Answered step by step

Verified Expert Solution

Question

1 Approved Answer

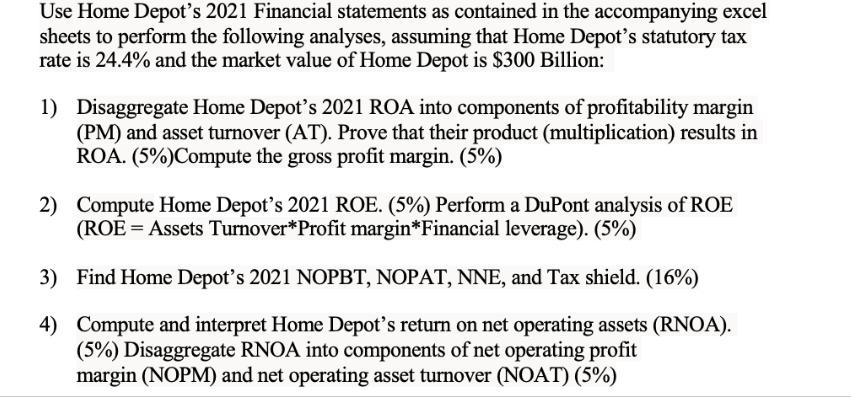

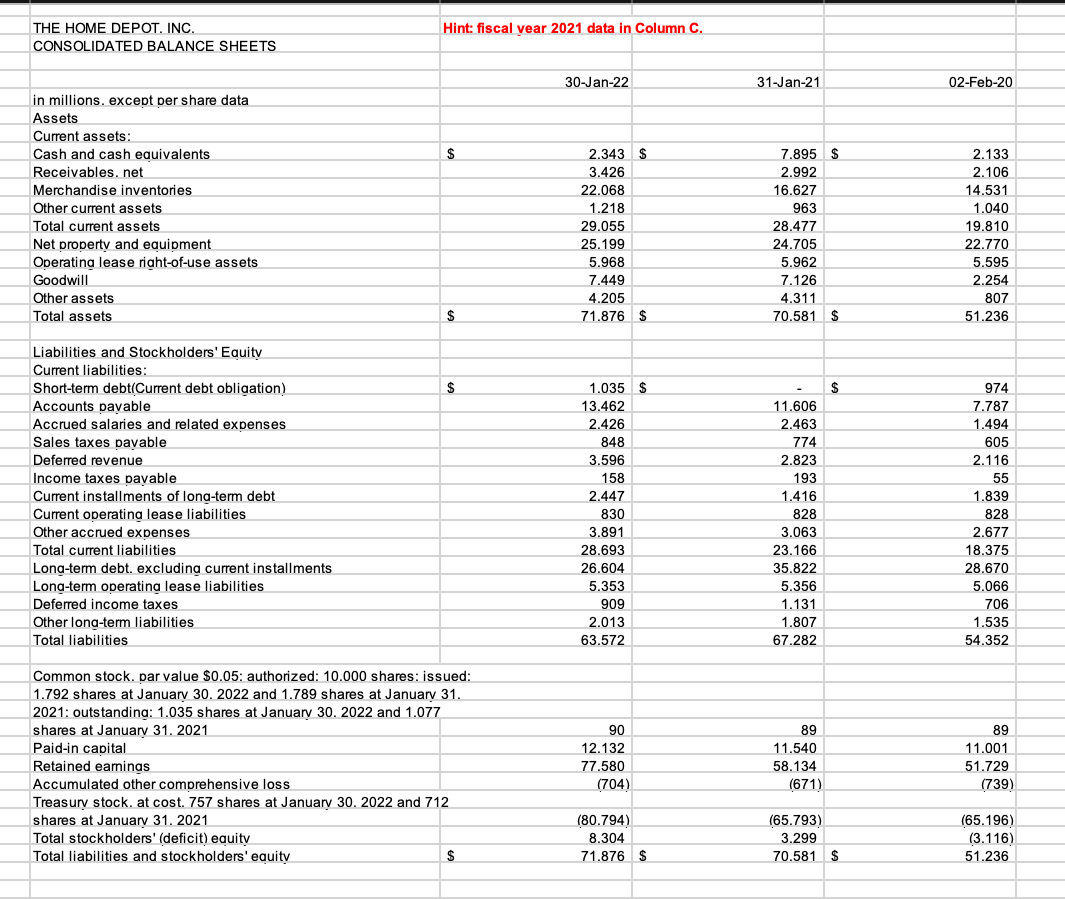

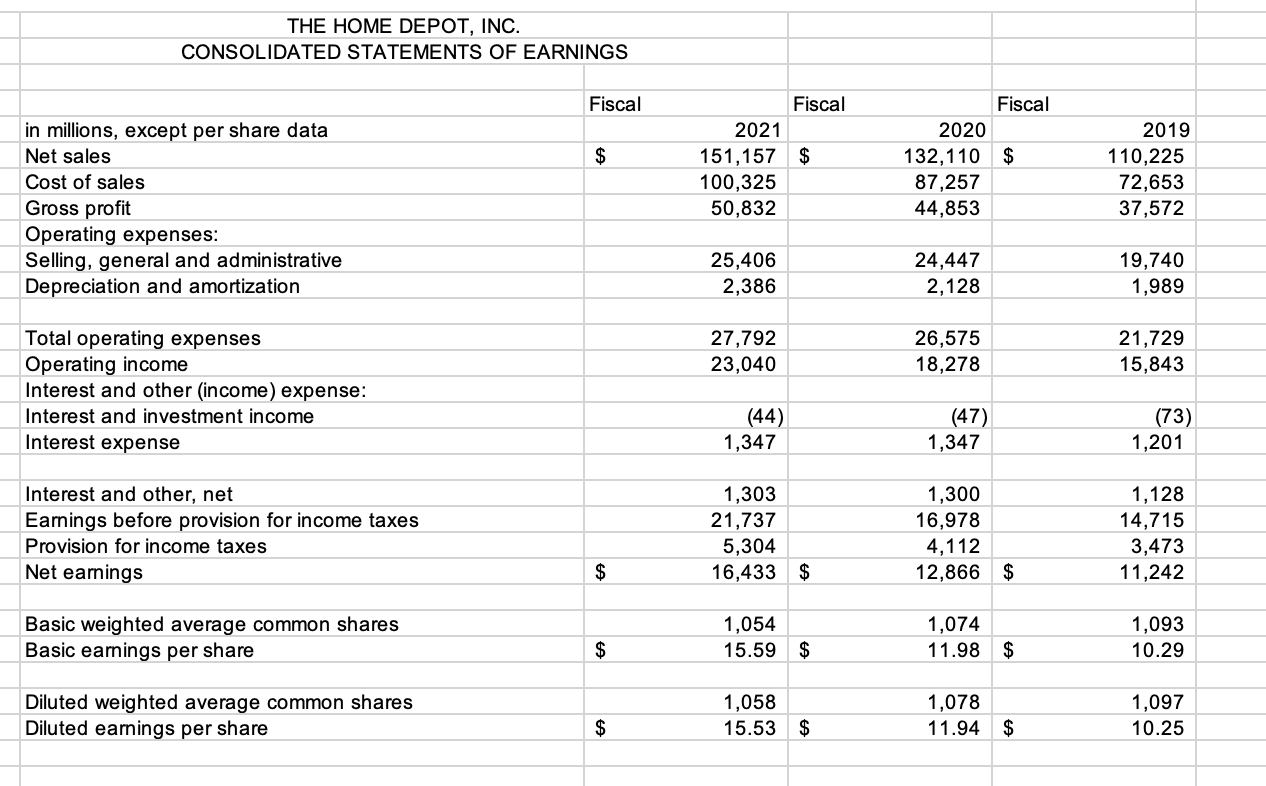

Use Home Depot's 2021 Financial statements as contained in the accompanying excel sheets to perform the following analyses, assuming that Home Depot's statutory tax

Use Home Depot's 2021 Financial statements as contained in the accompanying excel sheets to perform the following analyses, assuming that Home Depot's statutory tax rate is 24.4% and the market value of Home Depot is $300 Billion: 1) Disaggregate Home Depot's 2021 ROA into components of profitability margin (PM) and asset turnover (AT). Prove that their product (multiplication) results in ROA. (5%) Compute the gross profit margin. (5%) 2) Compute Home Depot's 2021 ROE. (5%) Perform a DuPont analysis of ROE (ROE Assets Turnover*Profit margin*Financial leverage). (5%) 3) Find Home Depot's 2021 NOPBT, NOPAT, NNE, and Tax shield. (16%) 4) Compute and interpret Home Depot's return on net operating assets (RNOA). (5%) Disaggregate RNOA into components of net operating profit margin (NOPM) and net operating asset turnover (NOAT) (5%) THE HOME DEPOT. INC. CONSOLIDATED BALANCE SHEETS Hint: fiscal year 2021 data in Column C. 30-Jan-22 31-Jan-21 02-Feb-20 in millions. except per share data Assets Current assets: Cash and cash equivalents Receivables. net Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease right-of-use assets Goodwill Other assets 2.343 $ 3.426 7.895 $ 2.992 2.133 2.106 22.068 16.627 14.531 1.218 963 1.040 29.055 28.477 19.810 25.199 24.705 22.770 5.968 5.962 5.595 7.449 7.126 2.254 4.205 4.311 807 Total assets $ 71.876 $ 70.581 $ 51.236 Liabilities and Stockholders' Equity Current liabilities: Short-term debt(Current debt obligation) $ Accounts payable 1.035 $ 13.462 $ 974 11.606 7.787 Accrued salaries and related expenses 2.426 2.463 1.494 Sales taxes payable 848 774 605 Deferred revenue 3.596 2.116 Income taxes payable Current installments of long-term debt Current operating lease liabilities Other accrued expenses Total current liabilities Long-term debt. excluding current installments Long-term operating lease liabilities Deferred income taxes Other long-term liabilities Total liabilities Common stock. par value $0.05: authorized: 10.000 shares: issued: 1.792 shares at January 30, 2022 and 1.789 shares at January 31. 830 3.891 3.063 28.693 23.166 158 2.447 2.823 193 1.416 828 55 1.839 828 2.677 18.375 26.604 35.822 28.670 5.353 5.356 5.066 909 1.131 2.013 63.572 1.807 67.282 54.352 706 1.535 2021: outstanding: 1.035 shares at January 30. 2022 and 1.077 shares at January 31. 2021 90 Paid-in capital 12.132 89 11.540 89 11.001 Retained earnings 77.580 58.134 51.729 Accumulated other comprehensive loss. (704) (671) (739) Treasury stock. at cost. 757 shares at January 30. 2022 and 712 shares at January 31. 2021 (80.794) (65.793) (65.196) Total stockholders' (deficit) equity 8.304 3.299 (3.116) Total liabilities and stockholders' equity $ 71.876 $ 70.581 $ 51.236 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS Fiscal Fiscal Fiscal in millions, except per share data Net sales 2021 2020 2019 $ 151,157 $ 132,110 $ 110,225 Interest and investment income Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Total operating expenses Operating income Interest and other (income) expense: Interest expense 100,325 87.257 72,653 50,832 44,853 37,572 25,406 24,447 19,740 2,386 2,128 1,989 27,792 26,575 21,729 23,040 18,278 15,843 (44) (47) (73) 1,347 1,347 1,201 Interest and other, net 1,303 1,300 1,128 Eamings before provision for income taxes 21,737 16,978 14,715 Provision for income taxes 5,304 4,112 3,473 Net eamings $ 16,433 $ 12,866 $ 11,242 Basic weighted average common shares 1,054 1,074 1,093 Basic eamings per share $ 15.59 $ 11.98 $ 10.29 Diluted weighted average common shares 1,058 1,078 1,097 Diluted eamings per share $ 15.53 $ 11.94 $ 10.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started