Use only the information provided under the heading CASE STUDY , to identify and discuss the risks of material misstatement at the overall financial statement level, which the audit team should consider to plan the 31 October 2021 year- end audit of Rent-a-Car Ltd.

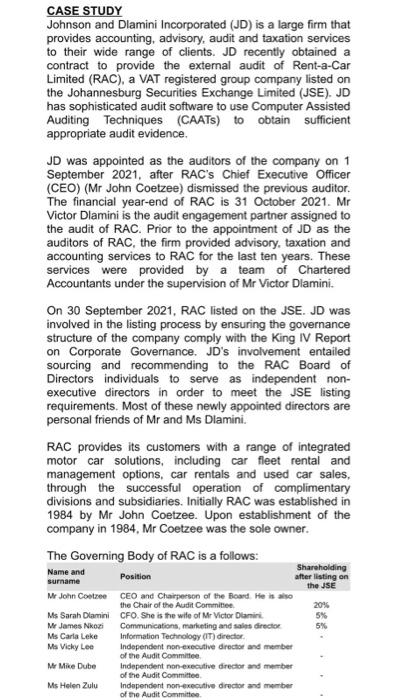

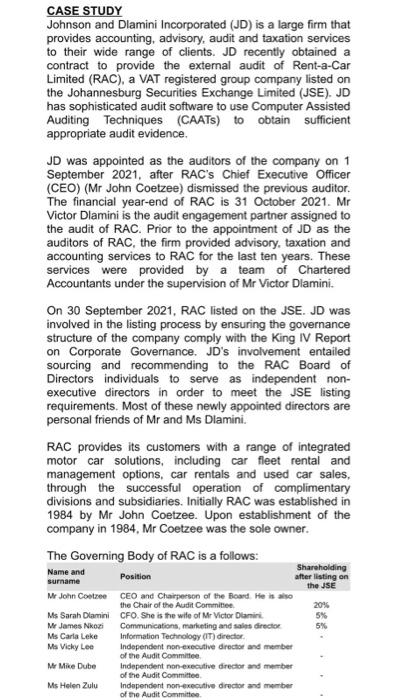

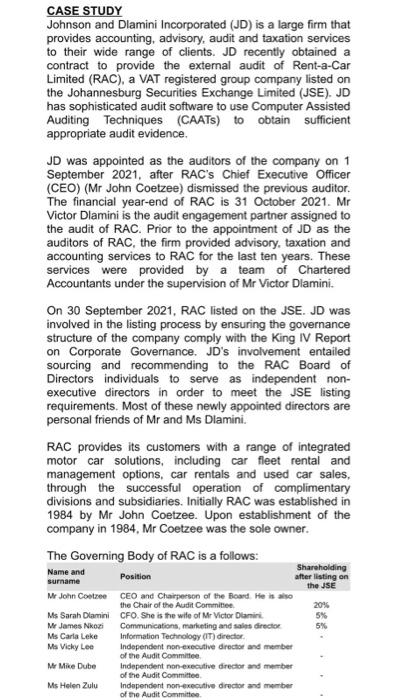

CASE STUDY Johnson and Dlamini Incorporated (JD) is a large firm that provides accounting, advisory, audit and taxation services to their wide range of clients. JD recently obtained a contract to provide the external audit of Rent-a-Car Limited (RAC), a VAT registered group company listed on the Johannesburg Securities Exchange Limited (JSE). JD has sophisticated audit software to use Computer Assisted Auditing Techniques (CAATS) to obtain sufficient appropriate audit evidence. JD was appointed as the auditors of the company on 1 September 2021, after RAC's Chief Executive Officer (CEO) (Mr John Coetzee) dismissed the previous auditor. The financial year-end of RAC is 31 October 2021. Mr Victor Dlamini is the audit engagement partner assigned to the audit of RAC. Prior to the appointment of JD as the auditors of RAC, the firm provided advisory, taxation and accounting services to RAC for the last ten years. These services were provided by a team of Chartered Accountants under the supervision of Mr Victor Dlamini. On 30 September 2021, RAC listed on the JSE. JD was involved in the listing process by ensuring the governance structure of the company comply with the King IV Report on Corporate Governance. JD's involvement entailed sourcing and recommending to the RAC Board of Directors individuals to serve as independent non- executive directors in order to meet the JSE listing requirements. Most of these newly appointed directors are personal friends of Mr and Ms Dlamini. RAC provides its customers with a range of integrated motor car solutions, including car fleet rental and management options, car rentals and used car sales, through the successful operation of complimentary divisions and subsidiaries. Initially RAC was established in 1984 by Mr John Coetzee. Upon establishment of the company in 1984, Mr Coetzee was the sole owner. The Governing Body of RAC is a follows: Shareholding Name and Position after listing on the JSE Mr John Coetzee CEO and Chairperson of the Board. He is also the Chair of the Audit Committee 20% Ms Sarah Dlamini CFO. She is the wife of Mr Victor Dlanini Mr James Nkozi Communications, mariting and sales director Ms Carla Leke Information Technology (IT) director Ma Vicky Lee Independent non-executive director and member of the Audit Committee Mr Mike Dube Independent non-executive director and member of the Audit Committee Ms Helen Zulu Independent non-executive director and member surname 5% 5% The remainder of the share capital in RAC is held by individual investors. Ms Sarah Dlamini is concerned about the impact of various accounting standards because she has limited knowledge of International Financial Reporting Standards (IFRS), specifically the impact of IFRS 3 - Business Combinations, when obtaining the additional subsidiary. Although the company is listed on the JSE, she feels that compliance with the King IV Report on Corporate Governance and the Companies Act is a complete waste of valuable resources. Her views are shared by many of the other Board members. Some of the key personnel in the accounting division of RAC are family members of Mr John Coetzee and Ms Sarah Dlamini, with limited knowledge and experience of financial accounting standards. Interviews with some of the lower level accounting staff revealed that they are often instructed to override controls put in place by the IT director. These staff members also indicated that Mr Coetzee and Ms Dlamini has an autocratic management style. On 10 September 2021 RAC changed its IT system from a number of separate, less sophisticated application modules to a real-time integrated online application system that combines all the previously standalone modules into one central application system. RAC outsourced the development and testing of, as well as the implementation (including the migration) to the new EffectiveRent IT application system and the post implementation system support and maintenance, to Smart-Solutions (Pty) Ltd (Smart-Solutions). The EffectiveRent application system was customized by Smart-Solutions to the specific needs of RAC. Training of RAC personnel is also included in the outsource agreement, but because the accounting division of RAC has been understaffed, under pressure and is experiencing a high staff turnover (specifically in the accounting department), staff members have not yet been trained by Smart-Solutions. RAC has not yet implemented back-up policies or procedures of the new Effective Rent IT application system