Answered step by step

Verified Expert Solution

Question

1 Approved Answer

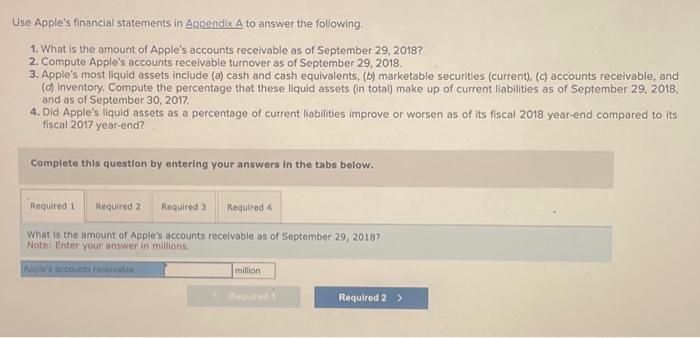

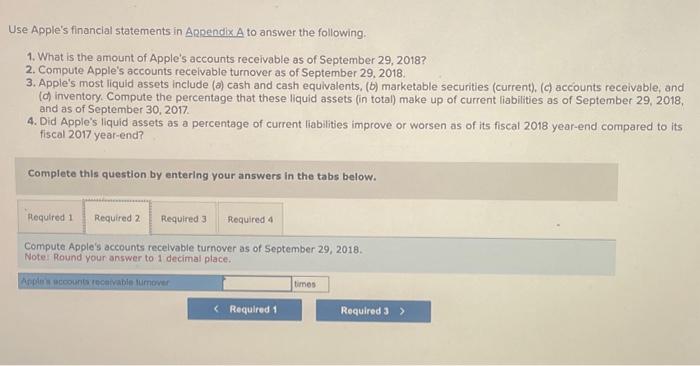

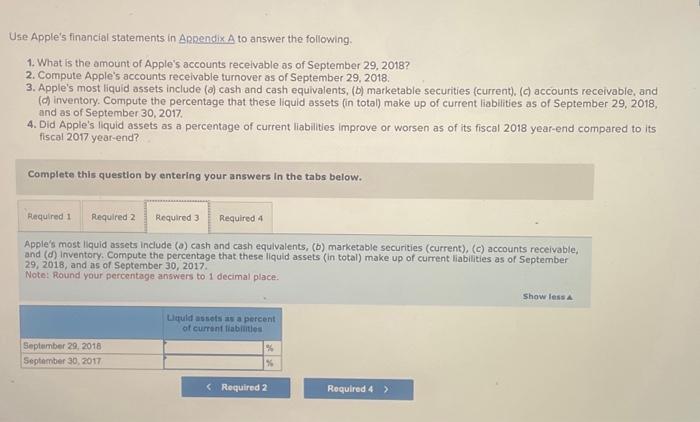

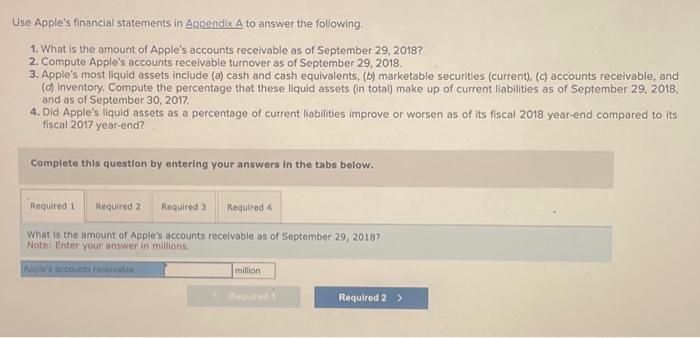

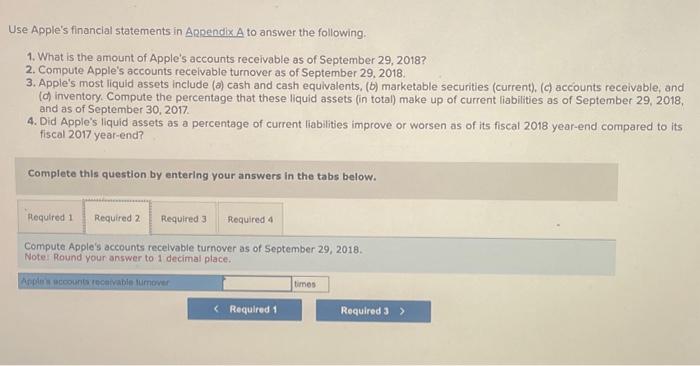

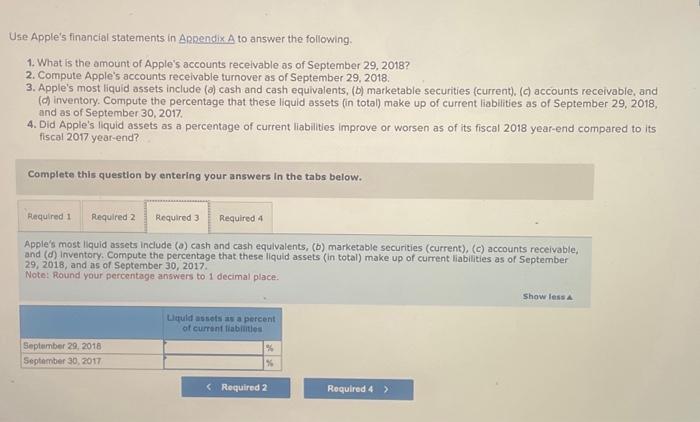

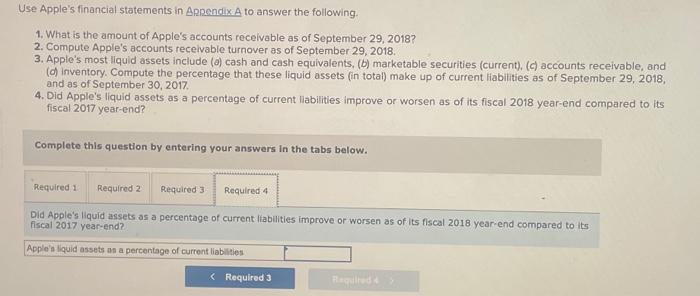

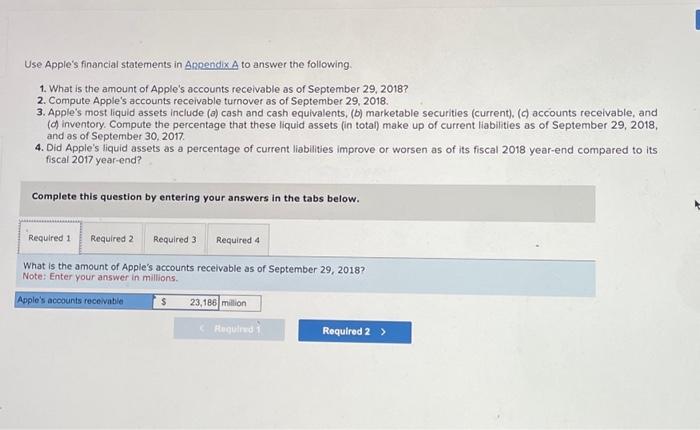

Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018?

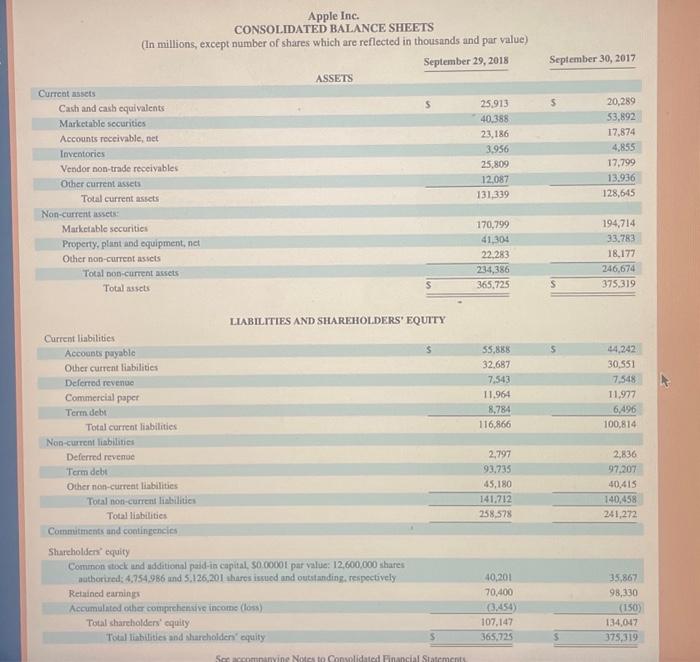

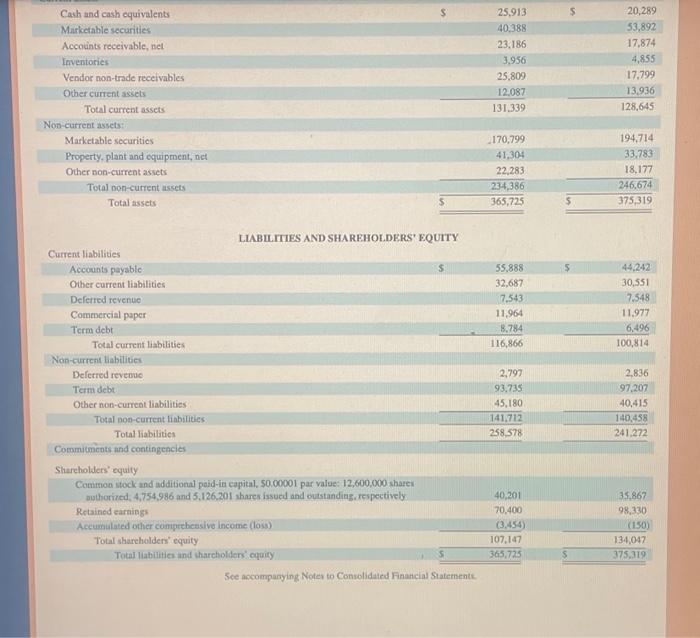

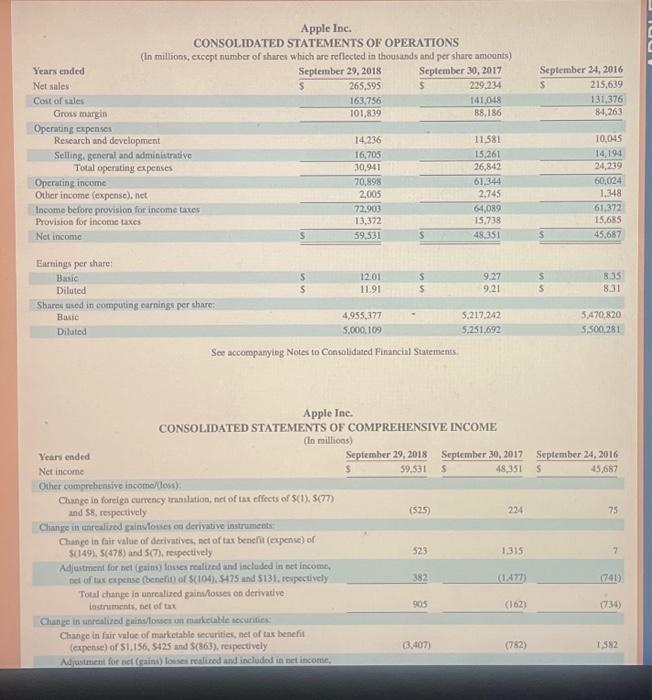

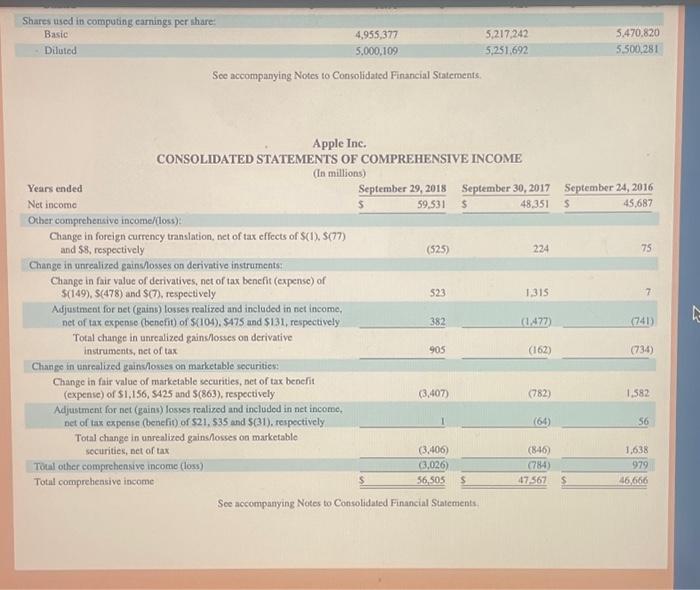

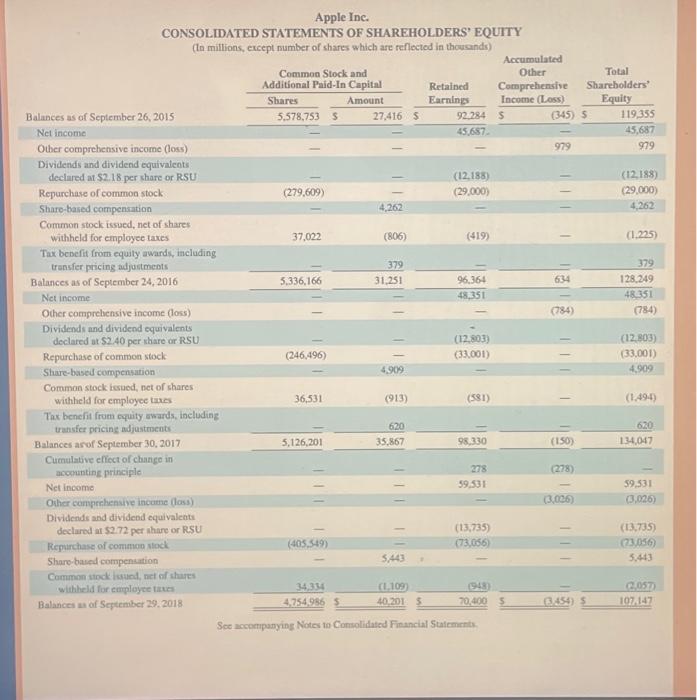

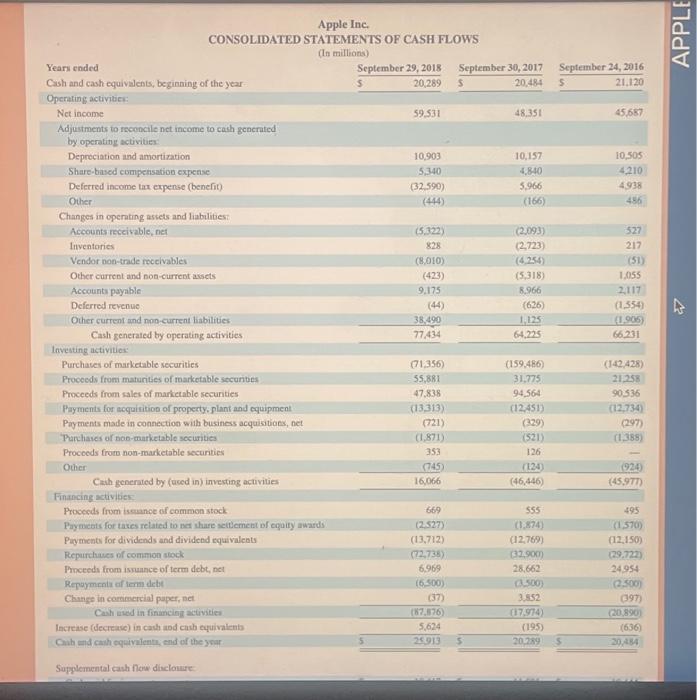

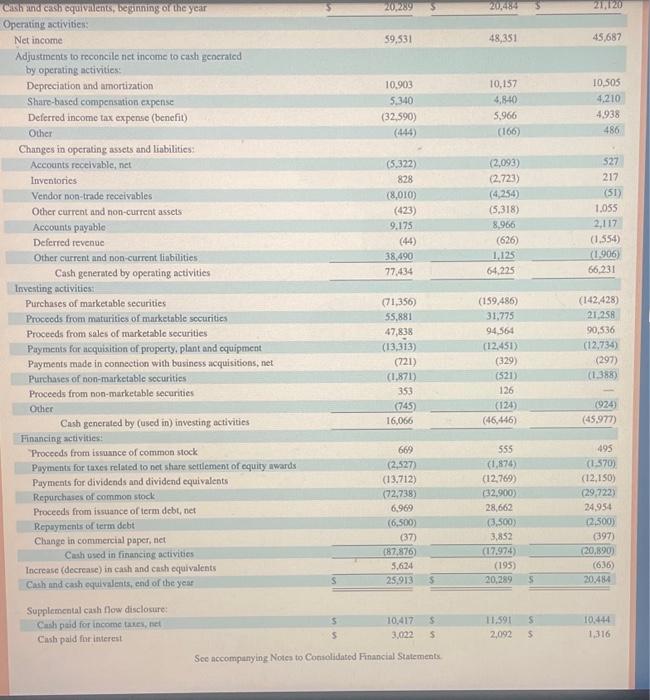

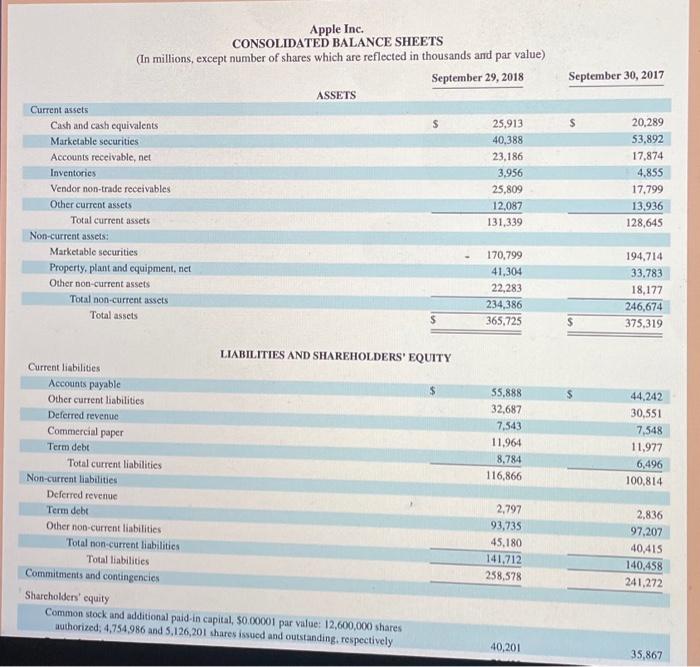

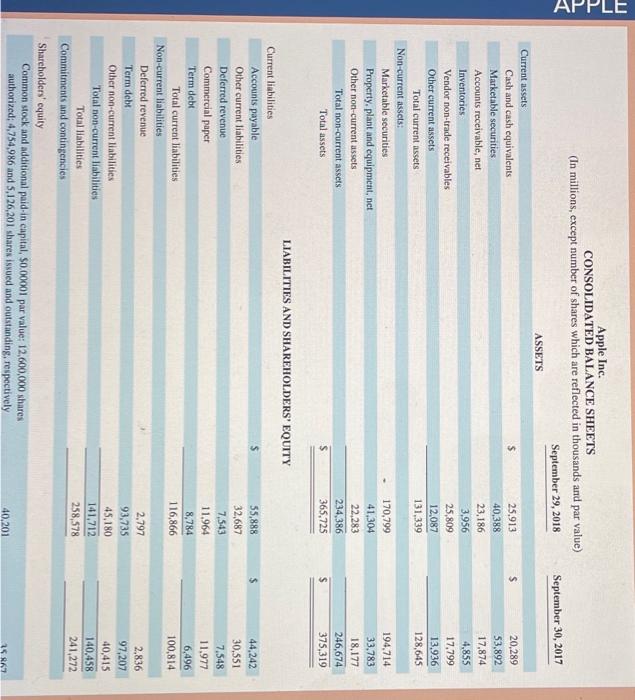

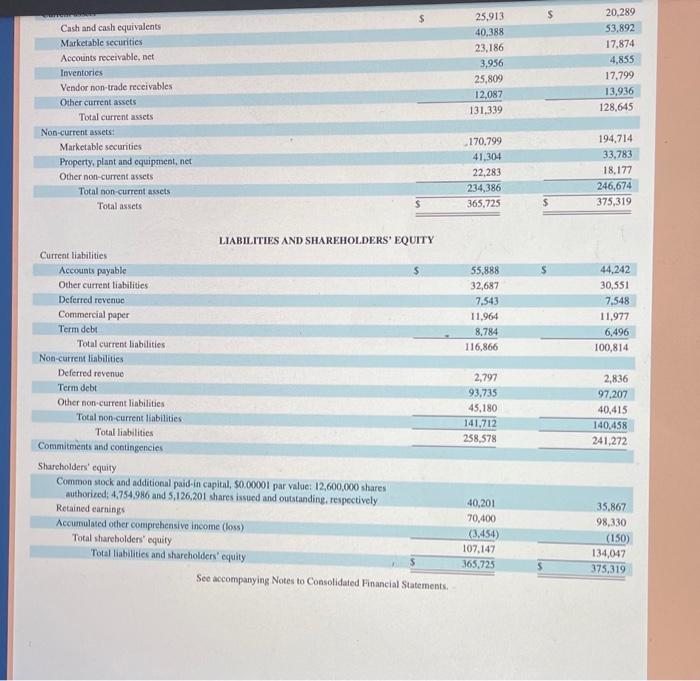

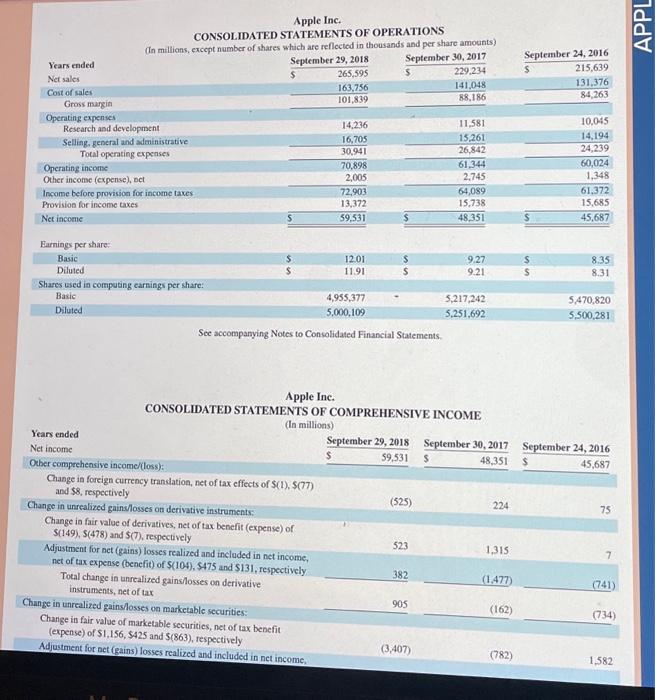

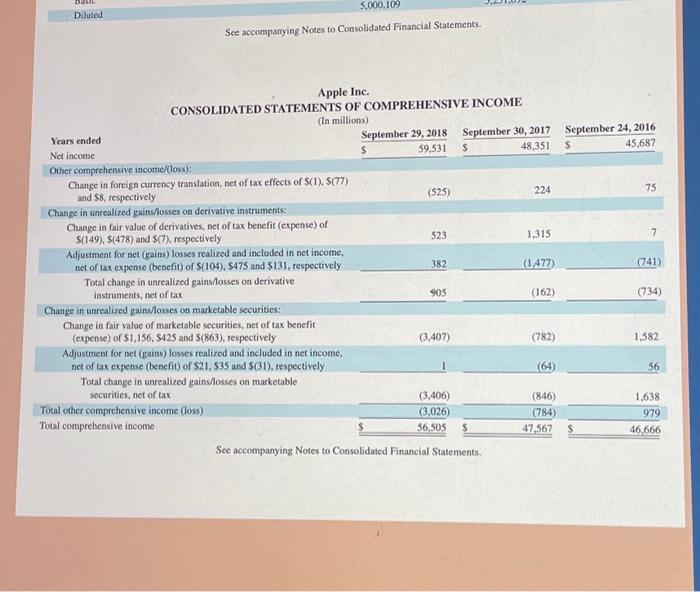

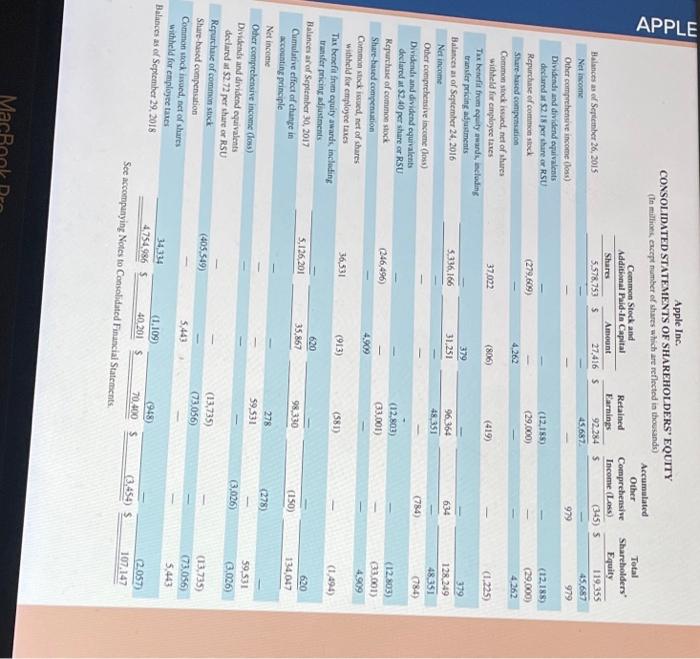

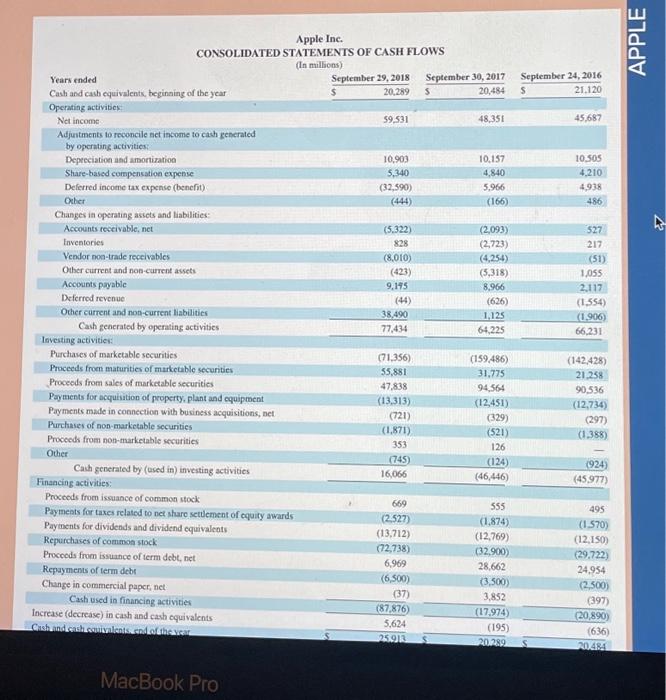

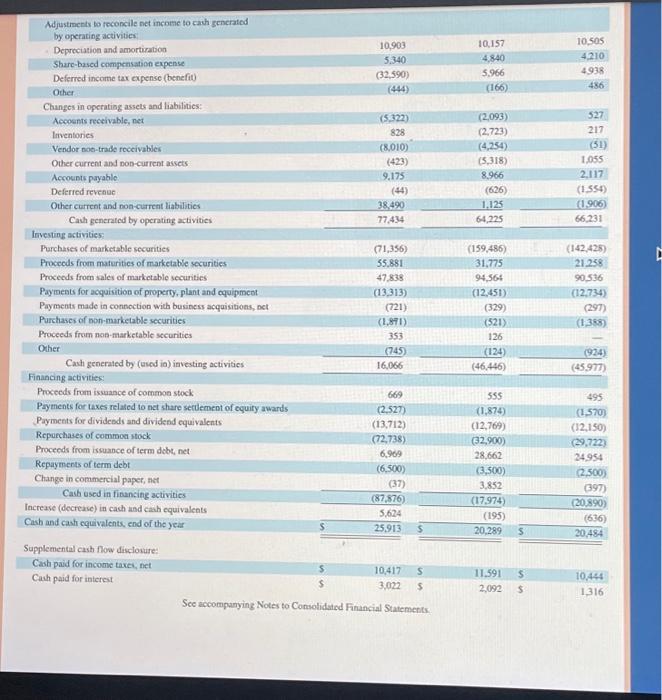

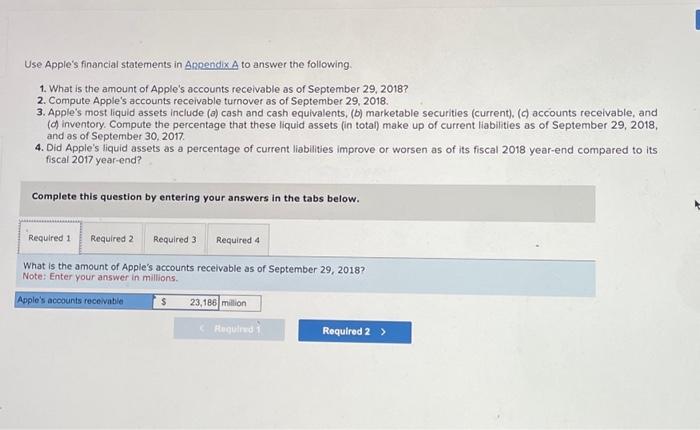

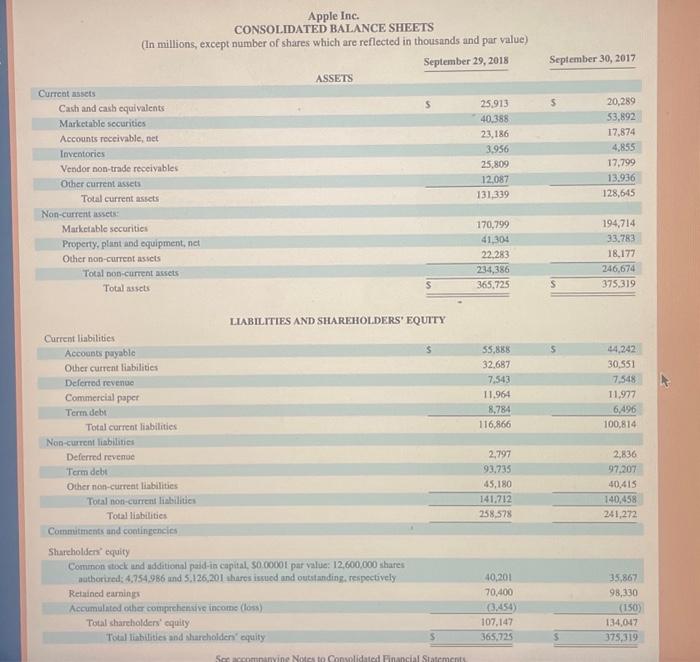

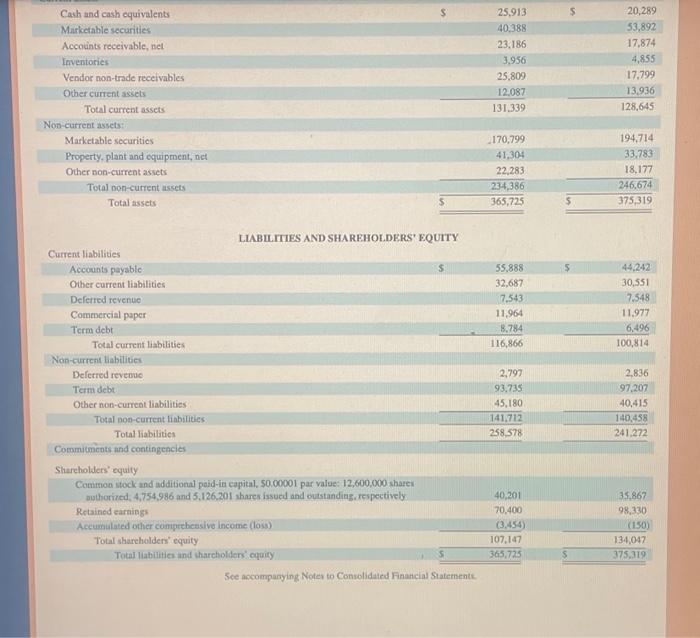

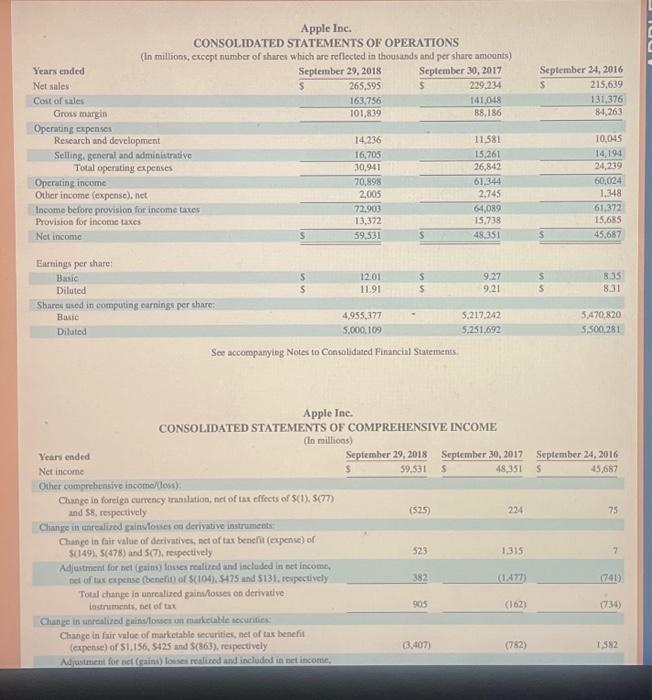

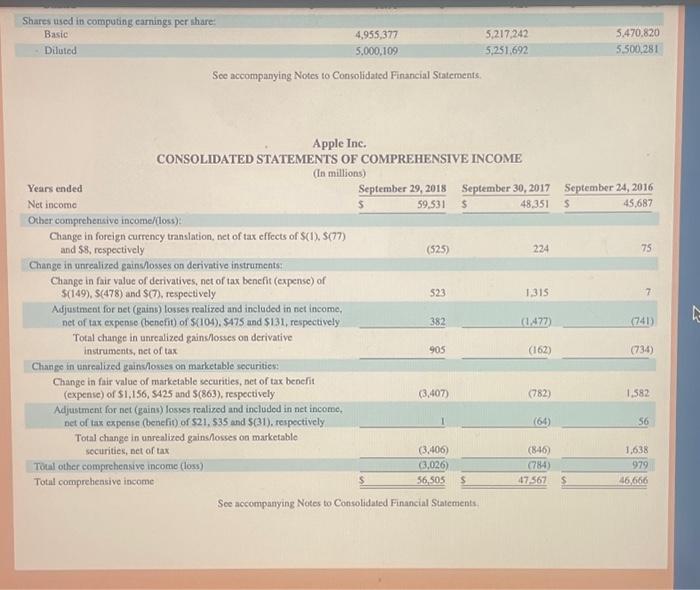

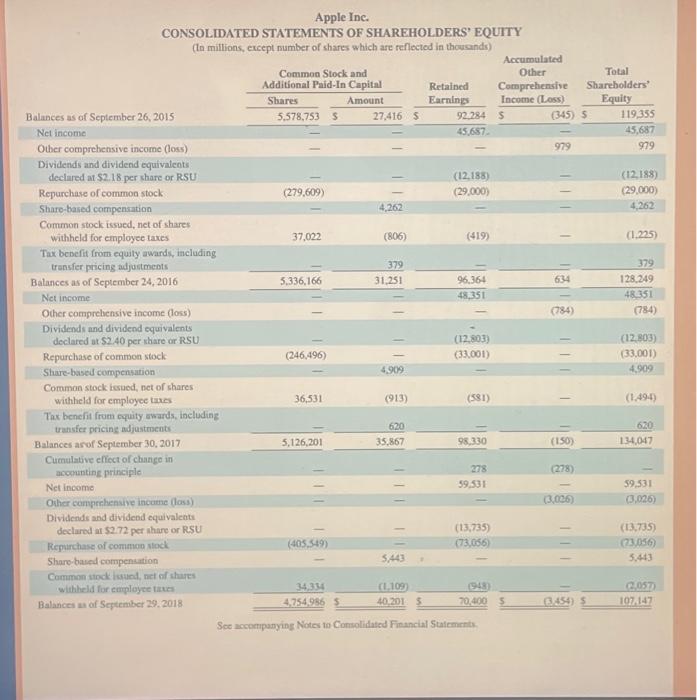

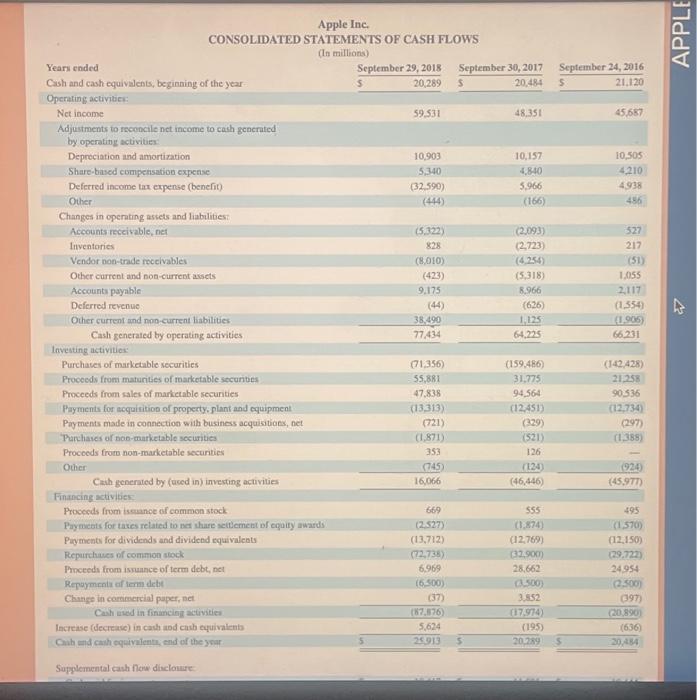

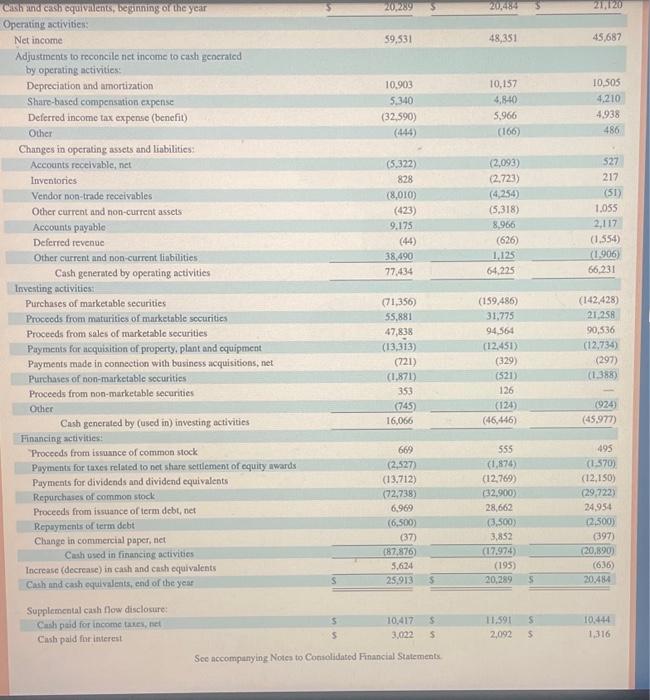

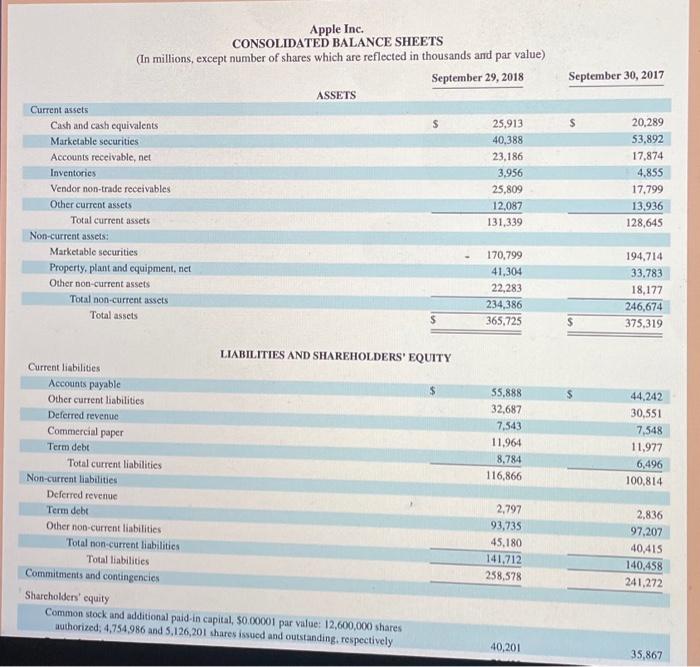

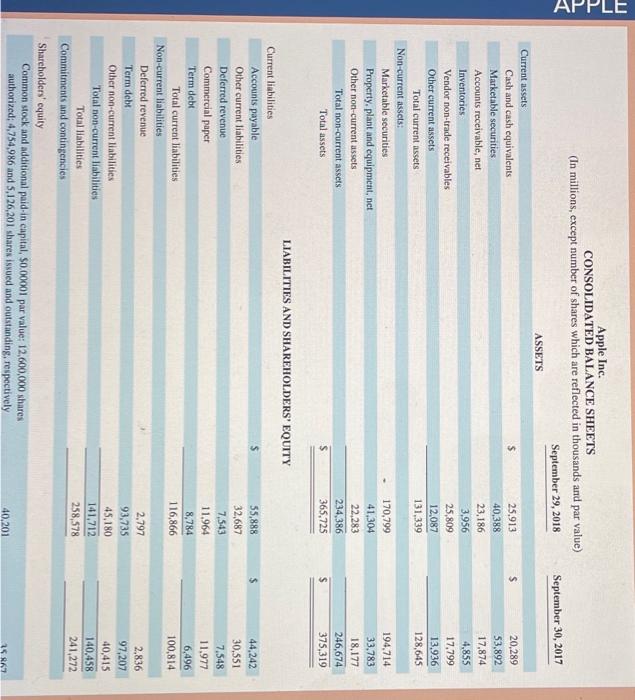

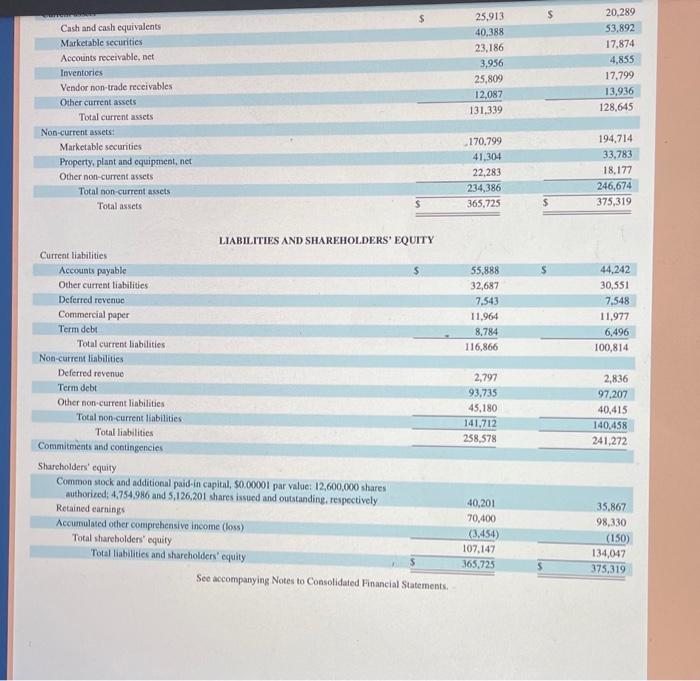

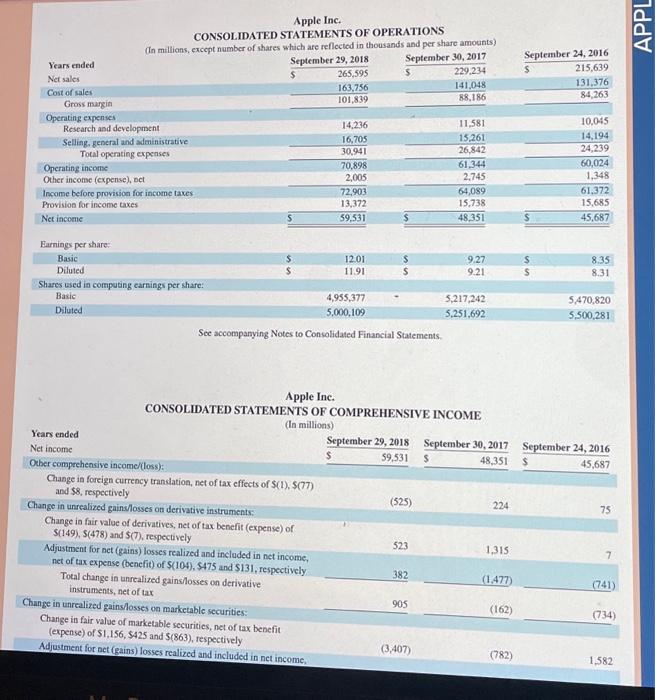

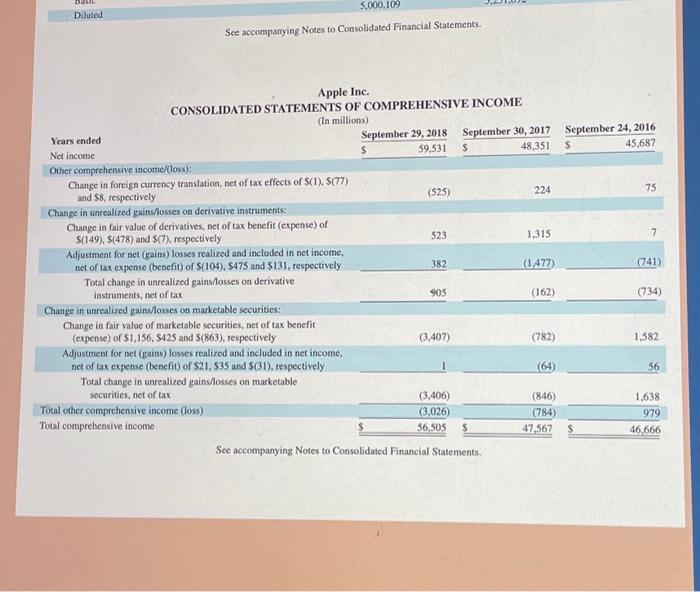

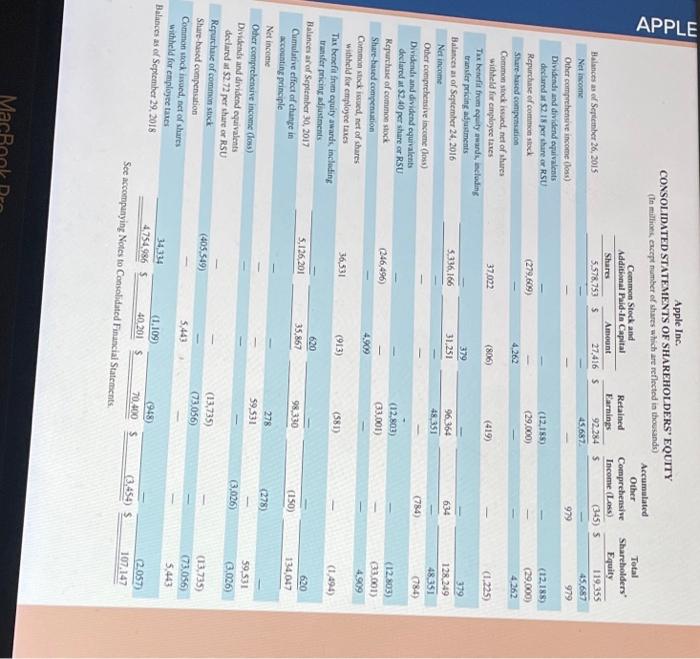

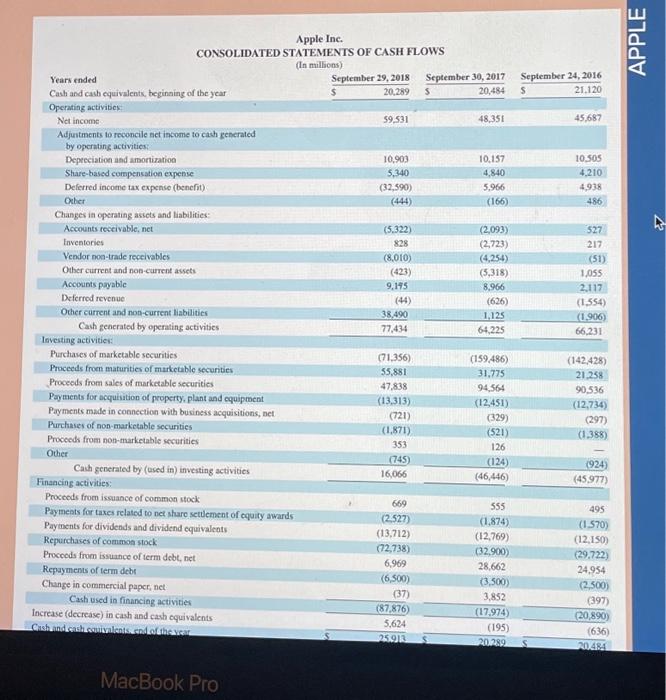

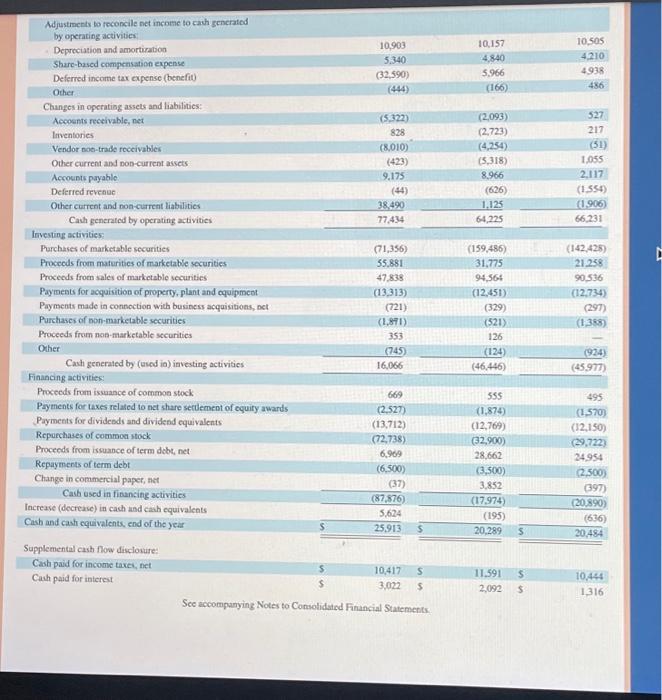

Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29, 2018, 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018. and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts recelvable turnover as of September 29,2018. 3. Apple's most liquid assets include (b) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30,2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Compute Apple's accounts recelvable turnover as of September 29, 2018. Note: Round your answer to 1 decimal place. Use Apple's financial statements in Aprendix A to answer the following. 1. What is the amount of Apple's accounts recelvable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). ( ) ) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30,2017. 4. Did Apple's lquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. Note: Round your percentage answers to 1 decimal place. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Did Apple's liquid assets as a percentage of current liablities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Sce accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions. excent number of shares which are reflocted in thousands and per share amoonts See accompanying Notes to Consolidated Financial Statements See accompanying Notes to Consolidated Financial Statements. See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Apple Ine. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year- Operating activitiex: Net income 5September29,201820,289 5September30,2017 Adjustments to recencile net income to cach gencrated by operating activities: Depreciation and amortization Share-bisod comperisation expense Deferred income tax expense (benefit) 59531 48,351 Other (32.599) 10.157 (44) 4.840 10,505 Changes in operating astets and liabilities: Accounts meceivable, net Inventories Vendor non-trade receivables (5.322) 5.966 4210 Other current and non-current aisets Accounts payable (166) 4938 Deferred revenue Other current and nop-current liabilities Cash generated by operating activities 828 (8,010) (2.093) (423) (2,723) 9.175 (4.254) 456 Cash generaicd by operaung activites Investing activitiox: Purchases of marketable securities (44) (5,318) 527 Proceeds from maturities of marketable securies Proceeds from sales of marketable secunties Payments for acquirition of property, plant and equipment 33.490 8.966 217 Payments made in conection with business acquisitioes, net 77.434 (626) (51) Parchaies of non-marketable securitica 38,49077,434 Proceeds from non-marketable secunties Other (71,356) (159,486) 1.055 2.117 (a.554) Ther: Cath generated by (uced in) investing activities 55,881 31,775 662340.905 47.838 94.564 (13,313) (12,451) (329) (1,871) (521) 353 126 (745) (122) (924) 16,066 (46,446) (45,977) Financing activities: Procerds frum iseance of common stack Paymects for taies related to na ihure seltement of equity awards 669 555 495 Payments for dividends and dividend equivalents (2.527) (1,874) (1,570) Repurchues of common slock (13,712) (12,769) (12.150) Proceeds from isruance of term debt, net (72.736) (32,900) (29.722). Repuymenta of tem debt 28,662 24954 Change in commertial puper, net Cahh eved in financing activities (6.500 as00 (2.500) Supplemental cash fow dinclouire: Cash ind cash cquvalents, vegnting or the year Operating activitien: Net income 59,531 48,351 45,687 Adjustments to reconcile net income to cash geocrated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Aceocints receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable 10,903 Deferred revenue Other current and non-current liabilities Cash generated by operating activities 5.340 10,157 10,505 (32.590) 4,840 4,210 5,966 4,938 (444) (166) 486 Supplemental cash flow disclosure: Cash paid for income taies, net Cash paid finr interest 5 5 10.417 3.022 10,444 1,316 See accompanying Notes to Coniclidated Financial Statementx. Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements. Avole Ine. Sec accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millionst) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY A worle Ine See accompurying Notes to Consolidated Financial Statemerts Use Apple's financial statements in Anpendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts recelvable turnover as of September 29, 2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29, 2018, 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018. and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts recelvable turnover as of September 29,2018. 3. Apple's most liquid assets include (b) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30,2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Compute Apple's accounts recelvable turnover as of September 29, 2018. Note: Round your answer to 1 decimal place. Use Apple's financial statements in Aprendix A to answer the following. 1. What is the amount of Apple's accounts recelvable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). ( ) ) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30,2017. 4. Did Apple's lquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. Note: Round your percentage answers to 1 decimal place. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Did Apple's liquid assets as a percentage of current liablities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Sce accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions. excent number of shares which are reflocted in thousands and per share amoonts See accompanying Notes to Consolidated Financial Statements See accompanying Notes to Consolidated Financial Statements. See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Apple Ine. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year- Operating activitiex: Net income 5September29,201820,289 5September30,2017 Adjustments to recencile net income to cach gencrated by operating activities: Depreciation and amortization Share-bisod comperisation expense Deferred income tax expense (benefit) 59531 48,351 Other (32.599) 10.157 (44) 4.840 10,505 Changes in operating astets and liabilities: Accounts meceivable, net Inventories Vendor non-trade receivables (5.322) 5.966 4210 Other current and non-current aisets Accounts payable (166) 4938 Deferred revenue Other current and nop-current liabilities Cash generated by operating activities 828 (8,010) (2.093) (423) (2,723) 9.175 (4.254) 456 Cash generaicd by operaung activites Investing activitiox: Purchases of marketable securities (44) (5,318) 527 Proceeds from maturities of marketable securies Proceeds from sales of marketable secunties Payments for acquirition of property, plant and equipment 33.490 8.966 217 Payments made in conection with business acquisitioes, net 77.434 (626) (51) Parchaies of non-marketable securitica 38,49077,434 Proceeds from non-marketable secunties Other (71,356) (159,486) 1.055 2.117 (a.554) Ther: Cath generated by (uced in) investing activities 55,881 31,775 662340.905 47.838 94.564 (13,313) (12,451) (329) (1,871) (521) 353 126 (745) (122) (924) 16,066 (46,446) (45,977) Financing activities: Procerds frum iseance of common stack Paymects for taies related to na ihure seltement of equity awards 669 555 495 Payments for dividends and dividend equivalents (2.527) (1,874) (1,570) Repurchues of common slock (13,712) (12,769) (12.150) Proceeds from isruance of term debt, net (72.736) (32,900) (29.722). Repuymenta of tem debt 28,662 24954 Change in commertial puper, net Cahh eved in financing activities (6.500 as00 (2.500) Supplemental cash fow dinclouire: Cash ind cash cquvalents, vegnting or the year Operating activitien: Net income 59,531 48,351 45,687 Adjustments to reconcile net income to cash geocrated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Aceocints receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable 10,903 Deferred revenue Other current and non-current liabilities Cash generated by operating activities 5.340 10,157 10,505 (32.590) 4,840 4,210 5,966 4,938 (444) (166) 486 Supplemental cash flow disclosure: Cash paid for income taies, net Cash paid finr interest 5 5 10.417 3.022 10,444 1,316 See accompanying Notes to Coniclidated Financial Statementx. Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements. Avole Ine. Sec accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millionst) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY A worle Ine See accompurying Notes to Consolidated Financial Statemerts Use Apple's financial statements in Anpendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts recelvable turnover as of September 29, 2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions

Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29, 2018, 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018. and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts recelvable turnover as of September 29,2018. 3. Apple's most liquid assets include (b) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30,2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Compute Apple's accounts recelvable turnover as of September 29, 2018. Note: Round your answer to 1 decimal place. Use Apple's financial statements in Aprendix A to answer the following. 1. What is the amount of Apple's accounts recelvable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). ( ) ) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30,2017. 4. Did Apple's lquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. Note: Round your percentage answers to 1 decimal place. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Did Apple's liquid assets as a percentage of current liablities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Sce accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions. excent number of shares which are reflocted in thousands and per share amoonts See accompanying Notes to Consolidated Financial Statements See accompanying Notes to Consolidated Financial Statements. See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Apple Ine. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year- Operating activitiex: Net income 5September29,201820,289 5September30,2017 Adjustments to recencile net income to cach gencrated by operating activities: Depreciation and amortization Share-bisod comperisation expense Deferred income tax expense (benefit) 59531 48,351 Other (32.599) 10.157 (44) 4.840 10,505 Changes in operating astets and liabilities: Accounts meceivable, net Inventories Vendor non-trade receivables (5.322) 5.966 4210 Other current and non-current aisets Accounts payable (166) 4938 Deferred revenue Other current and nop-current liabilities Cash generated by operating activities 828 (8,010) (2.093) (423) (2,723) 9.175 (4.254) 456 Cash generaicd by operaung activites Investing activitiox: Purchases of marketable securities (44) (5,318) 527 Proceeds from maturities of marketable securies Proceeds from sales of marketable secunties Payments for acquirition of property, plant and equipment 33.490 8.966 217 Payments made in conection with business acquisitioes, net 77.434 (626) (51) Parchaies of non-marketable securitica 38,49077,434 Proceeds from non-marketable secunties Other (71,356) (159,486) 1.055 2.117 (a.554) Ther: Cath generated by (uced in) investing activities 55,881 31,775 662340.905 47.838 94.564 (13,313) (12,451) (329) (1,871) (521) 353 126 (745) (122) (924) 16,066 (46,446) (45,977) Financing activities: Procerds frum iseance of common stack Paymects for taies related to na ihure seltement of equity awards 669 555 495 Payments for dividends and dividend equivalents (2.527) (1,874) (1,570) Repurchues of common slock (13,712) (12,769) (12.150) Proceeds from isruance of term debt, net (72.736) (32,900) (29.722). Repuymenta of tem debt 28,662 24954 Change in commertial puper, net Cahh eved in financing activities (6.500 as00 (2.500) Supplemental cash fow dinclouire: Cash ind cash cquvalents, vegnting or the year Operating activitien: Net income 59,531 48,351 45,687 Adjustments to reconcile net income to cash geocrated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Aceocints receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable 10,903 Deferred revenue Other current and non-current liabilities Cash generated by operating activities 5.340 10,157 10,505 (32.590) 4,840 4,210 5,966 4,938 (444) (166) 486 Supplemental cash flow disclosure: Cash paid for income taies, net Cash paid finr interest 5 5 10.417 3.022 10,444 1,316 See accompanying Notes to Coniclidated Financial Statementx. Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements. Avole Ine. Sec accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millionst) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY A worle Ine See accompurying Notes to Consolidated Financial Statemerts Use Apple's financial statements in Anpendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts recelvable turnover as of September 29, 2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29, 2018, 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018. and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29, 2018? 2. Compute Apple's accounts recelvable turnover as of September 29,2018. 3. Apple's most liquid assets include (b) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30,2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Compute Apple's accounts recelvable turnover as of September 29, 2018. Note: Round your answer to 1 decimal place. Use Apple's financial statements in Aprendix A to answer the following. 1. What is the amount of Apple's accounts recelvable as of September 29, 2018? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). ( ) ) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30,2017. 4. Did Apple's lquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. Note: Round your percentage answers to 1 decimal place. Use Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts receivable turnover as of September 29,2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current), (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29, 2018, and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. Did Apple's liquid assets as a percentage of current liablities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Sce accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions. excent number of shares which are reflocted in thousands and per share amoonts See accompanying Notes to Consolidated Financial Statements See accompanying Notes to Consolidated Financial Statements. See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Apple Ine. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year- Operating activitiex: Net income 5September29,201820,289 5September30,2017 Adjustments to recencile net income to cach gencrated by operating activities: Depreciation and amortization Share-bisod comperisation expense Deferred income tax expense (benefit) 59531 48,351 Other (32.599) 10.157 (44) 4.840 10,505 Changes in operating astets and liabilities: Accounts meceivable, net Inventories Vendor non-trade receivables (5.322) 5.966 4210 Other current and non-current aisets Accounts payable (166) 4938 Deferred revenue Other current and nop-current liabilities Cash generated by operating activities 828 (8,010) (2.093) (423) (2,723) 9.175 (4.254) 456 Cash generaicd by operaung activites Investing activitiox: Purchases of marketable securities (44) (5,318) 527 Proceeds from maturities of marketable securies Proceeds from sales of marketable secunties Payments for acquirition of property, plant and equipment 33.490 8.966 217 Payments made in conection with business acquisitioes, net 77.434 (626) (51) Parchaies of non-marketable securitica 38,49077,434 Proceeds from non-marketable secunties Other (71,356) (159,486) 1.055 2.117 (a.554) Ther: Cath generated by (uced in) investing activities 55,881 31,775 662340.905 47.838 94.564 (13,313) (12,451) (329) (1,871) (521) 353 126 (745) (122) (924) 16,066 (46,446) (45,977) Financing activities: Procerds frum iseance of common stack Paymects for taies related to na ihure seltement of equity awards 669 555 495 Payments for dividends and dividend equivalents (2.527) (1,874) (1,570) Repurchues of common slock (13,712) (12,769) (12.150) Proceeds from isruance of term debt, net (72.736) (32,900) (29.722). Repuymenta of tem debt 28,662 24954 Change in commertial puper, net Cahh eved in financing activities (6.500 as00 (2.500) Supplemental cash fow dinclouire: Cash ind cash cquvalents, vegnting or the year Operating activitien: Net income 59,531 48,351 45,687 Adjustments to reconcile net income to cash geocrated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Aceocints receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable 10,903 Deferred revenue Other current and non-current liabilities Cash generated by operating activities 5.340 10,157 10,505 (32.590) 4,840 4,210 5,966 4,938 (444) (166) 486 Supplemental cash flow disclosure: Cash paid for income taies, net Cash paid finr interest 5 5 10.417 3.022 10,444 1,316 See accompanying Notes to Coniclidated Financial Statementx. Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements. Avole Ine. Sec accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millionst) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY A worle Ine See accompurying Notes to Consolidated Financial Statemerts Use Apple's financial statements in Anpendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 29,2018 ? 2. Compute Apple's accounts recelvable turnover as of September 29, 2018. 3. Apple's most liquid assets include (a) cash and cash equivalents, (b) marketable securities (current). (c) accounts receivable, and (d) inventory. Compute the percentage that these liquid assets (in total) make up of current liabilities as of September 29,2018 , and as of September 30, 2017. 4. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2018 year-end compared to its fiscal 2017 year-end? Complete this question by entering your answers in the tabs below. What is the amount of Apple's accounts receivable as of September 29, 2018? Note: Enter your answer in millions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started