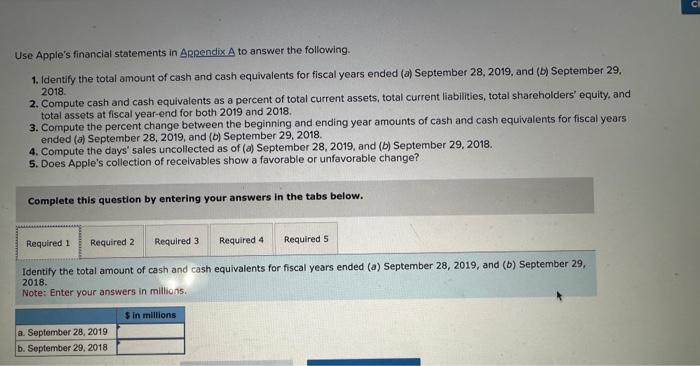

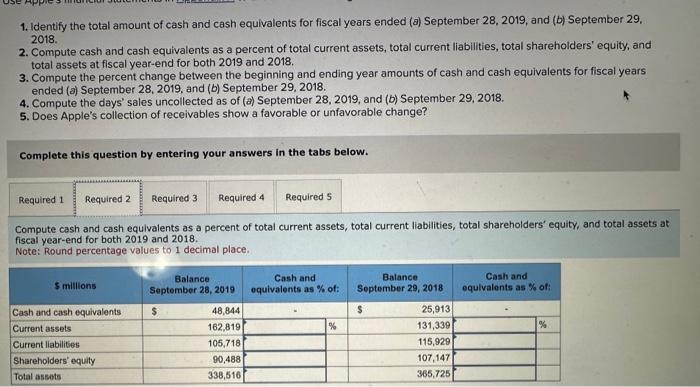

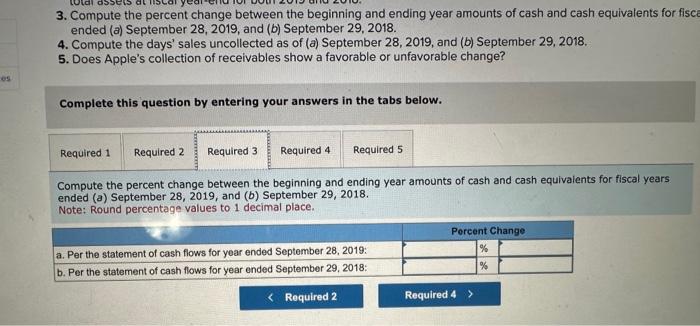

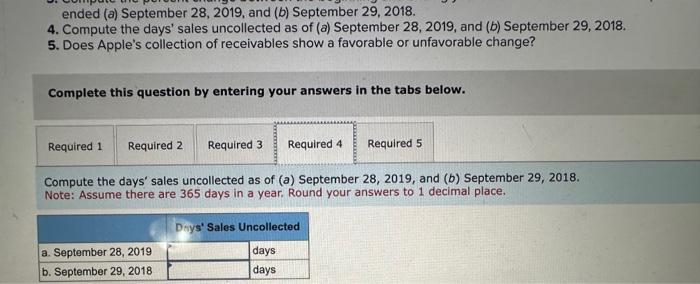

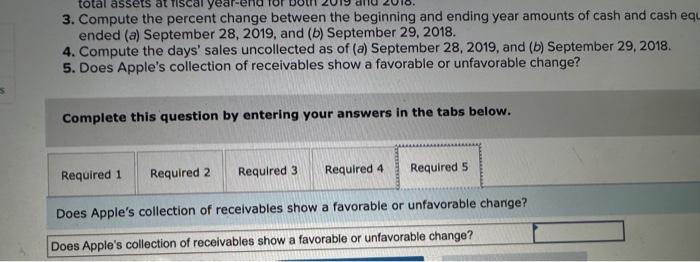

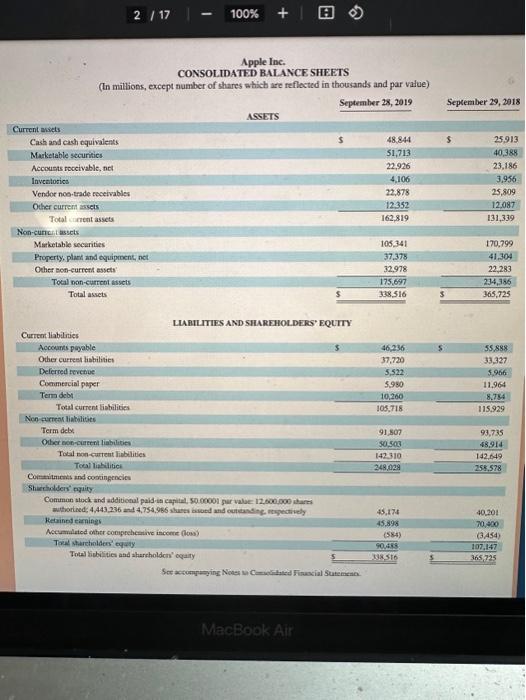

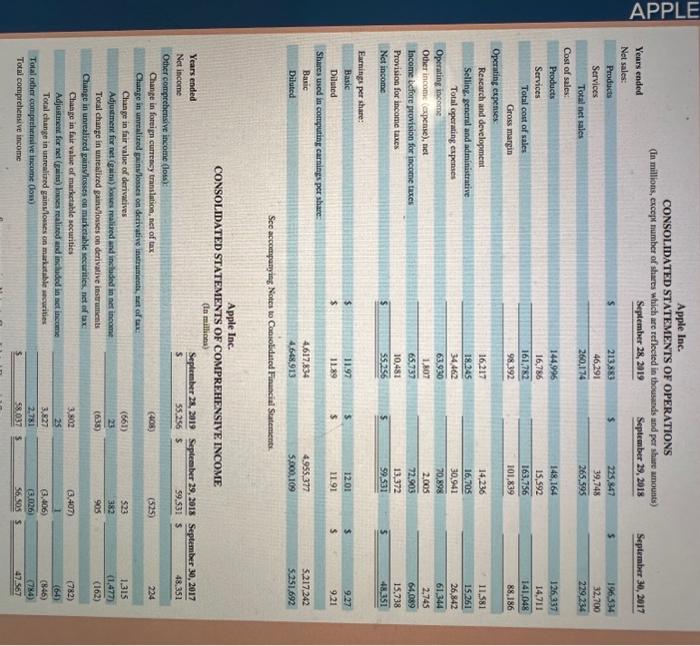

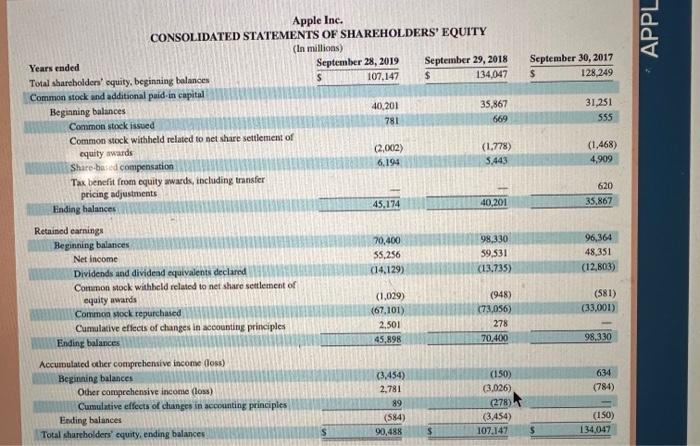

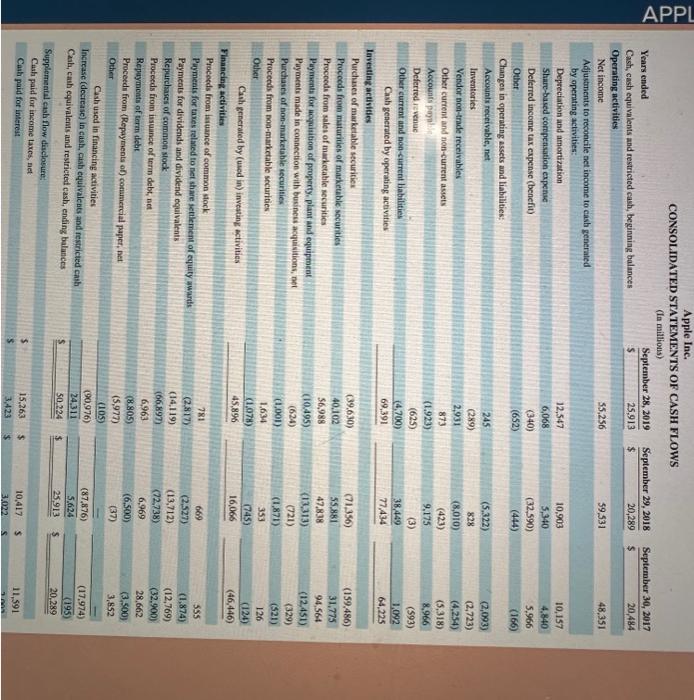

Use Apple's financial statements in ARpendix.A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28,2019 , and (b) September 29 . 2018. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28,2019 , and (b) September 29 , 2018. Note: Enter your answers in millions. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28,2019 , and (b) September 29 , 2018. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. Note: Round percentage values to 1 decimal place. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fisce ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. Note: Round percentage values to 1 decimal place. ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. Note: Assume there are 365 days in a year. Round your answers to 1 decimal place. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equ ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Does Apple's collection of receivables show a favorable or unfavorable change? Apple Ine. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflocted in thousands and par value) LARIUTIES AND SHAREHOLDERS' EQUTY Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except number of shares which are reflected in thousands and per share anounts) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Years ended \\ Net sales: \end{tabular}} & \multicolumn{2}{|c|}{ September 28, 2019} & \multicolumn{2}{|c|}{ September 29,2018 } & \multicolumn{2}{|c|}{ September 30, 2017} \\ \hline & & & & & & \\ \hline Products & $ & 213,883 & 5 & 225,847 & 5 & 196,534 \\ \hline Serviees & & 46,291 & & 39,748 & & 32,700 \\ \hline Total act sales & & 260,174 & & 265,595 & & 229,234 \\ \hline \multicolumn{7}{|l|}{ Cost of sales: } \\ \hline Products & & 144,996 & & 148,164 & & 126337 \\ \hline Services & & 16,786 & & 15,592 & & 14,711 \\ \hline Total cost of sales & & 161,782 & & 163,756 & & 141,048 \\ \hline Gross margin & & 98,392 & & 101,839 & & 88,186 \\ \hline \multicolumn{7}{|l|}{ Operating expenses: } \\ \hline Reseatch and development & & 16,217 & & 14,236 & & 11,581 \\ \hline Selling. general and administrative. & 1 & 18,245 & & 16,705 & & 15,261 \\ \hline Total operating expenses & & 34,462 & & 30,941 & & 26,842 \\ \hline Operating incoms & & 63,930 & & 70.898 & & 61,344 \\ \hline Other income (expense), aet & & 1,807 & & 2,005 & & 2,745 \\ \hline lacome before provision for incune tuxes & & 65,737 & & 72,903 & & 64,089 \\ \hline Provision for income taxes & & 10,451 & & 13,372 & & 15,738 \\ \hline Net income & $ & 55,256 & 5 & 59.531 & 5 & 48.351 \\ \hline \multicolumn{7}{|l|}{ Earaings per share: } \\ \hline Basic & $ & 11.97 & s & 12.01 & 5 & 9.27 \\ \hline Diluted & $ & 11.89 & 5 & 11.91 & s & 921 \\ \hline \multicolumn{7}{|l|}{ Shares used in corrquting carnings per share: } \\ \hline Basic & & 4,617,834 & & 4.955,377 & & 5,217,242 \\ \hline Diluted & & 4.648,913 & & 5,000,109 & & 5251.692 \\ \hline \end{tabular} See accoerpanyins Notes to Caniolidated Financial Suatements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (ta milliona) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Years ended \\ Net income \end{tabular}} & \multicolumn{2}{|c|}{ September 28, 2019} & \multicolumn{2}{|c|}{ Septeaber 29, 2018} & \multicolumn{2}{|c|}{ September 30, 2017} \\ \hline & 5 & 55,256 & $ & 59.531 & s & 48.351 \\ \hline \multicolumn{7}{|l|}{ Other comprebensive income (loss): } \\ \hline Change in foreign currescy translation, net of tax & & (406) & & (525) & & 224 \\ \hline \\ \hline Change in fair value of derivatives & & (661) & & 523 & & 1,315 \\ \hline Adjustment for net ( g inu) bous realined and incladed in nef incame. & & 23. & & 382 & & (1,477) \\ \hline Total change in untealixed gainslosses on derivative instruments & & (633) & & 905 & & (162) \\ \hline \multicolumn{7}{|l|}{ Change in uniealined zainvllosses on marketable securities, net of tax: } \\ \hline Chasge in fair value of marketable securities & & 3,502 & & (3,407) & & (782) \\ \hline Adjostmect for net (guras) lases realined and included in act incume. & & 25 & & 1 & & (64) \\ \hline Total change in unrealized gainulouves on markutable aecurities & & 3.827 & & (3,406) & & (846) \\ \hline Total other conspetantaive incoene (bos) & & 2,781 & & (3,026) & & (784) \\ \hline Tocal comprehensive income - & s. & 58037 & s & 56.505 & s. & 47.567 \\ \hline \end{tabular} Apple Inc