 WAGE BRACKET METHOD TABLES FOR INC MARRIED Persons-SEMIMONTHLY Payroll Period For Wagas Paid through December 31, 2010 And the numbor of withholding alowances claimod is And the wages re- At least And the w 01 2 a45 7 The amount of income tax to be wthhold is sol 89 But loss than At least 10 Sol SEMIMONTHLY MARRIED PERSONS 3,145 $1.165 and edei eieieieiri eieieiei deleini eeieni eiinini iriniein cininieiei eininieiei inininii eininin ie poo o0o000000 000000 0000000 D00000000000000000 000000000000000 peo 00o000000000000000000 000000000 000000000000000000000 00000 poo 00o000000000000 00000 000000000 0 00000 00000.00000000000000 boo 0000000000.00000 0000000000 0000000000 0000000000000 oagu boo 00000090000 0000000000000000000 000000 000ONTenge ZERN ZEER 2000 D 0000 0 000 0000 0000 00000 00000 00000 00000 0...0 WAGE BRACKET METHOD SINGLE Persons-MONTHLY Payroll Period (For Wages Paid through Docamber 31, 2018) And the wag And the numbar of withholding allowances daimed is And the wages are- 2 a46 7 The amount of income tax to be withheld is- 10 01 But lees At least A-Z At least than MONTHLY SINGLE PERSONS 5,366 $5.406 bO000 000 00000000000000000000 00000 000000 00000 00000 0000 00000 bo0 00 00000 000000 00000 000000 00000 000000 00000 000000 00 000 00000 p00000000000 000000 0000000000 00000000000000.00000 0000o000000 poo o0 000 00 00000000000 00000000000 000000 000000000000000 00oo boo oo 000 00 00000000 00000 0000 00000 000000 00000 0 0000 04 e 5.0R 58BREa 5858F 2o000 00000 00000 o00000000000000 0000000000 000enap MARRIED Persons-MONTHLY Payroll Period (For Wages Pald through Docember 31, 2018) And the wage At loast B And the number of withholding alowances claimed is 01 2 34 6 7 The amount of income tax to be withhold is And the wages aro At least But los than 9 10 MONTHLY MARRIED PERSONS $6.360 an gefefefes efee4 fulul ulddd bO0 000 000000 0 00000 D0000 00000 000000000000000 0000000000 00000 bO000 00000 000 00 000 00 00000000000 00000000000 00000 000000 00000 poo 000 000000 0 00000 00000 00000 000000000000000 000000O31-228E b00000000 000000000 o 00000 00000 0000000000000m RR Jeiel einiedeii einidein eiieielel eieieieied eieielefe eleloiei de 8888 ees eese 22222 einiN eeininie eeife eesnd 22222 SINGLE Persons-DAILY Payroll Period (For Wagas Paid through Decamber 31, 2018) And the wages are- And the wag And the number of withholding allowances claimed is- At loast 34 5 6 7 But loss than 0 1 2 The amount of income tax to be withheld is- 10 At least DAILY SINGLE PERSONS S395 ande b0000 00000 00000 000 00 00000000 000 00000 000000 01110 dnn0 cee bo0 oe 00000 00000 00000 000 00 900 000 o111240e enen ee *00 poo oo 00000 00000 000 0000000001112NN n 44400 00777 040022 bOO00 000 00 00000 00000011110ereN.mm 444050 e00000 8b000222 RNS 1UL-- PLLLL DI 20000 000000 0000 00000 00000 000011 12000e eL 43S0O77700 000222EE WAGE B ACKE MARRIED Persons-DAILY Payroll Period (For Wages Paid through December 31, 2018 And the number of withholding allowancos claimed is- 2 3 4 56 7 8 The amount of income tax to bo withhold is- And the wag And the wagas are But los than 10 At least At lanst DAILY MARRIED PERSONS PO0000000000O 00000 00000 00000 0000o.00000 oo0or as ne ce b0000 00000000000 0000000 0000o 00000 0000--t nnnne eee ceech DO000 000 00000000 000000000000 00011 ent ne1e eee coom e 20000 00000 00000 00000 0011122200 444 n ecehA7000 00000 Iso000 00000 00000 00111 22200 m34444 e eOnAN0ea0 000EE ER 2222 2222 ....... Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Amount to Be Withheld No. of Marital withholding Gross Wage Percentage Wage-Bracket Employee Status or Salary Allowances Method Method Corn, A. 2. $675 weekly Fogge, P. 1,960 weekly Felps, S. M. 1,775 biweekly Carson, W. 2,480 semimonthly M. 5,380 monthly Helm, M. Use (a) the percentage method and (b) the wage-bracket method to compute the federal income tases te withhold from the wages or salaries af each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Click here ta access the Tahe of Aliowance Values Cick here to access the Percentage Hethod Tables Click here to access the Wage-Bracket Hethod Tables Amount to Be withheld No. of Withholding Allewances Gress Wage or Salary Marital Percentage Wage-Bracket Employee Status Method Method Con, A 75 weekly Togge, Feion,S 1775 biwekly Carsen, W 2.480 sennenthy 5.30moy Table of Allowance Values for 2018 Weekly 79.80 Biweekly 159.60 Semimonthly 172.90 Monthly 345 80 Quarterly 1,037.50 Semiannual 2,075.00 Annual 4.150.00 Daily/Misc. 16.00 The following tables were in effect during 2018. Table of Allowance Values Payroll Period One Withholding Allowance Weekly $ 79.80 Biweekly 159.60 Semimonthly 172.90 Monthly 345.80 Quarterly 1,037.50 Semiannually 2,075.00 Annually 4,150.00 Daily or miscellaneous (each day of the payroll period) 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1-WEEKLY Payro Period (a SOLE person nugtead ohoho- MAREO person Faages The anount f income The amount of income wit Not er $7 Over SPI of eecess over Over- But not eve fescess over TABLE 2-BIWERKLY Py Pertd IMARRIED esen Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1-WEEKLY Payrol Period SINGLE person induding head ofhousehold- The amount of wage erubrang wihholong alowances Not over $71 Over ST1 (b) MARRIED person rhe amount of wages liaher suteactng wihhoing aloances) Not over S2 The amount of income la lo wihhold The amount of income ta wthold is But not over 4254 of excess over-Over But not over of excess over- 4222 4588 -51711 -53.395 -56.200 -57.914 511761 $0.00 p 10 S18.30 p12 $8s 62 plus22 $271.00 pl2 361716 ps 32% sa 00 plus 10 $36.60 ps125 $171.36 plus 2s $54184 pus 2NS $123424 30% S1757.12s 305 $3. 103 67h37% -471 -5254 -5815 $222 $588 S1.711 $3.395 $6.280 -5588 -$1.711 63.395 46.200 $1.658 -83/00 -3317 S858 $1.658 $3.100 $3.917 9.447 -$7914 -$3.917 $7 914 $2.898.10 s 37% 87 sit.761 TABLE 2-BWEEKLY Payroll Period (SNGLE person ndluding head of hoihold he t of wages Hafter utacing withoong alo Not over $142 Over $142 ss09 ST43 19.315 200 STA35 S19.373 (b) MARRED person Lahe anourt ofwages liahersobeacing ihholding atownces Nor over $44 The amount olincore wihold The amount ofincome wthhcid s B netover -4509 of excess ove Jover -4142 -5509 -51.631 But so over of escess dver- $444 $1.17 $3.421 is se.790 -6.200 $12 560 so be ps 10 $73.0 pus 2N $342.56 plus 22% S1083.26ps24% SEAA.50cs 32% $3.514.64 s 3 13420phs 2% $171 13541.82ph24% $1.23422 3 $1.75742 % $5.795.22. S -43421 -50.790 -512.560 415429 -S1322 -3421 -4.790 -312300 5429 -523.321 .200 -S19.373 TABLE3-5EMIMONTHLY Payroll Period SNGLE peson ndungheaoho The anout ofeaes laher subeactg bi MARRED person The amount tnome wages Fonersuba The a t dtocoe t Ne ver S Neroer Sn Over $154 But net ove Texcess over- Over Bot ove 1.275 -45.00 of excess avier- -481 -1275 -3.706 5461 s0.00p10 379.46phust25 37112phsN S374.120k 24% 1glus 12% $1.767 -4717 4.717 $1.307.12 k 32 1,900.4s3 A275.643 -313.406 S20 -12000s5.481 TABLE MONTHLY Pay Period -da5401 NOLE person nuding head ofhousek- Teou deages terdcting whong ance Not or Sce Over laMARRED person The amountinome to whhd wages The amount ofncome t thhods st over- -11.100 -43.533 Texpess over Ove 10.00 But t ever 2550 of excess oer- -8063 -12.500 s000 ph 1 $2.500 S742.0 2 pks 2 $134 asi4.213 22% 12342 24% S7A148 2 1382ps 3% -514.713 $41 -534.20 -di0.063 (For Wages Paid in 2018) TAILES-OUARTERLY P a Pa NOEpon. ingeat h MARRED Ncome t AS TABLE MONTHLY PayrolI Period le MARRIED person- e the amount of wages her subracting holding owance o wthhold is Not over $963 JOver- S963 $2.580 $7 A13 (a) SINGLE person (including head ol household- Ihe amount of wages (after subtracting weholding akowancen) Not over $308 Ove $308 $1, 100 $3.530 $7. 183 $13.433 S1e.975 S41.975 The amount of income tax The amount ol income ox to wihhold is 50 of excess over -5963 -$2.550 STA13 -$14.713 -27213 -$34296 -%250.963 But not eve 2.550 ATA13 excess ever- S0.00 pus 10 $158.70 pus 12 S7422 pus 22% $2.34 pus 24s $5342 ps 2s 578142 3% But not over- 308 50.00 plun 10 $79.40 pus 12% $371.12 plus 225 $1.174.12 pus 24% $2.674.12 s 32% $3.80750 plus 35% $12.557 56 plus 37% -$1.102 533 27213 834298 -850.063 37.163 $14.713 $13.433 27 213 $13.433 S16,975 al975 16.975 $34.296 (For Wages Paid in 2018) TABLE SOUARTERLY Payoll Period DI MARRIED perse linthe amountd wages (ater subtracting weholding allo Notover $26e But not ove 7.850 (a) SINGE pers (nckding headof household- he amount of wages aher suotracting wthhong alowances is Not over $92s Over The The amount of income tax owthhold is Tercess over- of escess over-Over -$025 -33.306 $10.600 $2225 21.550 $44.3 S40.300 sa But net over $3.306 S10.600 RL550 SC.00 p 10 $47620 $2.20 57.044 $16.04476 ps 32 $2284476pk 35% $280 $7.650 $0.00 plus 10% $238.10 plus 12 $1.113.38 plus 22% $3.522 38 plus 24% S8.022 38 plus 32 $11.422 36 plus 35% $37 672 38 plus 37 $3.306 $10.600 $2150 $40.300 550.925 $125.925 -444130 L838 24% 550.925 41255 TABLE 6-SEMIANNUAL Payroll Period MARRIED person Ithe anourt of wages (ater subtracting hoiding allo Notover $5.775 (a) SINGLE person (inckuding head of household he amount of wages after suttracing wihholding alowances) is Not over $1.8so Over $1.850 $6.013 $21.200 $43 100 s80.000 -sio1.0 si01,850 -S2S1.850 $251.850 The tofincome tak The amount of income ta owehold in of excess ove-Over- $5.775 of excessover -85.775 5.300 4.475 s88.275 S103.275 5206.775 But not over -56.613 But net ever- 15.300 644 475 s88.275 4A so00 41850 -56.613 S15.300 -$21.200 $4,475 -S43, 100 s275- 5 -S80.600 S163.275-205.775 -S10180 S205.775-305.775 -5251850 30s 775 S0.00 pus 10% -21.200 47630ps 12 $2226 74 pus 22% S7044.74 pus 24% S16.044.7 plus 32% $22844.74 plus 35% $7534474 pus 3% -543,100 80.600 775 TABLE 7ANNUAL Payro Period MARRIED person nthe amout wages (a) SINGLE person including head of householdi- he amount of wages ater subrading whholding alownces is lowihold is Not over $3.700 Over- $3.700 $13.225 $42.400 S86.200 -S161.200 SIG1 200 -s203.700 S203.700S503,700 $s03.700 The amount of ncome tax The aount of income t withholding allowances is ehols Not over $11,500 so of excess over-Over- But not over -S13.225 But not over- -4.00 of excess over- -$11.550 -500.600 -S88.950 176.550 -4320.550 -2411.550 $011.550 -53.700 S11550 -$13.225 30B00- 50 -$2.400 S950-176 5.s700 h 2 S00.200 $176.550-326550 1200 $306.550 -41150 S17900 pn 3 s200.700 $411550-561L500 -$s03.700 ser1550 S0.00 ps 10% -42.400. S95250 ps 12 S6.200 $4453.50 plus 22 $140e9 50 plus 24% $32.0 s0 phus % s0.00 p 10 S1.905.00 pus 12% S217900ps 24% nd os sass TABLE 8-DAILY or MSCELLANEOUS Payo Peried S9137900 ps 30 $1613900 pus 37% DI MARRED perso () SINGLE person (incudng head of hounehold- The amount of wages wr ttacting withhodng aloances dvided by the umber of days in the payrl period Hehold per day is Not over $1420 Over- $14.20 S50.90 $163.10 $331 50 S620 00 S783 50-1.907.30 $1.07 30 me amount of wages fcater wthholding wtow lovided by bher Days in the payrok peroda o wenod per day s Notover $4440 bacino The amount ofincome The amount ot income ta of escess over-lover -214.20 But not over- -150.90 -$163.10 -5331.50 -M20 00 -$78350 But not ove 4117.20 1342 10 of excess over- $44 40 0s0 $117.70 -$163.10 $34210 s0.00 plus 10 $347 plus 12 $17.13 ps 22 S54.18 p 2S $12342p 32s $175.74 p 3% $579.57 3% s.00 p 1% $7.30 p 12% $34.2 p 22% $108.3 -244.40 -$117.70 -1342 10 -4679.00 -4125.00 41582.90 -42252.10 so $478.00 254.00 0.00s1.256.00 -1520 -$783.501.582 0-230210 -41.207.30.352 10 $35147 gs 30% $420 s37% WAGE BRACKET METHOD TABLES FOR INC SINGLE Persons-WEEKLY Payroll Period HOLD For Wgas Paid through December 31, 201 Ard the wage And the numbar of withholding allowancen claimed is- Pers And the wages aro- 9 10 012 34 567 The amount of income tax to be withhold in- At last But less than At loast WEEKLY SINGLE PERSONS $1.200 and ov bo0 00 000 0000000000000000000 o 0o000 0000o 00000 00000 00000 0000g pO00000000000 0000000000 00D00 0000o 00000 00000 0000000000 00000 00 0000000000 0000000000.00000 00000000000o00o 00000 00000 000o- b0000 00000000000 00000000000 000000 000000 000000000 OrNne den WAGE BRACKET METHOD TABLES FOR INCO MARRIED Persons-WEEKLY Payroll Period For Wagen Paid through December 31, 2016 And the number of withholding allowancos claimed is- And the wage And the wagos are- O1 2 3 4 5 7 B9 10 At least At loast But less than The amount of incomo tax to be withhold is- WEEKLY MARRIED PERSONS 1,505 $1,575 and ow go000 000000000000 000000 000000000 0000 000000 0000000000 0000o 00000 000000O000000 000000 000000000 0000 000000000000000 0000O 00000 00 00000 0000o 00000 O0000 00000 000000000000000000000000014040 10000 000000000000 0000000000000000 0000 00000000000000-234501 00- 00000 00000 00000 000000 00000 000000 000010v h-00123iO Ogr WAGE BRACKET METHOD TABLES FOR INCON SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through Decomber a1, 201 And the number of withholding allowancos claimod is- And the wager At least And the wages are- 10 a 4 5 6 7 012 At legst But los The amount than nt of income tax to be withheld is- $0 BIWEEKLY SINGLE PERSONS TieOLOIN $2.200 and ove L22el edeleleiel elelelelel 0o 000000000 o00000 00000 o0000 00000 00000 00000 00000 00000 00000 boo 00000 0000 o 00000 000000000000000 00000 00000 0o000 0000o 00000 boo 00000 0000 000000 0c0000 0o000 00000 00000 o000o o0000 00000 00000 190000 pOo 000000000o 00000 0000000000 00000 00000 00000 00000 00000 00000 boo oo 000 00 000 00 000 000 00 000 00 0000 0 00000o00000 00000000000 o0000 00000 00000 00000 00000 000000 00000 o00000 000000 000 0O00 000 000000 000000 0000 lgo000 00000 00000 00000 00000 00000 000000 0000 0000000000 000 00000000100 oro 1ULLLL R0000 00000 00000 00000 00000 00000 000000 00000000000000 00019579 R r h View Enlarged Image WAGE BRACKET METHOD TABLES FOR INCO MARRIED Persons- BIWEEKLY Payroll Perlod bentr 1.201 Fa Wagns Pd though D And the number of withnolding alowancos claimod is And the wa And the wages are But le than At loast At lont A-Z t ol income tax to be wthneld a REAL BIWEEKLY MARRIED PERSONS eR iedeiedel elrieiriel eleieleied edelelelel edeinni cieleirel eleieleir eirieleiei addin Ne poo 0000 00000 0000000000b0000 00000.0000000000 0000000000 00000 PO0 0000000000 000000o000 00000 0000o 00000 0000000000 00000 00000 100000 000000000000 o 00000 000000000000000000 000 000 000000 0 000-n b0000000 000 00000000000 0080000 0000000000000000 00 000-00n 11LLL 00000 000000000000 000000 00000 00000 00000 00120791n0e50e ere l00000 00000 000000000000 000000000 00000 00000 0000o -0000E 2 2 SEDRE SR: WAGE BRACKET METHOD TABLES FOR INCO SINGLE Persons-SEMIMONTHLY Payroll Period For Wages Paid trovgh Decomber a1. P018 And the number of withholding aowancos clamad is MEWAKAWNE WWhonont of nsme taxto be wthhalk And the wa And the wagon are /O/ Al kast SEMIMONTHLY SINGLE PERSONS rid ninininini doininin niininin 20000 1900000 F00 0000 000000 00000 000000000o 00000 00000 0000O 00000 00000 00000 bO0000o 00 000000000 O 00000 00000 00000 00000 0000000000 00000 00000 pOo000000000 000000 00000 00000 00000 00000 00000 00000 O0000 00000 Ro000 00000 00000 0 0000 00 000 OD0 000000 0 00000 00000 00000 000 000000o 00000 00000 33888 939AF 381 RERE R 83 8318 ES R 10700000 WAGE BRACKET METHOD TABLES FOR INC MARRIED Persons-SEMIMONTHLY Payroll Period For Wagas Paid through December 31, 2010 And the numbor of withholding alowances claimod is And the wages re- At least And the w 01 2 a45 7 The amount of income tax to be wthhold is sol 89 But loss than At least 10 Sol SEMIMONTHLY MARRIED PERSONS 3,145 $1.165 and edei eieieieiri eieieiei deleini eeieni eiinini iriniein cininieiei eininieiei inininii eininin ie poo o0o000000 000000 0000000 D00000000000000000 000000000000000 peo 00o000000000000000000 000000000 000000000000000000000 00000 poo 00o000000000000 00000 000000000 0 00000 00000.00000000000000 boo 0000000000.00000 0000000000 0000000000 0000000000000 oagu boo 00000090000 0000000000000000000 000000 000ONTenge ZERN ZEER 2000 D 0000 0 000 0000 0000 00000 00000 00000 00000 0...0 WAGE BRACKET METHOD SINGLE Persons-MONTHLY Payroll Period (For Wages Paid through Docamber 31, 2018) And the wag And the numbar of withholding allowances daimed is And the wages are- 2 a46 7 The amount of income tax to be withheld is- 10 01 But lees At least A-Z At least than MONTHLY SINGLE PERSONS 5,366 $5.406 bO000 000 00000000000000000000 00000 000000 00000 00000 0000 00000 bo0 00 00000 000000 00000 000000 00000 000000 00000 000000 00 000 00000 p00000000000 000000 0000000000 00000000000000.00000 0000o000000 poo o0 000 00 00000000000 00000000000 000000 000000000000000 00oo boo oo 000 00 00000000 00000 0000 00000 000000 00000 0 0000 04 e 5.0R 58BREa 5858F 2o000 00000 00000 o00000000000000 0000000000 000enap MARRIED Persons-MONTHLY Payroll Period (For Wages Pald through Docember 31, 2018) And the wage At loast B And the number of withholding alowances claimed is 01 2 34 6 7 The amount of income tax to be withhold is And the wages aro At least But los than 9 10 MONTHLY MARRIED PERSONS $6.360 an gefefefes efee4 fulul ulddd bO0 000 000000 0 00000 D0000 00000 000000000000000 0000000000 00000 bO000 00000 000 00 000 00 00000000000 00000000000 00000 000000 00000 poo 000 000000 0 00000 00000 00000 000000000000000 000000O31-228E b00000000 000000000 o 00000 00000 0000000000000m RR Jeiel einiedeii einidein eiieielel eieieieied eieielefe eleloiei de 8888 ees eese 22222 einiN eeininie eeife eesnd 22222 SINGLE Persons-DAILY Payroll Period (For Wagas Paid through Decamber 31, 2018) And the wages are- And the wag And the number of withholding allowances claimed is- At loast 34 5 6 7 But loss than 0 1 2 The amount of income tax to be withheld is- 10 At least DAILY SINGLE PERSONS S395 ande b0000 00000 00000 000 00 00000000 000 00000 000000 01110 dnn0 cee bo0 oe 00000 00000 00000 000 00 900 000 o111240e enen ee *00 poo oo 00000 00000 000 0000000001112NN n 44400 00777 040022 bOO00 000 00 00000 00000011110ereN.mm 444050 e00000 8b000222 RNS 1UL-- PLLLL DI 20000 000000 0000 00000 00000 000011 12000e eL 43S0O77700 000222EE WAGE B ACKE MARRIED Persons-DAILY Payroll Period (For Wages Paid through December 31, 2018 And the number of withholding allowancos claimed is- 2 3 4 56 7 8 The amount of income tax to bo withhold is- And the wag And the wagas are But los than 10 At least At lanst DAILY MARRIED PERSONS PO0000000000O 00000 00000 00000 0000o.00000 oo0or as ne ce b0000 00000000000 0000000 0000o 00000 0000--t nnnne eee ceech DO000 000 00000000 000000000000 00011 ent ne1e eee coom e 20000 00000 00000 00000 0011122200 444 n ecehA7000 00000 Iso000 00000 00000 00111 22200 m34444 e eOnAN0ea0 000EE ER 2222 2222