Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use Excel or MS Word to present your answers The questions (a) through (g) refer to Five Star Manufacturing Company. Use the following information to

use Excel or MS Word to present your answers

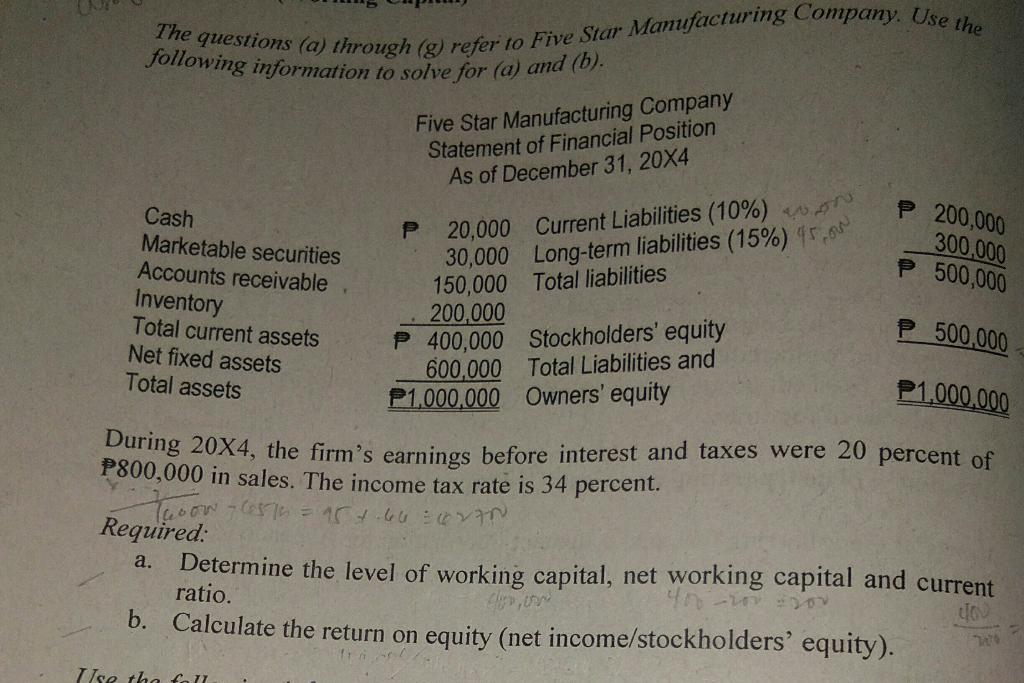

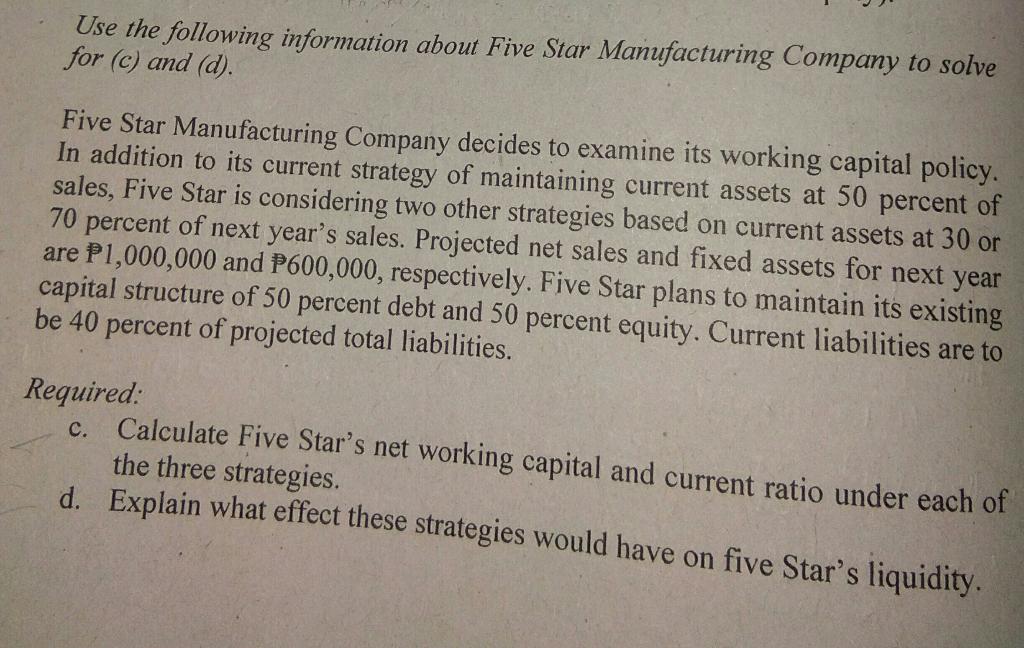

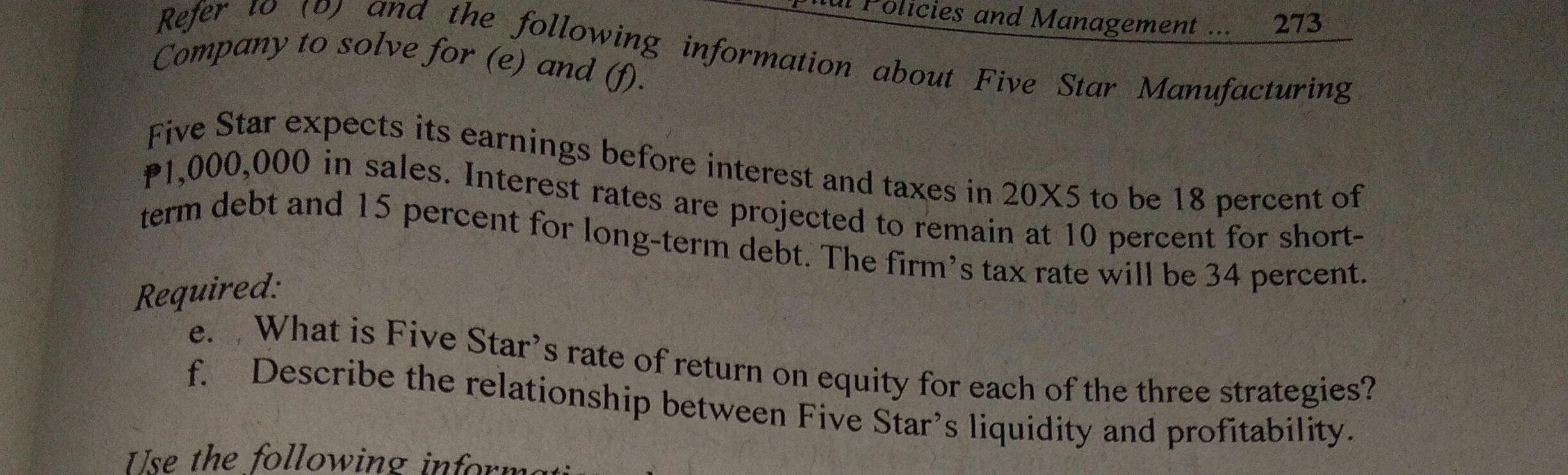

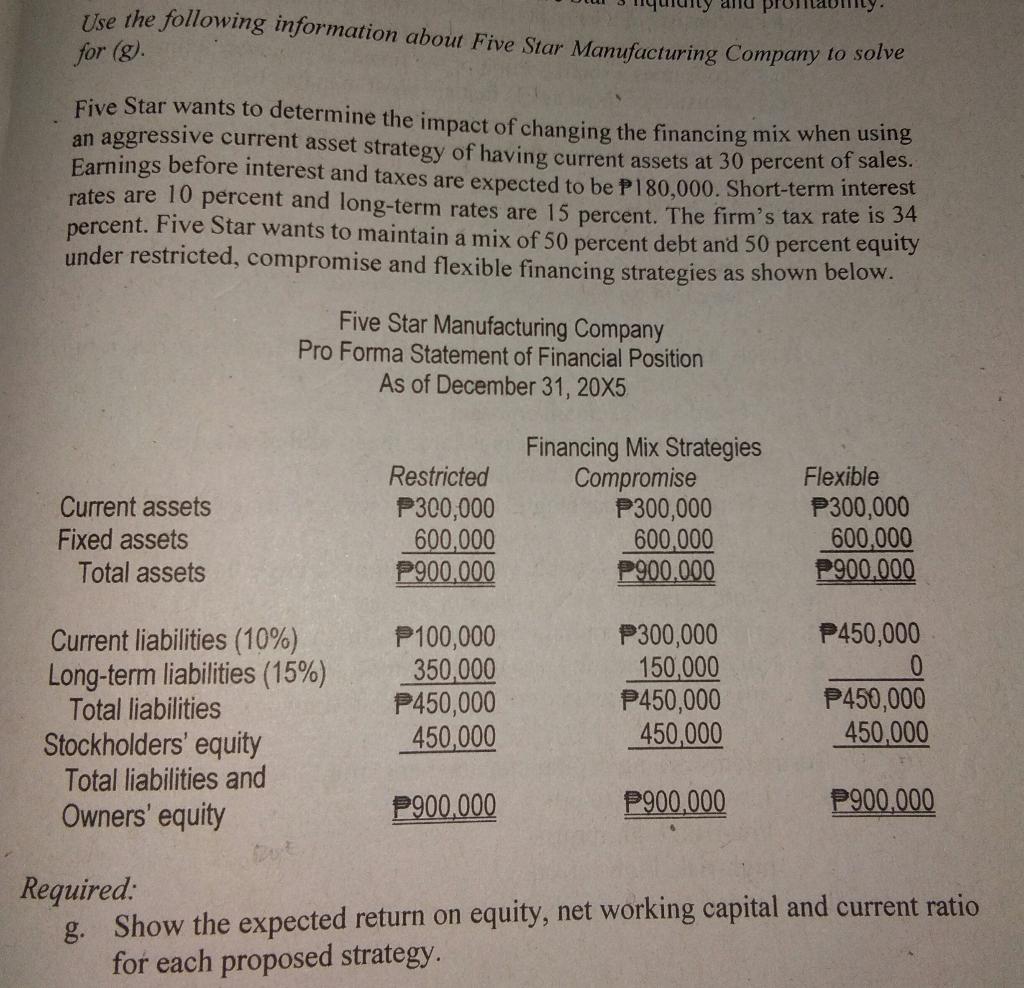

The questions (a) through (g) refer to Five Star Manufacturing Company. Use the following information to solve for (a) and (b). Five Star Manufacturing Company Statement of Financial Position As of December 31, 20X4 P200,000 300,000 P500,000 20,000 Current Liabilities (10%) 30,000 Long-term liabilities (15%) 5,00 150,000 Total liabilities 200,000 P 400,000 Stockholders' equity 600,000 Total Liabilities and P1,000,000 Owners' equity P500,000 P1.000.000 Cash Marketable securities Accounts receivable Inventory Total current assets Net fixed assets Total assets During 20X4, the firm's earnings before interest and taxes were 20 percent of P800,000 in sales. The income tax rate is 34 percent. Tarowth 15 t. 66 8270 Required: Determine the level of working capital, net working capital and current 20- 5 JO ratio. b. Calculate the return on equity (net income/stockholders' equity). a. Ilse the foll Use the following information about Five Star Manufacturing Company to solve for (c) and (d). Five Star Manufacturing Company decides to examine its working capital policy. In addition to its current strategy of maintaining current assets at 50 percent of sales, Five Star is considering two other strategies based on current assets at 30 or 70 percent of next year's sales. Projected net sales and fixed assets for next year are P1,000,000 and P600,000, respectively. Five Star plans to maintain its existing capital structure of 50 percent debt and 50 percent equity. Current liabilities are to be 40 percent of projected total liabilities. Required: c. Calculate Five Star's net working capital and current ratio under each of the three strategies. d. Explain what effect these strategies would have on five Star's liquidity. Refer licies and Management 273 and the following information about Five Star Manufacturing Company to solve for (e) and (1) expects its earnings before interest and taxes in 20x5 to be 18 percent of P1,000,000 in sales. Interest rates are projected to remain at 10 percent for short- debt and 15 percent for long-term debt. The firm's tax rate will be 34 percent. Five Star term Required: e. What is Five Star's rate of return on equity for each of the three strategies? f. Describe the relationship between Five Star's liquidity and profitability. Use the following informati Use the following information about Five Star Manufacturing Company to solve for (g). Five Star wants to determine the impact of changing the financing mix when using an aggressive current asset strategy of having current assets at 30 percent of sales. Earnings before interest and taxes are expected to be P180,000. Short-term interest rates are 10 percent and long-term rates are 15 percent. The firm's tax rate is 34 percent. Five Star wants to maintain a mix of 50 percent debt and 50 percent equity under restricted, compromise and flexible financing strategies as shown below. Five Star Manufacturing Company Pro Forma Statement of Financial Position As of December 31, 20X5 Current assets Fixed assets Total assets Restricted P300,000 600,000 P900,000 Financing Mix Strategies Compromise P300,000 600,000 P900.000 Flexible P300,000 600,000 P900.000 Current liabilities (10%) Long-term liabilities (15%) Total liabilities Stockholders' equity Total liabilities and Owners' equity P100,000 350,000 P450,000 450,000 P300,000 150,000 P450,000 450,000 P450,000 0 P450,000 450.000 P900.000 P900.000 P900.000 Required: g. Show the expected return on equity, net working capital and current ratio for each proposed strategyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started