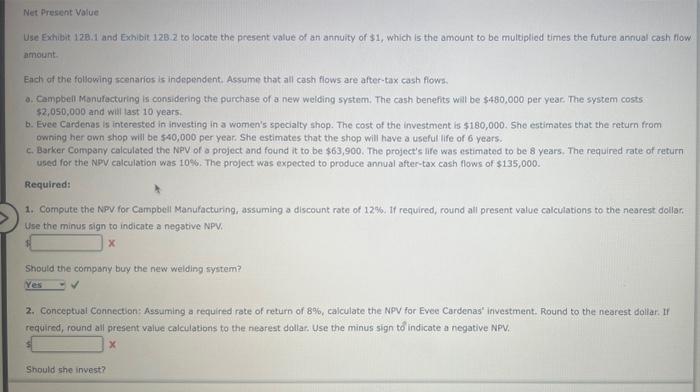

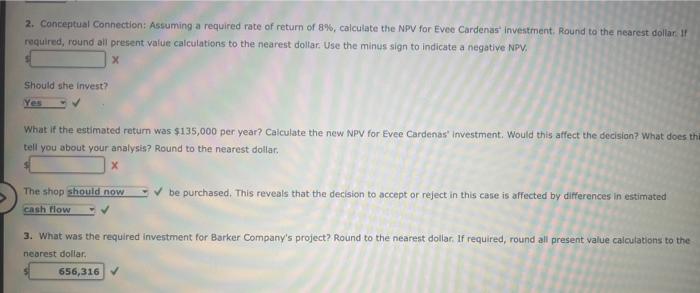

Use Exhibit 128.1 and Exhibit 128.2 to locote the present value of an annuity of 31 , which is the amount to be multiplied times the future aninal cash fiow amount. Each of the foljoving scenarios is independent. Assume that all cash flows are after-tax cash flows: o. Camploel Manufacturing is considering the parchase of a new weiding 5 ystem. The cash benefits will be $480,000 per year. The system costs 52,050,000 and wil last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $180,000. She estimates that the raturn from owning her own shop will be $40,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years, The required rate of return used for the NPv calculation was 10\%, The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPv. for Campbeil Manufacturing, assuming a discount rate of 12%. If required, round all present value calculabions to the nearest doliar. Use the minus sign to indicate a negstive NPV. Should the company bury the new welding system? 2. Conceptuat Coninection: Assuming a required rate of return of 8%, calculate the NPV for Evee Cardenas' investment. Round to the nearest dollar. If required, found all gresent value caleulations to the nearest dollar. Use the minus sign to indicate a negative NpV. Should she invest? 2. Conceptual Connection: Assuming a required rate of return of 8%, caiculate the NPV for Evee Cardenas investinent. Round to the nearest dollan. If required, round ail present value calculations to the nearest dollar, Use the minus sign to indicate a negative NpV. Should she invest? What if the estimated retum was $135,000 per year? Calculate the new NpV for Evee Cardenas' investment. Would this affect the decision? What does th tell you about your analysis? Round to the nearest dollar. The shop be purchased. This reveals that the decision to accept or reject in this case is affected by differences in estimated 3. What was the required investment for Barker Company's project? Round to the nearest dollar. If required, round all present value calculations to the nearest doliar