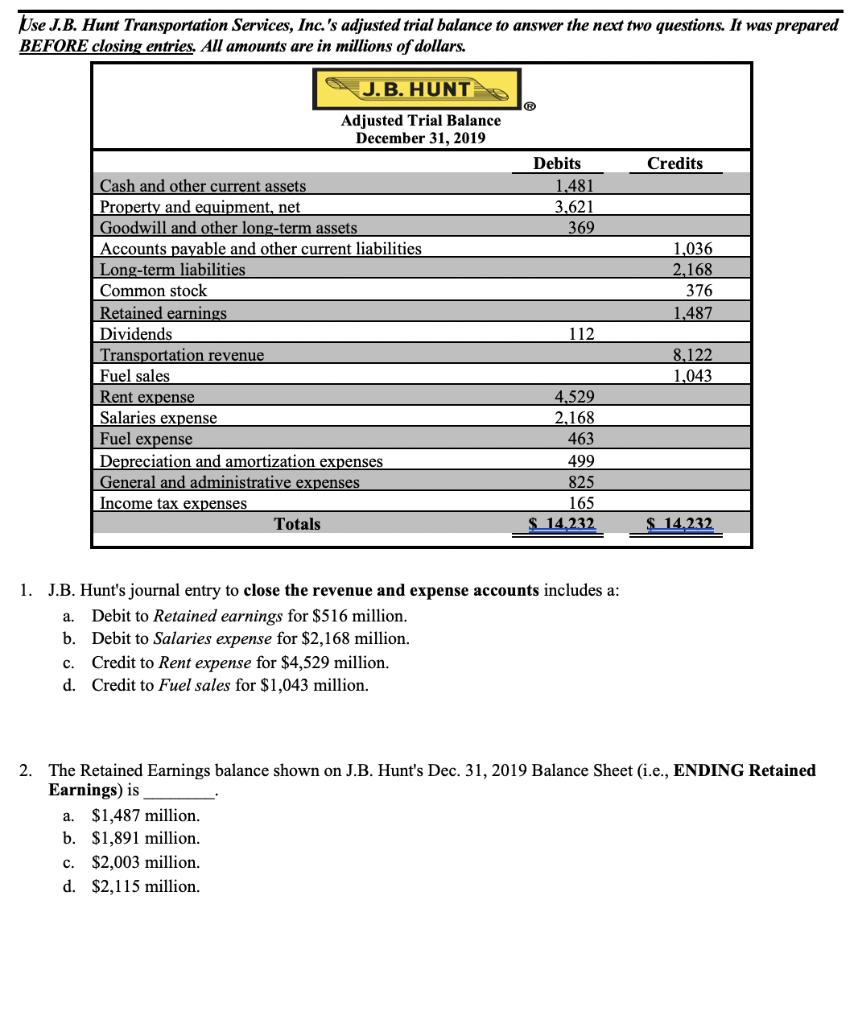

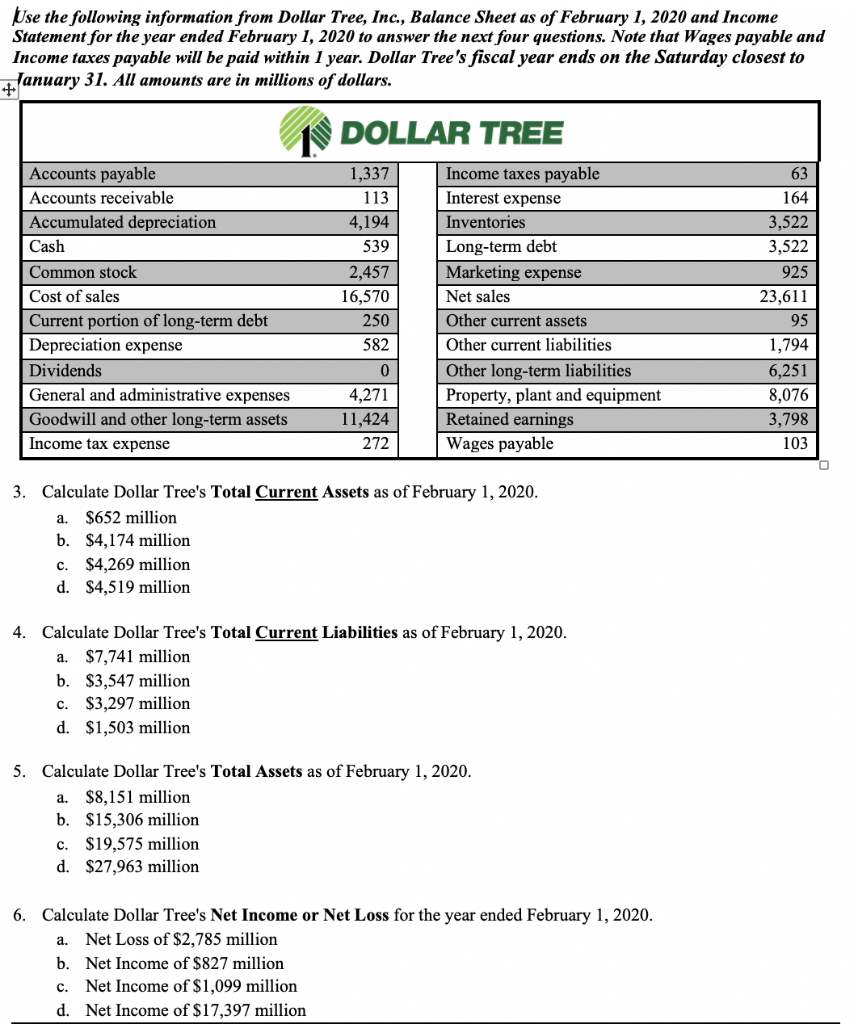

Use J.B. Hunt Transportation Services, Inc.'s adjusted trial balance to answer the next two questions. It was prepared BEFORE closing entries. All amounts are in millions of dollars. J.B. HUNT Adjusted Trial Balance December 31, 2019 Credits Debits 1.481 3,621 369 1,036 2,168 376 1,487 a 112 Cash and other current assets Property and equipment, net Goodwill and other long-term assets Accounts payable and other current liabilities Long-term liabilities Common stock Retained earnings Dividends Transportation revenue Fuel sales Rent expense Salaries expense Fuel expense Depreciation and amortization expenses General and administrative expenses Income tax expenses Totals 8,122 1,043 4,529 2,168 463 499 825 165 $ 14,232 S 14,232 1. J.B. Hunt's journal entry to close the revenue and expense accounts includes a: a. Debit to Retained earnings for $516 million. b. Debit to Salaries expense for $2,168 million. c. Credit to Rent expense for $4,529 million. d. Credit to Fuel sales for $1,043 million. 2. The Retained Earnings balance shown on J.B. Hunt's Dec. 31, 2019 Balance Sheet (i.e., ENDING Retained Earnings) is a. $1,487 million. b. $1,891 million. c. $2,003 million. d. $2,115 million. Use the following information from Dollar Tree, Inc., Balance Sheet as of February 1, 2020 and Income Statement for the year ended February 1, 2020 to answer the next four questions. Note that Wages payable and Income taxes payable will be paid within 1 year. Dollar Tree's fiscal year ends on the Saturday closest to January 31. All amounts are in millions of dollars. DOLLAR TREE Accounts payable Accounts receivable Accumulated depreciation Cash Common stock Cost of sales Current portion of long-term debt Depreciation expense Dividends General and administrative expenses Goodwill and other long-term assets Income tax expense 1,337 113 4,194 539 2,457 16,570 ! 250 582 16, Income taxes payable Interest expense Inventories Long-term debt Marketing expense Net sales Other current assets Other current liabilities Other long-term liabilities Property, plant and equipment Retained earnings Wages payable 63 164 3,522 3,522 925 23,611 95 1,794 6,251 8,076 3,798 103 4,271 11,424 272 3. Calculate Dollar Tree's Total Current Assets as of February 1, 2020. a. $652 million b. $4,174 million c. $4,269 million d. $4,519 million 4. Calculate Dollar Tree's Total Current Liabilities as of February 1, 2020. a. $7,741 million b. $3,547 million c. $3,297 million d. $1,503 million 5. Calculate Dollar Tree's Total Assets as of February 1, 2020. a. $8,151 million b. $15,306 million c. $19,575 million d. $27,963 million 6. Calculate Dollar Tree's Net Income or Net Loss for the year ended February 1, 2020. a. Net Loss of $2,785 million b. Net Income of $827 million c. Net Income of $1,099 million d. Net Income of $17,397 million