Question

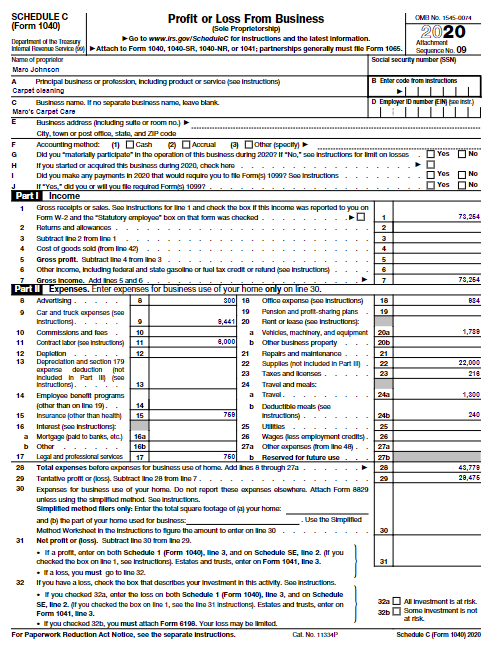

Use Form 8879 for this section and then transfer the total Expenses for Business Use of the Home to Line 30 on the Schedule C:

Use Form 8879 for this section and then transfer the total Expenses for Business Use of the Home to Line 30 on the Schedule C:

He has a home office where he conducts all of the administrative functions of his business (invoicing customers, making appointments, etc.). His house is 1,800 square feet (line 2) and his office takes up 180 square feet of his home (line 1). Expenses relating to his entire home (these go in the indirect expenses diction of Part II) were: mortgage interest $9,760 (line 10b), property taxes $2,237 (line 11b), utilities $1,598 (line 20b), and homeowners insurance $525 (line 17). Allowable depreciation for the home office is $2,000 (line 41 and line 29). Once you calculate the total home office deduction (line 36), add that amount to Line 30 on the Schedule C.

Then you can determine Net Profit or Loss (Sch C Line 31) by taking Tentative Profit or Loss (line 29) minus Expenses for Business Use of Your Home (line 30). After you complete the Schedule C, you also need to calculate how much Self-Employment Tax Marc owes. You put net income from the Schedule C (line 30) on Line 2 of the Schedule SE. Use that number to go through the calculation to determine self-employment tax and also the deduction for of the SE tax that goes into Adjustments for Adjusted Gross Income if you were doing the entire return. Here are the steps line by line:

Line 2 & 3: Net income from line 31 on the Schedule C Line 4A: Multiply line 3 x 92.35%, then copy that number into lines 4C and 6 Line 10: Multiply line 6 x 12.4% Line 11: Multiply line 6 x 2.9% Line 12: Add lines 10 & 11

Line 13: Half of line 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started