Question

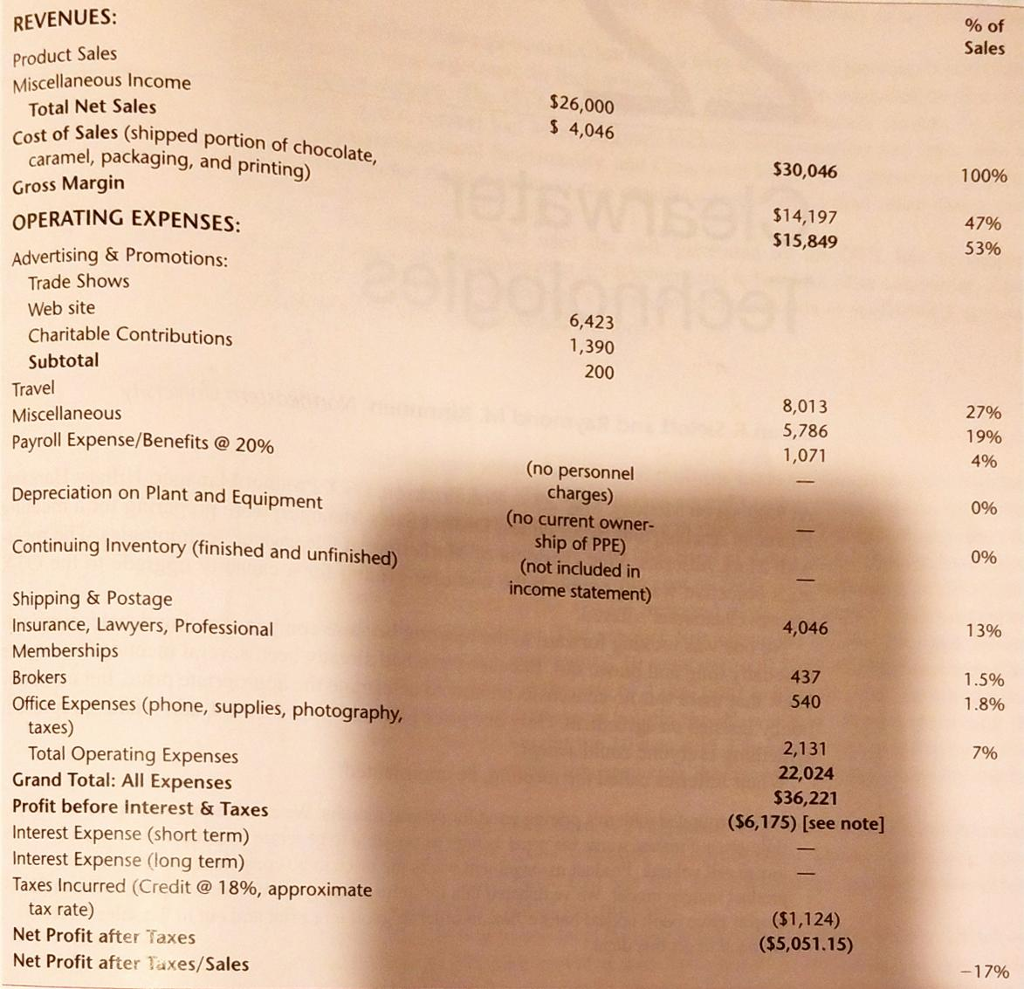

Use information in Exhibit 5, attempt to compute the breakeven revenue for three different conditions: (1) assumes Marilyn wants to cover only the annual fixed

Use information in Exhibit 5, attempt to compute the breakeven revenue for three different conditions: (1) assumes Marilyn wants to cover only the annual fixed costs through operations, and without paying a salary for herself; (2) assumes Marilyn wants to cover the annual fixed costs, and charges a modest $30,000 in salary and benefits, to cover her cost of inventory, her previous years loss and some other personal expenses; (3) assumes Marilyn can manage to cut the Cost of Sales by 10%, and she wants to cover the annual fixed costs and charges a modest $30,000 in salary and benefits.

%of Sales REVENUES: Product Sales Miscellaneous Income $26,000 4,046 Total Net Sales cost of Sales (shipped portion of chocolate, caramel, packaging, and printing) Gross Margin OPERATING EXPENSES: Advertising & Promotions: $30,046 100% $14,197 $15,849 47% 53% Trade Shows Web site 6,423 1,390 200 Charitable Contributions Subtotal Travel Miscellaneous Payroll Expense/Benefits @ 20% 27% 19% 4% 5,786 1,071 (no personnel charges) (no current owner- ship of PPE) (not included in income statement) Depreciation on Plant and Equipment 0% Continuing Inventory (finished and unfinished) 0% Shipping & Postage Insurance, Memberships Brokers Office Expenses (phone, supplies, photography, 4,046 13% Lawyers, Professional 437 540 1.5% 1.8% taxes) 2,131 22,024 $36,221 ($6,175) [see note] 7% Total Operating Expenses Grand Total: All Expenses Profit before interest & Taxes Interest Expense (short term) Interest Expense (long term) Taxes Incurred (Credit @ 18%, approximate tax rate) Net Profit after Taxes Net Profit after Taxes/Sales ($1,124) ($5,051.15) -17%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started