Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use liability method in requirement 1 and expense method in requirement 2 On Sept. 1, 2020, Mary Cruz received a promissory note of P30,000 to

Use liability method in requirement 1 and expense method in requirement 2

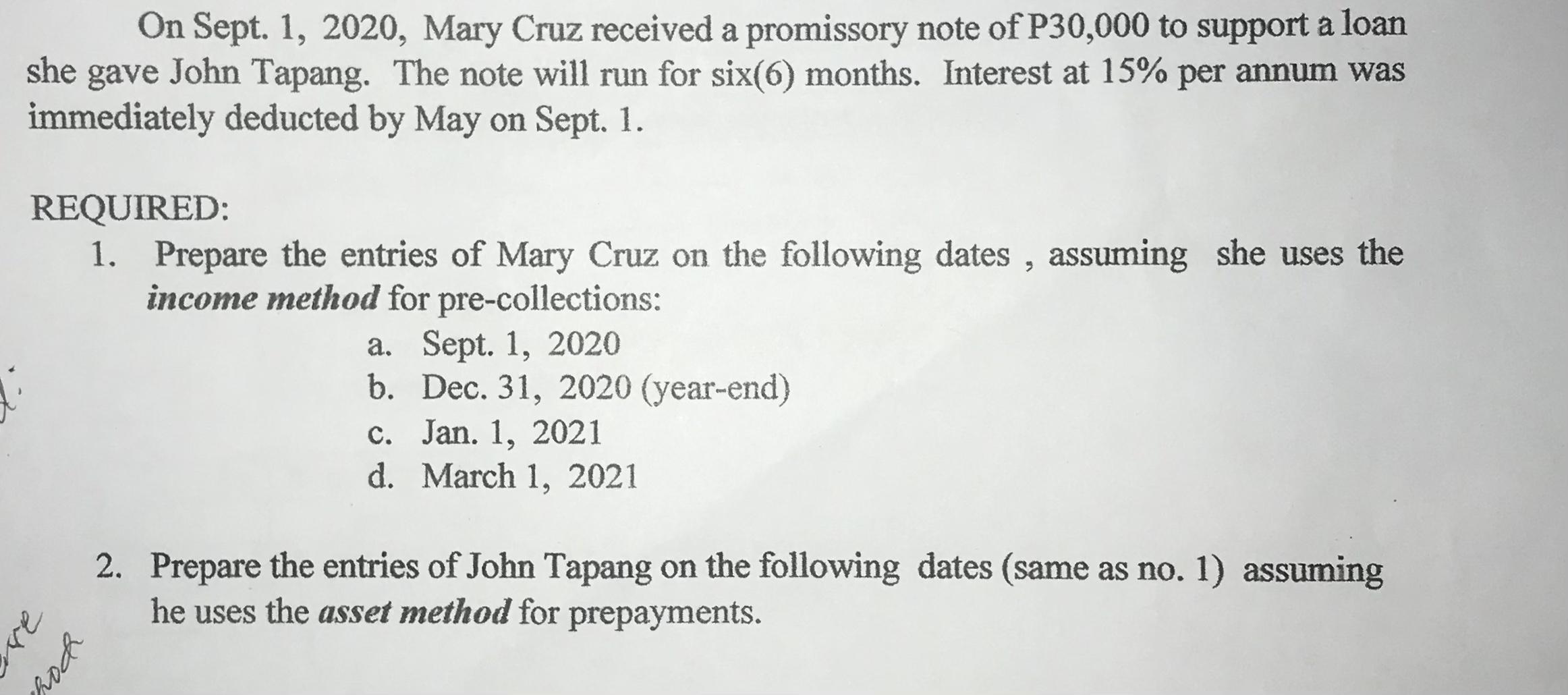

On Sept. 1, 2020, Mary Cruz received a promissory note of P30,000 to support a loan she gave John Tapang. The note will run for six(6) months. Interest at 15% per annum was immediately deducted by May on Sept. 1. REQUIRED: 1. Prepare the entries of Mary Cruz on the following dates , assuming she uses the income method for pre-collections: a. Sept. 1, 2020 b. Dec. 31, 2020 (year-end) c. Jan. 1, 2021 d. March 1, 2021 2. Prepare the entries of John Tapang on the following dates (same as no. 1) assuming he uses the asset method for prepayments. re hoch

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare the entries of Mary Cruz on the following dates assuming she uses the income method for pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started