Answered step by step

Verified Expert Solution

Question

1 Approved Answer

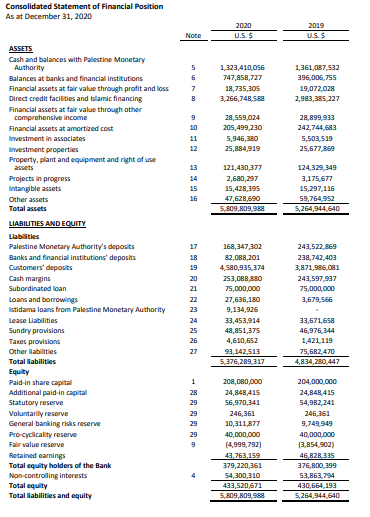

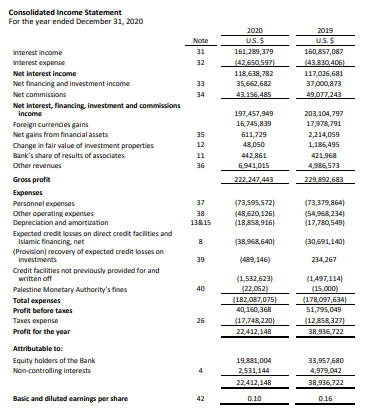

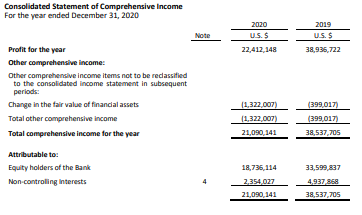

Use financial statements for this bank for one past year and apply the Uniform Bank Performance Report (UBPR) to measure the performance ? Consolidated Statement

Use financial statements for this bank for one past year and apply the Uniform Bank Performance Report (UBPR) to measure the performance ?

Consolidated Statement of Financial Position As at December 31, 2020 2020 2019 Note U.S. $ US $ ASSETS Cash and balances with Palestine Monetary Authority Balances at banks and financial institutions 5 1,323,410,056 747,858,727 1,361,087,532 396,006,755 6 7 18,735,305 3,266,748, 588 19,072,028 2,983,385,227 Financial assets at fair value through profit and loss Direct credit facilities and Islamic financing Financial assets at fair value through other comprehensive income 9 28,559,024 205,499,230 28,899,933 242,744,683 Financial assets at amortized cost 10 Investment in associates 11 5,946,380 25,884,919 5,503,519 25,677,859 12 Investment properties Property, plant and equipment and right of use 13 124,329,349 121,430,377 2,680,297 14 Projects in progress Intangible assets 15 3,175,677 15,297,116 59,754.952 5,264,944 640 Other assets 15,428,395 47,628,690 5.809,809,988 16 Total assets 17 168,347,302 18 82,088,201 4,580,935,374 243,522,869 238,742.403 3,871,986.081 19 LIABILITIES AND EQUITY Liabilities Palestine Monetary Authority's deposits Banks and financial institutions' deposits Customers' deposits Cash margins Subordinated loan Loans and borrowings Istidama loans from Palestine Monetary Authority Lease Liabilities Sundry provisions 20 253,088,880 75,000,000 21 243,597,937 75,000,000 3,679,566 22 27,636,180 9,134,926 23 24 25 33,671,658 46,976,344 1,421, 119 75,682,470 26 33,453,914 48,851,375 4,610,652 93,142,513 5,376,289 317 Taxes provisions Other abilities 27 Total liabilities 4,834,280,447 1 208,000,000 28 24,848,415 56,970,141 29 Equity Paid-in share capital Additional paid.in capital Statutory reserve Voluntarily reserve General banking risks reserve Pro-cyclicality reserve Fair value reserve 29 246,361 10,311,877 204,000,000 24,848.415 54,982 241 246,361 9,749.049 40,000,000 13,854,902) 29 29 9 Retained earnings Total equity holders of the Bank Non-controlling interests Total equity Total abilities and equity 40,000,000 (4,999,792) 43,76.159 379,220,361 54,300,310 433,520,671 5.809,809.988 4 46,828,335 376,800,399 53,863,794 430,664,193 5,264,944,640 Consolidated Income Statement For the year ended December 31, 2020 Note Interest income 31 2020 US $ 161 289,379 (42,650,597) 118,638,782 35,662,682 2019 US $ 160,857,087 (43330,406 117,026,681 37.000,873 Interest expense Net interest income Net financing and investment income 33 Net commissions 43.156,485 49,077,243 Net interest, financing investment and commissions income 203,104,797 197,457,949 16,745,839 17,978,791 35 Foreign currencies gains Niet gains from financial assets Change in fair value of investment properties Bank's share of results of associates 611,729 48,050 2,214,059 1,185,495 12 11 442.861 6.941,015 421.968 4,985,573 Other revenues 36 Gross profit 222.247,443 229,892,683 Expenses 37 Personnel expenses Other operating expenses Depreciation and amortization 38 13815 (73,595,572) (48,620,1261 (18,358,916) (73,379,864) (54,968,234) (17,780,549) Expected credit losses on direct credit facilities and Islamic financing.net (Provision) recovery of expected credit losses on (38,958,540) (30,691,140) investments 39 (489,146) 234 267 Credit facilities not previously provided for and written off Palestine Monetary Authority's fines Total expenses Profit before taxes 40 (1,497,114) (15,000) (1,532,623) (22.052) (182,087,075) 40,160,368 (17,748,220) 22,412,148 (178,097,634) 51,795,049 26 (12,858,327) Taves expense Profit for the year 38,936,722 Attributable to Equity holders of the Bank Non-controlling interests 19.881,004 2,531,144 22,412,148 33,957,680 4,979,042 38,935,722 Basic and diluted earnings per share 42 0.10 0.16 Consolidated Statement of Comprehensive Income For the year ended December 31, 2020 2020 U.S.S 2019 US $ Note Profit for the year 22,412,148 38,936,722 Other comprehensive income: Other comprehensive income items not to be reclassified to the consolidated income statement in subsequent periods: Change in the fair value of financial assets (1,322,007) (399,017) Total other comprehensive income (1,322,007) (399,017) Total comprehensive income for the year 21,090,141 38,537,705 Attributable to: Equity holders of the Bank 18,736,114 33,599,837 Non controlling interests 2,354,027 4,937,858 21,090,141 38,537,705 Consolidated Statement of Financial Position As at December 31, 2020 2020 2019 Note U.S. $ US $ ASSETS Cash and balances with Palestine Monetary Authority Balances at banks and financial institutions 5 1,323,410,056 747,858,727 1,361,087,532 396,006,755 6 7 18,735,305 3,266,748, 588 19,072,028 2,983,385,227 Financial assets at fair value through profit and loss Direct credit facilities and Islamic financing Financial assets at fair value through other comprehensive income 9 28,559,024 205,499,230 28,899,933 242,744,683 Financial assets at amortized cost 10 Investment in associates 11 5,946,380 25,884,919 5,503,519 25,677,859 12 Investment properties Property, plant and equipment and right of use 13 124,329,349 121,430,377 2,680,297 14 Projects in progress Intangible assets 15 3,175,677 15,297,116 59,754.952 5,264,944 640 Other assets 15,428,395 47,628,690 5.809,809,988 16 Total assets 17 168,347,302 18 82,088,201 4,580,935,374 243,522,869 238,742.403 3,871,986.081 19 LIABILITIES AND EQUITY Liabilities Palestine Monetary Authority's deposits Banks and financial institutions' deposits Customers' deposits Cash margins Subordinated loan Loans and borrowings Istidama loans from Palestine Monetary Authority Lease Liabilities Sundry provisions 20 253,088,880 75,000,000 21 243,597,937 75,000,000 3,679,566 22 27,636,180 9,134,926 23 24 25 33,671,658 46,976,344 1,421, 119 75,682,470 26 33,453,914 48,851,375 4,610,652 93,142,513 5,376,289 317 Taxes provisions Other abilities 27 Total liabilities 4,834,280,447 1 208,000,000 28 24,848,415 56,970,141 29 Equity Paid-in share capital Additional paid.in capital Statutory reserve Voluntarily reserve General banking risks reserve Pro-cyclicality reserve Fair value reserve 29 246,361 10,311,877 204,000,000 24,848.415 54,982 241 246,361 9,749.049 40,000,000 13,854,902) 29 29 9 Retained earnings Total equity holders of the Bank Non-controlling interests Total equity Total abilities and equity 40,000,000 (4,999,792) 43,76.159 379,220,361 54,300,310 433,520,671 5.809,809.988 4 46,828,335 376,800,399 53,863,794 430,664,193 5,264,944,640 Consolidated Income Statement For the year ended December 31, 2020 Note Interest income 31 2020 US $ 161 289,379 (42,650,597) 118,638,782 35,662,682 2019 US $ 160,857,087 (43330,406 117,026,681 37.000,873 Interest expense Net interest income Net financing and investment income 33 Net commissions 43.156,485 49,077,243 Net interest, financing investment and commissions income 203,104,797 197,457,949 16,745,839 17,978,791 35 Foreign currencies gains Niet gains from financial assets Change in fair value of investment properties Bank's share of results of associates 611,729 48,050 2,214,059 1,185,495 12 11 442.861 6.941,015 421.968 4,985,573 Other revenues 36 Gross profit 222.247,443 229,892,683 Expenses 37 Personnel expenses Other operating expenses Depreciation and amortization 38 13815 (73,595,572) (48,620,1261 (18,358,916) (73,379,864) (54,968,234) (17,780,549) Expected credit losses on direct credit facilities and Islamic financing.net (Provision) recovery of expected credit losses on (38,958,540) (30,691,140) investments 39 (489,146) 234 267 Credit facilities not previously provided for and written off Palestine Monetary Authority's fines Total expenses Profit before taxes 40 (1,497,114) (15,000) (1,532,623) (22.052) (182,087,075) 40,160,368 (17,748,220) 22,412,148 (178,097,634) 51,795,049 26 (12,858,327) Taves expense Profit for the year 38,936,722 Attributable to Equity holders of the Bank Non-controlling interests 19.881,004 2,531,144 22,412,148 33,957,680 4,979,042 38,935,722 Basic and diluted earnings per share 42 0.10 0.16 Consolidated Statement of Comprehensive Income For the year ended December 31, 2020 2020 U.S.S 2019 US $ Note Profit for the year 22,412,148 38,936,722 Other comprehensive income: Other comprehensive income items not to be reclassified to the consolidated income statement in subsequent periods: Change in the fair value of financial assets (1,322,007) (399,017) Total other comprehensive income (1,322,007) (399,017) Total comprehensive income for the year 21,090,141 38,537,705 Attributable to: Equity holders of the Bank 18,736,114 33,599,837 Non controlling interests 2,354,027 4,937,858 21,090,141 38,537,705Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started