Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use Leaming resources (Slides) and Ebook Ch 10 Norking space for requirements #1-10. UIRED FOR POINTS: Complete a depreciation schedule for the new assembly machine

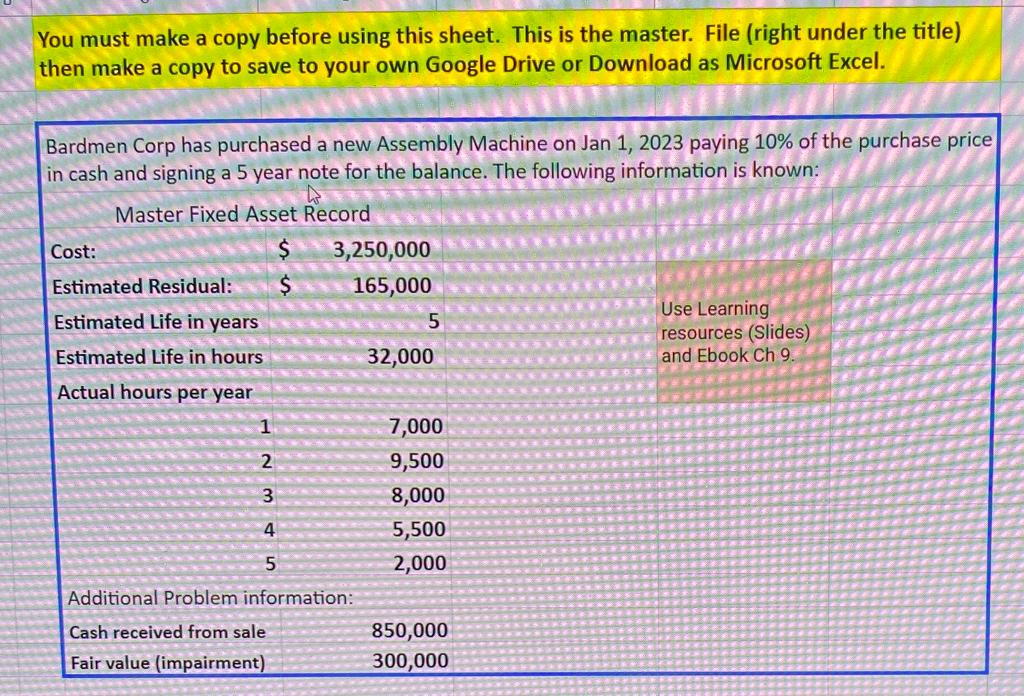

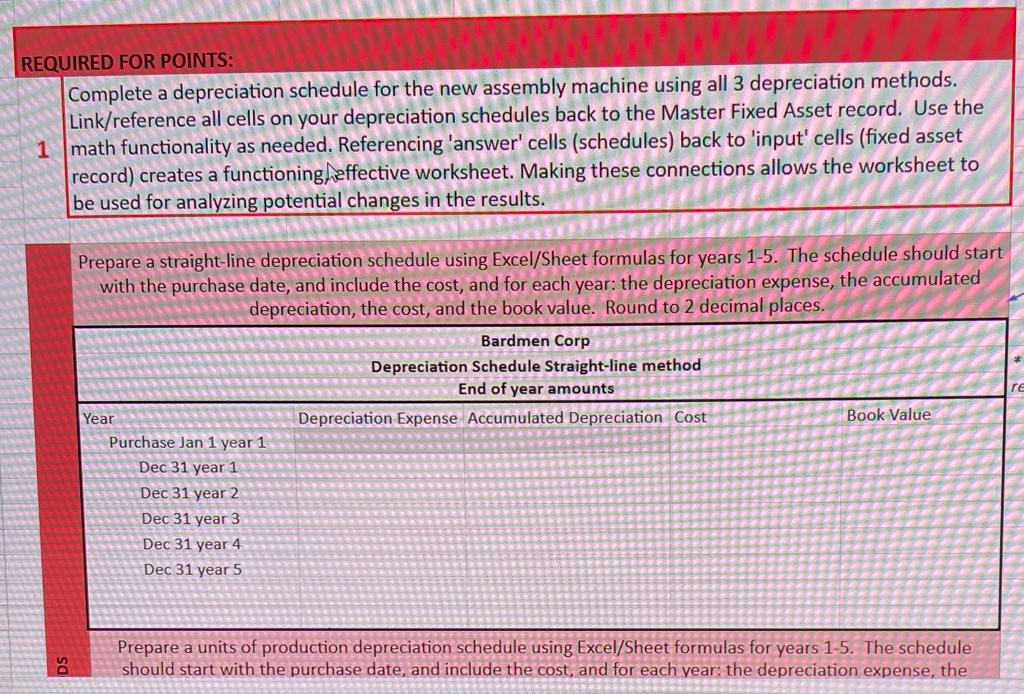

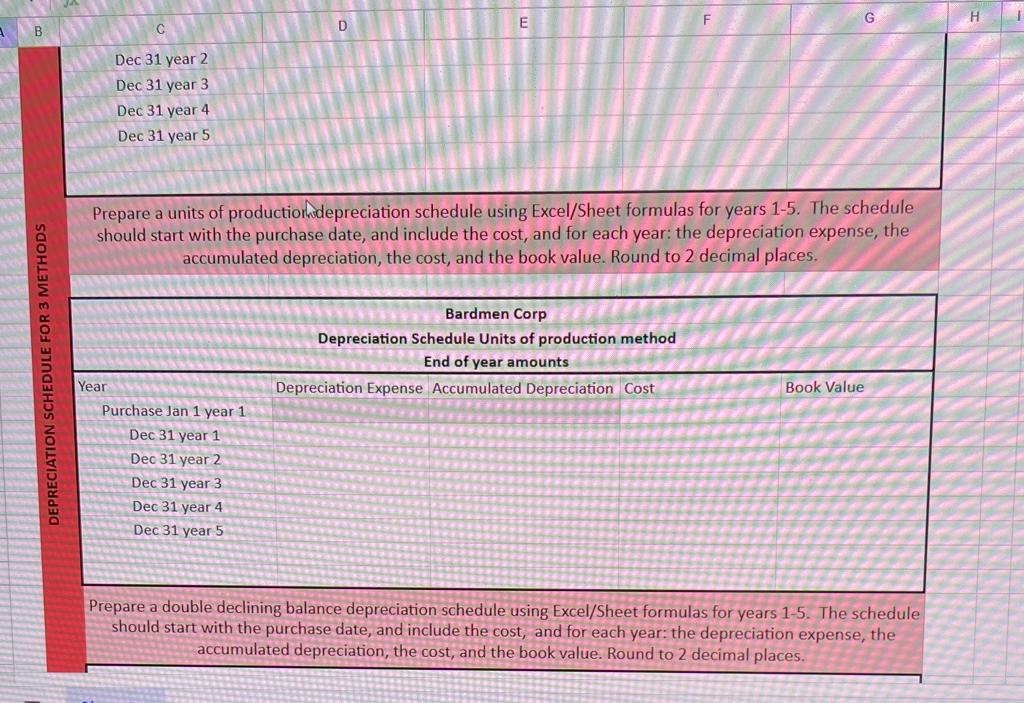

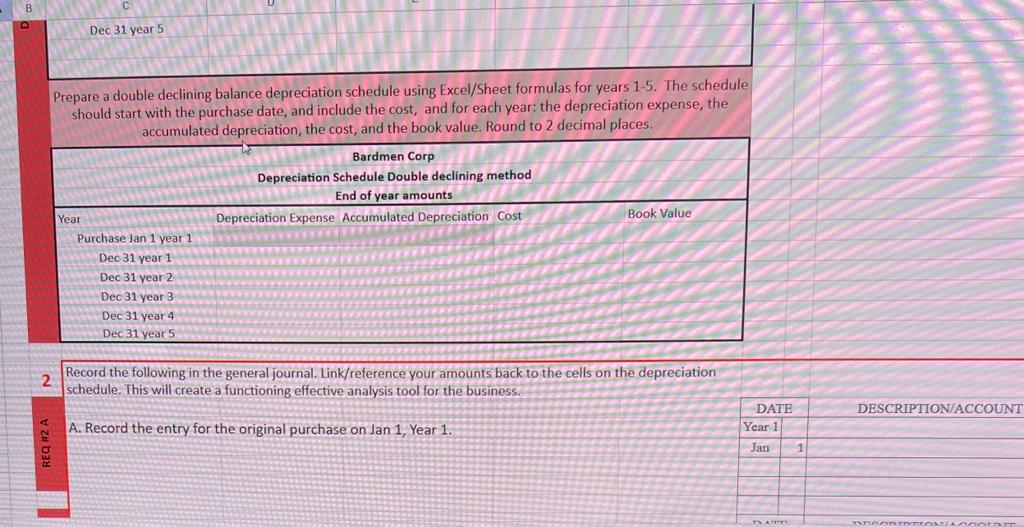

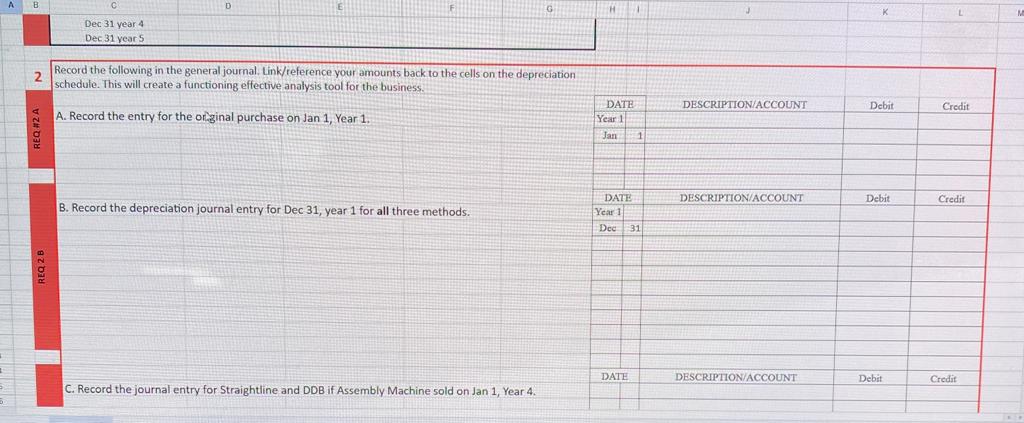

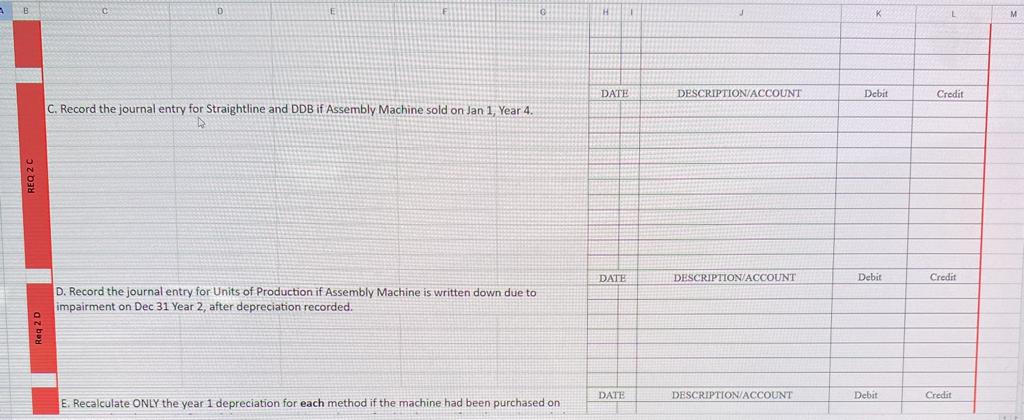

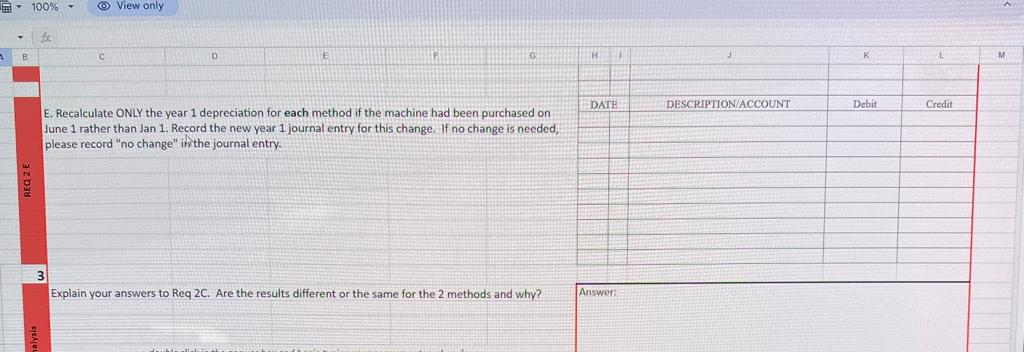

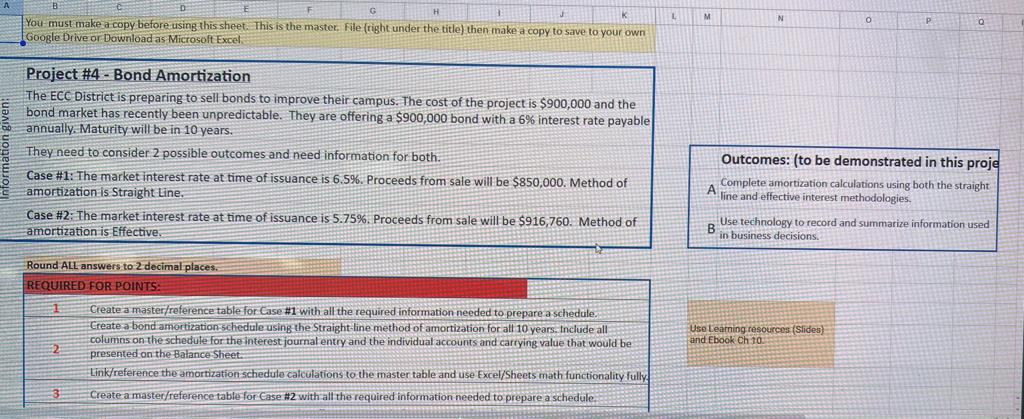

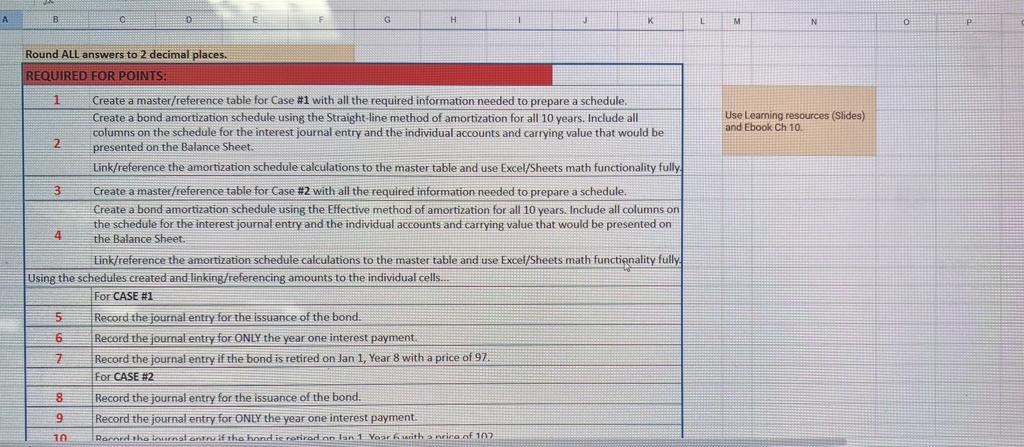

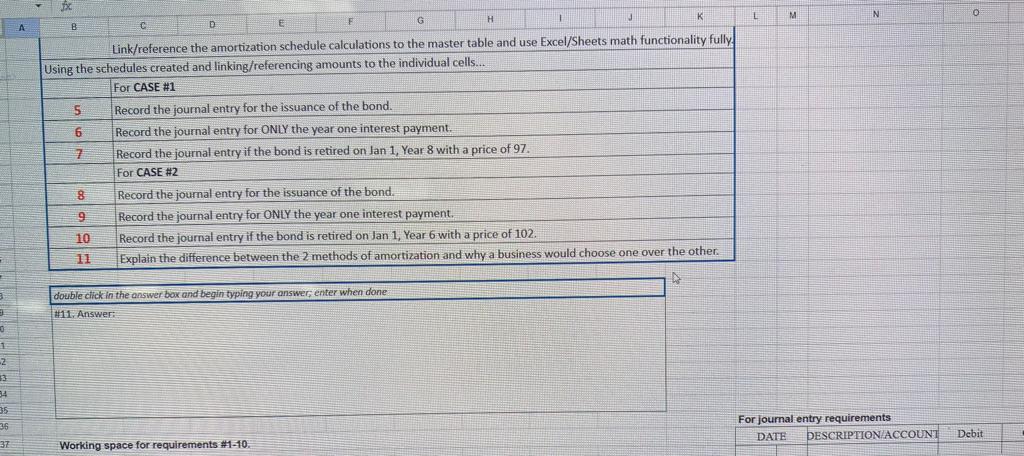

Use Leaming resources (Slides) and Ebook Ch 10 Norking space for requirements \#1-10. UIRED FOR POINTS: Complete a depreciation schedule for the new assembly machine using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Master Fixed Asset record. Use the math functionality as needed. Referencing 'answer' cells (schedules) back to 'input' cells (fixed asset record) creates a functioning Aeffective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should star with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 15. The schedule should start with the purchase date, and include the cost, and for each vear: the depreciation expense, the You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy to save to your own Google Drive or Download as Microsoft Excel. Bardmen Corp has purchased a new Assembly Machine on Jan 1, 2023 paying 10\% of the purchase price in cash and signing a 5 year note for the balance. The following information is known: Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Record the following in the general journal. Link/reference your amounts back to the cells on the depreciation schedule. This will create a functioning effective analysis tool for the business. A. Record the entry for the original purchase on Jan 1, Year 1. Outcomes: (to be demonstrated in this proje A complete amortization calculations using both the straight line and effective interest methodologies. B Use technology to record and summarize information used in business decisions. Use Learning resources (Sides) and Ebook Ch 10 . Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality fully. Using the schedules created and linking/referencing amounts to the individual cells... \begin{tabular}{|c|l|} \hline 5 & For CASE #1 \\ \hline 6 & Record the journal entry for the issuance of the bond. \\ \hline 7 & Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. \\ \hline 8 & For CASE #2 \\ \hline 9 & Record the journal entry for the issuance of the bond. \\ \hline 10 & Record the journal entry if the bond is retired on lan 1, Year 6 with a price of 102. \\ \hline 11 & Explain the difference between the 2 methods of amortization and why a business would choose one over the other. \\ \hline \end{tabular} double cick in the answer bax and begin typing your answer, enter when done H11. Answer: For journal entry requirements Working space for requirements #10. Record the following in the general journal. Link/reference your amounts back to the cells on the depreciation schedule. This will create a functioning effective analysis tool for the business. A. Record the entry for the orginal purchase on Jan 1, Year 1. B. Record the depreciation journal entry for Dec 31 , year 1 for all three methods. C. Record the journal entry for Straightline and DDB if Assembly Machine sold on Jan 1, Year 4. Prepare a units of productiorndepreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places

Use Leaming resources (Slides) and Ebook Ch 10 Norking space for requirements \#1-10. UIRED FOR POINTS: Complete a depreciation schedule for the new assembly machine using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Master Fixed Asset record. Use the math functionality as needed. Referencing 'answer' cells (schedules) back to 'input' cells (fixed asset record) creates a functioning Aeffective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should star with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 15. The schedule should start with the purchase date, and include the cost, and for each vear: the depreciation expense, the You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy to save to your own Google Drive or Download as Microsoft Excel. Bardmen Corp has purchased a new Assembly Machine on Jan 1, 2023 paying 10\% of the purchase price in cash and signing a 5 year note for the balance. The following information is known: Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Record the following in the general journal. Link/reference your amounts back to the cells on the depreciation schedule. This will create a functioning effective analysis tool for the business. A. Record the entry for the original purchase on Jan 1, Year 1. Outcomes: (to be demonstrated in this proje A complete amortization calculations using both the straight line and effective interest methodologies. B Use technology to record and summarize information used in business decisions. Use Learning resources (Sides) and Ebook Ch 10 . Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality fully. Using the schedules created and linking/referencing amounts to the individual cells... \begin{tabular}{|c|l|} \hline 5 & For CASE #1 \\ \hline 6 & Record the journal entry for the issuance of the bond. \\ \hline 7 & Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. \\ \hline 8 & For CASE #2 \\ \hline 9 & Record the journal entry for the issuance of the bond. \\ \hline 10 & Record the journal entry if the bond is retired on lan 1, Year 6 with a price of 102. \\ \hline 11 & Explain the difference between the 2 methods of amortization and why a business would choose one over the other. \\ \hline \end{tabular} double cick in the answer bax and begin typing your answer, enter when done H11. Answer: For journal entry requirements Working space for requirements #10. Record the following in the general journal. Link/reference your amounts back to the cells on the depreciation schedule. This will create a functioning effective analysis tool for the business. A. Record the entry for the orginal purchase on Jan 1, Year 1. B. Record the depreciation journal entry for Dec 31 , year 1 for all three methods. C. Record the journal entry for Straightline and DDB if Assembly Machine sold on Jan 1, Year 4. Prepare a units of productiorndepreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started