Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use excel to solve 1) You owe $63,000 at 4.5%. You decided to pay off the loan over 10 years of monthly payments. (Make sure

Use excel to solve

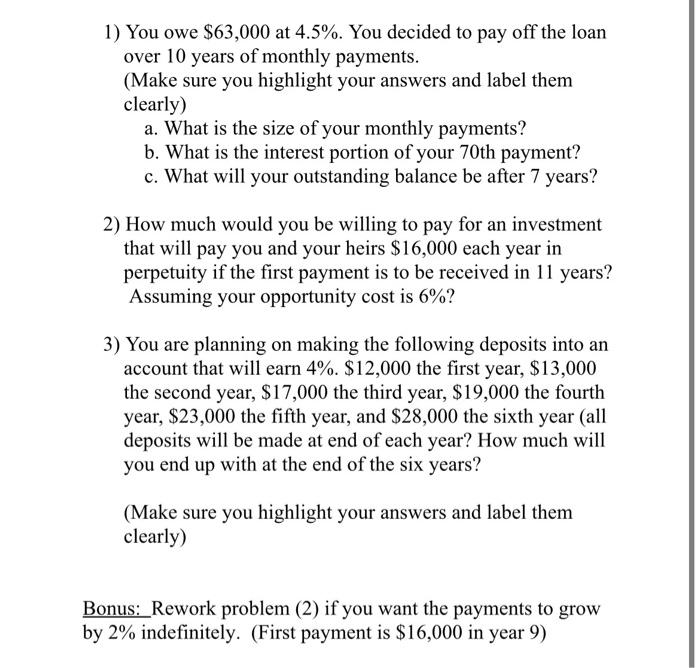

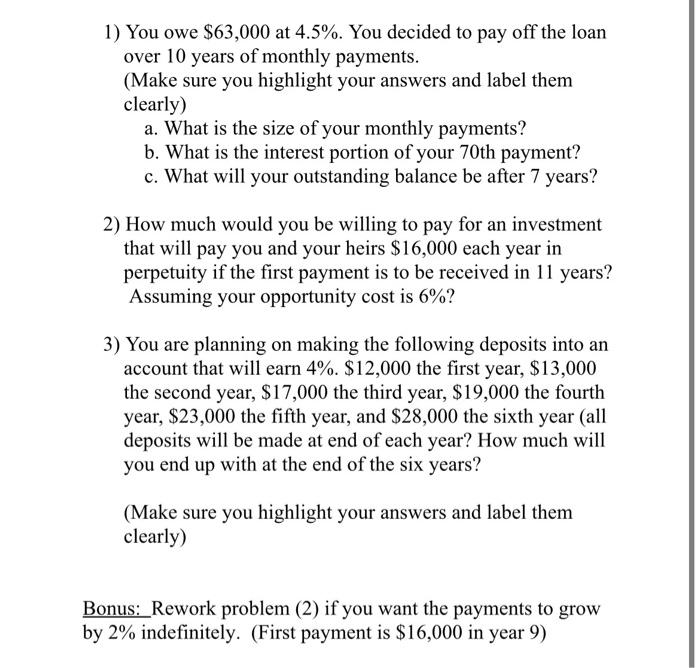

1) You owe $63,000 at 4.5%. You decided to pay off the loan over 10 years of monthly payments. (Make sure you highlight your answers and label them clearly) a. What is the size of your monthly payments? b. What is the interest portion of your 70th payment? c. What will your outstanding balance be after 7 years? 2) How much would you be willing to pay for an investment that will pay you and your heirs $16,000 each year in perpetuity if the first payment is to be received in 11 years? Assuming your opportunity cost is 6%? 3) You are planning on making the following deposits into an account that will earn 4%. $12,000 the first year, $13,000 the second year, $17,000 the third year, $19,000 the fourth year, $23,000 the fifth year, and $28,000 the sixth year (all deposits will be made at end of each year? How much will you end up with at the end of the six years? (Make sure you highlight your answers and label them clearly) Bonus: Rework problem (2) if you want the payments to grow by 2% indefinitely. (First payment is $16,000 in year 9)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started