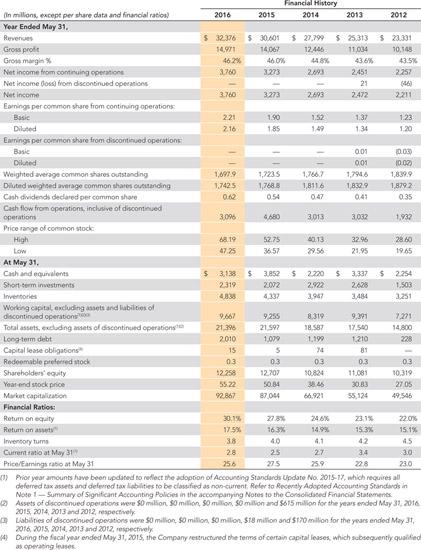

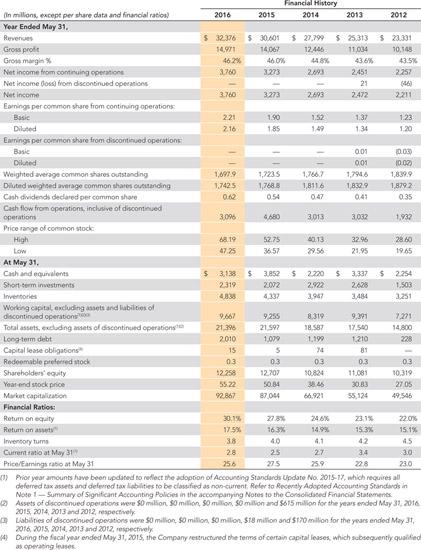

- Use Nikes Selected Financial Data on in Appendix B to identify the gross margin percent for 20162012. Round gross margin percents to one decimal place.

- Management has implemented strategies to generate more income from each item sold. Is the trend in the gross margin percent favorable or unfavorable?

- Show how amounts on Nikes Consolidated Statements of Income, on , were used to calculate the margin percent for 2016.

2.45 185 - 04 Financial History In millions, except per share data and financial ration) 2016 2015 2014 2013 2012 Year Ended May 31. Revenue $ 32,376530.001 $ 27.299 $ 25,313 $ 23.331 Gross profit 14.97 14067 12.446 11.034 10,145 Grote margin 462% 460% 44.8% 43.6% 13.5% Niet income from continuing operatione 1760 3273 2003 2.257 Net income from discontinued operations 21 4460 Net Income 3.760 3273 2.623 2472 2.211 Earnings per common share from continuing operations Basic 2.21 1.90 1.52 137 1.23 Diluted 2.16 1:49 134 1.20 Earrings per common share from discontinued operatione Basic 001 0.03 Diluted 001 10.02 Weighted average common shares outstanding 1,097.9 1,7235 1,7667 1,796 1,8399 Diluted weighed average common shares tanding 1.7425 1,7833 1,8116 18322 1,8792 Cash dividends declared per common share 054 0.41 0.35 Cash flow from operations, inclusive of discontinued operations 3.096 680 3013 3.032 1.932 Price range of common stock High 48. 19 52.75 4013 32.95 2860 Low 47.25 36:57 2956 21.95 19.65 At May 31, Cath and equalents $ 3.138 $ 3.852 $ 2.220 $ 3.337 $ 2.254 Short-term investments 2319 2002 2.922 2.628 1.503 Investors 4833 4337 3.947 3.454 3.251 Working capital excluding assets and abilities of discontinued operations 9.667 9255 8.319 9,391 7.221 Total assets, excluding assets of discontinued operation 21.396 21.592 18.587 17.50 14800 Long term debt 2010 1.009 1,199 1210 22 Capital lease obligations 15 5 74 81 Redeemable preferred stock 03 03 03 0.3 03 Shareholders' evity 12.258 12.707 10.824 11.081 10.319 Year and stock price 5522 50.84 3845 30.83 2705 Maiat capitalization 92.867 87064 66.921 55,124 49,546 Financial Ration: Retum on equity 3015 2283 246% 2315 Return on a 163% 14.9% 153% 15.1% Inventory tums 38 40 4.1 42 45 Current alo at May 31 28 25 27 34 3.0 Price/Earnings rabio at May 31 256 23.0 m) Prior year amounts have been updated to reflect the adoption of Accounting Standards Update No. 2015-17, which requires all deferred tax assets and deferred tax bilties to be classified as non-current. Refer to Recently Adopted Accounting Standards in Note 1 - Summary of Significant Accounting Policies in the accompanying Notes to the Consolidated Financial Statements Assets of discontinued operations were so million milion, 50 million so milion and 5615 million for the years ended May 31 2016 2015 2014 2013 and 2012, respectively abilities of discontinued operations were 50 million S0 milion milion $18 million and $10 million for the years ended May 31 2016 2015 2014 2013 and 2012, respectively During the facal year ended May 31, 2015, the Company restructured the terms of certain capital feases, which subsequently qualified as operating 220% 175 215