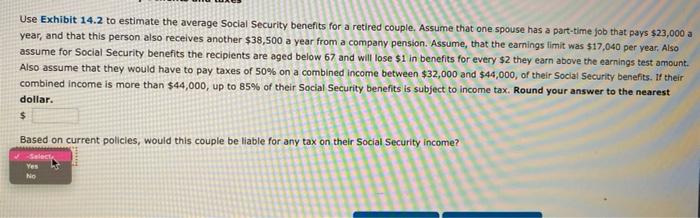

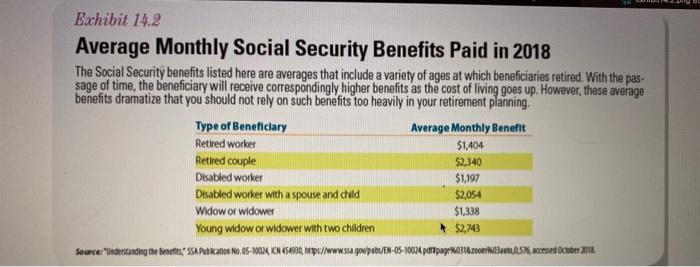

Use Exhibit 14.2 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $23,000 a year, and that this person also receives another $38,500 a year from a company pension. Assume that the earnings limit was $17,040 per year. Also assume for Social Security benefits the recipients are aged below 67 and will lose $1 in benefits for every $2 they earn above the earnings test amount. Also assume that they would have to pay taxes of 50% on a combined income between $32,000 and $44,000, of their Social Security benefits. If their combined Income is more than $44,000, up to 85% of their Social Security benefits is subject to income tax. Round your answer to the nearest dollar. $ Based on current policies, would this couple be liable for any tax on their Social Security income? Yes No Exhibit 14.2 Average Monthly Social Security Benefits Paid in 2018 The Social Security benefits listed here are averages that include a variety of ages at which beneficiaries retired. With the pas- sage of time, the beneficiary will receive correspondingly higher benefits as the cost of living goes up. However, these average benefits dramatize that you should not rely on such benefits too heavily in your retirement planning. Type of Beneficiary Average Monthly Benefit Retired worker $1,404 Retired couple 52,340 Disabled worker $1,197 Disabled worker with a spouse and child $2,054 Widow or widower $1,338 Young widow or widower with two children $2,743 Sourcer "Understanding the benets' SSAP No.05-100 KN 451920, heps//www.ssa jopub/EN-05-100 portpago.2008031,0,576 meter 2018 Use Exhibit 14.2 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $23,000 a year, and that this person also receives another $38,500 a year from a company pension. Assume that the earnings limit was $17,040 per year. Also assume for Social Security benefits the recipients are aged below 67 and will lose $1 in benefits for every $2 they earn above the earnings test amount. Also assume that they would have to pay taxes of 50% on a combined income between $32,000 and $44,000, of their Social Security benefits. If their combined Income is more than $44,000, up to 85% of their Social Security benefits is subject to income tax. Round your answer to the nearest dollar. $ Based on current policies, would this couple be liable for any tax on their Social Security income? Yes No Exhibit 14.2 Average Monthly Social Security Benefits Paid in 2018 The Social Security benefits listed here are averages that include a variety of ages at which beneficiaries retired. With the pas- sage of time, the beneficiary will receive correspondingly higher benefits as the cost of living goes up. However, these average benefits dramatize that you should not rely on such benefits too heavily in your retirement planning. Type of Beneficiary Average Monthly Benefit Retired worker $1,404 Retired couple 52,340 Disabled worker $1,197 Disabled worker with a spouse and child $2,054 Widow or widower $1,338 Young widow or widower with two children $2,743 Sourcer "Understanding the benets' SSAP No.05-100 KN 451920, heps//www.ssa jopub/EN-05-100 portpago.2008031,0,576 meter 2018