Answered step by step

Verified Expert Solution

Question

1 Approved Answer

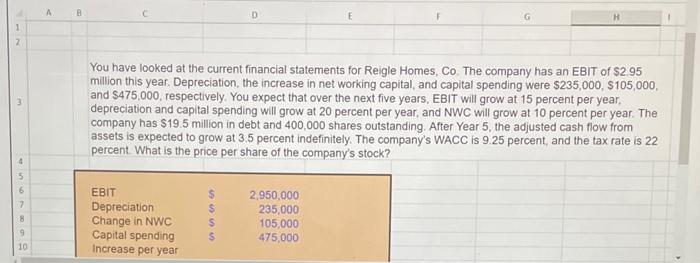

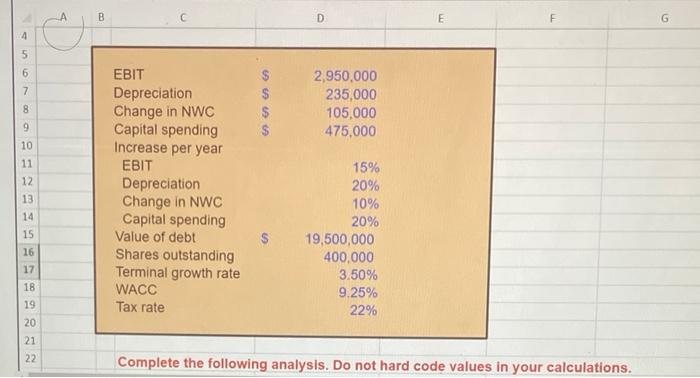

Use excel formulas for answers You have looked at the current financial statements for Reigle Homes, Co. The company has an EBIT of $2.95 million

Use excel formulas for answers

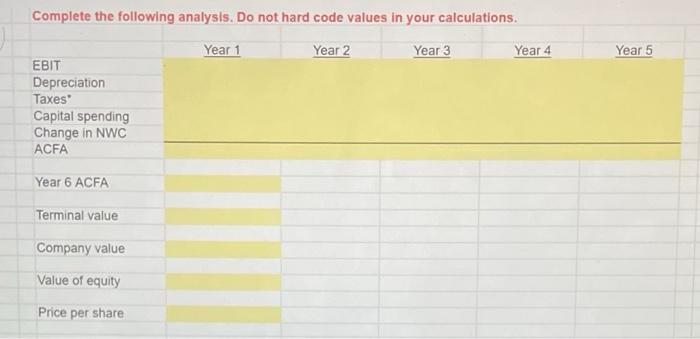

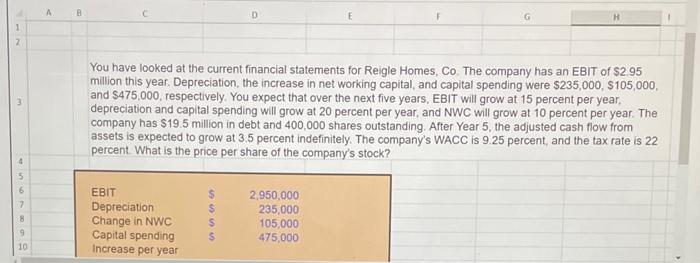

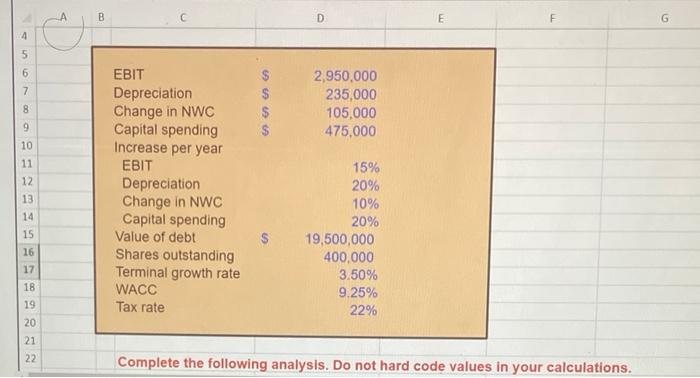

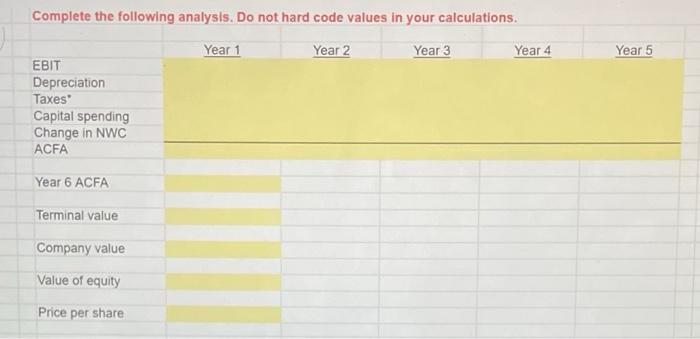

You have looked at the current financial statements for Reigle Homes, Co. The company has an EBIT of \$2.95 million this year. Depreciation, the increase in net working capital, and capital spending were $235,000,$105,000, and $475,000, respectively. You expect that over the next five years, EBIT will grow at 15 percent per year, depreciation and capital spending will grow at 20 percent per year, and NWC will grow at 10 percent per year. The company has $19.5 million in debt and 400,000 shares outstanding. After Year 5 , the adjusted cash flow from assets is expected to grow at 3.5 percent indefinitely. The company's WACC is 9.25 percent, and the tax rate is 22 percent. What is the price per share of the company's stock? Complete the following analysis. Do not hard code values in your calculations. Complete the following analysis. Do not hard code values in your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started