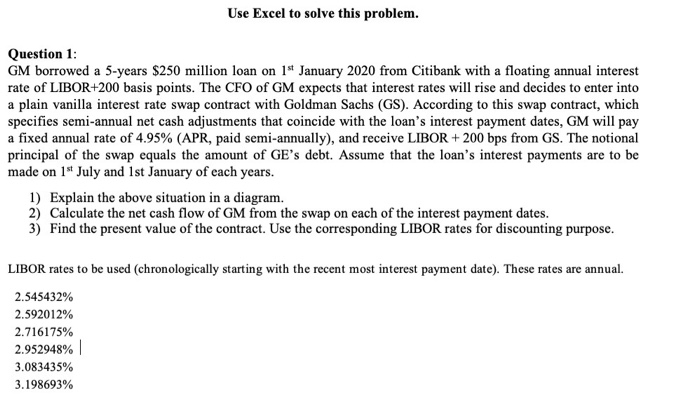

Use Excel to solve this problem. Question 1: GM borrowed a 5-years $250 million loan on 1st January 2020 from Citibank with a floating annual interest rate of LIBOR+200 basis points. The CFO of GM expects that interest rates will rise and decides to enter into a plain vanilla interest rate swap contract with Goldman Sachs (GS). According to this swap contract, which specifies semi-annual net cash adjustments that coincide with the loan's interest payment dates, GM will pay a fixed annual rate of 4.95% (APR, paid semi-annually), and receive LIBOR + 200 bps from GS. The notional principal of the swap equals the amount of GE's debt. Assume that the loan's interest payments are to be made on 1" July and 1st January of each years. 1) Explain the above situation in a diagram. 2) Calculate the net cash flow of GM from the swap on each of the interest payment dates. 3) Find the present value of the contract. Use the corresponding LIBOR rates for discounting purpose. LIBOR rates to be used (chronologically starting with the recent most interest payment date). These rates are annual 2.545432% 2.592012% 2.716175% 2.952948% 3.083435% 3.198693% Use Excel to solve this problem. Question 1: GM borrowed a 5-years $250 million loan on 1st January 2020 from Citibank with a floating annual interest rate of LIBOR+200 basis points. The CFO of GM expects that interest rates will rise and decides to enter into a plain vanilla interest rate swap contract with Goldman Sachs (GS). According to this swap contract, which specifies semi-annual net cash adjustments that coincide with the loan's interest payment dates, GM will pay a fixed annual rate of 4.95% (APR, paid semi-annually), and receive LIBOR + 200 bps from GS. The notional principal of the swap equals the amount of GE's debt. Assume that the loan's interest payments are to be made on 1" July and 1st January of each years. 1) Explain the above situation in a diagram. 2) Calculate the net cash flow of GM from the swap on each of the interest payment dates. 3) Find the present value of the contract. Use the corresponding LIBOR rates for discounting purpose. LIBOR rates to be used (chronologically starting with the recent most interest payment date). These rates are annual 2.545432% 2.592012% 2.716175% 2.952948% 3.083435% 3.198693%