Answered step by step

Verified Expert Solution

Question

1 Approved Answer

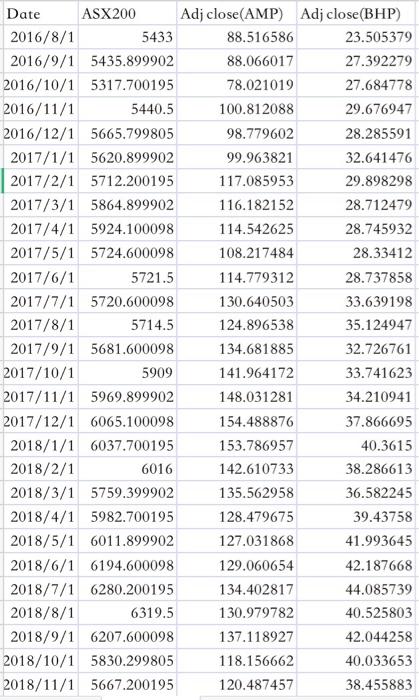

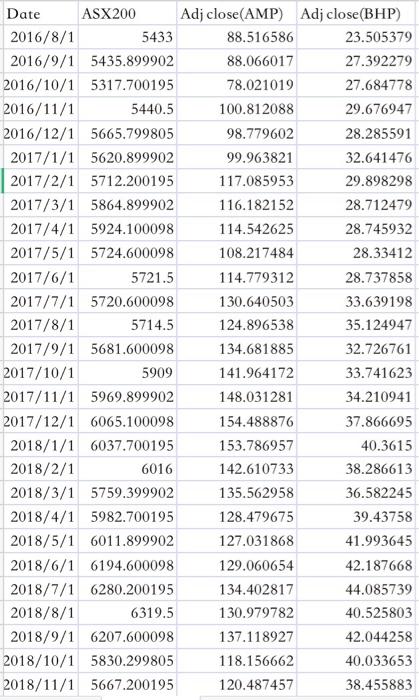

Use excel to complete the question Date ASX200 Adj close(AMP) Adj close(BHP) 2016/8/1 5433 88.516586 23.505379 2016/9/1 5435.899902 88.066017 27.392279 2016/10/1 5317.700195 78.021019 27.684778 2016/11/1

Use excel to complete the question

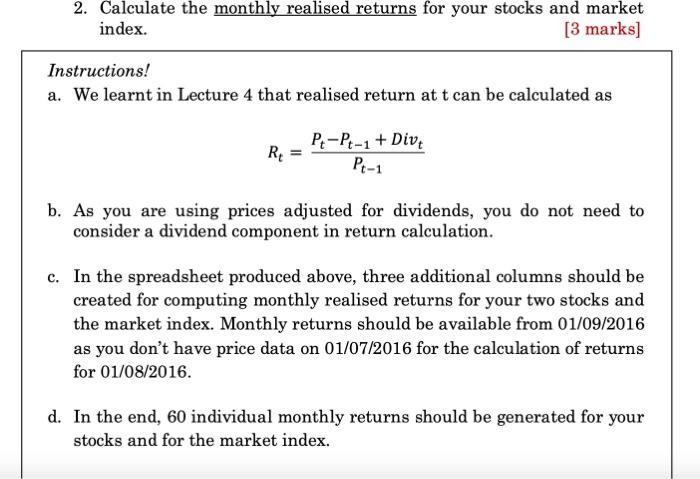

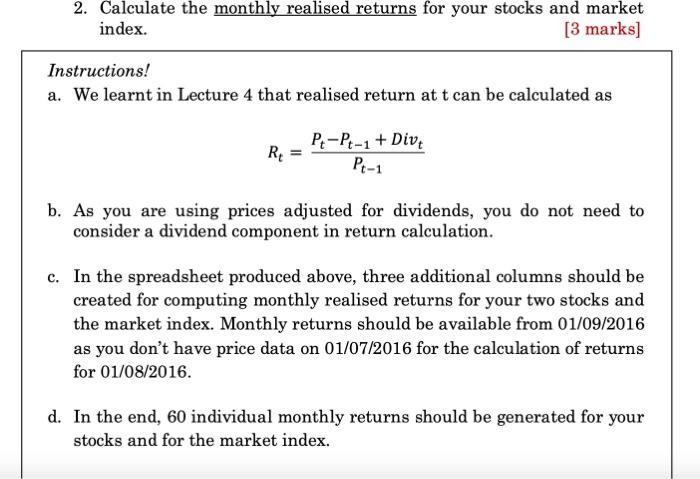

Date ASX200 Adj close(AMP) Adj close(BHP) 2016/8/1 5433 88.516586 23.505379 2016/9/1 5435.899902 88.066017 27.392279 2016/10/1 5317.700195 78.021019 27.684778 2016/11/1 5440.5 100.812088 29.676947 2016/12/1 5665.799805 98.779602 28.285591 2017/1/1 5620.899902 99.963821 32.641476 2017/2/1 5712.200195 117.085953 29.898298 2017/3/1 5864.899902 116.182152 28.712479 2017/4/1 5924.100098 114.542625 28.745932 2017/5/1 5724.600098 108.217484 28.33412 2017/6/1 5721.5 114.779312 28.737858 2017/7/1 5720.600098 130.640503 33.639198 2017/8/1 5714.5 124.896538 35.124947 2017/9/1 5681.600098 134.681885 32.726761 2017/10/1 5909 141.964172 33.741623 2017/11/1 5969.899902 148.031281 34.210941 2017/12/1 6065.100098 154.488876 37.866695 2018/1/1 6037.700195 153.786957 40.3615 2018/2/1 6016 142.610733 38.286613 2018/3/1 5759.399902 135.562958 36.582245 2018/4/1 5982.700195 128.479675 39.43758 2018/5/1 6011.899902 127.031868 41.993645 2018/6/1 6194.600098 129.060654 42.187668 2018/7/1 6280.200195 134.402817 44.085739 2018/8/1 6319.5 130.979782 40.525803 2018/9/1 6207.600098 137.118927 42.044258 2018/10/1 5830.299805 118.156662 40.033653 2018/11/1 5667.200195 120.487457 38.455883 2. Calculate the monthly realised returns for your stocks and market index. [3 marks) Instructions! a. We learnt in Lecture 4 that realised return at t can be calculated as R Pt-P-1 + Dive Pr-1 b. As you are using prices adjusted for dividends, you do not need to consider a dividend component in return calculation. c. In the spreadsheet produced above, three additional columns should be created for computing monthly realised returns for your two stocks and the market index. Monthly returns should be available from 01/09/2016 as you don't have price data on 01/07/2016 for the calculation of returns for 01/08/2016. d. In the end, 60 individual monthly returns should be generated for your stocks and for the market index. Date ASX200 Adj close(AMP) Adj close(BHP) 2016/8/1 5433 88.516586 23.505379 2016/9/1 5435.899902 88.066017 27.392279 2016/10/1 5317.700195 78.021019 27.684778 2016/11/1 5440.5 100.812088 29.676947 2016/12/1 5665.799805 98.779602 28.285591 2017/1/1 5620.899902 99.963821 32.641476 2017/2/1 5712.200195 117.085953 29.898298 2017/3/1 5864.899902 116.182152 28.712479 2017/4/1 5924.100098 114.542625 28.745932 2017/5/1 5724.600098 108.217484 28.33412 2017/6/1 5721.5 114.779312 28.737858 2017/7/1 5720.600098 130.640503 33.639198 2017/8/1 5714.5 124.896538 35.124947 2017/9/1 5681.600098 134.681885 32.726761 2017/10/1 5909 141.964172 33.741623 2017/11/1 5969.899902 148.031281 34.210941 2017/12/1 6065.100098 154.488876 37.866695 2018/1/1 6037.700195 153.786957 40.3615 2018/2/1 6016 142.610733 38.286613 2018/3/1 5759.399902 135.562958 36.582245 2018/4/1 5982.700195 128.479675 39.43758 2018/5/1 6011.899902 127.031868 41.993645 2018/6/1 6194.600098 129.060654 42.187668 2018/7/1 6280.200195 134.402817 44.085739 2018/8/1 6319.5 130.979782 40.525803 2018/9/1 6207.600098 137.118927 42.044258 2018/10/1 5830.299805 118.156662 40.033653 2018/11/1 5667.200195 120.487457 38.455883 2. Calculate the monthly realised returns for your stocks and market index. [3 marks) Instructions! a. We learnt in Lecture 4 that realised return at t can be calculated as R Pt-P-1 + Dive Pr-1 b. As you are using prices adjusted for dividends, you do not need to consider a dividend component in return calculation. c. In the spreadsheet produced above, three additional columns should be created for computing monthly realised returns for your two stocks and the market index. Monthly returns should be available from 01/09/2016 as you don't have price data on 01/07/2016 for the calculation of returns for 01/08/2016. d. In the end, 60 individual monthly returns should be generated for your stocks and for the market index

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started