Question

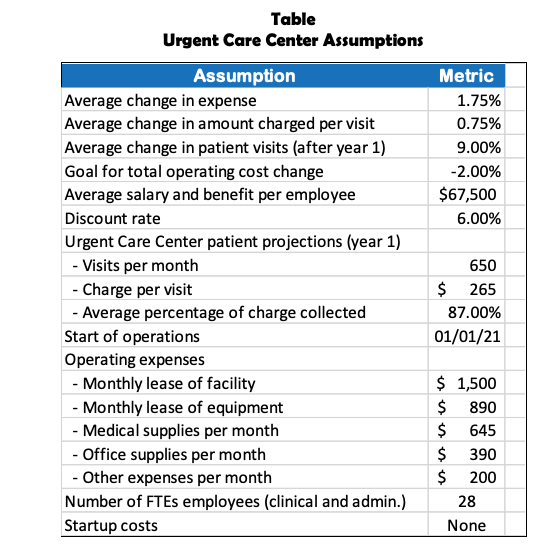

use excel to project a finanical analysis for 3 years, divided by quarter, using the following assumptions. Given the areas demographic trends discussed above, the

use excel to project a finanical analysis for 3 years, divided by quarter, using the following assumptions.

Given the areas demographic trends discussed above, the citys and countys financial conditions have been reasonably stable. The implementation of the Affordable Care Act has improved finances over the past several years, however there are early indications that area growth may be slowing. In addition, the state is considering changes to the Medicaid program that would, if adopted, negatively impact KHs future financial health. Should this happen, the payer mix which currently favors privately insured patients may become less profitable. The loss of employers and the growing unemployment rate have combined to slow the growth of tax revenues for the city and one of the counties the other county has remained relatively stable. Accordingly, the Regional Hospital Authority is now suggesting that KH begins to trim expenses while looking for new, more profitable services to offer.

The financial analysis component should cover the 3-year operating period 2021-2023 and include quarterly projections for operating revenue and expense for the new opportunity. The nature of any start-up capital costs should be identified but do not need to be quantified or included in the projections. For example, if it believed that a new ambulance would be necessary to support the proposed expansion that should be noted in the discussion; however, there will be no requirement to include any capital budget items in the analysis. For the analysis period, all capital items will be leased

Table Urgent Care Center Assumptions Metric 1.75% 0.75% 9.00% -2.00% $67,500 6.00% Assumption Average change in expense Average change in amount charged per visit Average change in patient visits (after year 1) Goal for total operating cost change Average salary and benefit per employee Discount rate Urgent Care Center patient projections (year 1) - Visits per month - Charge per visit - Average percentage of charge collected Start of operations Operating expenses - Monthly lease of facility - Monthly lease of equipment - Medical supplies per month - Office supplies per month - Other expenses per month Number of FTEs employees (clinical and admin.) Startup costs 650 $ 265 87.00% 01/01/21 $ 1,500 $ 890 $ 645 $ 390 $ 200 28 None Table Urgent Care Center Assumptions Metric 1.75% 0.75% 9.00% -2.00% $67,500 6.00% Assumption Average change in expense Average change in amount charged per visit Average change in patient visits (after year 1) Goal for total operating cost change Average salary and benefit per employee Discount rate Urgent Care Center patient projections (year 1) - Visits per month - Charge per visit - Average percentage of charge collected Start of operations Operating expenses - Monthly lease of facility - Monthly lease of equipment - Medical supplies per month - Office supplies per month - Other expenses per month Number of FTEs employees (clinical and admin.) Startup costs 650 $ 265 87.00% 01/01/21 $ 1,500 $ 890 $ 645 $ 390 $ 200 28 NoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started