Use of futures contracts to hedge cotton inventory- fair value hedge

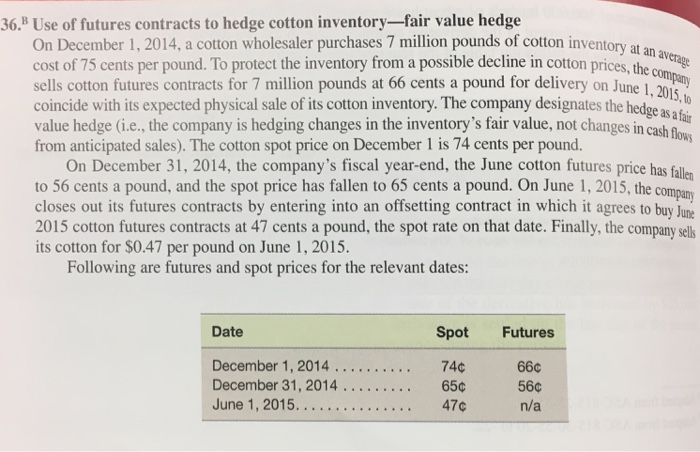

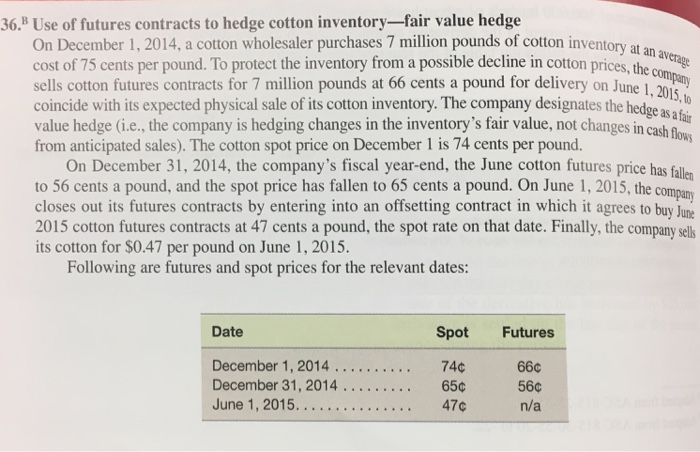

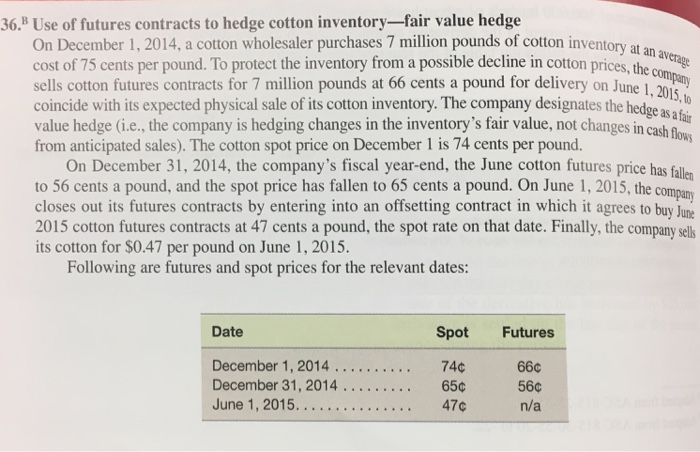

36. Use of futures contracts to hedge cotton inventory-fair value hedge On December 1, 2014, a cotton wholesaler purchases 7 million pounds of cotton inventory at an cost of 75 cents per pound. To protect the inventory from a possible decline in cotton prices, the sells cotton futures contracts for 7 million pounds at 66 cents a pound for delivery on June 1,2015 coincide with its expected physical sale of its cotton inventory. The company designates the hedge a value hedge (i.e., the company is hedging changes in the inventory's fair value, not changes in cash from anticipated sales). The cotton spot price on December 1 is 74 cents per pound. , to On December 31, 2014, the company's fiscal year-end, the June cotton futures price has fallen to 56 cents a pound, and the spot price has fallen to 65 cents a pound. On June 1, 2015, the compam closes out its futures contracts by entering into an offsetting contract in which it agrees to buy June 2015 cotton futures contracts at 47 cents a pound, the spot rate on that date. Finally, the company sells its cotton for $0.47 per pound on June 1,2015 Following are futures and spot prices for the relevant dates: Date Spot Futures 740 66 560 n/a June 1,2015... 47c 36. Use of futures contracts to hedge cotton inventory-fair value hedge On December 1, 2014, a cotton wholesaler purchases 7 million pounds of cotton inventory at an cost of 75 cents per pound. To protect the inventory from a possible decline in cotton prices, the sells cotton futures contracts for 7 million pounds at 66 cents a pound for delivery on June 1,2015 coincide with its expected physical sale of its cotton inventory. The company designates the hedge a value hedge (i.e., the company is hedging changes in the inventory's fair value, not changes in cash from anticipated sales). The cotton spot price on December 1 is 74 cents per pound. , to On December 31, 2014, the company's fiscal year-end, the June cotton futures price has fallen to 56 cents a pound, and the spot price has fallen to 65 cents a pound. On June 1, 2015, the compam closes out its futures contracts by entering into an offsetting contract in which it agrees to buy June 2015 cotton futures contracts at 47 cents a pound, the spot rate on that date. Finally, the company sells its cotton for $0.47 per pound on June 1,2015 Following are futures and spot prices for the relevant dates: Date Spot Futures 740 66 560 n/a June 1,2015... 47c