Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE EXCEL TO SOLVE IT PLEASE 4. (25 points) Three years ago a semi-automated material handling system was purchased for the DC of a retailer

USE EXCEL TO SOLVE IT PLEASE

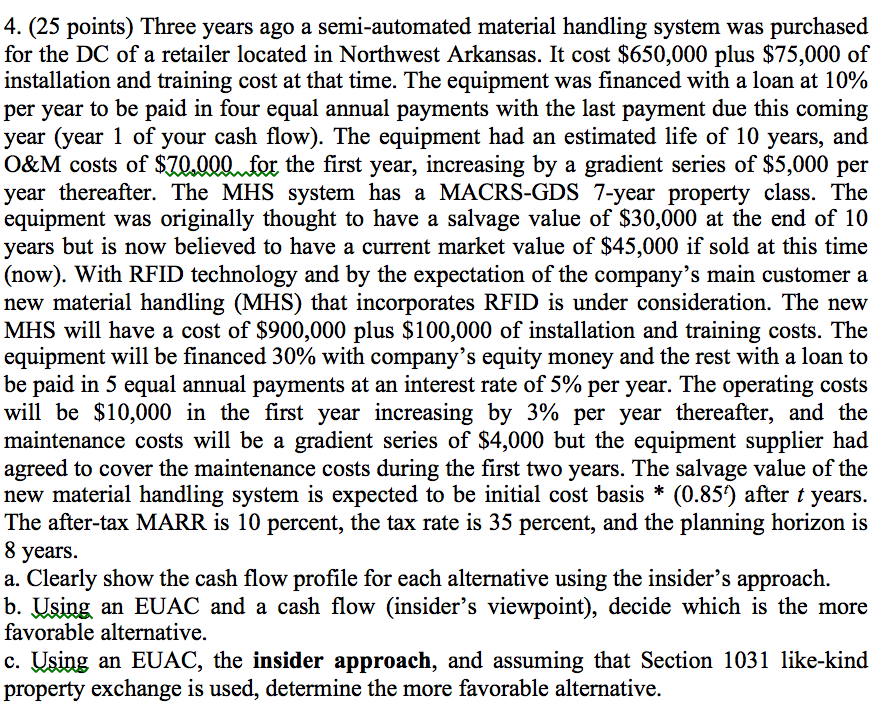

4. (25 points) Three years ago a semi-automated material handling system was purchased for the DC of a retailer located in Northwest Arkansas. It cost $650,000 plus $75,000 of installation and training cost at that time. The equipment was financed with a loan at 10% per year to be paid in four equal annual payments with the last payment due this coming year (year 1 of your cash flow). The equipment had an estimated life of 10 years, and O&M costs of 0.000 for the first year, increasing by a gradient series of $5,000 per year thereafter. The MHS system has a MACRS-GDS 7-year property class. The equipment was originally thought to have a salvage value of $30,000 at the end of 10 years but is now believed to have a current market value of $45,000 if sold at this time now). With RFID technology and by the expectation of the company's main customer a new material handling (MHS) that incorporates RFID is under consideration. The new MHS will have a cost of $900,000 plus $100,000 of installation and training costs. The equipment will be financed 30% with company's equity money and the rest with a loan to be paid in 5 equal annual payments at an interest rate of 5% per year. The operating costs will be $10,000 in the first year increasing by 3% per year thereafter, and the maintenance costs will be a gradient series of $4,000 but the equipment supplier had agreed to cover the maintenance costs during the first two years. The salvage value of the new material handling system is expected to be initial cost basis (0.85) after t years The after-tax MARR is 10 percent, the tax rate is 35 percent, and the planning horizon is 8 years a. Clearly show the cash flow profile for each alternative using the insider's approach b. Using an EUAC and a cash flow (insider's viewpoint), decide which is the more favorable alternative c. Using an EUAC, the insider approach, and assuming that Section 1031 like-kind property exchange is used, determine the more favorable alternativeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started