Answered step by step

Verified Expert Solution

Question

1 Approved Answer

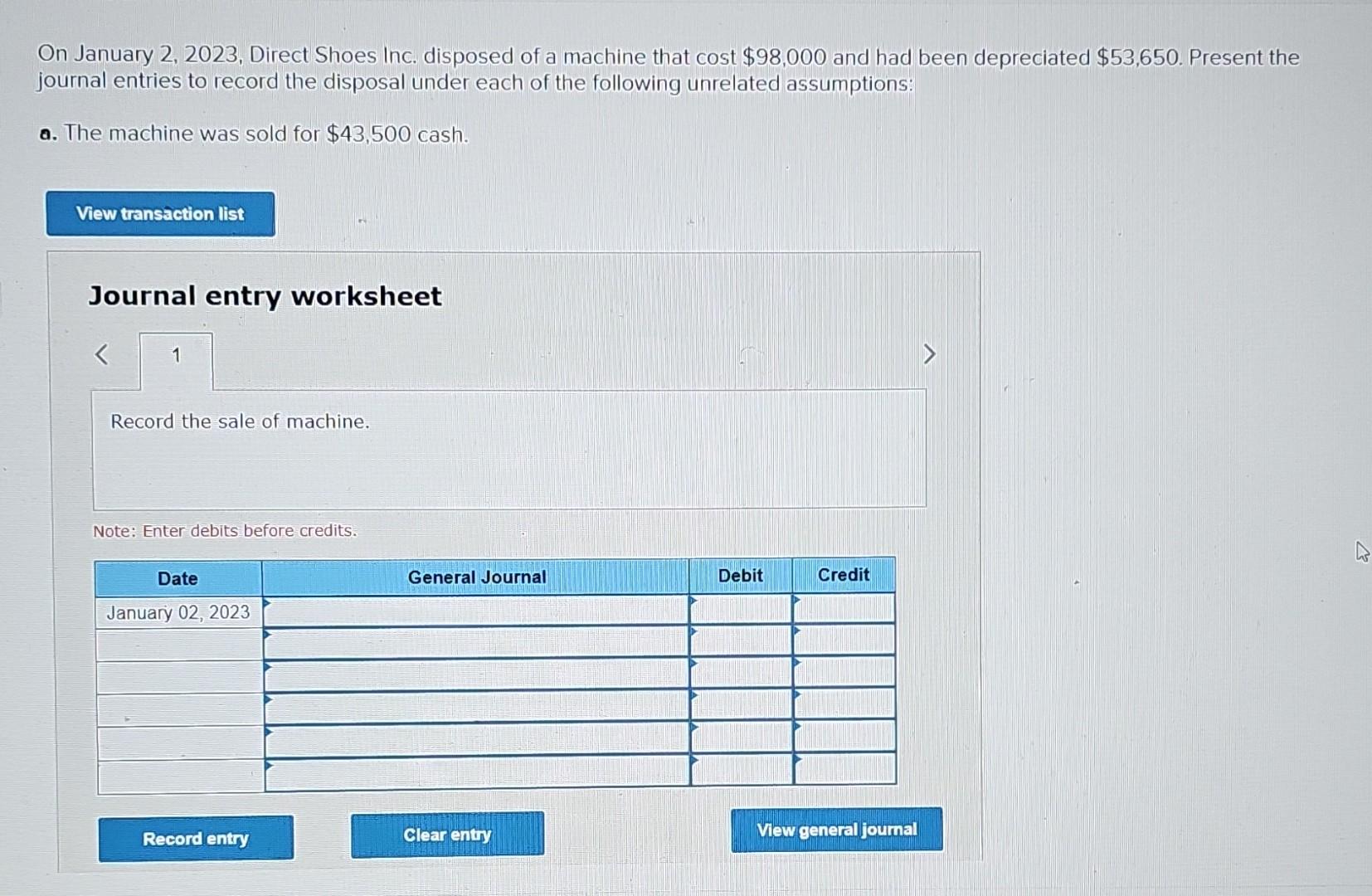

On January 2, 2023, Direct Shoes Inc. disposed of a machine that cost $98,000 and had been depreciated $53,650. Present the journal entries to record

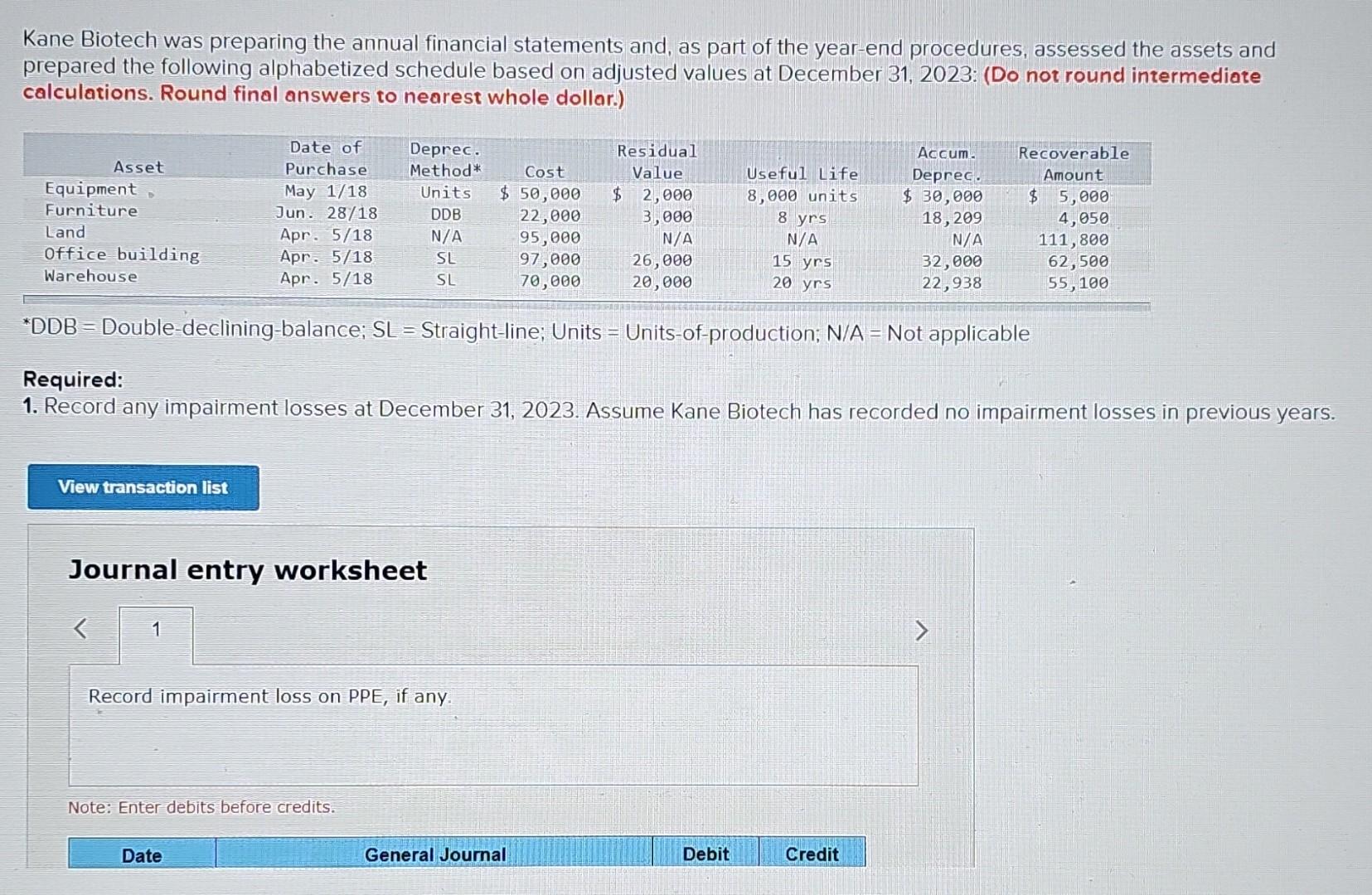

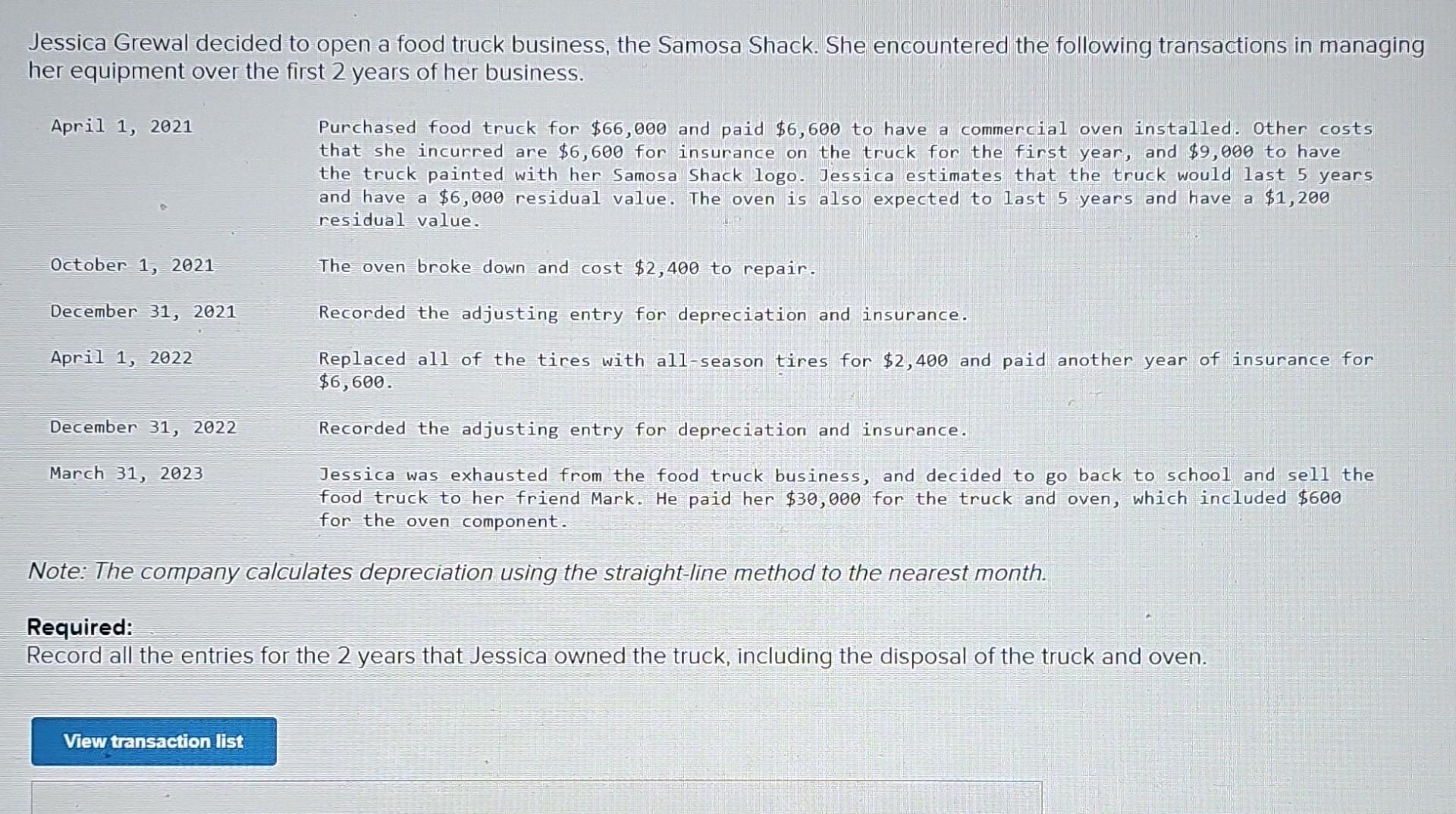

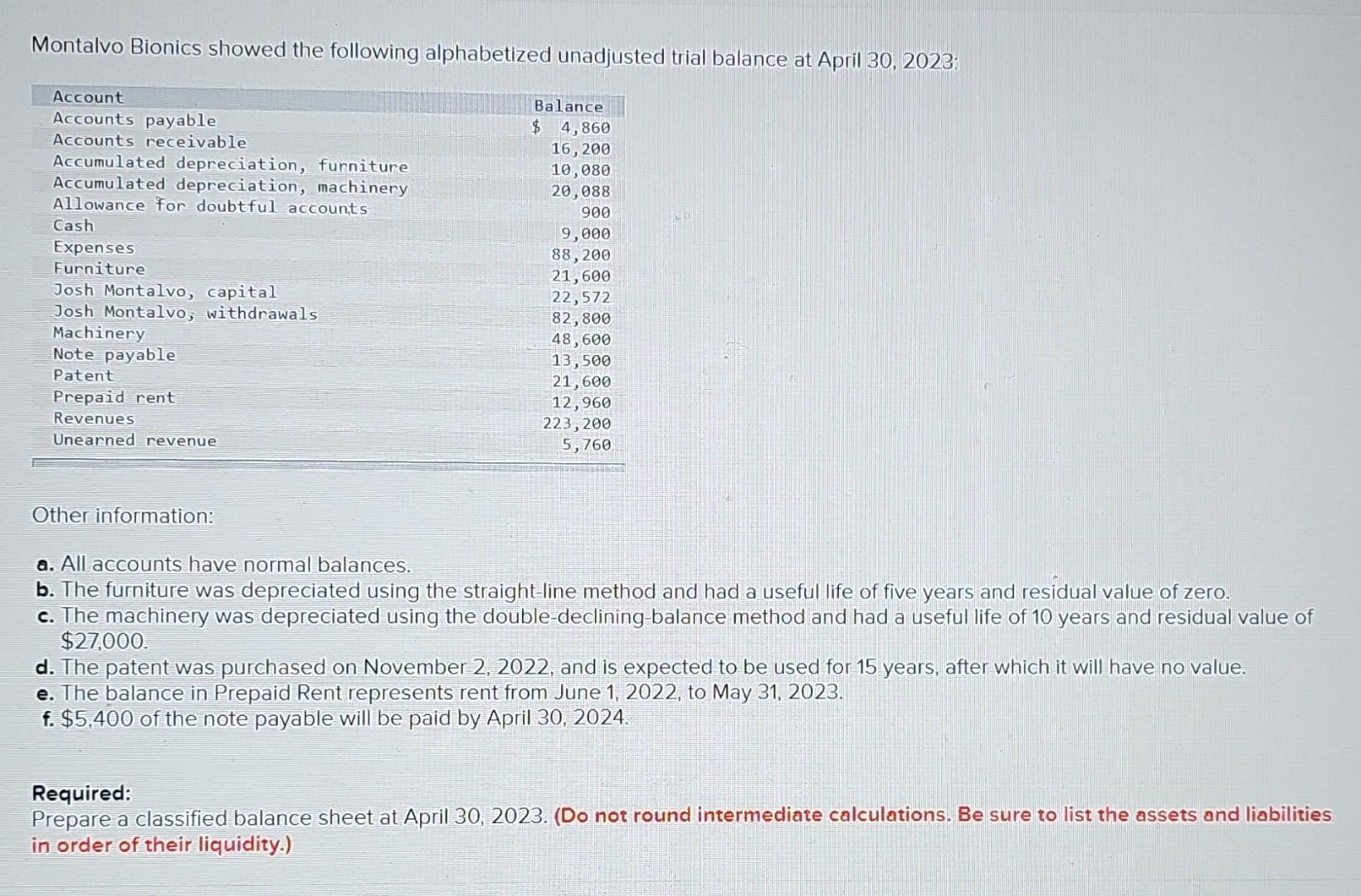

On January 2, 2023, Direct Shoes Inc. disposed of a machine that cost $98,000 and had been depreciated $53,650. Present the journal entries to record the disposal under each of the following unrelated assumptions: a. The machine was sold for $43,500 cash. Journal entry worksheet Record the sale of machine. Note: Enter debits before credits. Montalvo Bionics showed the following alphabetized unadjusted trial balance at April 30, 2023: Other information: a. All accounts have normal balances. b. The furniture was depreciated using the straight-line method and had a useful life of five years and residual value of zero. c. The machinery was depreciated using the double-declining-balance method and had a useful life of 10 years and residual value of $27,000. d. The patent was purchased on November 2, 2022, and is expected to be used for 15 years, after which it will have no value. e. The balance in Prepaid Rent represents rent from June 1, 2022, to May 31, 2023. f. $5,400 of the note payable will be paid by April 30, 2024 . Required: Prepare a classified balance sheet at April 30, 2023. (Do not round intermediate calculations. Be sure to list the assets and liabilities in order of their liquidity.) Kane Biotech was preparing the annual financial statements and, as part of the year-end procedures, assessed the assets and prepared the following alphabetized schedule based on adjusted values at December 31, 2023: (Do not round intermediate calculations. Round final answers to nearest whole dollar.) *DDB = Double-declining-balance; SL= Straight-line; Units = Units-of-production; N/A = Not applicable Required: 1. Record any impairment losses at December 31, 2023. Assume Kane Biotech has recorded no impairment losses in previous years Journal entry worksheet Record impairment loss on PPE, if any. Note: Enter debits before credits. Jessica Grewal decided to open a food truck business, the Samosa Shack. She encountered the following transactions in managing her equipment over the first 2 years of her business. April 1, 2021 October 1, 2021 December 31, 2021 April 1, 2022 December 31, 2022 March 31, 2023 Purchased food truck for $66,000 and paid $6,600 to have a commercial oven installed. Other costs that she incurred are $6,600 for insurance on the truck for the first year, and $9,000 to have the truck painted with her Samosa Shack logo. Jessica estimates that the truck would last 5 years and have a $6,000 residual value. The oven is also expected to last 5 years and have a $1,200 residual value. The oven broke down and cost $2,400 to repair. Recorded the adjusting entry for depreciation and insurance. Replaced all of the tires with all-season tires for $2,400 and paid another year of insurance for $6,600. Recorded the adjusting entry for depreciation and insurance. Jessica was exhausted from the food truck business, and decided to go back to school and sell the food truck to her friend Mark. He paid her $30,000 for the truck and oven, which included \$600 for the oven component. Note: The company calculates depreciation using the straight-line method to the nearest month. Required: Record all the entries for the 2 years that Jessica owned the truck, including the disposal of the truck and oven

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started