Answered step by step

Verified Expert Solution

Question

1 Approved Answer

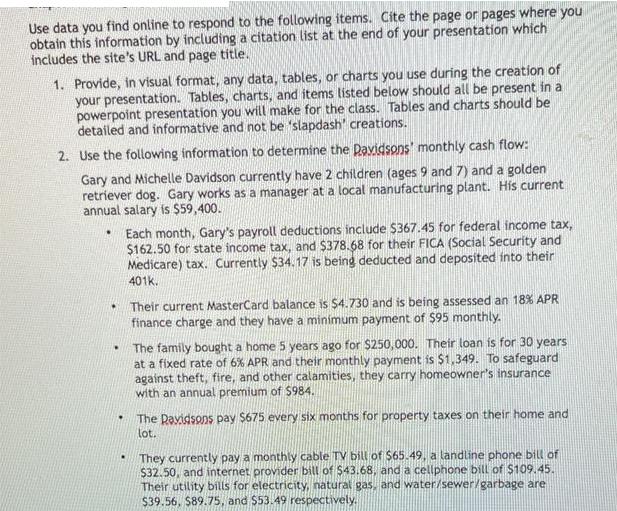

Use data you find online to respond to the following items. Cite the page or pages where you obtain this information by including a

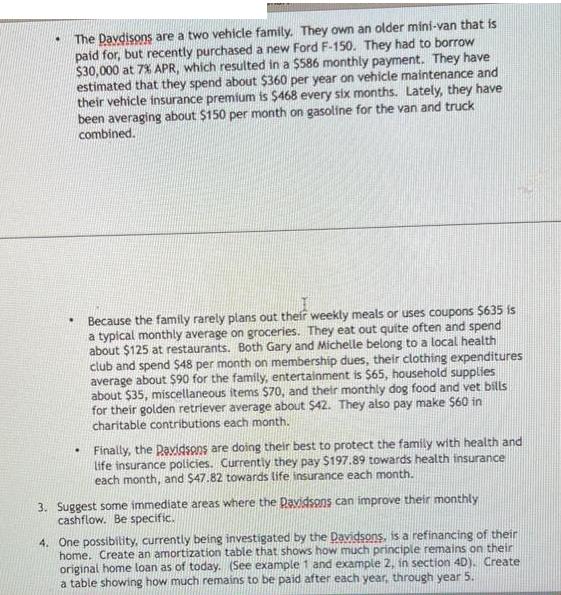

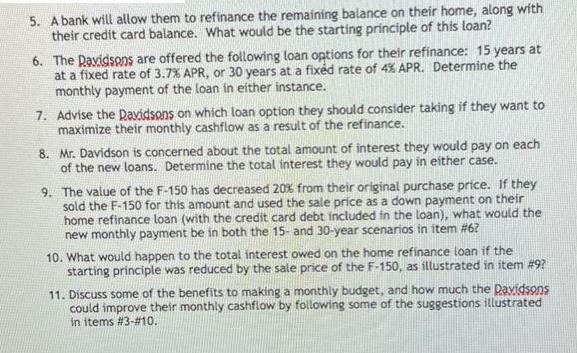

Use data you find online to respond to the following items. Cite the page or pages where you obtain this information by including a citation list at the end of your presentation which includes the site's URL and page title. 1. Provide, in visual format, any data, tables, or charts you use during the creation of your presentation. Tables, charts, and items listed below should all be present in a powerpoint presentation you will make for the class. Tables and charts should be detailed and informative and not be 'slapdash' creations. 2. Use the following information to determine the Davidsons' monthly cash flow: Gary and Michelle Davidson currently have 2 children (ages 9 and 7) and a golden retriever dog. Gary works as a manager at a local manufacturing plant. His current annual salary is $59,400. A Each month, Gary's payroll deductions include $367.45 for federal income tax, $162.50 for state income tax, and $378.68 for their FICA (Social Security and Medicare) tax. Currently $34.17 is being deducted and deposited into their 401k. . . . . Their current MasterCard balance is $4.730 and is being assessed an 18% APR finance charge and they have a minimum payment of $95 monthly. The family bought a home 5 years ago for $250,000. Their loan is for 30 years at a fixed rate of 6% APR and their monthly payment is $1,349. To safeguard against theft, fire, and other calamities, they carry homeowner's insurance with an annual premium of $984. The Davidsons pay $675 every six months for property taxes on their home and lot. They currently pay a monthly cable TV bill of $65.49, a landline phone bill of $32.50, and internet provider bill of $43.68, and a cellphone bill of $109.45. Their utility bills for electricity, natural gas, and water/sewer/garbage are $39.56, $89.75, and $53.49 respectively. The Davdisons are a two vehicle family. They own an older mini-van that is paid for, but recently purchased a new Ford F-150. They had to borrow $30,000 at 7% APR, which resulted in a $586 monthly payment. They have estimated that they spend about $360 per year on vehicle maintenance and their vehicle insurance premium is $468 every six months. Lately, they have been averaging about $150 per month on gasoline for the van and truck combined. . Because the family rarely plans out their weekly meals or uses coupons $635 is a typical monthly average on groceries. They eat out quite often and spend about $125 at restaurants. Both Gary and Michelle belong to a local health club and spend $48 per month on membership dues, their clothing expenditures average about $90 for the family, entertainment is $65, household supplies about $35, miscellaneous items $70, and their monthly dog food and vet bills for their golden retriever average about $42. They also pay make $60 in charitable contributions each month. Finally, the Davidsons are doing their best to protect the family with health and life insurance policies. Currently they pay $197.89 towards health insurance each month, and $47.82 towards life insurance each month. 3. Suggest some immediate areas where the Davidsons can improve their monthly cashflow. Be specific. 4. One possibility, currently being investigated by the Davidsons, is a refinancing of their home. Create an amortization table that shows how much principle remains on their original home loan as of today. (See example 1 and example 2, in section 4D). Create a table showing how much remains to be paid after each year, through year 5. 5. A bank will allow them to refinance the remaining balance on their home, along with their credit card balance. What would be the starting principle of this loan? 6. The Davidsons are offered the following loan options for their refinance: 15 years at at a fixed rate of 3.7% APR, or 30 years at a fixed rate of 4% APR. Determine the monthly payment of the loan in either instance. 7. Advise the Davidsons on which loan option they should consider taking if they want to maximize their monthly cashflow as a result of the refinance. 8. Mr. Davidson is concerned about the total amount of interest they would pay on each of the new loans. Determine the total interest they would pay in either case. 9. The value of the F-150 has decreased 20% from their original purchase price. If they sold the F-150 for this amount and used the sale price as a down payment on their home refinance loan (with the credit card debt included in the loan), what would the new monthly payment be in both the and 30-year scenarios in item # 6? 10. What would happen to the total interest owed on the home refinance loan if the starting principle was reduced by the sale price of the F-150, as illustrated in item #9? 11. Discuss some of the benefits to making a monthly budget, and how much the Davidsons could improve their monthly cashflow by following some of the suggestions illustrated in items # 3-#10.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Statement of monthly net cash flow of Gary Particulars Monthly Salary A Tax deducctions Federal Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started