Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*Use excel to do the calculations Zoe is trying to plan for her retirement in ten years. Currently she has $13,100 in a savings account

*Use excel to do the calculations

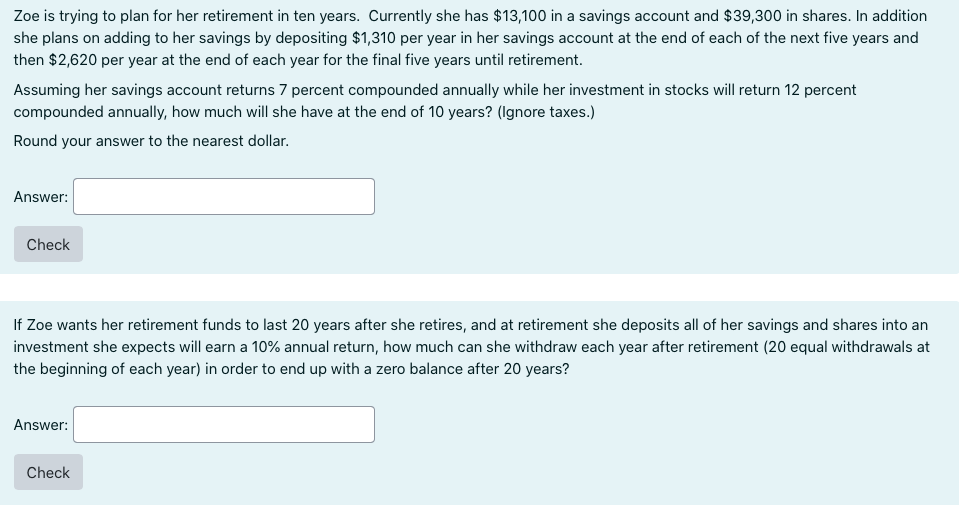

Zoe is trying to plan for her retirement in ten years. Currently she has $13,100 in a savings account and $39,300 in shares. In addition she plans on adding to her savings by depositing $1,310 per year in her savings account at the end of each of the next five years and then $2,620 per year at the end of each year for the final five years until retirement. Assuming her savings account returns 7 percent compounded annually while her investment in stocks will return 12 percent compounded annually, how much will she have at the end of 10 years? (Ignore taxes.) Round your answer to the nearest dollar. Answer: Check If Zoe wants her retirement funds to last 20 years after she retires, and at retirement she deposits all of her savings and shares into an investment she expects will earn a 10% annual return, how much can she withdraw each year after retirement (20 equal withdrawals at the beginning of each year) in order to end up with a zero balance after 20 years? Answer: CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started