Use one of the Strategic Marketing Models from Chapter 16 to analyze the company identified in your business proposal (Ansoff, BCG, General Electric, or SWOT). Label the axes, strategies, and position products or potential products within the strategic model. Explain your analysis completely and specifically. Use credible secondary data where you can, otherwise state your assumptions clearly and tell me why you made this assumption and on what it is based. What are the key implications of your analysis?

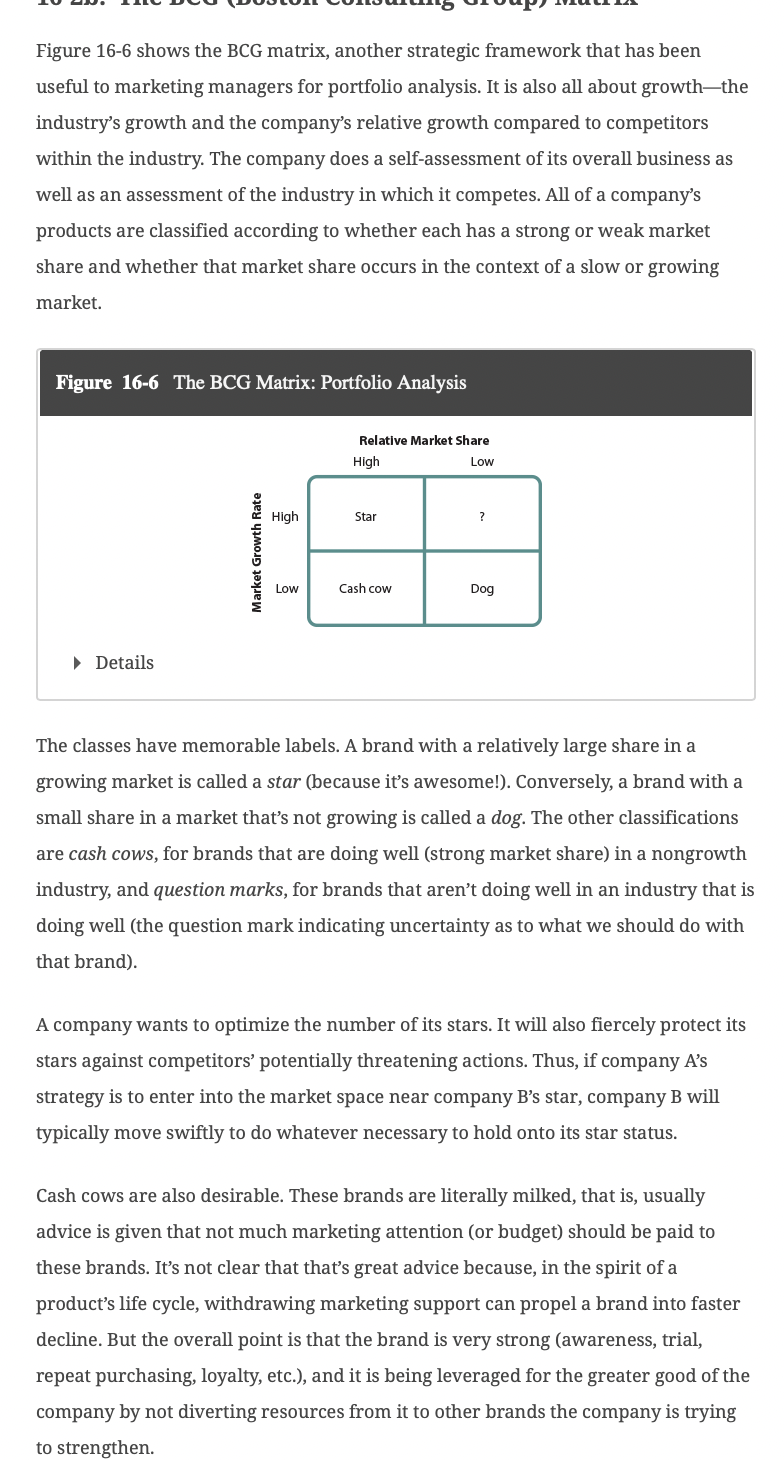

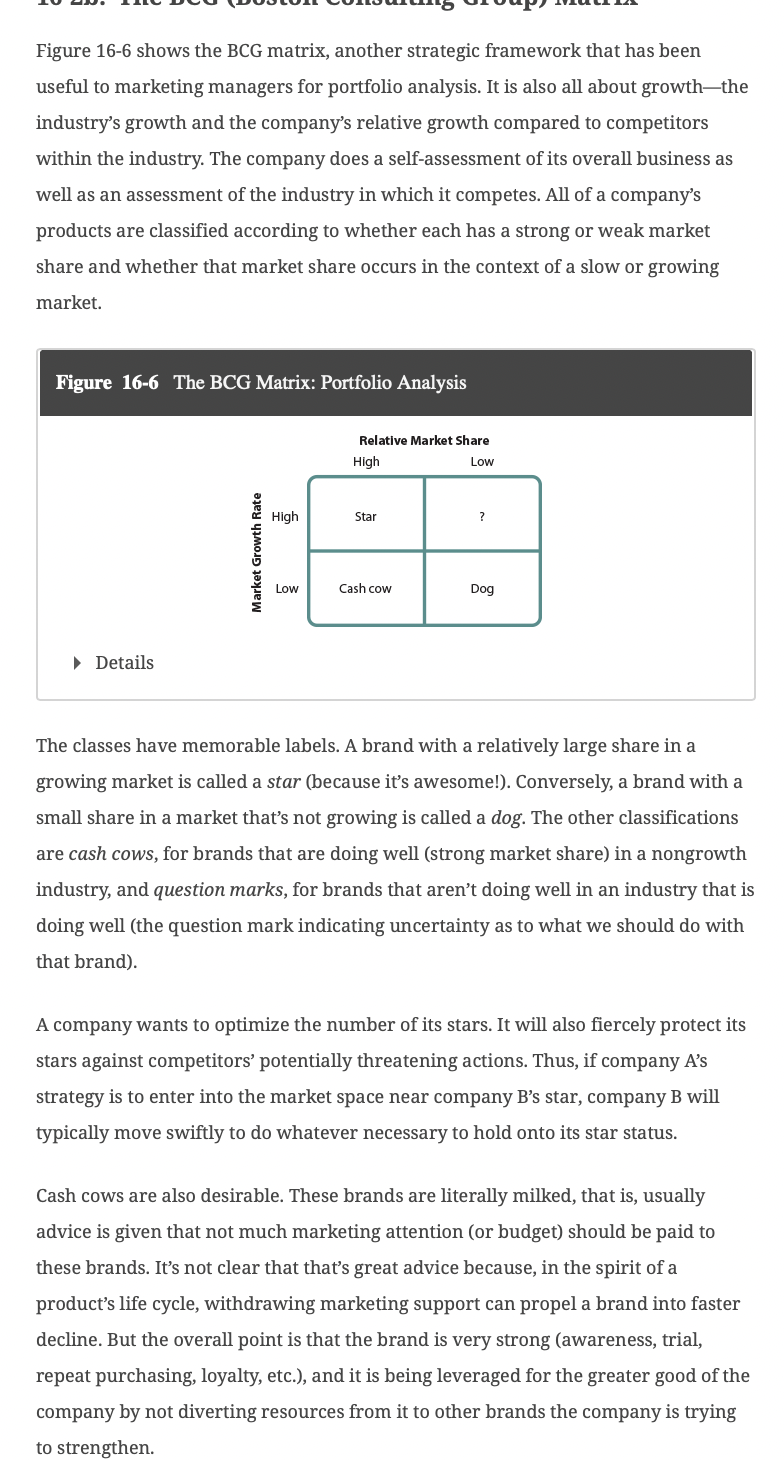

Figure 16-6 shows the BCG matrix, another strategic framework that has been useful to marketing managers for portfolio analysis. It is also all about growth-the industry's growth and the company's relative growth compared to competitors within the industry. The company does a self-assessment of its overall business as well as an assessment of the industry in which it competes. All of a company's products are classified according to whether each has a strong or weak market share and whether that market share occurs in the context of a slow or growing market. Figure 16-6 The BCG Matrix: Portfolio Analysis Details The classes have memorable labels. A brand with a relatively large share in a growing market is called a star (because its awesome!). Conversely, a brand with a small share in a market that's not growing is called a dog. The other classifications are cash cows, for brands that are doing well (strong market share) in a nongrowth industry, and question marks, for brands that aren't doing well in an industry that is doing well (the question mark indicating uncertainty as to what we should do with that brand). A company wants to optimize the number of its stars. It will also fiercely protect its stars against competitors' potentially threatening actions. Thus, if company A's strategy is to enter into the market space near company B's star, company B will typically move swiftly to do whatever necessary to hold onto its star status. Cash cows are also desirable. These brands are literally milked, that is, usually advice is given that not much marketing attention (or budget) should be paid to these brands. It's not clear that that's great advice because, in the spirit of a product's life cycle, withdrawing marketing support can propel a brand into faster decline. But the overall point is that the brand is very strong (awareness, trial, repeat purchasing, loyalty, etc.), and it is being leveraged for the greater good of the company by not diverting resources from it to other brands the company is trying The future of question marks is somewhat unknown and also somewhat under the company's control. The industry shows potential, so the company might wish to support the brand with richer marketing (quality improvements, promotional campaigns, temporary price cuts to attract more trial) in an attempt to transform the question mark into a star with an enhanced market share. These question mark products may be in development via new technologies, entering different markets, and so on, and they may need time and additional supporting resources to pay off for the company. Details Pressmaster/Shutterstock.com Good strategic planning requires good communication. Finally, the dog brands should be minimized. The company could just let them be and reap whatever profits they bring in, however meager. Alternatively, if these brands have any residual value, they're also candidates for divestment. So, who let the dogs out? Probably the brand manager