Answered step by step

Verified Expert Solution

Question

1 Approved Answer

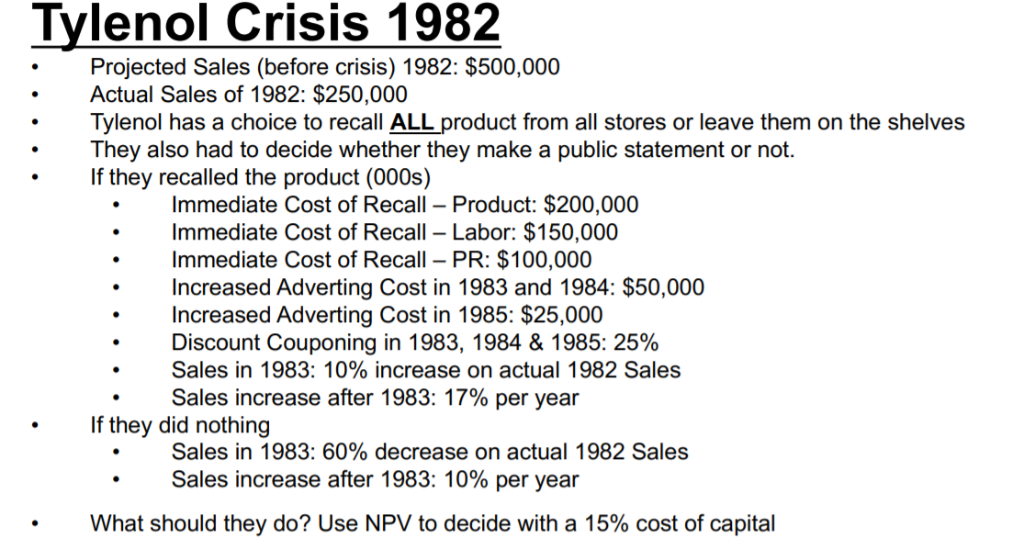

use Excel please Tvlenol Crisis 1982 Projected Sales (before crisis) 1982: $500,000 Actual Sales of 1982: $250,000 Tylenol has a choice to recall ALL product

use Excel please

Tvlenol Crisis 1982 Projected Sales (before crisis) 1982: $500,000 Actual Sales of 1982: $250,000 Tylenol has a choice to recall ALL product from all stores or leave them on the shelves They also had to decide whether they make a public statement or not. If they recalled the product (000s) Immediate Cost of Recall Product: $200,000 Immediate Cost of Recall Labor: $150,000 Immediate Cost of Recall PR: $100,000 Increased Adverting Cost in 1983 and 1984: $50,000 Increased Adverting Cost in 1985: $25,000 Discount Couponing in 1983, 1984 & 1985: 25% Sales in 1983: 10% increase on actual 1982 Sales Sales increase after 1983: 17% per year .If they did nothing Sales in 1983: 60% decrease on actual 1982 Sales Sales increase after 1983: 10% per year What should they do? Use NPV to decide with a 15% cost of capital Tvlenol Crisis 1982 Projected Sales (before crisis) 1982: $500,000 Actual Sales of 1982: $250,000 Tylenol has a choice to recall ALL product from all stores or leave them on the shelves They also had to decide whether they make a public statement or not. If they recalled the product (000s) Immediate Cost of Recall Product: $200,000 Immediate Cost of Recall Labor: $150,000 Immediate Cost of Recall PR: $100,000 Increased Adverting Cost in 1983 and 1984: $50,000 Increased Adverting Cost in 1985: $25,000 Discount Couponing in 1983, 1984 & 1985: 25% Sales in 1983: 10% increase on actual 1982 Sales Sales increase after 1983: 17% per year .If they did nothing Sales in 1983: 60% decrease on actual 1982 Sales Sales increase after 1983: 10% per year What should they do? Use NPV to decide with a 15% cost of capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started