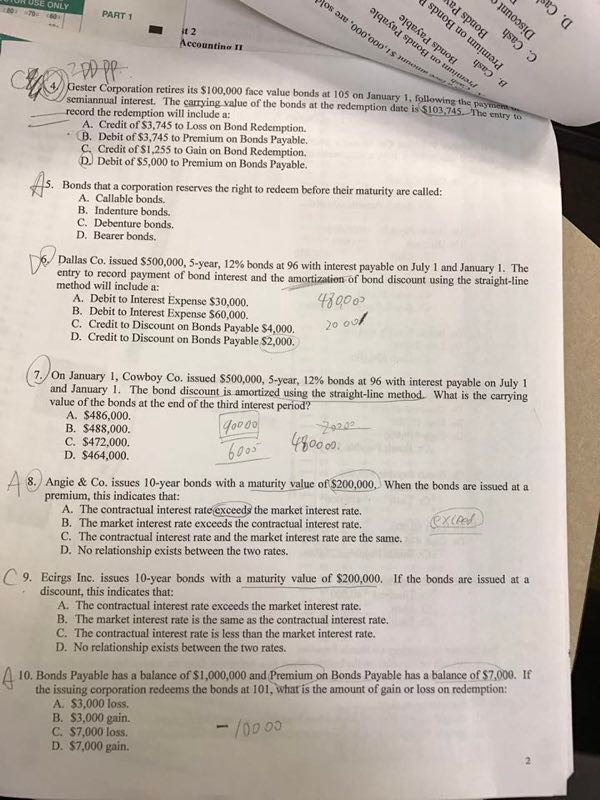

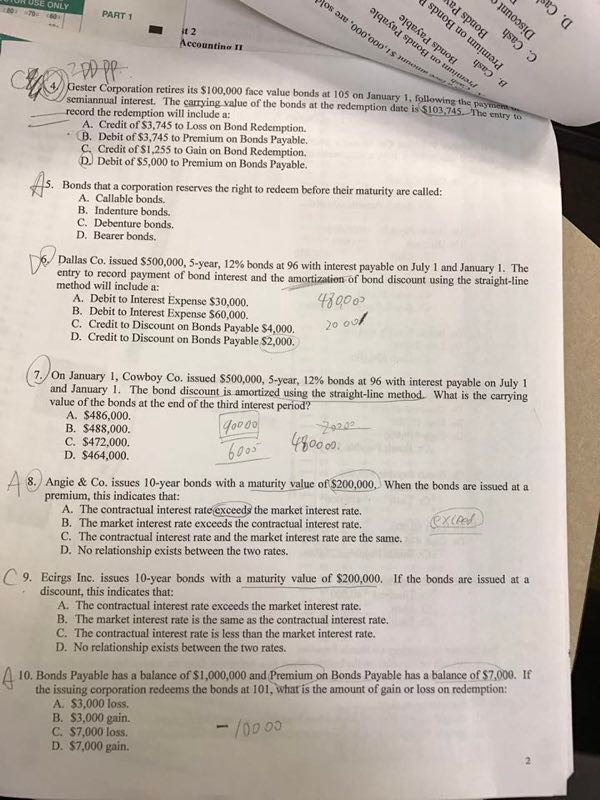

USE ONLY PART 1 000'1s Accountino II 4 Gester Corporation retires its $100,000 face value bonds at 105 on January 1, following the t semiannual interest. The carrying value of the bonds at the redemption date is $103,745. The entry to record the redemption will include a: . A. Credit of$3,745 to Loss on Bond Redemption. B. Debit of $3,745 to Premium on Bonds Payable. C Credit of $1,255 to Gain on Bond Redemption. D.) Debit of $5,000 to Premium on Bonds Payable. Bonds that a corporation reserves the right to redeem before their maturity are called A. Callable bonds. B. Indenture bonds. C. Debenture bonds. D. Bearer bonds. Dallas Co. issued S500,000 5-year, 12% bonds at 96 with interest payable on July 1 and January 1 entry to record payment of bond method will include a: The interest and the amortization of bond discount using the straight-line A. Debit to Interest Expense $30,000. B. Debit to Interest Expense $60,000. C. Credit to Discount on Bonds Payable $4,000. D. Credit to Discount on Bonds Payable $2,000. 20 o On January l, Cowboy Co. issued SS00000 5-year, 12% bonds at 96 with interest payable on July 1 and January 1. The bond discount is amortized using the straight-line metho valuc of the bonds at the end of the third interest period? 7 What is the carrying A. $486,000. B. $488,000. C. $472,000 D. $464,000. 03 8. Angie& Co. issues 10-year bonds with a maturity value of $200,000, When the bonds are issued at a premium, this indicates that: A. The contractual interest rateexceed, the market interest rate. B. The market interest rate exceeds the contractual interest rate. C. The contractual interest rate and the market interest rate are the same. D. No relationship exists between the two rates. 9. Ecirgs Inc. issues 10-year bonds with a maturity value of $200,000. If the bonds are issued at a discount, this indicates that: A. The contractual interest rate exceeds the market interest rate. B. The market interest rate is the same as the contractual interest rate. C. The contractual interest rate is less than the market interest rate. D. No relationship exists between the two rates. 10. Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7.000. If the issuing corporation redeems the bonds at 101, what is the amount of gain or loss on redemption: A. $3,000 loss B. $3,000 gain. C. $7,000 loss. D. $7,000 gain