Answered step by step

Verified Expert Solution

Question

1 Approved Answer

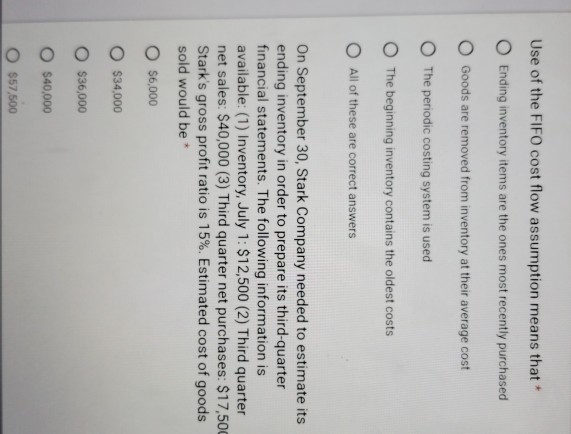

Use of the FIFO cost flow assumption means that O Ending inventory items are the ones most recently purchased O Goods are removed from inventory

Use of the FIFO cost flow assumption means that O Ending inventory items are the ones most recently purchased O Goods are removed from inventory at their average cost O The periodic costing system is used O The beginning inventory contains the oldest costs O All of these are correct answers On September 30, Stark Company needed to estimate its ending inventory in order to prepare its third-quarter financial statements. The following information is available: (1) Inventory, July 1: $12,500 (2) Third quarter net sales: $40,000 (3) Third quarter net purchases: $17,500 Stark's gross profit ratio is 15%. Estimated cost of goods sold would be * O $6,000 O $34,000 O $36,000 O $40,000 O $57,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started