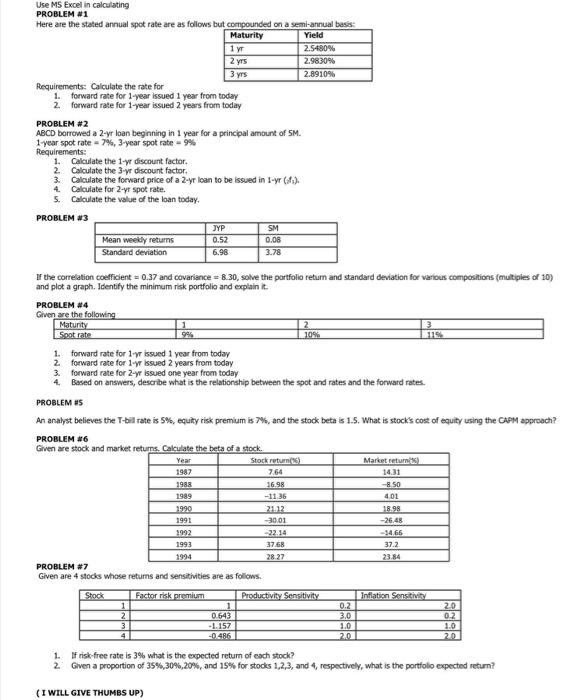

Use MS Excel in calculating PROBLEM #1 Here are the stated annual spot rate are as follows but compounded on a semi-annual basis: Maturity Yield 1 y 2.5480% 2 yrs 2.9830% 3 yrs 2.8910% Requirements: Calculate the rate for 1. forward rate for 1-year issued 1 year from today 2. forward rate for 1-year issued 2 years from today PROBLEM #2 ABCD borrowed a 2-yr loan beginning in 1 year for a principal amount of SM. 1-year spot rate - 7%, 3-year spot rate -9% Requirements: 1. Calculate the 1-yr discount factor. 2. Calculate the 3-yr discount factor. 3. Calculate the forward price of a 2-Yr loan to be issued in 1-yr (). 4 Calculate for 2-yr spot rate. 5. Calculate the value of the loan today PROBLEM #3 JYP SM Mean Weekly returns 0.52 0.08 Standard deviation 6.98 3.78 If the correlation coefficient = 0.37 and covariance = 8.30, solve the portfolio return and standard deviation for various compositions (multiples of 10) and plot a graph. Identify the minimum risk portfolio and explain it. PROBLEM #4 Given are the following Maturity Soot rate 1. forward rate for 1-y issued 1 year from today 2 forward rate for 1-y issued 2 years from today 3. forward rate for 2-yr issued one year from today 4. Based on answers, describe what is the relationship between the spot and rates and the forward rates. PROBLEM #5 An analyst believes the T-bil rate is 5%, equity risk premium is 76, and the stock bete is 1.5. What is stock's cost of equity using the CAPM approach? PROBLEM #6 Given are stock and market returns. Calculate the beta of a stock. Year Stock return Marketet 1987 7.64 14.31 1988 2698 8.50 1989 -11.36 4.01 1990 21.12 18.98 1991 -30.01 -26.48 1992 --22.14 -34.66 1993 37.68 37.2 1994 28.27 PROBLEM #7 Given are 4 stocks whose returns and sensitivities are as follows Shock Factor risk premium Productivity Sensitivity Inflation Sensitivity 1 2 3 4 1 0.643 -1.157 -0.486 0.2 3.0 1.0 20 02 1.0 2.0 1. Frisk-free rate is 3% what is the expected return of each stock? 2. Given a proportion of 35%,30%,20%, and 15% for stods 1,2,3, and 4, respectively, what is the portfolio expected return? (I WILL GIVE THUMBS UP) Use MS Excel in calculating PROBLEM #1 Here are the stated annual spot rate are as follows but compounded on a semi-annual basis: Maturity Yield 1 y 2.5480% 2 yrs 2.9830% 3 yrs 2.8910% Requirements: Calculate the rate for 1. forward rate for 1-year issued 1 year from today 2. forward rate for 1-year issued 2 years from today PROBLEM #2 ABCD borrowed a 2-yr loan beginning in 1 year for a principal amount of SM. 1-year spot rate - 7%, 3-year spot rate -9% Requirements: 1. Calculate the 1-yr discount factor. 2. Calculate the 3-yr discount factor. 3. Calculate the forward price of a 2-Yr loan to be issued in 1-yr (). 4 Calculate for 2-yr spot rate. 5. Calculate the value of the loan today PROBLEM #3 JYP SM Mean Weekly returns 0.52 0.08 Standard deviation 6.98 3.78 If the correlation coefficient = 0.37 and covariance = 8.30, solve the portfolio return and standard deviation for various compositions (multiples of 10) and plot a graph. Identify the minimum risk portfolio and explain it. PROBLEM #4 Given are the following Maturity Soot rate 1. forward rate for 1-y issued 1 year from today 2 forward rate for 1-y issued 2 years from today 3. forward rate for 2-yr issued one year from today 4. Based on answers, describe what is the relationship between the spot and rates and the forward rates. PROBLEM #5 An analyst believes the T-bil rate is 5%, equity risk premium is 76, and the stock bete is 1.5. What is stock's cost of equity using the CAPM approach? PROBLEM #6 Given are stock and market returns. Calculate the beta of a stock. Year Stock return Marketet 1987 7.64 14.31 1988 2698 8.50 1989 -11.36 4.01 1990 21.12 18.98 1991 -30.01 -26.48 1992 --22.14 -34.66 1993 37.68 37.2 1994 28.27 PROBLEM #7 Given are 4 stocks whose returns and sensitivities are as follows Shock Factor risk premium Productivity Sensitivity Inflation Sensitivity 1 2 3 4 1 0.643 -1.157 -0.486 0.2 3.0 1.0 20 02 1.0 2.0 1. Frisk-free rate is 3% what is the expected return of each stock? 2. Given a proportion of 35%,30%,20%, and 15% for stods 1,2,3, and 4, respectively, what is the portfolio expected return? (I WILL GIVE THUMBS UP)