Answered step by step

Verified Expert Solution

Question

1 Approved Answer

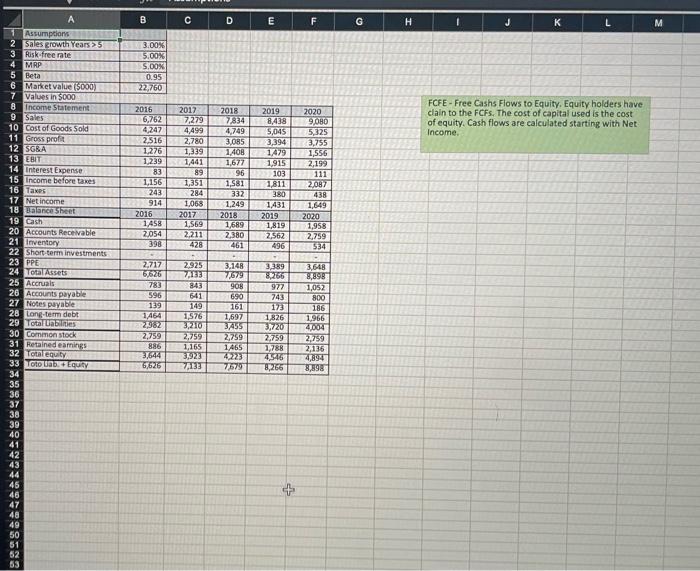

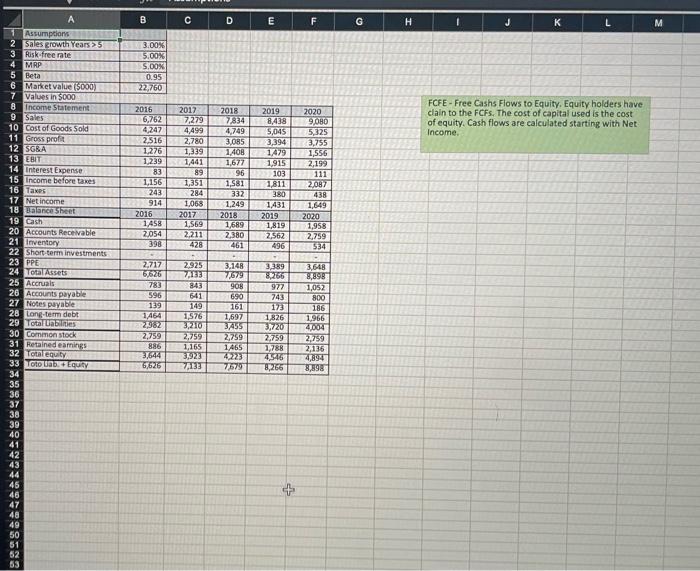

use accounting based valuations to find value of equity, include FCFE anf FCF B C D E F F G H J K L M

use accounting based valuations to find value of equity, include FCFE anf FCF

B C D E F F G H J K L M 3.00% 5.00% S.OOX 0.95 22,760 FCFE- Free Cash Flows to Equity. Equity holders have clain to the FCFS. The cost of capital used is the cost of equity. Cash flows are calculated starting with Net Income. 2016 6,762 4,247 2,516 1.276 1.239 83 1,156 243 914 2016 1,458 2054 398 2017 7,279 4,499 2,780 1,339 1,441 89 1,351 284 1,068 2017 1,569 2,211 428 - 2.925 7A133 843 641 149 1576 3,210 2,759 1.165 31923 2018 7834 4.749 3,085 1408 1,677 96 1,581 332 1,249 2018 1,689 2,380 461 - 2019 8,438 5,045 3,394 1479 1.915 103 1,811 380 1.431 2019 1,819 2,562 496 2020 5,325 3,755 1,556 2,199 111 2,087 438 1,649 2020 1,958 2,759 334 A Assumptions 2 Sales growth Years 5 3 Risk free rate 4 MRP 5 Beta 6 Market value (5000) 7 Values in S000 8 Income Statement 9 Sales 10 Cost of Goods Sold 11 Gross profit 12 SG&A 13 EBIT 14 interest Expense 15 Income before taxes 16 Taxes 17 Net income 18 Balance Sheet 19 Cash 20 Accounts Receivable 21 Inventory 22 Short-term investments 23 PPE 24 Totalase 25 Accruals 26 Accounts payable 27 Notes payable 28 Long-term debt 29 Total Uables 30 Common stock 31 Retained earnings 32 Totaleguity 33 Toto USBEQUE 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 3.148 2.717 6626 783 596 139 1,464 2982 2,759 71679 908 690 161 1,697 3455 2,759 1465 4225 77979 3,389 85.266 977 743 173 1826 3,720 2.759 1788 4546 9,266 3,648 8,898 1,052 800 186 1,966 2004 2,759 2,135 4,894 8,898 3,644 67626 7,133 + + 8988 53 B C D E F F G H J K L M 3.00% 5.00% S.OOX 0.95 22,760 FCFE- Free Cash Flows to Equity. Equity holders have clain to the FCFS. The cost of capital used is the cost of equity. Cash flows are calculated starting with Net Income. 2016 6,762 4,247 2,516 1.276 1.239 83 1,156 243 914 2016 1,458 2054 398 2017 7,279 4,499 2,780 1,339 1,441 89 1,351 284 1,068 2017 1,569 2,211 428 - 2.925 7A133 843 641 149 1576 3,210 2,759 1.165 31923 2018 7834 4.749 3,085 1408 1,677 96 1,581 332 1,249 2018 1,689 2,380 461 - 2019 8,438 5,045 3,394 1479 1.915 103 1,811 380 1.431 2019 1,819 2,562 496 2020 5,325 3,755 1,556 2,199 111 2,087 438 1,649 2020 1,958 2,759 334 A Assumptions 2 Sales growth Years 5 3 Risk free rate 4 MRP 5 Beta 6 Market value (5000) 7 Values in S000 8 Income Statement 9 Sales 10 Cost of Goods Sold 11 Gross profit 12 SG&A 13 EBIT 14 interest Expense 15 Income before taxes 16 Taxes 17 Net income 18 Balance Sheet 19 Cash 20 Accounts Receivable 21 Inventory 22 Short-term investments 23 PPE 24 Totalase 25 Accruals 26 Accounts payable 27 Notes payable 28 Long-term debt 29 Total Uables 30 Common stock 31 Retained earnings 32 Totaleguity 33 Toto USBEQUE 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 3.148 2.717 6626 783 596 139 1,464 2982 2,759 71679 908 690 161 1,697 3455 2,759 1465 4225 77979 3,389 85.266 977 743 173 1826 3,720 2.759 1788 4546 9,266 3,648 8,898 1,052 800 186 1,966 2004 2,759 2,135 4,894 8,898 3,644 67626 7,133 + + 8988 53

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started