Use below table format to complete

6.1

| Cash Receipts Journal | | Cash Payments Journal |

| Sundry account | Amount | | Sundry account | Amount |

| | | | | |

6.2

| BANK RECONCILIATION STATEMENT ON 31 OCTOBER 2019 |

| | DEBIT | CREDIT |

| Balance as per bank statement | | |

| Outstanding deposits | | |

| | | |

| Outstanding cheques: | | |

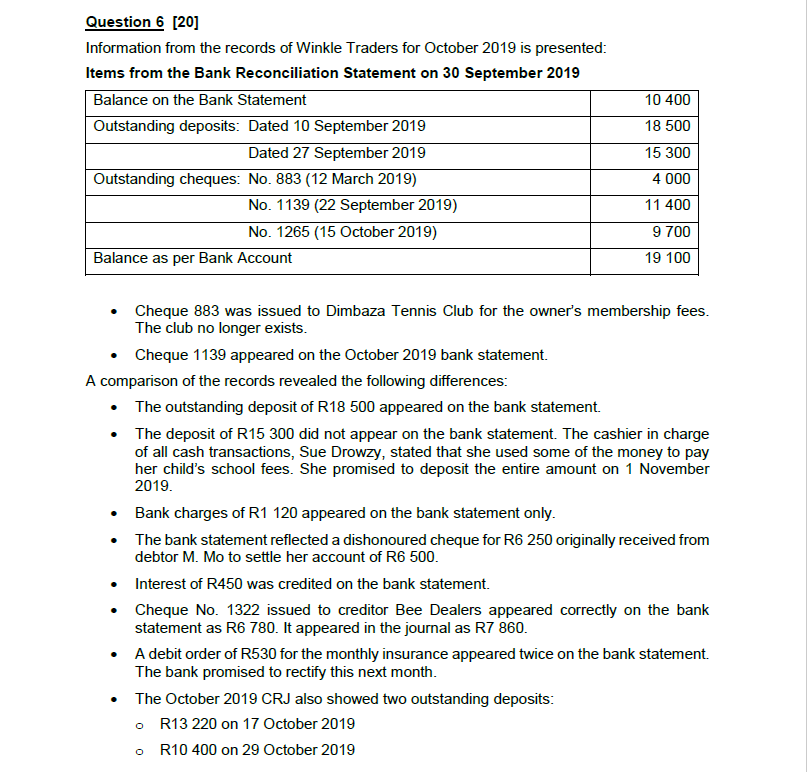

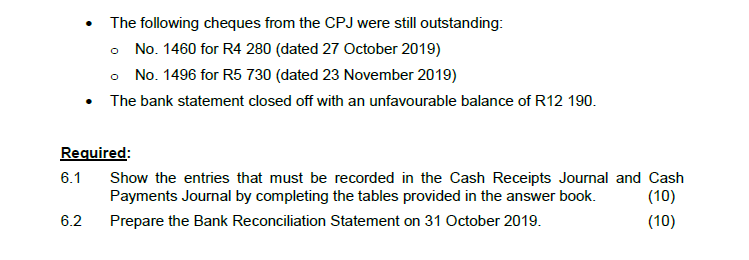

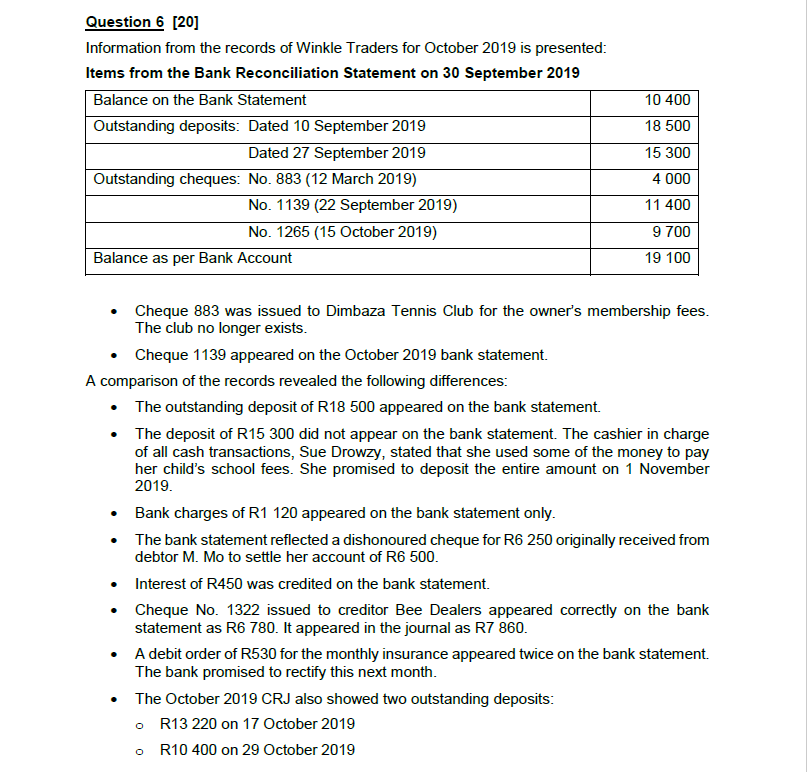

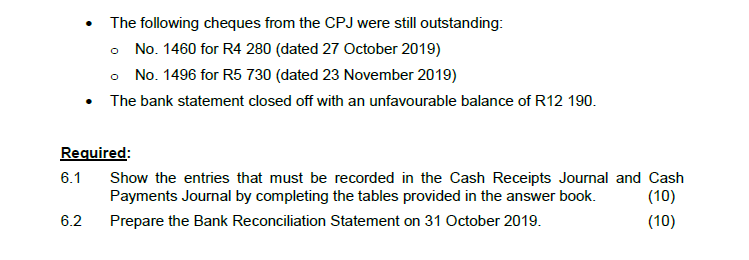

10 400 18 500 Question 6 [20] Information from the records of Winkle Traders for October 2019 is presented: Items from the Bank Reconciliation Statement on 30 September 2019 Balance on the Bank Statement Outstanding deposits: Dated 10 September 2019 Dated 27 September 2019 Outstanding cheques: No. 883 (12 March 2019) No. 1139 (22 September 2019) No. 1265 (15 October 2019) Balance as per Bank Account 15 300 4 000 11 400 9700 19 100 Cheque 883 was issued to Dimbaza Tennis Club for the owner's membership fees. The club no longer exists. Cheque 1139 appeared on the October 2019 bank statement. A comparison of the records revealed the following differences: The outstanding deposit of R18 500 appeared on the bank statement. The deposit of R15 300 did not appear on the bank statement. The cashier in charge of all cash transactions, Sue Drowzy, stated that she used some of the money to pay her child's school fees. She promised to deposit the entire amount on 1 November 2019. Bank charges of R1 120 appeared on the bank statement only. The bank statement reflected a dishonoured cheque for R6 250 originally received from debtor M. Mo to settle her account of R6 500. Interest of R450 was credited on the bank statement. Cheque No. 1322 issued to creditor Bee Dealers appeared correctly on the bank statement as R6 780. It appeared in the journal as R7 860. A debit order of R530 for the monthly insurance appeared twice on the bank statement. The bank promised to rectify this next month. The October 2019 CRJ also showed two outstanding deposits: R13 220 on 17 October 2019 R10 400 on 29 October 2019 The following cheques from the CPJ were still outstanding: o No. 1460 for R4 280 (dated 27 October 2019) o No. 1496 for R5 730 (dated 23 November 2019) The bank statement closed off with an unfavourable balance of R12 190. Required: 6.1 Show the entries that must be recorded in the Cash Receipts Journal and Cash Payments Journal by completing the tables provided in the answer book. (10) Prepare the Bank Reconciliation Statement on 31 October 2019. (10) 6.2 10 400 18 500 Question 6 [20] Information from the records of Winkle Traders for October 2019 is presented: Items from the Bank Reconciliation Statement on 30 September 2019 Balance on the Bank Statement Outstanding deposits: Dated 10 September 2019 Dated 27 September 2019 Outstanding cheques: No. 883 (12 March 2019) No. 1139 (22 September 2019) No. 1265 (15 October 2019) Balance as per Bank Account 15 300 4 000 11 400 9700 19 100 Cheque 883 was issued to Dimbaza Tennis Club for the owner's membership fees. The club no longer exists. Cheque 1139 appeared on the October 2019 bank statement. A comparison of the records revealed the following differences: The outstanding deposit of R18 500 appeared on the bank statement. The deposit of R15 300 did not appear on the bank statement. The cashier in charge of all cash transactions, Sue Drowzy, stated that she used some of the money to pay her child's school fees. She promised to deposit the entire amount on 1 November 2019. Bank charges of R1 120 appeared on the bank statement only. The bank statement reflected a dishonoured cheque for R6 250 originally received from debtor M. Mo to settle her account of R6 500. Interest of R450 was credited on the bank statement. Cheque No. 1322 issued to creditor Bee Dealers appeared correctly on the bank statement as R6 780. It appeared in the journal as R7 860. A debit order of R530 for the monthly insurance appeared twice on the bank statement. The bank promised to rectify this next month. The October 2019 CRJ also showed two outstanding deposits: R13 220 on 17 October 2019 R10 400 on 29 October 2019 The following cheques from the CPJ were still outstanding: o No. 1460 for R4 280 (dated 27 October 2019) o No. 1496 for R5 730 (dated 23 November 2019) The bank statement closed off with an unfavourable balance of R12 190. Required: 6.1 Show the entries that must be recorded in the Cash Receipts Journal and Cash Payments Journal by completing the tables provided in the answer book. (10) Prepare the Bank Reconciliation Statement on 31 October 2019. (10) 6.2