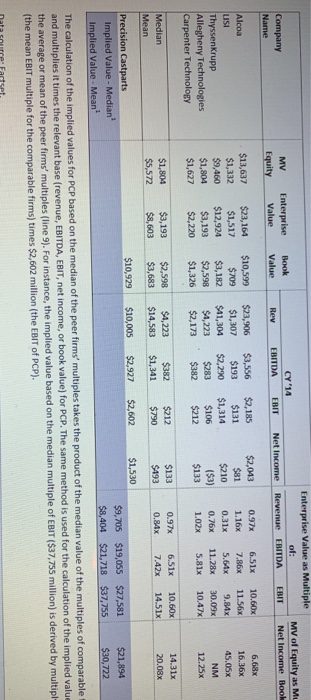

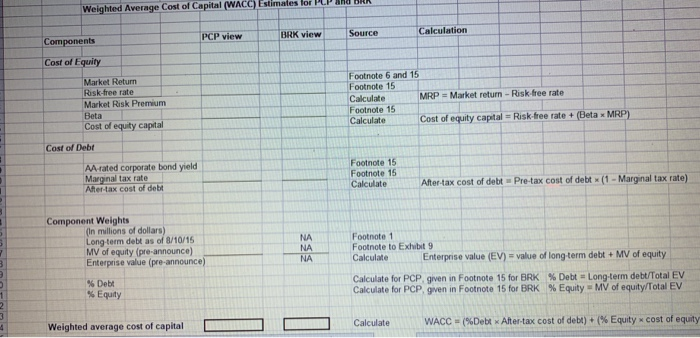

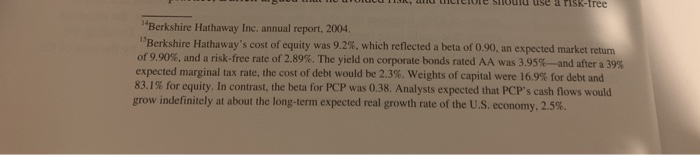

Use Exhibit 11 to calculate the weighted average cost of capital (WACC) for both BRK and PCP. Follow the prompts to locate the inputs in the case and perform the calculations. On the surface, which cost of capital is the appropriate hurdle rate to evaluate BRK's investment in PCP? Why? Enterprise Value as Multiple of: MV of Equity as M Net Income Book Company MV Enterprise Book CY 14 EquityValue Value Rev EBITDA ENT Net Inconne Revenue EBITDA EBIT $13,637 $23,164 $10,599 $23,906 $3,556 $2,185 $2,043 0.97x 6.51x 10.60 Alcoa $1,332 $1,517 $709 $1,307 $193 $131 $9,460 $12,924 $3,182 $41,304 $2,290 $1,314 $1,804 $3,193 $2,598 $4,223 $283 $106 $1,627 $2,220 $1,326 $2,173 $382 $212 16.36x ThyssenKrupp Allegheny Technologies Carpenter Technology $81 1.16x 7.86x 11.56x $210 0.31x 5.64x 9.8x ($3) 0.76x 11.28x 30.09x $133 1.02x 5.81x 10.47x NM $1,804 $3,193 $2,598 $4,223 $382 $212 $5,572 $8,603 $3,683 $14,583 $1,341 $790 133 0.97x 6.51x 10.60x $4930.8x 7.42x 1451x 20.08x Median 14.31x Precision Castparts $10,929 $10,005 $2,927 $2,602 $1,530 Implied Value-Median $9,705 $19,055 $27,581 $21,894 $8,404 $21,718 $37,755$30,722 Implied Value- Mean The calculation of the implied values for PCP based on the median of the peer firms' multiples takes the product of th and multiplies it times the relevant base (revenue, EBITDA, EBIT, net income, or book value) for e median value of the multiples of comparable t f multiples (line s). For instance, the implied value based on the median multiple of EBIT (537.755 million) is derived by mutipl the mean EBIT multiple for the comparable firms) times $2,602 million (the EBIT of PCP) Weighted Average Cost of Capital (WACC) Estimates for PP AG BAA PCP view BRK viewSource Calculation Components Cost of Equity Footnote 6 and 15 Market Return Risk-free rate Market Risk Premium Beta Cost of equity captal Footnote 15 CalculateMRP - Market return-Risk free rate Footnote 15 Calculate -- Cost of equity capital = Risk-free rate + (Beta x MRP) Cost of Debt AA rated corporate bond yield Marginal tax rate After-tax cost of deb Footnote 15 Footnote 1 CalculateAfter-tax cost of debt Pre-tax cost of debtx(1-Marginal tax rate) Component Weights millions of dollars) Long-term debt as of 8/10/1 MV of equity (pre-announce) Enterprise value (pre-announce) Footnote Footnote to Exhubit 9 NA NA NACalculateEnterprise value (EV)value of long-term debt+ MV of equity % Debt % Equity Calculate for PCP, given in Footnote 15 for BRK Calculate for PCP, given in Footnote 15 for BRK % Debt-Long-term debt/Total EV % Equity . MV of equity/Total EV Weighted average cost of capital Calculate WACC-(%Debt After-tax cost of debt) + (% Equity cost of equity h theleoe Slouid use a nSk-free "Berkshire Hathaway Inc. annual report, 2004. "Berkshire Hathaway's cost of equity was 92%, which reflected a beta of 0.90, an expected market return of 9.90%, and a risk-free rate of 2.89%. The yield on corporate bonds rated AA was 3.95%--and after a 39% expected marginal tax rate, the cost of debt would be 2.3%. weights of capital were 16.9% for debt and 83.1% for equity. In contrast, the beta for PCP was 0.38. Analysts expected that PCP's cash flows would grow indefinitely at about the long-term expected real growth rate of the US, economy, 2.5%. Use Exhibit 11 to calculate the weighted average cost of capital (WACC) for both BRK and PCP. Follow the prompts to locate the inputs in the case and perform the calculations. On the surface, which cost of capital is the appropriate hurdle rate to evaluate BRK's investment in PCP? Why? Enterprise Value as Multiple of: MV of Equity as M Net Income Book Company MV Enterprise Book CY 14 EquityValue Value Rev EBITDA ENT Net Inconne Revenue EBITDA EBIT $13,637 $23,164 $10,599 $23,906 $3,556 $2,185 $2,043 0.97x 6.51x 10.60 Alcoa $1,332 $1,517 $709 $1,307 $193 $131 $9,460 $12,924 $3,182 $41,304 $2,290 $1,314 $1,804 $3,193 $2,598 $4,223 $283 $106 $1,627 $2,220 $1,326 $2,173 $382 $212 16.36x ThyssenKrupp Allegheny Technologies Carpenter Technology $81 1.16x 7.86x 11.56x $210 0.31x 5.64x 9.8x ($3) 0.76x 11.28x 30.09x $133 1.02x 5.81x 10.47x NM $1,804 $3,193 $2,598 $4,223 $382 $212 $5,572 $8,603 $3,683 $14,583 $1,341 $790 133 0.97x 6.51x 10.60x $4930.8x 7.42x 1451x 20.08x Median 14.31x Precision Castparts $10,929 $10,005 $2,927 $2,602 $1,530 Implied Value-Median $9,705 $19,055 $27,581 $21,894 $8,404 $21,718 $37,755$30,722 Implied Value- Mean The calculation of the implied values for PCP based on the median of the peer firms' multiples takes the product of th and multiplies it times the relevant base (revenue, EBITDA, EBIT, net income, or book value) for e median value of the multiples of comparable t f multiples (line s). For instance, the implied value based on the median multiple of EBIT (537.755 million) is derived by mutipl the mean EBIT multiple for the comparable firms) times $2,602 million (the EBIT of PCP) Weighted Average Cost of Capital (WACC) Estimates for PP AG BAA PCP view BRK viewSource Calculation Components Cost of Equity Footnote 6 and 15 Market Return Risk-free rate Market Risk Premium Beta Cost of equity captal Footnote 15 CalculateMRP - Market return-Risk free rate Footnote 15 Calculate -- Cost of equity capital = Risk-free rate + (Beta x MRP) Cost of Debt AA rated corporate bond yield Marginal tax rate After-tax cost of deb Footnote 15 Footnote 1 CalculateAfter-tax cost of debt Pre-tax cost of debtx(1-Marginal tax rate) Component Weights millions of dollars) Long-term debt as of 8/10/1 MV of equity (pre-announce) Enterprise value (pre-announce) Footnote Footnote to Exhubit 9 NA NA NACalculateEnterprise value (EV)value of long-term debt+ MV of equity % Debt % Equity Calculate for PCP, given in Footnote 15 for BRK Calculate for PCP, given in Footnote 15 for BRK % Debt-Long-term debt/Total EV % Equity . MV of equity/Total EV Weighted average cost of capital Calculate WACC-(%Debt After-tax cost of debt) + (% Equity cost of equity h theleoe Slouid use a nSk-free "Berkshire Hathaway Inc. annual report, 2004. "Berkshire Hathaway's cost of equity was 92%, which reflected a beta of 0.90, an expected market return of 9.90%, and a risk-free rate of 2.89%. The yield on corporate bonds rated AA was 3.95%--and after a 39% expected marginal tax rate, the cost of debt would be 2.3%. weights of capital were 16.9% for debt and 83.1% for equity. In contrast, the beta for PCP was 0.38. Analysts expected that PCP's cash flows would grow indefinitely at about the long-term expected real growth rate of the US, economy, 2.5%