Use all the Cost-Volume-Profit related applications to analyse the company and then determine the amount that the company should make, at least, to make profit, and a 10% profit.

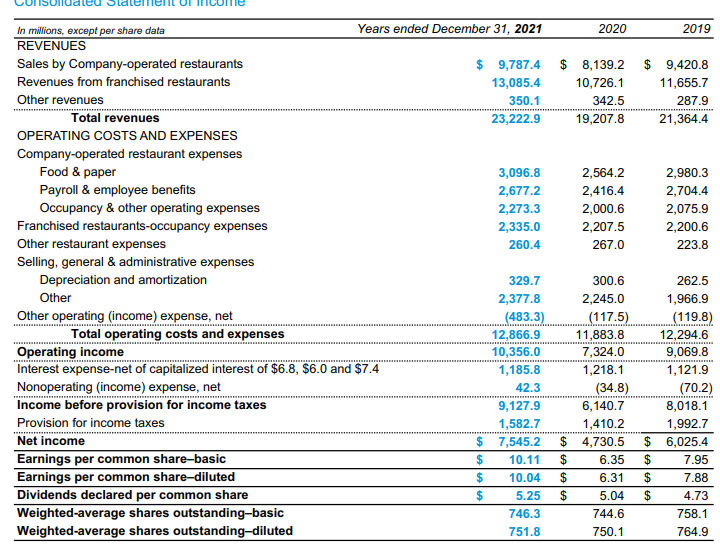

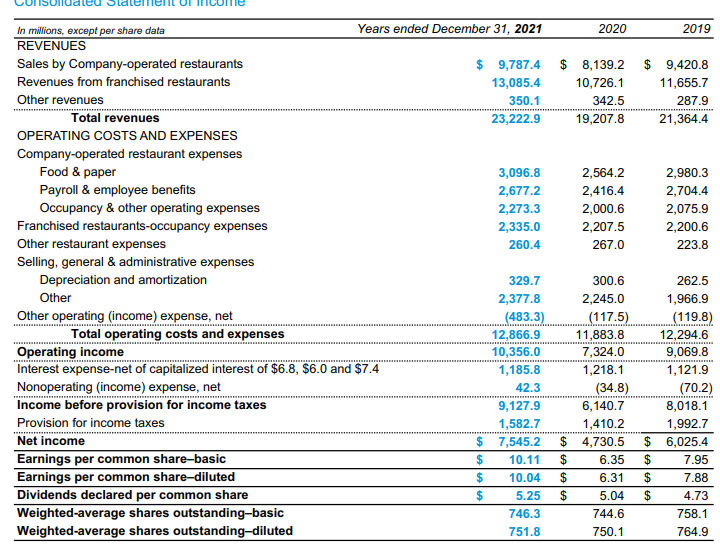

Years ended December 31, 2021 $ 9,787.4 13,085.4 350.1 23,222.9 3,096.8 2,677.2 2,273.3 2,335.0 260.4 329.7 2,377.8 (483.3) 12,866.9 10,356.0 1,185.8 42.3 9,127.9 1,582.7 7,545.2 In millions, except per share data REVENUES Sales by Company-operated restaurants Revenues from franchised restaurants Other revenues ......... Total revenues OPERATING COSTS AND EXPENSES Company-operated restaurant expenses Food & paper Payroll & employee benefits Occupancy & other operating expenses Franchised restaurants-occupancy expenses Other restaurant expenses Selling, general & administrative expenses Depreciation and amortization Other Other operating (income) expense, net Total operating costs and expenses Operating income Interest expense-net of capitalized interest of $6.8, $6.0 and $7.4 Nonoperating (income) expense, net Income before provision for income taxes Provision for income taxes Net income Earnings per common share-basic Earnings per common share-diluted Dividends declared per common share Weighted-average shares outstanding-basic Weighted-average shares outstanding-diluted $ $ $ $ 2020 2019 $ 8,139.2 $ 9,420.8 10,726.1 11,655.7 342.5 287.9 19,207.8 21,364.4 2,564.2 2,980.3 2,416.4 2,704.4 2,000.6 2,075.9 2,207.5 2,200.6 267.0 223.8 300.6 262.5 2,245.0 1,966.9 746.3 751.8 10.11 $ 10.04 $ 5.25 $ (117.5) 11,883.8 7,324.0 1,218.1 (70.2) 6,140.7 8,018.1 1,410.2 1,992.7 $ 4,730.5 $ 6,025.4 6.35 $ 7.95 6.31 $ 7.88 5.04 $ 4.73 744.6 758.1 750.1 764.9 (119.8) (34.8) 12,294.6 9,069.8 1,121.9 Years ended December 31, 2021 $ 9,787.4 13,085.4 350.1 23,222.9 3,096.8 2,677.2 2,273.3 2,335.0 260.4 329.7 2,377.8 (483.3) 12,866.9 10,356.0 1,185.8 42.3 9,127.9 1,582.7 7,545.2 In millions, except per share data REVENUES Sales by Company-operated restaurants Revenues from franchised restaurants Other revenues ......... Total revenues OPERATING COSTS AND EXPENSES Company-operated restaurant expenses Food & paper Payroll & employee benefits Occupancy & other operating expenses Franchised restaurants-occupancy expenses Other restaurant expenses Selling, general & administrative expenses Depreciation and amortization Other Other operating (income) expense, net Total operating costs and expenses Operating income Interest expense-net of capitalized interest of $6.8, $6.0 and $7.4 Nonoperating (income) expense, net Income before provision for income taxes Provision for income taxes Net income Earnings per common share-basic Earnings per common share-diluted Dividends declared per common share Weighted-average shares outstanding-basic Weighted-average shares outstanding-diluted $ $ $ $ 2020 2019 $ 8,139.2 $ 9,420.8 10,726.1 11,655.7 342.5 287.9 19,207.8 21,364.4 2,564.2 2,980.3 2,416.4 2,704.4 2,000.6 2,075.9 2,207.5 2,200.6 267.0 223.8 300.6 262.5 2,245.0 1,966.9 746.3 751.8 10.11 $ 10.04 $ 5.25 $ (117.5) 11,883.8 7,324.0 1,218.1 (70.2) 6,140.7 8,018.1 1,410.2 1,992.7 $ 4,730.5 $ 6,025.4 6.35 $ 7.95 6.31 $ 7.88 5.04 $ 4.73 744.6 758.1 750.1 764.9 (119.8) (34.8) 12,294.6 9,069.8 1,121.9