Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE EXCEL AND PROVIDE A FORMULA FOR THE GIVEN ANSWERS ABOVE. SHOW YOUR CALCULATIONS. THANK YOU. I'LL GIVE A THUMBS UP WHEN THERE IS A

USE EXCEL AND PROVIDE A FORMULA FOR THE GIVEN ANSWERS ABOVE. SHOW YOUR CALCULATIONS. THANK YOU. I'LL GIVE A THUMBS UP WHEN THERE IS A FORMULA AND SOLUTION.

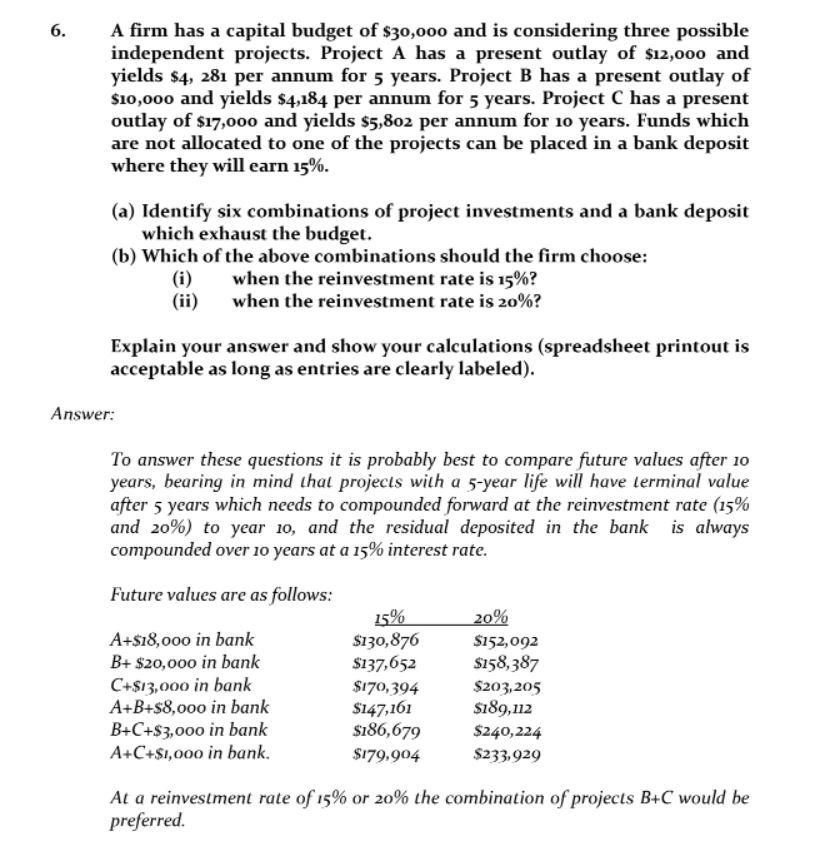

6. A firm has a capital budget of $30,000 and is considering three possible independent projects. Project A has a present outlay of $12,000 and yields $4, 281 per annum for 5 years. Project B has a present outlay of $10,000 and yields $4,184 per annum for 5 years. Project C has a present outlay of $17,000 and yields $5,802 per annum for 10 years. Funds which are not allocated to one of the projects can be placed in a bank deposit where they will earn 15%. (a) Identify six combinations of project investments and a bank deposit which exhaust the budget. (b) Which of the above combinations should the firm choose: (i) when the reinvestment rate is 15%? when the reinvestment rate is 20%? (ii) Explain your answer and show your calculations (spreadsheet printout is acceptable as long as entries are clearly labeled). Answer: To answer these questions it is probably best to compare future values after 10 years, bearing in mind that projects with a 5-year life will have terminal value after 5 years which needs to compounded forward at the reinvestment rate (15% and 20%) to year 10, and the residual deposited in the bank is always compounded over 10 years at a 15% interest rate. Future values are as follows: 15% 20% A+$18,000 in bank $130,876 $152,092 $137,652 $158,387 B+ $20,000 in bank C+$13,000 in bank A+B+$8,000 in bank $170,394 $203,205 $147,161 $189,112 B+C+$3,000 in bank $186,679 $240,224 A+C+$1,000 in bank. $179,904 $233,929 At a reinvestment rate of 15% or 20% the combination of projects B+C would be preferred. 6. A firm has a capital budget of $30,000 and is considering three possible independent projects. Project A has a present outlay of $12,000 and yields $4, 281 per annum for 5 years. Project B has a present outlay of $10,000 and yields $4,184 per annum for 5 years. Project C has a present outlay of $17,000 and yields $5,802 per annum for 10 years. Funds which are not allocated to one of the projects can be placed in a bank deposit where they will earn 15%. (a) Identify six combinations of project investments and a bank deposit which exhaust the budget. (b) Which of the above combinations should the firm choose: (i) when the reinvestment rate is 15%? when the reinvestment rate is 20%? (ii) Explain your answer and show your calculations (spreadsheet printout is acceptable as long as entries are clearly labeled). Answer: To answer these questions it is probably best to compare future values after 10 years, bearing in mind that projects with a 5-year life will have terminal value after 5 years which needs to compounded forward at the reinvestment rate (15% and 20%) to year 10, and the residual deposited in the bank is always compounded over 10 years at a 15% interest rate. Future values are as follows: 15% 20% A+$18,000 in bank $130,876 $152,092 $137,652 $158,387 B+ $20,000 in bank C+$13,000 in bank A+B+$8,000 in bank $170,394 $203,205 $147,161 $189,112 B+C+$3,000 in bank $186,679 $240,224 A+C+$1,000 in bank. $179,904 $233,929 At a reinvestment rate of 15% or 20% the combination of projects B+C would be preferredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started