Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use FIFO evaluation ABC Hardware Store had the following transactions during the year starting January 1, 2022. At the beginning of 2022, the ledger of

use FIFO evaluation

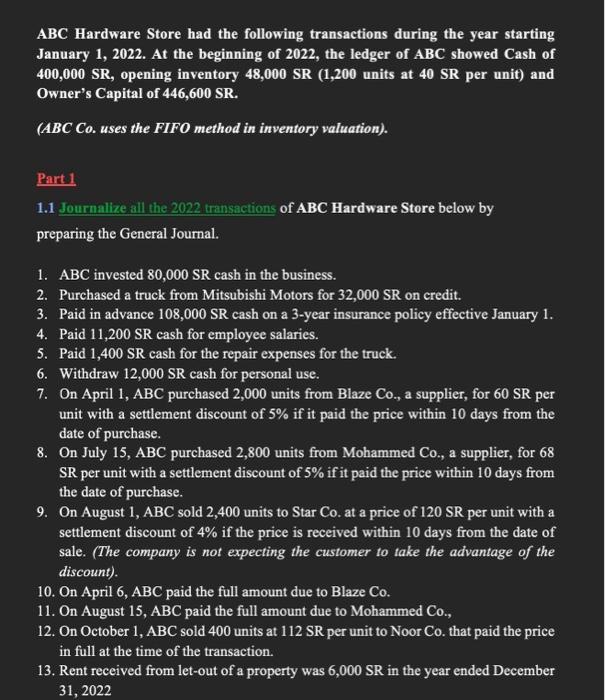

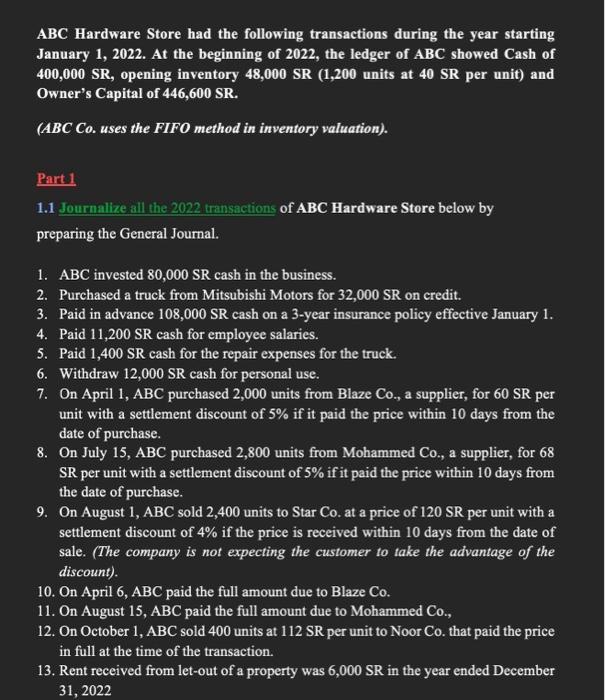

ABC Hardware Store had the following transactions during the year starting January 1, 2022. At the beginning of 2022, the ledger of ABC showed Cash of 400,000 SR, opening inventory 48,000 SR (1,200 units at 40 SR per unit) and Owner's Capital of 446,600 SR. (ABC Co. uses the FIFO method in inventory valuation). Part 1 1.1 Journalize all the 2022 transactions of ABC Hardware Store below by preparing the General Journal. 1. ABC invested 80,000SR cash in the business. 2. Purchased a truck from Mitsubishi Motors for 32,000SR on credit. 3. Paid in advance 108,000 SR cash on a 3 -year insurance policy effective January 1 . 4. Paid 11,200 SR cash for employee salaries. 5. Paid 1,400 SR cash for the repair expenses for the truck. 6. Withdraw 12,000SR cash for personal use. 7. On April 1, ABC purchased 2,000 units from Blaze Co., a supplier, for 60SR per unit with a settlement discount of 5% if it paid the price within 10 days from the date of purchase. 8. On July 15,ABC purchased 2,800 units from Mohammed Co., a supplier, for 68 SR per unit with a settlement discount of 5% if it paid the price within 10 days from the date of purchase. 9. On August 1, ABC sold 2,400 units to Star Co. at a price of 120SR per unit with a settlement discount of 4% if the price is received within 10 days from the date of sale. (The company is not expecting the customer to take the advantage of the discount). 10. On April 6, ABC paid the full amount due to Blaze Co. 11. On August 15, ABC paid the full amount due to Mohammed Co., 12. On October 1, ABC sold 400 units at 112SR per unit to Noor Co. that paid the price in full at the time of the transaction. 13. Rent received from let-out of a property was 6,000SR in the year ended December 31,2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started