Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use excel please jeniti/main.uni 120% no BACK NEX PRINTER VERSION amanjeet Chinmayi left her job as the production manager of a medium-sized firm two years

use excel please

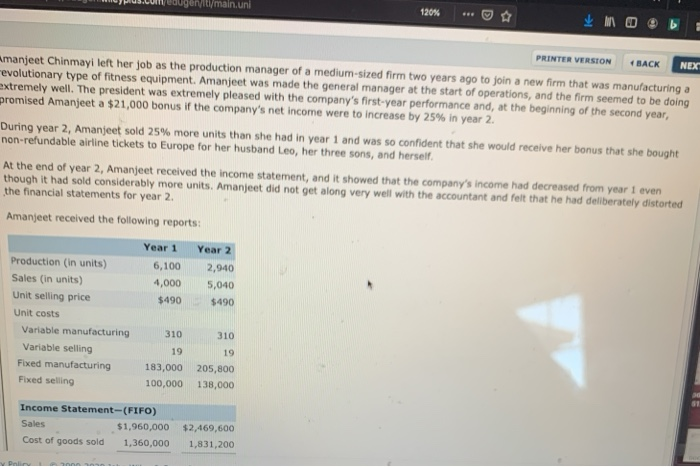

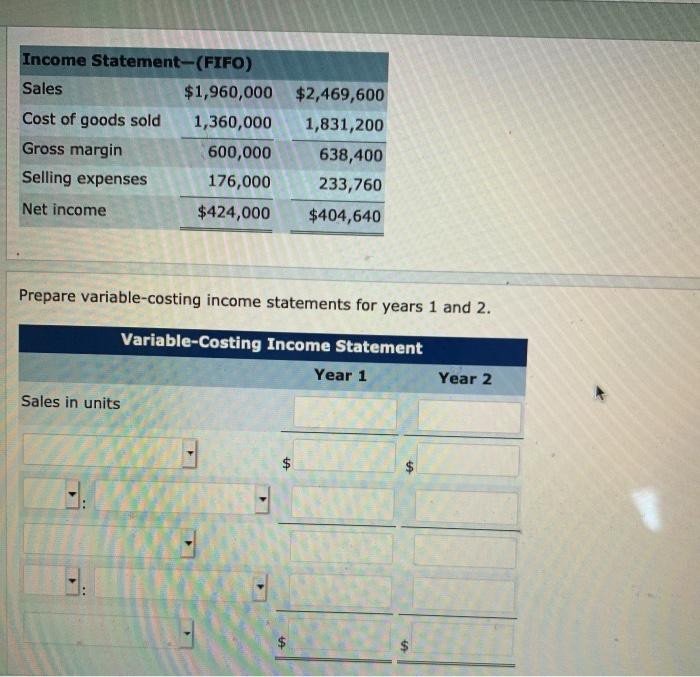

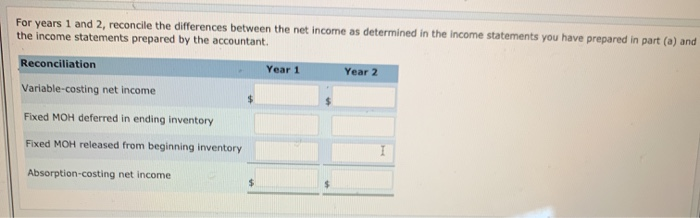

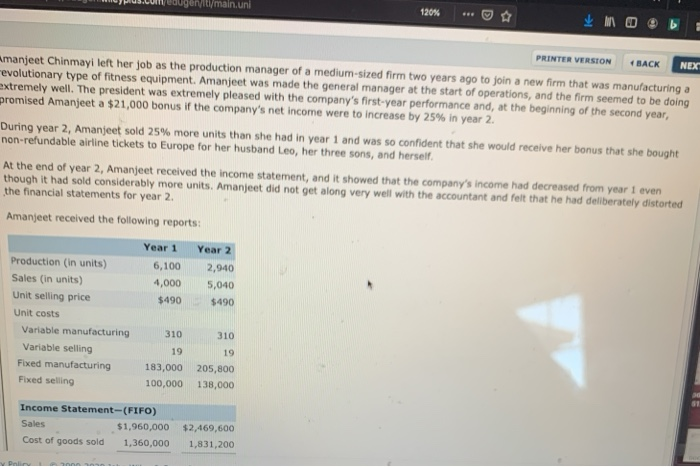

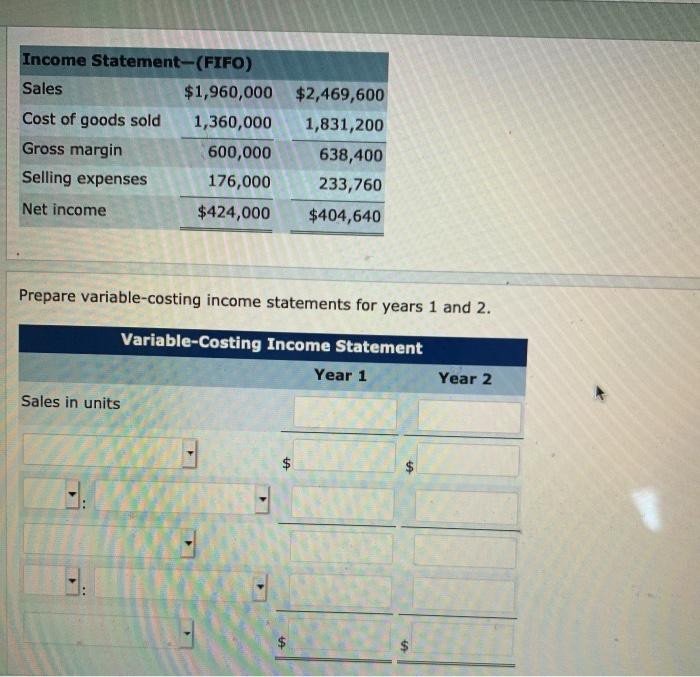

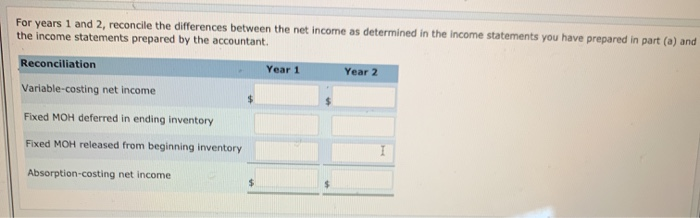

jeniti/main.uni 120% no BACK NEX PRINTER VERSION amanjeet Chinmayi left her job as the production manager of a medium-sized firm two years ago to join a new firm that was manufacturing a evolutionary type of fitness equipment. Amanjeet was made the general manager at the start of operations, and the firm seemed to be doing extremely well. The president was extremely pleased with the company's first-year performance and, at the beginning of the second year, promised Amanjeet a $21,000 bonus if the company's net income were to increase by 25% in year 2. During year 2, Amanjeet sold 25% more units than she had in year 1 and was so confident that she would receive her bonus that she bought non-refundable airline tickets to Europe for her husband Leo, her three sons, and herself At the end of year 2, Amanjeet received the income statement, and it showed that the company's income had decreased from year i even though it had sold considerably more units. Amanjeet did not get along very well with the accountant and felt that he had deliberately distorted the financial statements for year 2. Amanjeet received the following reports: Year 1 6,100 4,000 $490 Year 2 2,940 5,040 $490 Production (In units) Sales (in units) Unit selling price Unit costs Variable manufacturing Variable selling Fixed manufacturing Fixed selling 310 310 19 19 183,000 205,800 100,000 138,000 Income Statement-(FIFO) Sales $1,960,000 Cost of goods sold 1,360,000 $2,469,600 1,831,200 Income Statement-(FIFO) Sales $1,960,000 $2,469,600 Cost of goods sold 1,360,000 1,831,200 Gross margin 600,000 638,400 Selling expenses 176,000 233,760 Net income $424,000 $404,640 Prepare variable-costing income statements for years 1 and 2. Variable-Costing Income Statement Year 1 Year 2 Sales in units . tA . $ For years 1 and 2, reconcile the differences between the net income as determined in the income statements you have prepared in part (a) and the income statements prepared by the accountant. Reconciliation Year 1 Year 2 Variable-casting net income Fixed MOH deferred in ending inventory Fixed MOH released from beginning inventory Absorption-costing net income $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started